Free Quitclaim Deed Template for Texas

Create Other Popular Quitclaim Deed Forms for Different States

How to Gift a House to a Family Member - This form is commonly used when there is a relationship between the parties, such as family members or friends.

Quick Deed Michigan - Quitclaim Deeds do not require the buyer to perform due diligence on the property's title.

To safeguard against potential claims, utilizing a comprehensive Release of Liability option can be crucial. This document serves to clarify the responsibilities and risks associated with participation in specific activities, ensuring that all parties are aware of their rights and obligations.

Quit Claim Deed Form Free - The document itself can vary in format but typically includes the names of the grantor and grantee.

Free Quit Claim Deed Template - This form does not eliminate existing encumbrances on the property being transferred.

Similar forms

A Warranty Deed is similar to a Quitclaim Deed in that both are used to transfer property ownership. However, a Warranty Deed provides a guarantee from the seller that they hold clear title to the property and have the right to sell it. This means that if any issues arise regarding ownership, the seller is legally responsible. In contrast, a Quitclaim Deed does not offer any guarantees about the title, making it a riskier option for the buyer.

When dealing with transactions involving vehicles, it is essential to utilize the appropriate documentation to ensure a seamless ownership transfer. The Florida Motor Vehicle Bill of Sale serves this very purpose; not only does it accurately reflect the details of the transaction, but it also protects the interests of both the buyer and seller. To initiate your vehicle transaction successfully, you can easily access and complete the necessary form through Fill PDF Forms.

A Special Warranty Deed also shares similarities with a Quitclaim Deed, as both documents are used to transfer property. The key difference lies in the level of protection offered. A Special Warranty Deed guarantees that the seller has not caused any title issues during their ownership. However, it does not protect against any problems that may have existed before the seller acquired the property. This limited assurance contrasts with the lack of guarantees in a Quitclaim Deed.

A Bargain and Sale Deed is another document that resembles a Quitclaim Deed. It transfers ownership of property but does not provide any warranties regarding the title. While a Bargain and Sale Deed implies that the seller has an interest in the property, it does not guarantee that the title is free from defects. This makes it similar to a Quitclaim Deed, which also does not assure the buyer of a clear title.

A Deed of Trust is related to property transactions but serves a different purpose. It is used to secure a loan by placing a lien on the property. While it does not transfer ownership like a Quitclaim Deed, it is often part of the same process when purchasing property. Both documents can be involved in real estate transactions, but a Deed of Trust focuses on securing financing rather than transferring ownership.

A Life Estate Deed allows a property owner to transfer ownership while retaining the right to use the property for the rest of their life. This document is similar to a Quitclaim Deed in that it transfers interests in property. However, unlike a Quitclaim Deed, a Life Estate Deed creates a future interest for another party, meaning that the property will automatically pass to the designated person upon the owner's death.

An Executor's Deed is used when an estate is being settled after someone's death. This document transfers property from the deceased person's estate to the heirs or beneficiaries. Similar to a Quitclaim Deed, it does not provide any warranties about the title. The focus is on transferring ownership, but the Executor's Deed is specifically tied to the probate process, while a Quitclaim Deed can be used in various contexts.

