Free Transfer-on-Death Deed Template for Texas

Create Other Popular Transfer-on-Death Deed Forms for Different States

Survivorship Deed Vs Transfer on Death - With a Transfer-on-Death Deed, you retain full ownership and control of the property during your lifetime.

The Employment Application PDF form serves as a crucial tool for employers, ensuring they collect vital information from candidates efficiently. By including personal details, work history, and educational background, this document simplifies the hiring process. To begin your application, you can easily access and Fill PDF Forms online.

Tod Form Ohio - Some states may have additional requirements for the creation or revocation of a Transfer-on-Death Deed.

How to Avoid Probate in Illinois - It provides a straightforward way to ensure loved ones inherit property without the complications of probate proceedings.

Free Printable Transfer on Death Deed Form Georgia - With a Transfer-on-Death Deed, you can retain full ownership and use of the property while you are alive.

Similar forms

The Texas Transfer-on-Death Deed (TODD) is similar to a will in that both documents allow individuals to dictate how their assets will be distributed upon their death. A will requires the probate process, which can be time-consuming and costly. In contrast, a TODD allows property to transfer directly to the designated beneficiary without going through probate. This streamlined process can save time and expenses for the heirs, making the TODD a more efficient option for many property owners in Texas.

The Employment Verification Form is an essential tool in confirming the work history of individuals, benefiting both employers and lending institutions. This form allows for the reliable validation of provided information, which can facilitate various processes such as applying for loans or jobs. For those looking to streamline this verification process, the form can be conveniently accessed at pdftemplates.info.

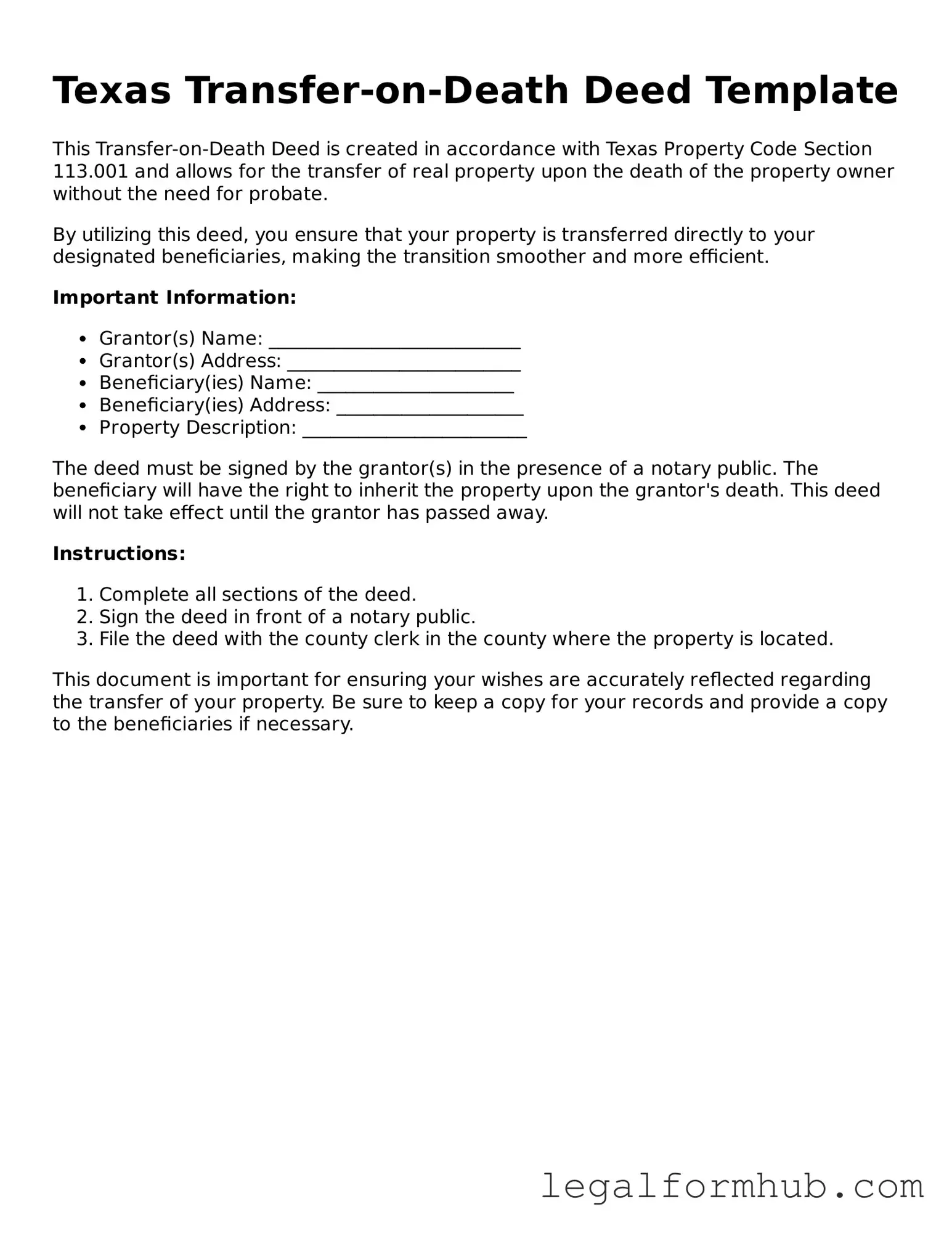

Instructions on Writing Texas Transfer-on-Death Deed

Once you have the Texas Transfer-on-Death Deed form ready, it’s time to complete it accurately. Follow these steps to ensure that all necessary information is filled out correctly.

