Free Promissory Note Template for Texas

Create Other Popular Promissory Note Forms for Different States

Ohio Promissory Note Requirements - A signed promissory note can go a long way in solidifying a verbal agreement.

For individuals looking to secure their decision-making capabilities, the process of establishing a Durable Power of Attorney is vital. This means having a trusted person who can manage your legal and financial matters if you cannot. To learn more about this important document, check out the comprehensive guide on Durable Power of Attorney available here.

Promissory Note Template Illinois - Legal enforceability is a key feature of a properly executed promissory note.

Similar forms

The Texas Promissory Note form shares similarities with a Loan Agreement. Both documents outline the terms of a loan, including the amount borrowed, interest rates, and repayment schedules. A Loan Agreement typically provides more detailed information about the obligations of both the borrower and the lender, such as collateral requirements and default conditions. While a Promissory Note is more straightforward, focusing primarily on the promise to pay, the Loan Agreement offers a comprehensive framework for the loan’s terms and conditions.

Another document that resembles the Texas Promissory Note is the Mortgage. Like a Promissory Note, a Mortgage involves borrowing money, but it specifically secures the loan with real estate. In essence, the borrower promises to repay the loan, while the lender holds a lien on the property until the loan is paid off. Both documents are critical in the lending process, but the Mortgage adds an additional layer of security for the lender by tying the loan to a tangible asset.

If you're interested in applying for a job at Chick Fil A, completing the Chick Fil A Job Application form is an essential step in the hiring process. This form, which collects personal information, work history, and availability, can be easily accessed online. To get started on your application, you can use the Fill PDF Forms link.

A Personal Guarantee is also similar to a Promissory Note. This document provides assurance from a third party, often a business owner or executive, that they will repay the loan if the primary borrower defaults. While a Promissory Note focuses on the borrower's commitment, a Personal Guarantee adds another layer of accountability, making it a valuable tool for lenders who want extra security for their investment.

The Texas Promissory Note is akin to an IOU. An IOU is a simple acknowledgment of debt, often less formal than a Promissory Note. While an IOU may not include detailed terms like interest rates or repayment schedules, it serves the same fundamental purpose: to recognize that one party owes money to another. Both documents create an obligation, but the Promissory Note is more structured and legally enforceable.

Lastly, a Credit Agreement bears similarities to the Texas Promissory Note. This document outlines the terms under which a lender extends credit to a borrower. Like a Promissory Note, it details the repayment terms and conditions. However, a Credit Agreement is often more complex, covering various aspects of the credit relationship, including fees, covenants, and conditions for borrowing. Both documents are essential in defining the financial relationship between the parties involved.

