Fill Your Time Card Form

Different PDF Templates

Chick-fil-a Job Application - Be part of a workplace that encourages creativity and problem-solving.

The Employment Application PDF form is a standardized document used by employers to gather essential information about job applicants. This form typically includes sections for personal details, work history, and educational background, facilitating a streamlined hiring process. To get started, Fill PDF Forms by clicking the button below.

Netspend All Access Customer Service - Clarify any concerns directly on the form regarding the reuse of your information.

Similar forms

The Employee Attendance Record serves a similar purpose to the Time Card form by tracking the days and hours an employee works. This document typically includes information such as the employee's name, the dates of attendance, and any absences or tardiness. Both documents help employers monitor employee attendance and ensure accurate payroll processing.

The Work Schedule is another document that aligns closely with the Time Card form. It outlines the specific hours and days an employee is expected to work. While the Time Card records actual hours worked, the Work Schedule provides a planned framework. Together, they assist in managing staffing needs and ensuring that shifts are adequately covered.

The Payroll Register is a comprehensive document that summarizes the payroll information for all employees within a specific pay period. It includes details like gross pay, deductions, and net pay. Similar to the Time Card form, the Payroll Register relies on accurate time tracking to calculate employee compensation, making both documents essential for effective payroll management.

A Power of Attorney (POA) form in Arizona is a legal document that allows one person to appoint another to make decisions on their behalf. This form can cover a wide range of matters, from financial transactions to healthcare decisions. Understanding the nuances of this document is crucial for anyone looking to ensure their wishes are honored when they can no longer speak for themselves. For more resources and templates, you can visit arizonapdfs.com/power-of-attorney-template.

The Overtime Request Form is also comparable to the Time Card form, as it is used to document requests for additional hours worked beyond the standard work schedule. This form typically requires approval from a supervisor and provides a record of the hours worked. Both documents play a crucial role in ensuring that employees are compensated fairly for their time.

Finally, the Leave Request Form shares similarities with the Time Card form in that it tracks the time an employee is absent from work. This document records the type of leave being requested, such as vacation or sick leave, and the duration of the absence. Both forms are essential for maintaining accurate records and managing employee time off effectively.