- Begin by entering the name of the property owner. This should match the name on the property title.

- Provide the address of the property. Include the street number, street name, city, and ZIP code.

- Identify the beneficiary. This is the person or entity who will receive the property upon the owner's death. Include their full name and relationship to the owner.

- List any additional beneficiaries, if applicable. Make sure to include their names and relationships as well.

- Indicate whether the beneficiaries will receive the property equally or in specific shares. Clearly state the distribution plan.

- Sign the form in the presence of a notary public. This step is crucial for the deed to be valid.

- Have the notary public sign and stamp the form. This confirms that the signature is legitimate.

- File the completed deed with the county clerk's office in the county where the property is located. There may be a filing fee.

After completing these steps, the deed will be recorded, ensuring that your wishes regarding the property transfer are legally recognized. Keep a copy of the filed deed for your records.

Misconceptions

The Texas Transfer-on-Death Deed (TODD) is a legal tool that allows property owners to designate beneficiaries who will receive their property upon their death. Despite its usefulness, several misconceptions exist regarding this form. Below is a list of nine common misconceptions along with explanations to clarify them.

- It requires probate. Many believe that property transferred via a TODD must go through probate. In reality, a TODD allows for direct transfer to beneficiaries, bypassing the probate process entirely.

- It can only be used for residential property. Some individuals think that the TODD is limited to residential real estate. However, it can be applied to various types of real property, including commercial properties and vacant land.

- It cannot be revoked. A common misunderstanding is that once a TODD is executed, it cannot be changed. In fact, property owners can revoke or modify the deed at any time before their death.

- All property owners can use it. Some assume that anyone can utilize a TODD. However, only individuals who hold title to the property can execute this deed; it is not available to entities like corporations or trusts.

- Beneficiaries must pay taxes immediately. There is a belief that beneficiaries are responsible for immediate tax payments upon the transfer of property. In reality, taxes are typically assessed at the time of the owner's death, and beneficiaries may not need to pay taxes until they sell the property.

- It is the same as a will. Many confuse a TODD with a traditional will. While both documents address the distribution of assets, a TODD specifically deals with real property and takes effect immediately upon the owner's death, unlike a will, which requires probate.

- It can be used for joint property. Some people think a TODD can apply to jointly owned property. However, a TODD only applies to property solely owned by the individual executing the deed.

- It does not require witnesses or notarization. There is a misconception that a TODD can be valid without witnesses or notarization. In Texas, a TODD must be signed, witnessed, and notarized to be legally binding.

- It guarantees the property will be transferred. Lastly, some believe that executing a TODD guarantees the property will transfer as intended. However, if the beneficiary predeceases the property owner, the transfer may not occur unless alternative arrangements are made.

Understanding these misconceptions can help property owners make informed decisions regarding their estate planning and the use of Transfer-on-Death Deeds in Texas.

Key takeaways

When filling out and using the Texas Transfer-on-Death Deed form, keep these key takeaways in mind:

- Eligibility: Only certain types of property can be transferred using this deed. Make sure your property qualifies.

- Signatures: The deed must be signed by the property owner and two witnesses. Ensure that all signatures are properly obtained.

- Recording: After completing the form, it must be filed with the county clerk's office where the property is located. This step is essential for the deed to be valid.

- Revocation: You can revoke the deed at any time before your death. This can be done by filing a new deed or a written revocation.

File Overview

| Fact Name | Description |

|---|---|

| Definition | A Texas Transfer-on-Death Deed allows an individual to transfer real property to beneficiaries upon their death without going through probate. |

| Governing Law | The Transfer-on-Death Deed in Texas is governed by Chapter 114 of the Texas Estates Code. |

| Eligibility | Any individual who owns real property in Texas can create a Transfer-on-Death Deed. |

| Beneficiaries | Beneficiaries can be individuals, organizations, or trusts, and they can be designated in the deed. |

| Revocability | A Transfer-on-Death Deed can be revoked at any time by the grantor before their death. |

| Recording Requirement | The deed must be recorded in the county where the property is located to be effective. |

| No Immediate Transfer | Ownership does not transfer to the beneficiaries until the grantor passes away. |

| Tax Implications | Beneficiaries may receive a step-up in basis for tax purposes, which can reduce capital gains tax when they sell the property. |

| Form Simplicity | The form is relatively simple to complete, requiring basic information about the property and beneficiaries. |

| Legal Advice Recommended | While it is not required, consulting with a legal professional is advisable to ensure the deed is executed correctly. |