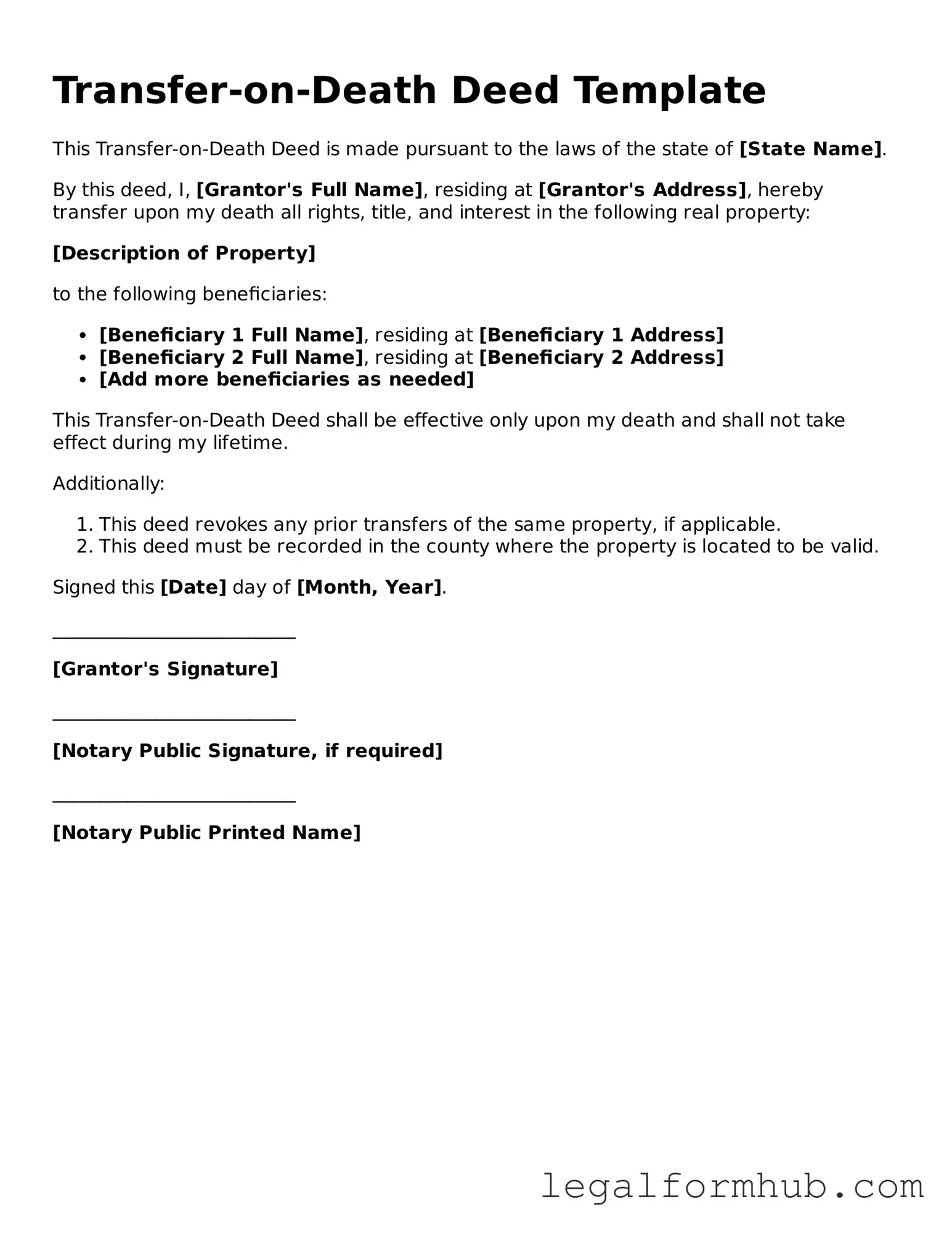

Printable Transfer-on-Death Deed Document

Common Transfer-on-Death Deed Documents:

What Is a Deed in Lieu - Homeowners can negotiate a timeline for vacating the property when signing this deed.

