Printable Vehicle Repayment Agreement Document

More Forms:

Notice of Termination of Lease - Notifying your landlord of your plans can alleviate potential conflicts during the move-out period.

To ensure a smooth application process, it's important for job seekers to familiarize themselves with the requirements of the Employment Application PDF form, which can be accessed easily online. For more information and to access the form, visit https://pdftemplates.info, where you'll find resources to help you complete your application accurately.

Chick-fil-a Job Application - Join a workforce that encourages input and feedback.

Similar forms

The Vehicle Repayment Agreement form shares similarities with the Loan Agreement document. Both forms outline the terms of a loan, specifying the amount borrowed, the repayment schedule, and the interest rate. In a Loan Agreement, the borrower receives funds to purchase a vehicle, while the Vehicle Repayment Agreement focuses on the repayment terms after the vehicle has been financed. Each document serves to protect the lender's interests while providing clarity to the borrower regarding their obligations.

Another document that resembles the Vehicle Repayment Agreement is the Lease Agreement. While a Vehicle Repayment Agreement is typically used for financed vehicles, a Lease Agreement pertains to the rental of a vehicle for a specified period. Both documents detail payment terms, including the amount due and the duration of the agreement. They also outline the responsibilities of the parties involved, ensuring that both the lessor and lessee understand their rights and obligations.

Understanding the various agreements involved in vehicle transactions is essential for both buyers and sellers. For those looking to formalize their corporate structure while navigating similar legal frameworks, it is important to have clear documentation. To ensure you have the proper foundational legal documents, you may want to learn about the different options available, such as the New York Articles of Incorporation.

The Promissory Note is also akin to the Vehicle Repayment Agreement. This document is a written promise to pay a specified amount of money to a lender at a defined time. Like the Vehicle Repayment Agreement, it includes details about the repayment schedule and interest rates. However, the Promissory Note is often simpler and may not include all the specific terms related to the vehicle itself, focusing instead on the financial obligation.

Another related document is the Security Agreement. This form is used when a borrower pledges collateral to secure a loan, such as a vehicle. In the case of the Vehicle Repayment Agreement, the vehicle itself often serves as collateral. Both documents outline the rights of the lender in the event of default, ensuring that the lender can reclaim the vehicle if payments are not made as agreed.

Lastly, the Bill of Sale is similar in that it is often used in conjunction with vehicle transactions. While the Vehicle Repayment Agreement focuses on the repayment terms, the Bill of Sale documents the actual transfer of ownership of the vehicle from the seller to the buyer. Both documents are crucial in the vehicle financing process, as they provide a legal framework for the transaction and protect the interests of both parties involved.

