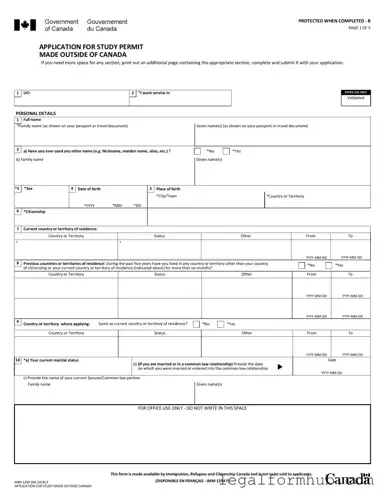

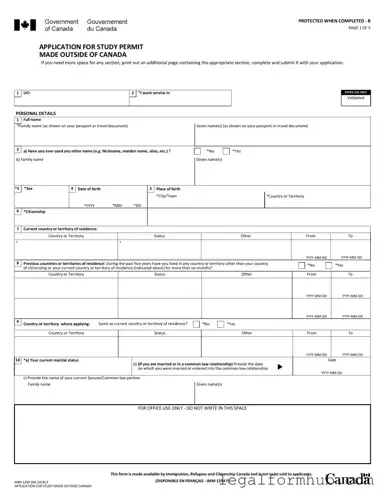

The IMM 1294 form is an application used by individuals seeking a study permit while outside of Canada. This form collects essential personal details and information regarding the applicant's intended studies in Canada. Completing the IMM 1294 accurately is crucial...

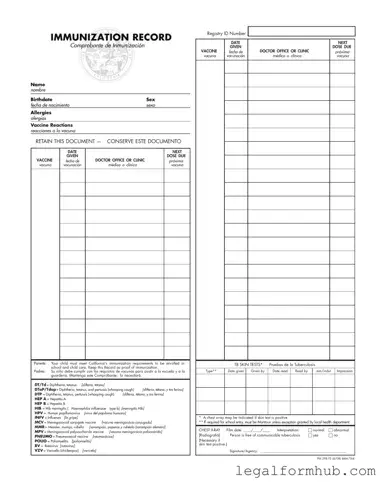

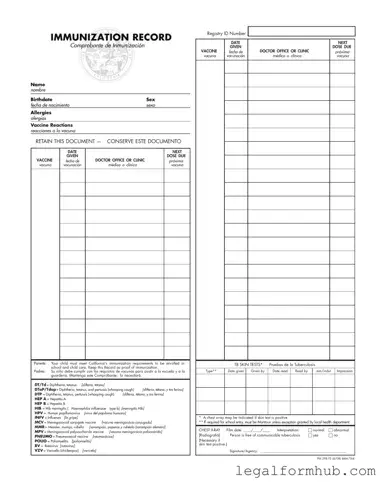

The Immunization Record form serves as an essential document that tracks an individual's vaccinations and immunization history. This form is particularly important for parents in California, as it demonstrates compliance with state immunization requirements for school and child care enrollment....

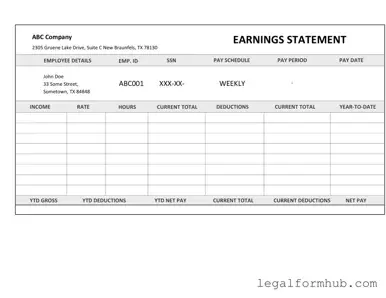

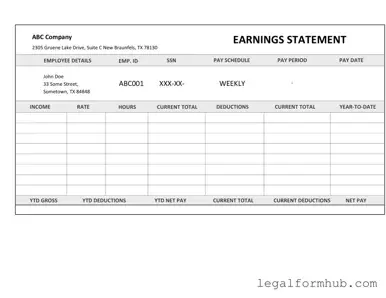

The Independent Contractor Pay Stub form is a document that outlines the payment details for services rendered by independent contractors. This form provides essential information such as the amount earned, deductions, and payment dates. Understanding this form is crucial for...