It is essential to have a reliable legal framework in place, especially in uncertain times; therefore, utilizing a document like the California Power of Attorney can provide peace of mind and clarity. When you're prepared to designate a trusted individual to manage your affairs, consider visiting Fill PDF Forms to access the necessary forms and begin the process of securing your future.

Transfer-on-Death Deed - Tailored for Each State

Similar forms

A Last Will and Testament is a legal document that outlines how a person's assets will be distributed upon their death. Like a Transfer-on-Death Deed, it allows individuals to specify beneficiaries for their property. However, a will typically goes through probate, which can be a lengthy and costly process. In contrast, a Transfer-on-Death Deed allows for the direct transfer of property without the need for probate, making it a more straightforward option for some individuals.

A Living Trust is another document that serves a similar purpose. It allows individuals to place their assets into a trust during their lifetime, which can then be distributed to beneficiaries after death. While both a Living Trust and a Transfer-on-Death Deed avoid probate, a Living Trust requires more management and may involve ongoing costs, such as trustee fees. The Transfer-on-Death Deed is generally simpler and less expensive to set up.

The Arizona Motor Vehicle Bill of Sale form is a vital document for anyone looking to purchase or sell a vehicle in the state, ensuring that all parties have clear guidelines about the transaction. This documentation serves not only as proof of sale but also captures necessary details about the vehicle such as make, model, and VIN, thereby minimizing misunderstandings. To access a template for creating this important document, you can visit arizonapdfs.com/motor-vehicle-bill-of-sale-template, which offers a user-friendly resource for both buyers and sellers to facilitate their motor vehicle transactions.

A Payable-on-Death (POD) account is a financial account that designates a beneficiary to receive the funds upon the account holder's death. Similar to a Transfer-on-Death Deed, a POD account allows for a direct transfer of assets without probate. This document is often used for bank accounts and can be an effective way to ensure that funds are quickly accessible to loved ones after death.

A Transfer-on-Death Registration for securities, such as stocks or bonds, functions similarly to a Transfer-on-Death Deed. It allows the owner to designate beneficiaries for their securities, ensuring that ownership transfers automatically upon death. Both documents facilitate the transfer process without the need for probate, providing a streamlined approach to asset distribution.

A Life Estate Deed is a document that allows an individual to retain the right to use a property during their lifetime while designating a beneficiary to receive the property upon their death. This is similar to a Transfer-on-Death Deed in that it ensures a smooth transition of property ownership. However, with a Life Estate Deed, the original owner retains some control over the property during their lifetime, which can complicate matters if they wish to sell or refinance.

A Family Limited Partnership (FLP) is an entity that can hold family assets, allowing for easier management and transfer of those assets among family members. Similar to a Transfer-on-Death Deed, an FLP can help avoid probate and facilitate the transfer of ownership. However, establishing an FLP involves more complexity and requires ongoing management, making it a more involved option compared to the straightforward nature of a Transfer-on-Death Deed.

Instructions on Writing Transfer-on-Death Deed

Once you have your Transfer-on-Death Deed form ready, it’s important to fill it out accurately to ensure your intentions are clear. Follow these steps carefully to complete the form correctly.

- Obtain the Form: Start by downloading the Transfer-on-Death Deed form from your state’s official website or a trusted legal resource.

- Identify the Property: Clearly write the legal description of the property you want to transfer. This may include the address and parcel number.

- List the Owner(s): Fill in your name or the names of all current owners as they appear on the property title.

- Designate Beneficiary(ies): Enter the name(s) of the person(s) you wish to inherit the property upon your death.

- Include Additional Information: If applicable, provide the relationship of the beneficiary(ies) to you.

- Sign the Form: All current owners must sign the form in the presence of a notary public.

- Notarization: Have the notary public complete their section, verifying your identity and signature.

- Record the Deed: Submit the completed and notarized form to the appropriate local government office, such as the county recorder's office, to make it official.

After completing these steps, keep a copy of the recorded deed for your records. It’s also wise to inform your beneficiaries about the deed and where they can find it when the time comes.

