Fill Your Texas residential property affidavit T-47 Form

Different PDF Templates

Excel Bar Chart - Name: The individual responsible for this chart.

The process of registering a birth is vital for ensuring official recognition of a child's identity, and this is encapsulated in the CDC U.S. Standard Certificate of Live Birth form, which can be conveniently completed by visiting pdftemplates.info. Having the right documentation is essential for legal purposes, making it important to follow the instructions carefully to avoid any ambiguities.

Dvla Form - Please provide the date you want your licence to start, if different from the application date.

Similar forms

The Texas residential property affidavit T-47 form shares similarities with the Title Commitment document. Both are essential in real estate transactions, providing crucial information about the property’s title status. The Title Commitment outlines the conditions under which a title insurance policy will be issued. It includes details about any existing liens, easements, or restrictions that may affect the property. Like the T-47, it serves to protect buyers and lenders by ensuring they are aware of any potential issues before finalizing the purchase.

Understanding the intricacies of legal documents is crucial for making informed decisions, particularly when it comes to property transactions. Just as various affidavits and deeds clarify ownership and responsibilities, resources such as the arizonapdfs.com/medical-power-of-attorney-template serve to ensure that individuals are well-informed about their rights and options when designating a trusted agent for healthcare decisions.

Another document comparable to the T-47 is the Property Disclosure Statement. Sellers typically complete this form to disclose any known issues with the property, such as structural problems or pest infestations. Similar to the T-47, the Property Disclosure Statement is designed to inform potential buyers about the condition of the property. Transparency is key in both documents, as they help buyers make informed decisions and avoid unexpected surprises after the sale.

The Affidavit of Heirship is also similar to the T-47 in that it addresses ownership issues. This document is often used when property is inherited, and it helps establish the rightful heirs of a deceased person’s estate. Like the T-47, it provides a sworn statement regarding the ownership and can clarify title issues. Both documents play a significant role in ensuring that ownership is properly documented and recognized, thereby facilitating smoother transactions.

Lastly, the Deed of Trust bears resemblance to the T-47 as it outlines the agreement between the borrower and lender regarding property financing. This document secures the loan with the property itself, providing the lender a claim to the property if the borrower defaults. While the T-47 focuses on affirming the property’s status and ownership, the Deed of Trust ensures that financial interests are protected. Both documents are vital in real estate transactions, contributing to the overall security and clarity of property ownership and financing.