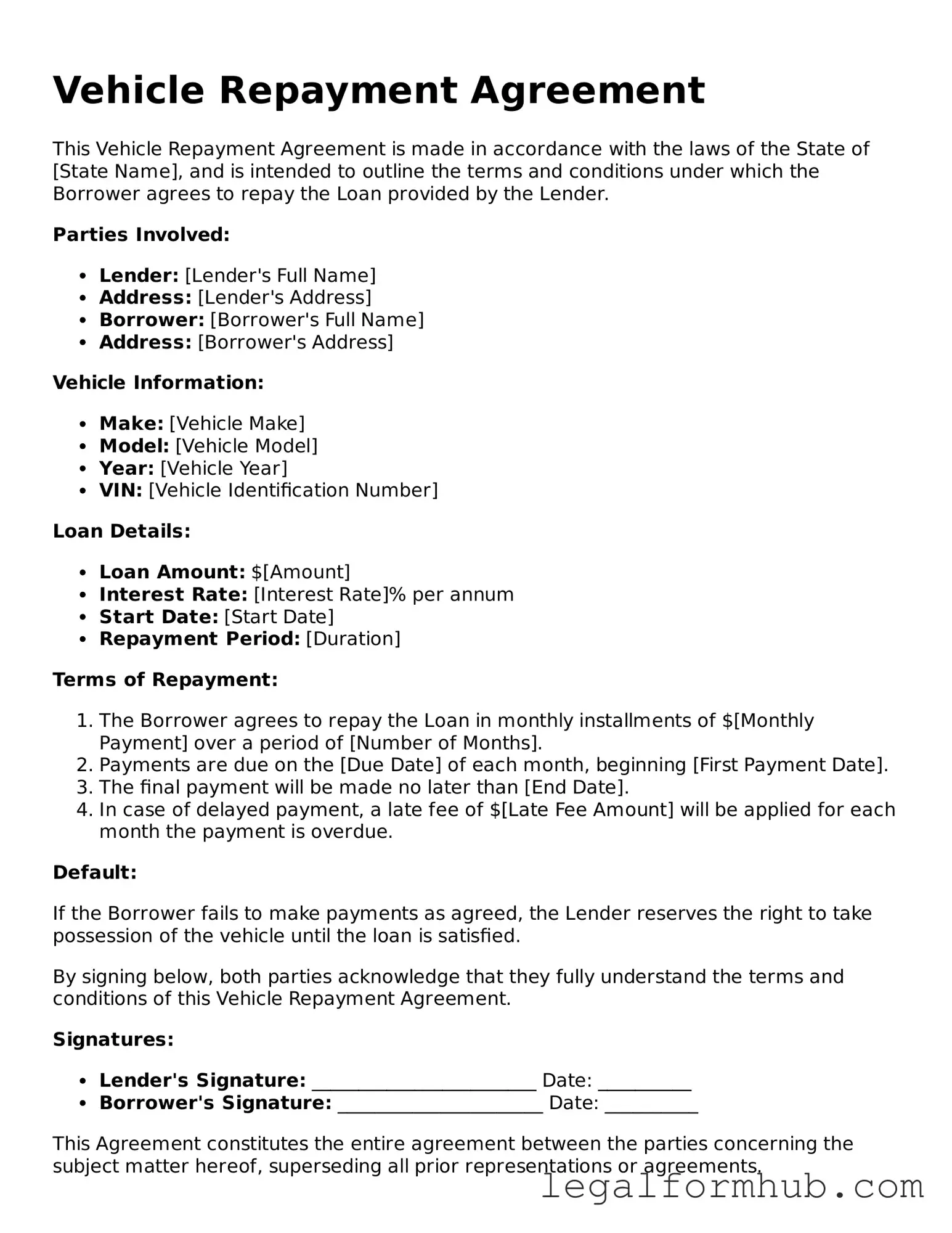

Instructions on Writing Vehicle Repayment Agreement

Once you have the Vehicle Repayment Agreement form in hand, it’s time to fill it out accurately. Completing this form correctly is essential for ensuring that all parties involved are clear about the terms of repayment. Follow these steps to complete the form efficiently.

- Begin by entering your full name in the designated space at the top of the form.

- Provide your current address, including street, city, state, and ZIP code.

- Fill in the date on which you are completing the form.

- Enter the details of the vehicle, including make, model, year, and Vehicle Identification Number (VIN).

- Specify the total amount owed on the vehicle.

- Indicate the repayment terms, including the payment amount and frequency (weekly, bi-weekly, or monthly).

- Include your contact information, such as phone number and email address.

- Sign and date the form at the bottom to confirm your agreement to the terms outlined.

After completing the form, ensure that you keep a copy for your records. Submit the form as directed to finalize the repayment arrangement.

Misconceptions

Misconceptions about the Vehicle Repayment Agreement form can lead to confusion and mismanagement. Here are seven common misunderstandings:

- It is only for individuals with bad credit. Many believe that this form is exclusively for those with poor credit histories. In reality, anyone financing a vehicle can use this agreement to outline repayment terms.

- It guarantees loan approval. Some think that signing a Vehicle Repayment Agreement ensures they will receive financing. However, approval is contingent on the lender's criteria and the borrower's financial situation.

- It is a legally binding contract. While the agreement outlines repayment terms, it may not be enforceable in all situations. The enforceability can depend on state laws and specific circumstances surrounding the agreement.

- It covers all vehicle-related expenses. Many assume that the Vehicle Repayment Agreement includes costs such as insurance, maintenance, and taxes. Typically, it only addresses the loan repayment terms.

- Once signed, the terms cannot be changed. Some believe that the agreement is set in stone after signing. In fact, borrowers can negotiate changes with the lender before the agreement is finalized.

- It is unnecessary if you have a good payment history. Some individuals think that a strong payment history negates the need for this agreement. However, it remains important for clarifying terms and protecting both parties.

- It is the same as a lease agreement. There is a misconception that the Vehicle Repayment Agreement functions like a lease. In reality, it is specifically focused on loan repayment, while a lease agreement involves renting the vehicle.

Key takeaways

When filling out and using the Vehicle Repayment Agreement form, it is important to understand the following key points:

- Complete Accuracy: Ensure that all information provided on the form is accurate and complete. This includes details about the vehicle, repayment terms, and personal information.

- Signatures Required: Both parties involved in the agreement must sign the document. This signifies mutual consent and agreement to the terms outlined.

- Clear Terms: Clearly outline the repayment terms, including the amount, due dates, and any interest rates if applicable. Ambiguity can lead to disputes.

- Keep Copies: After the agreement is signed, both parties should retain copies of the document for their records. This helps in case of any future disagreements.

- Legal Compliance: Ensure that the agreement complies with state and local laws. Different jurisdictions may have specific requirements regarding vehicle repayment agreements.

- Review Before Signing: Both parties should thoroughly review the agreement before signing. This ensures that everyone understands their obligations and rights.

File Overview

| Fact Name | Description |

|---|---|

| Purpose | The Vehicle Repayment Agreement form is used to outline the terms under which a borrower agrees to repay a loan for a vehicle. |

| Governing Law | In the United States, the governing laws for vehicle repayment agreements may vary by state. For example, in California, the relevant laws include the California Civil Code. |

| Key Components | This form typically includes details such as the loan amount, interest rate, repayment schedule, and consequences of default. |

| Signature Requirement | Both the borrower and the lender must sign the agreement to make it legally binding. |