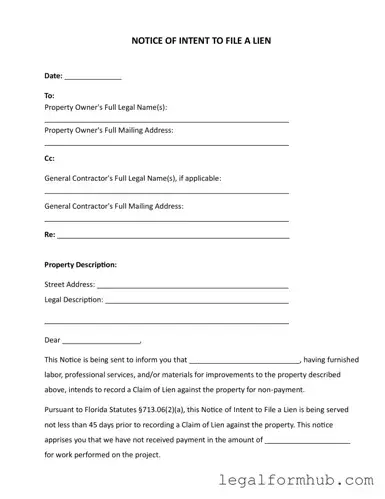

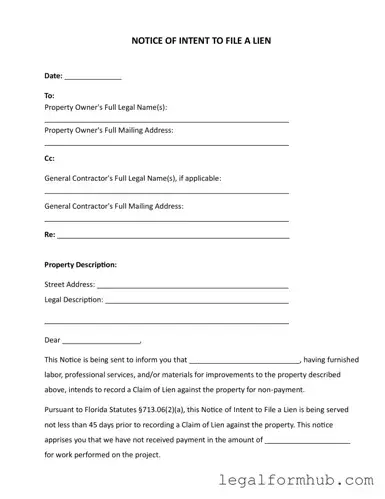

The Intent to Lien Florida form serves as a formal notice to property owners that a lien may be filed against their property due to non-payment for services rendered or materials supplied. This document is crucial for contractors and suppliers,...

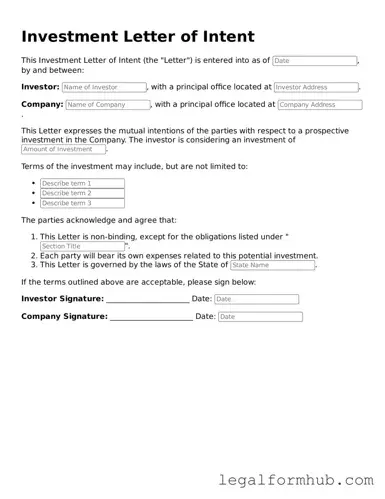

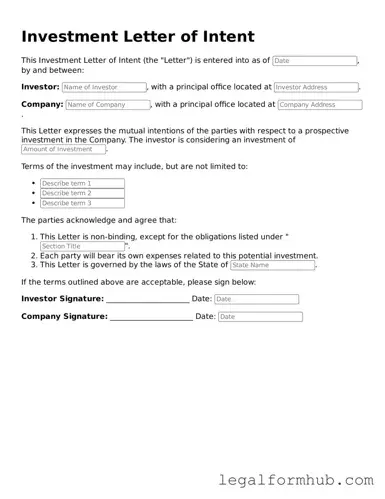

The Investment Letter of Intent form serves as a preliminary agreement between an investor and a company, outlining the terms and conditions for a potential investment. This document is crucial for establishing the framework of the investment process and ensuring...

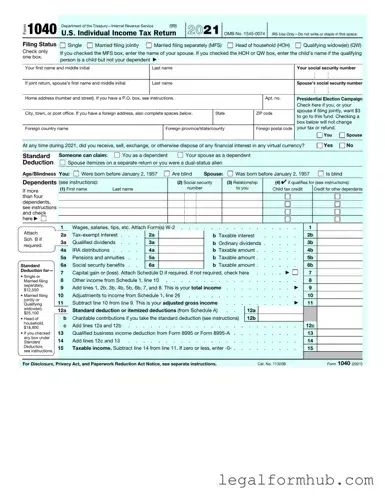

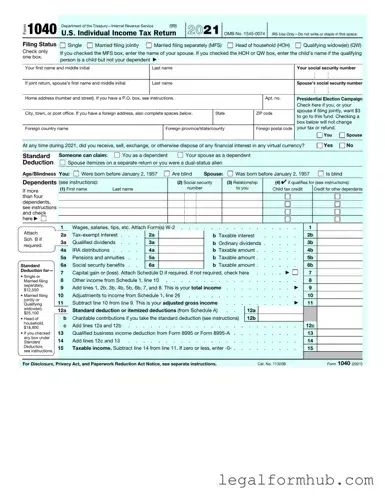

The IRS 1040 form is the standard individual income tax return used by U.S. taxpayers to report their annual income and calculate their tax liability. This form plays a crucial role in the tax filing process, allowing individuals to detail...