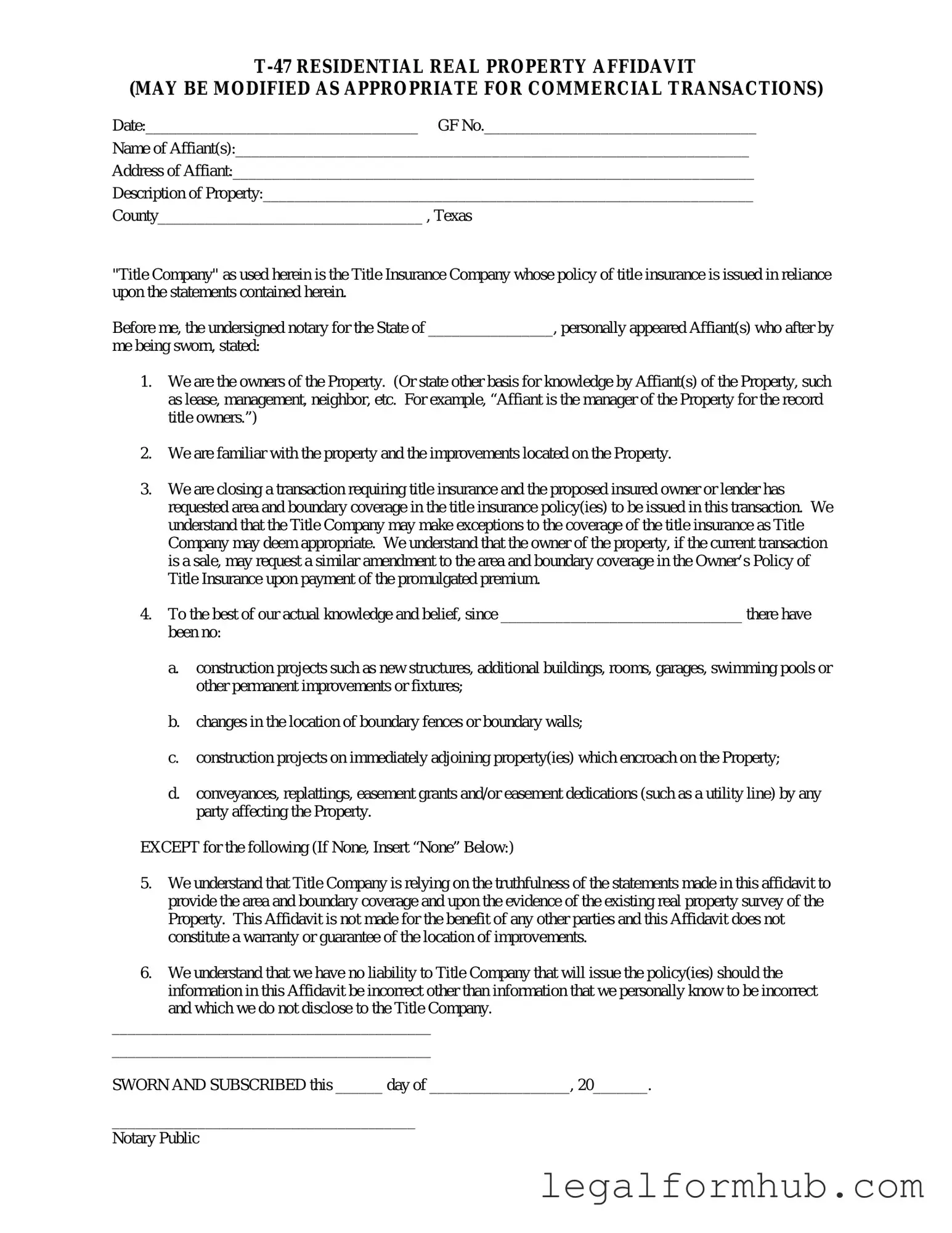

Instructions on Writing Texas residential property affidavit T-47

After obtaining the Texas Residential Property Affidavit T-47 form, you will need to complete it accurately to ensure your property records are updated correctly. Follow these steps to fill out the form properly.

- Begin by entering the property owner's name at the top of the form. Ensure the name matches the official records.

- Next, provide the property address, including the street number, street name, city, and zip code.

- Fill in the legal description of the property. This can usually be found on the property deed or tax documents.

- Indicate the date of acquisition of the property. This is the date when the property was purchased or transferred to you.

- In the next section, list any existing liens on the property. If there are none, clearly state that.

- Provide your contact information, including your phone number and email address, for any follow-up communications.

- Sign and date the form at the bottom. Make sure your signature matches the name provided at the top.

Once completed, submit the form to the appropriate local authority or office that handles property records in Texas. Keep a copy for your records.

Misconceptions

The Texas residential property affidavit T-47 form is an important document used in real estate transactions. However, there are several misconceptions surrounding its purpose and use. Understanding these misconceptions can help individuals navigate the process more effectively.

- Misconception 1: The T-47 form is only for new home purchases.

- Misconception 2: The T-47 form guarantees clear title to the property.

- Misconception 3: Only the seller needs to sign the T-47 form.

- Misconception 4: The T-47 form is optional in all transactions.

- Misconception 5: The T-47 form can be completed without any supporting documents.

- Misconception 6: The T-47 form is the same as a property deed.

This is not true. The T-47 form can be utilized in various situations, including refinancing and transferring property ownership, not just for new home purchases.

While the T-47 form provides a declaration of the current state of the property, it does not guarantee that the title is free of issues. Buyers should still conduct a title search to ensure there are no liens or encumbrances.

Both the seller and the buyer may need to sign the T-47 form, depending on the circumstances of the transaction. This ensures that both parties acknowledge the information contained in the affidavit.

This is misleading. In many cases, lenders will require the T-47 form as part of the closing process. It is important to check with the lender to understand their specific requirements.

In reality, supporting documents may be necessary to substantiate the information provided in the T-47 form. This could include surveys, previous title documents, or other relevant materials.

The T-47 form serves a different purpose than a property deed. While a deed transfers ownership of the property, the T-47 form is an affidavit that provides information about the property’s condition and the ownership history.

Key takeaways

The Texas residential property affidavit T-47 form serves as a crucial document in real estate transactions. Here are some key takeaways to consider when filling out and using this form:

- Purpose of the Form: The T-47 affidavit is primarily used to confirm the identity of the property and its ownership. It helps establish clear title and can be essential for lenders and title companies.

- Accuracy is Essential: When completing the form, ensure that all information is accurate and up-to-date. Any discrepancies can lead to delays in the transaction process or even legal complications.

- Signature Requirements: The form must be signed by the property owner. This signature must be notarized to validate the affidavit, so plan accordingly to avoid any last-minute issues.

- Use in Transactions: The T-47 affidavit is often required during the closing process. It provides assurance to buyers and lenders that there are no undisclosed liens or claims against the property.

File Information

| Fact Name | Description |

|---|---|

| Purpose | The T-47 form serves to confirm the current state of a residential property's ownership and any changes to the property since the last title insurance policy was issued. |

| Governing Law | This form is governed by the Texas Property Code, specifically under Title 11, Chapter 5. |

| Who Uses It | Homeowners, sellers, and title companies utilize the T-47 form during real estate transactions to ensure accurate title insurance coverage. |

| Signature Requirement | The form must be signed by the property owner or an authorized representative to validate the information provided. |

| Filing Necessity | While the T-47 is not filed with the county clerk, it is often required by title companies to issue title insurance. |

| Common Uses | It is commonly used in residential real estate transactions, especially when refinancing or selling a property. |

| Information Required | The form requires details about the property, including its legal description and any changes in ownership or encumbrances. |

| Importance for Title Insurance | The T-47 form is crucial for title insurance as it helps to disclose any potential issues that may affect the property's title. |

| Validity Period | The information provided in the T-47 is typically considered valid for a limited time, often up to 90 days, depending on the title company's requirements. |