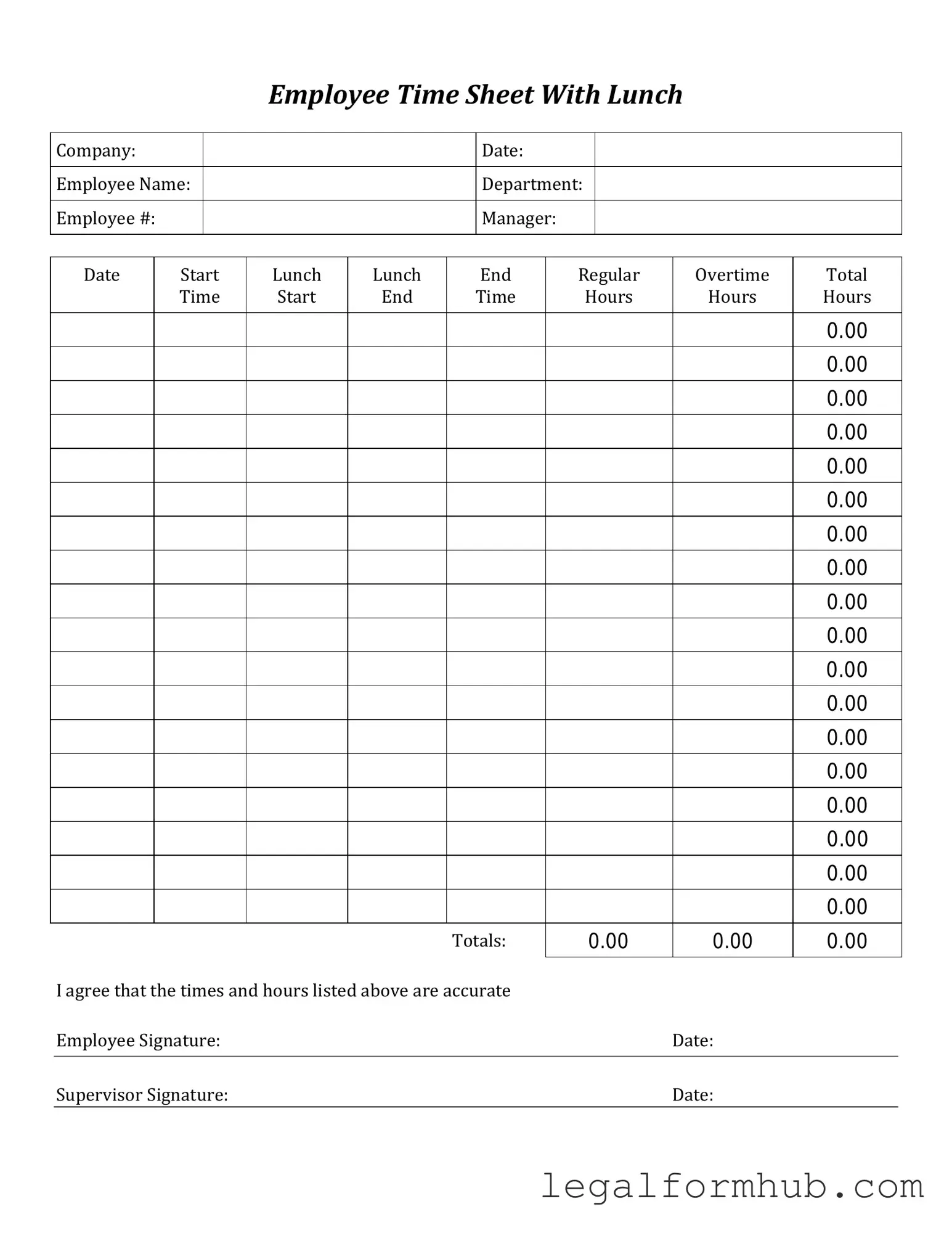

Instructions on Writing Time Card

Completing the Time Card form is an essential task that helps ensure accurate tracking of hours worked. By following the steps outlined below, you can easily fill out the form and submit it for processing.

- Start by entering your name in the designated field at the top of the form.

- Next, fill in your employee ID number. This helps identify your records accurately.

- Indicate the pay period by entering the start and end dates. Make sure these dates are correct to avoid any discrepancies.

- In the time entry section, record the hours worked each day. Be sure to include both regular and overtime hours, if applicable.

- If you took any leave during the pay period, note the type of leave and the hours taken in the appropriate section.

- After completing the hours worked, review the total hours for accuracy. Double-check your calculations to ensure they are correct.

- Finally, sign and date the form at the bottom. This confirms that the information provided is accurate and complete.

Misconceptions

Many people have misunderstandings about the Time Card form. Here are eight common misconceptions, along with clarifications to help clear up any confusion.

-

Misconception 1: The Time Card form is only for hourly employees.

This is not true. While hourly employees commonly use Time Cards to track hours worked, salaried employees may also need to submit them for various reasons, such as project tracking or compliance.

-

Misconception 2: Time Cards are only necessary for payroll purposes.

Time Cards serve multiple functions beyond payroll. They help monitor project progress, manage resources, and ensure compliance with labor laws.

-

Misconception 3: Submitting a Time Card late is acceptable as long as it gets submitted.

Late submissions can lead to payroll delays and inaccuracies. Timeliness is crucial for maintaining accurate records and ensuring employees are paid on time.

-

Misconception 4: You can estimate hours worked if you forget to track them.

Estimating hours can lead to discrepancies and may violate company policies. It’s best to record hours accurately to avoid potential issues.

-

Misconception 5: Once submitted, a Time Card cannot be changed.

Most companies allow for corrections to be made if an error is discovered. However, it’s essential to follow the proper procedures for making changes.

-

Misconception 6: Time Cards are not important for independent contractors.

Independent contractors may also need to track their hours for invoicing purposes or project documentation, making Time Cards relevant for them as well.

-

Misconception 7: You only need to fill out the Time Card if you worked overtime.

All hours worked, regardless of overtime, should be recorded on the Time Card. This ensures accurate tracking of all work performed.

-

Misconception 8: The Time Card form is the same across all departments.

Different departments may have specific requirements or formats for Time Cards. Always check with your supervisor or HR for the correct form to use.

Understanding these misconceptions can help ensure that everyone uses the Time Card form correctly and effectively.

Key takeaways

Filling out and using a Time Card form is essential for tracking work hours accurately. Here are some key takeaways to keep in mind:

- Be Consistent: Make sure to fill out your Time Card regularly. Consistency helps ensure that all hours worked are recorded accurately, preventing any discrepancies later.

- Double-Check Entries: Before submitting your Time Card, review it for any errors. Simple mistakes can lead to payment delays or incorrect hours being reported.

- Understand Your Policies: Familiarize yourself with your employer's policies regarding time tracking. Knowing the rules can help you avoid potential issues and ensure compliance.

- Document Breaks: Don’t forget to record any breaks taken during your shift. This information is crucial for maintaining accurate records of your working hours.

- Submit on Time: Ensure that you submit your Time Card by the deadline set by your employer. Late submissions can result in delayed paychecks or complications with payroll processing.

By keeping these points in mind, you can effectively manage your time tracking and contribute to a smoother payroll process.

File Information

| Fact Name | Description |

|---|---|

| Purpose | The Time Card form is used to record the hours worked by an employee during a specific pay period. |

| Employee Identification | It typically includes the employee's name, identification number, and department for accurate record-keeping. |

| Time Entry | Employees enter their start and end times for each workday, along with any breaks taken. |

| Pay Period | The form specifies the pay period for which the hours are being reported, ensuring proper payroll processing. |

| Signature Requirement | Most Time Card forms require the employee's signature to verify the accuracy of the recorded hours. |

| State-Specific Regulations | In some states, employers must comply with specific labor laws regarding timekeeping. For example, California requires accurate time tracking under the California Labor Code. |

| Overtime Calculation | The form may be used to calculate overtime hours worked, which are subject to different pay rates. |

| Record Retention | Employers are generally required to keep time cards for a specified period, often three years, for auditing and compliance purposes. |

| Digital vs. Paper | Time Cards can be maintained in either digital or paper format, depending on company policy and state regulations. |

| Audit Trail | Accurate completion of Time Cards provides an audit trail for payroll accuracy and can be essential in dispute resolution. |