Misconceptions

Understanding the Transfer-on-Death (TOD) deed can help individuals make informed decisions about their estate planning. However, there are several misconceptions that can lead to confusion. Here are ten common misconceptions about the TOD deed form:

- It automatically transfers property upon signing. Many believe that simply signing a TOD deed transfers ownership immediately. In reality, the transfer occurs only upon the death of the property owner.

- It replaces a will. Some think that a TOD deed can take the place of a will. However, a TOD deed only addresses specific property and does not cover other assets or wishes outlined in a will.

- All states recognize TOD deeds. Not every state allows for TOD deeds. It's essential to check local laws to determine if this option is available.

- It avoids probate for all assets. While a TOD deed can help avoid probate for the property it covers, other assets not included may still go through probate.

- Only individuals can use a TOD deed. Some people think only individuals can create a TOD deed. In fact, certain types of entities, such as trusts, can also utilize this form.

- Beneficiaries cannot be changed. There is a misconception that once a beneficiary is named, it cannot be changed. In reality, the property owner can revoke or modify the deed at any time before their death.

- It is only for real estate. While primarily used for real estate, a TOD deed can also apply to other types of property, depending on state laws.

- There are no tax implications. Some believe that using a TOD deed means there are no tax consequences. However, beneficiaries may still be subject to taxes on the property after the owner's death.

- All debts are wiped clean upon death. Many think that a TOD deed allows beneficiaries to inherit property free of debt. However, outstanding debts may still need to be settled before beneficiaries receive their inheritance.

- It guarantees the property will go to the intended beneficiary. While a TOD deed designates a beneficiary, disputes can arise, and courts may still intervene, especially if there are challenges to the deed's validity.

By clarifying these misconceptions, individuals can better navigate the complexities of estate planning and make choices that align with their wishes and needs.

Key takeaways

When considering a Transfer-on-Death Deed (TODD), it’s important to understand its implications and requirements. Here are some key takeaways to keep in mind:

- Purpose of the TODD: A Transfer-on-Death Deed allows property owners to designate beneficiaries who will automatically receive the property upon the owner’s death, avoiding probate.

- Filling Out the Form: Ensure that the form is filled out completely and accurately. Include the legal description of the property and the names of all beneficiaries.

- State-Specific Requirements: Each state may have different rules regarding TODDs. It’s crucial to check local laws to ensure compliance and validity.

- Recording the Deed: After completing the form, it must be recorded with the appropriate county office where the property is located. This step is essential for the deed to take effect.

- Revoking the Deed: If circumstances change, the property owner can revoke the TODD at any time before death, provided they follow the proper legal procedures.

Understanding these aspects of the Transfer-on-Death Deed can help ensure a smoother transition of property and minimize complications for loved ones in the future.

File Overview

| Fact Name | Details |

|---|---|

| Definition | A Transfer-on-Death Deed allows an individual to transfer real estate to a beneficiary upon death without going through probate. |

| Governing Law | The laws governing Transfer-on-Death Deeds vary by state. For example, in California, it is governed by the California Probate Code, Section 5600. |

| Beneficiary Designation | Individuals can name one or more beneficiaries. If multiple beneficiaries are named, specify how the property is divided. |

| Revocability | The deed can be revoked at any time before the owner’s death, allowing flexibility in estate planning. |

| No Immediate Transfer | The property remains under the owner’s control during their lifetime. Beneficiaries have no rights until the owner passes away. |

| State-Specific Forms | Each state may have its own form. Ensure to use the correct form based on state laws, like the Florida Statutes, Chapter 732 for Florida. |

| Tax Implications | Transfer-on-Death Deeds do not affect property taxes during the owner’s lifetime. However, tax implications may arise for beneficiaries after the transfer. |

| Filing Requirements | Most states require the deed to be recorded with the county recorder’s office to be effective. |

| Limitations | Not all types of property can be transferred using a Transfer-on-Death Deed. Check state laws for restrictions. |

| Legal Assistance | While individuals can complete the form without an attorney, consulting a legal expert is advisable to ensure compliance with state laws. |