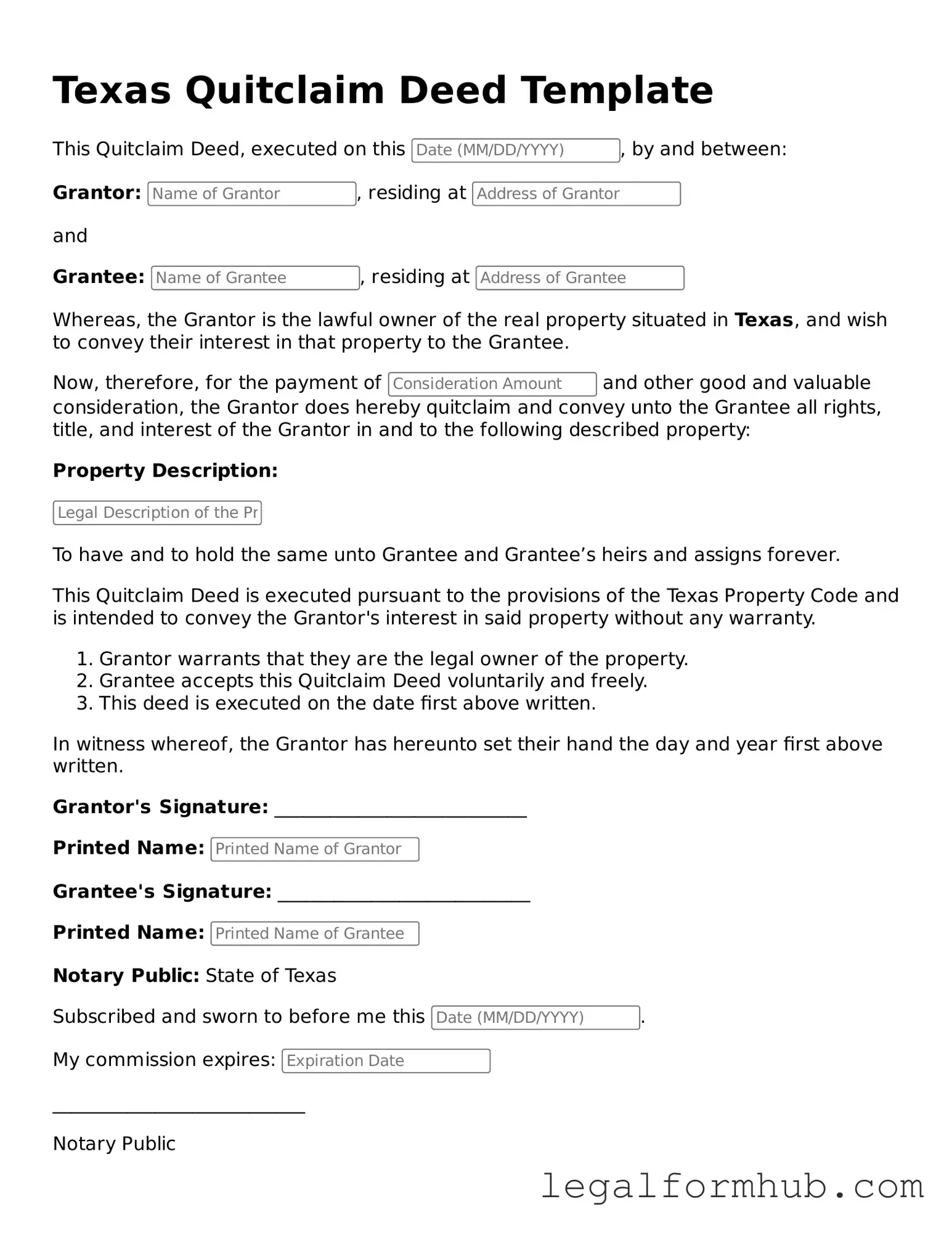

Instructions on Writing Texas Quitclaim Deed

After obtaining the Texas Quitclaim Deed form, you are ready to begin the process of transferring property ownership. Ensure you have all necessary information at hand, such as the details of the property and the parties involved. Following these steps will help you fill out the form accurately.

- Obtain the Form: Start by downloading or acquiring the Texas Quitclaim Deed form from a reliable source.

- Identify the Grantor: In the designated section, clearly write the full name of the person transferring the property (the grantor).

- Identify the Grantee: Next, write the full name of the person receiving the property (the grantee).

- Property Description: Provide a detailed description of the property. Include the address, legal description, and any relevant identifiers like parcel numbers.

- Consideration: State the consideration, or payment, involved in the transfer. If no money is exchanged, you can note "for love and affection" or similar wording.

- Signatures: The grantor must sign the document in the presence of a notary public. Ensure the signature matches the name listed as the grantor.

- Notarization: The notary will complete their section, confirming the identity of the grantor and witnessing the signature.

- Filing: Finally, file the completed deed with the county clerk’s office in the county where the property is located. There may be a filing fee, so check the local requirements.

Misconceptions

Understanding the Texas Quitclaim Deed form is essential for anyone involved in real estate transactions. However, several misconceptions often arise regarding its purpose and implications. Below is a list of five common misconceptions.

- A Quitclaim Deed Transfers Ownership Completely. Many believe that a quitclaim deed guarantees a full transfer of ownership. In reality, it only transfers whatever interest the grantor has in the property, which may be limited or nonexistent.

- A Quitclaim Deed Provides Title Insurance. Some assume that using a quitclaim deed ensures title insurance coverage. This is misleading. Title insurance is not automatically provided and must be purchased separately to protect against potential claims.

- A Quitclaim Deed is Only for Family Transfers. While quitclaim deeds are often used among family members, they are not limited to such transactions. They can be utilized in various situations, including divorces or settling disputes.

- A Quitclaim Deed is the Same as a Warranty Deed. Many people confuse these two types of deeds. Unlike a warranty deed, which guarantees clear title and protection against claims, a quitclaim deed offers no such assurances.

- Filing a Quitclaim Deed is Complicated. Some individuals believe that the process is overly complex. In fact, filing a quitclaim deed is relatively straightforward and can often be completed without legal assistance, provided all necessary information is accurately included.

By addressing these misconceptions, individuals can make more informed decisions when dealing with property transfers in Texas.

Key takeaways

When filling out and using the Texas Quitclaim Deed form, it is essential to keep several key points in mind. The following takeaways can help ensure a smooth process.

- The Quitclaim Deed transfers ownership interest in a property from one party to another without guaranteeing the title's validity.

- Both the grantor (the person transferring the property) and the grantee (the person receiving the property) must be clearly identified.

- Legal descriptions of the property must be accurate and detailed to avoid future disputes.

- Signatures of both parties are required, and the document must be notarized to be legally binding.

- After completion, the Quitclaim Deed should be filed with the county clerk's office where the property is located.

- Filing fees may apply, and it is advisable to check with the local office for the exact amount.

- Using a Quitclaim Deed is common for transferring property between family members or in divorce settlements.

- Consulting with a legal professional can provide clarity on the implications of using a Quitclaim Deed.

File Overview

| Fact Name | Description |

|---|---|

| Definition | A Texas Quitclaim Deed is a legal document used to transfer ownership of real property without making any guarantees about the title. |

| Governing Law | The Texas Quitclaim Deed is governed by the Texas Property Code, specifically Title 1, Chapter 5. |

| Use Cases | This form is often used among family members or to clear up title issues, as it does not require a warranty of title. |

| Filing Requirements | To be valid, the Quitclaim Deed must be signed by the grantor and may need to be notarized before being filed with the county clerk. |