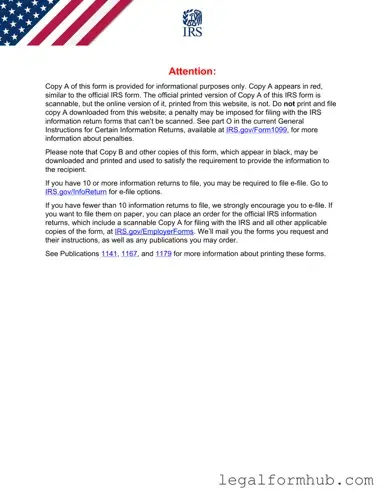

The IRS 1099-MISC form is used to report various types of income received by individuals who are not classified as employees. This includes payments made to independent contractors, freelancers, and other non-employee service providers. Understanding how to accurately complete and...

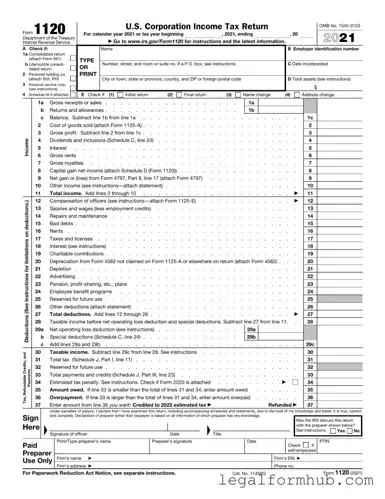

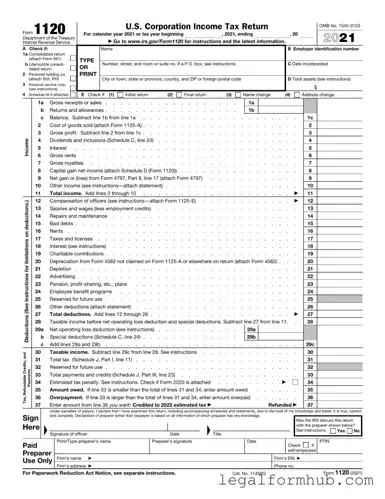

The IRS Form 1120 is a tax return form used by corporations to report their income, gains, losses, deductions, and credits. This essential document enables the Internal Revenue Service to assess the tax liability of corporations operating within the United...

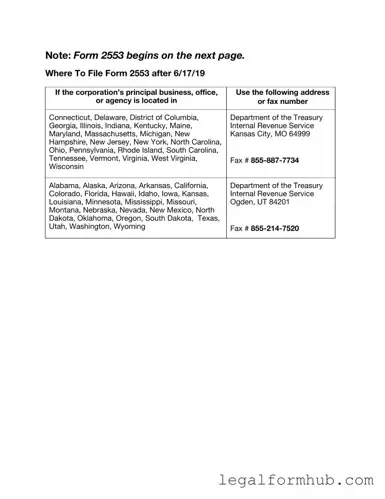

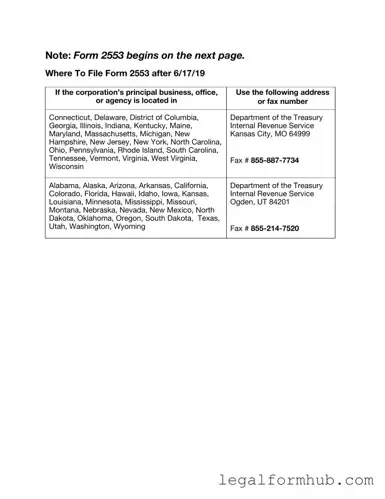

The IRS 2553 form is a crucial document that allows a corporation to elect to be taxed as an S corporation. This election can offer significant tax benefits, including avoiding double taxation on corporate income. Understanding the requirements and process...

The IRS 941 form is a quarterly tax return that employers use to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. This form provides essential information to the Internal Revenue Service (IRS) about the payroll...

The IRS Schedule C (Form 1040) is a tax form used by sole proprietors to report income or loss from their business activities. This form allows individuals to detail their earnings and expenses, helping to determine their overall taxable income....

The IRS W-2 form is a crucial document that reports an employee's annual wages and the taxes withheld from their paycheck. This form is essential for accurate tax filing and ensures that both employees and the IRS have a clear...