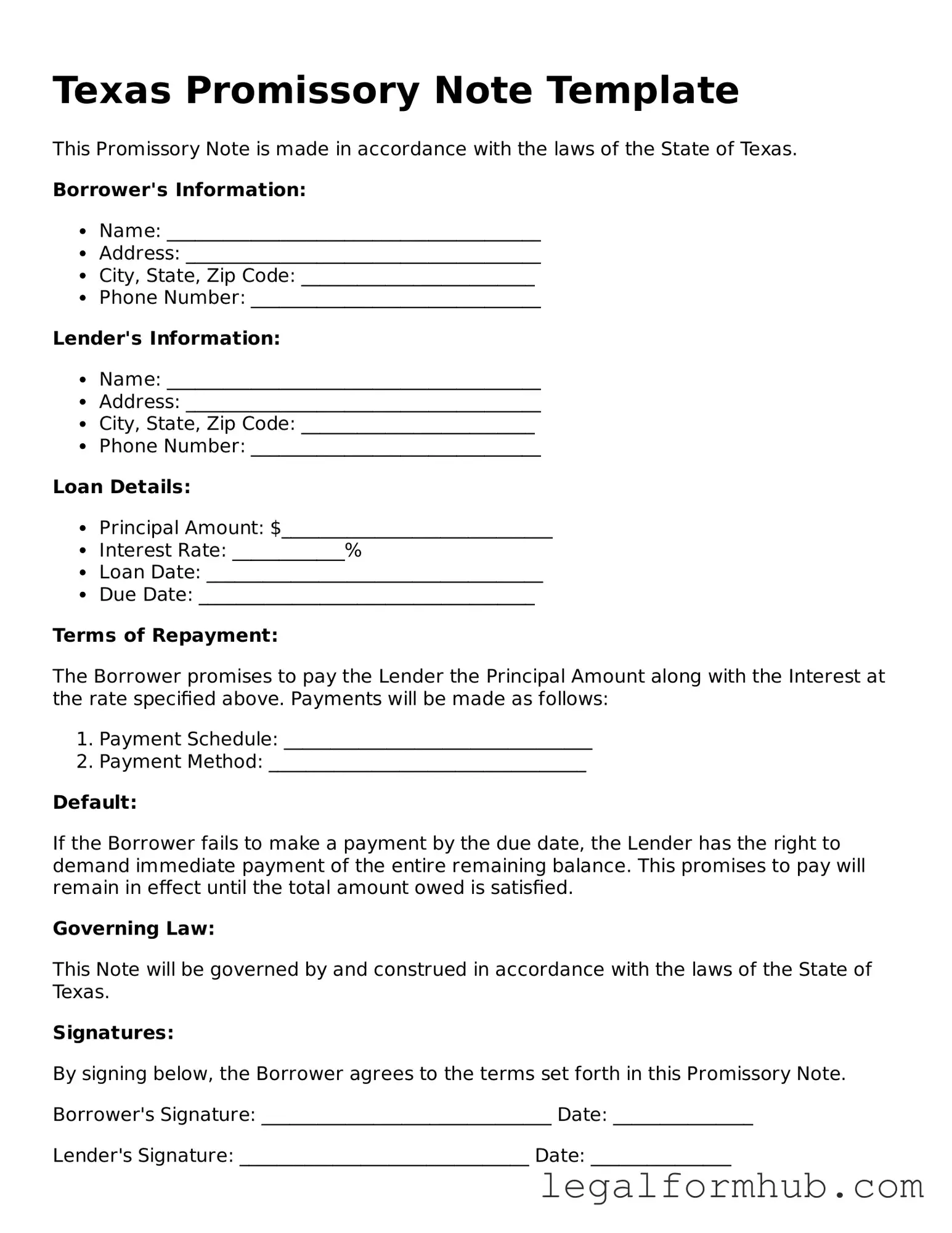

Instructions on Writing Texas Promissory Note

Once you have the Texas Promissory Note form in front of you, it's important to carefully fill it out to ensure that all necessary information is included. After completing the form, you may want to discuss the terms with the other party involved and keep a copy for your records.

- Begin by entering the date at the top of the form. This should be the date when the note is being signed.

- Next, identify the borrower. Write the full name and address of the person or entity borrowing the money.

- Then, provide the lender's information. Include the full name and address of the person or entity lending the money.

- Specify the principal amount. This is the total amount of money being borrowed, and it should be clearly stated in both numbers and words.

- Indicate the interest rate. If there is an interest rate, write it down clearly. If there is no interest, state "0%" or "no interest."

- Outline the repayment terms. Clearly describe how and when the borrower will repay the loan. This may include monthly payments, a lump sum, or other arrangements.

- Include any late fees or penalties. If applicable, specify any fees that will be charged if payments are late.

- State the governing law. Indicate that the note will be governed by the laws of Texas.

- Finally, both the borrower and lender should sign and date the form. Ensure that the signatures are legible and include printed names beneath the signatures.

Misconceptions

Understanding the Texas Promissory Note form can be tricky, especially with the many misconceptions that surround it. Here’s a look at some common misunderstandings and the facts that clarify them.

- Misconception 1: A promissory note is the same as a loan agreement.

- Misconception 2: You don’t need a written promissory note for small loans.

- Misconception 3: Promissory notes are only for formal loans.

- Misconception 4: You cannot modify a promissory note once it’s signed.

- Misconception 5: Interest rates on promissory notes are always fixed.

- Misconception 6: A promissory note does not need to be notarized.

- Misconception 7: A promissory note is unenforceable without collateral.

- Misconception 8: You can’t use a promissory note for business loans.

- Misconception 9: Once a promissory note is signed, it cannot be disputed.

A promissory note is a written promise to pay a specific amount of money. In contrast, a loan agreement outlines the terms of the loan, including interest rates, repayment schedules, and other conditions.

While it might seem unnecessary for small amounts, having a written note protects both the lender and the borrower. It provides clear evidence of the loan terms and can prevent misunderstandings.

Promissory notes can be used for informal loans as well. Whether you’re borrowing from a friend or lending to a family member, a note can help clarify expectations.

It is possible to modify a promissory note. Both parties must agree to the changes, and it’s best to document any modifications in writing.

Interest rates can be fixed or variable, depending on what the parties agree upon. It’s important to specify the rate clearly in the note.

While notarization is not always required, having a note notarized can add an extra layer of legitimacy and may be necessary for certain situations.

A promissory note can still be enforceable even if it is unsecured. However, having collateral can provide additional security for the lender.

Promissory notes are commonly used in business transactions. They can help formalize loans between businesses or from individuals to businesses.

While a signed promissory note carries significant weight, disputes can arise over terms or conditions. If a disagreement occurs, parties may still seek resolution through negotiation or legal avenues.

Key takeaways

When dealing with the Texas Promissory Note form, understanding its components and requirements is crucial for both borrowers and lenders. Here are some key takeaways to keep in mind:

- Clear Identification: Always ensure that both parties—the borrower and the lender—are clearly identified. Include full names and addresses to avoid any confusion later.

- Loan Amount and Terms: Specify the exact amount being borrowed and the repayment terms. This includes the interest rate, payment schedule, and due dates.

- Signatures Required: Both parties must sign the document. This step is essential as it signifies agreement to the terms outlined in the note.

- Legal Compliance: Ensure that the note complies with Texas laws regarding interest rates and loan agreements. Familiarity with these regulations can prevent potential legal issues.

Taking these steps will help ensure that the Texas Promissory Note serves its purpose effectively and protects the interests of all involved parties.

File Overview

| Fact Name | Description |

|---|---|

| Definition | A Texas Promissory Note is a written promise to pay a specified amount of money to a designated party at a future date. |

| Governing Law | The Texas Promissory Note is governed by the Texas Business and Commerce Code, specifically Sections 3.101 to 3.605. |

| Parties Involved | Typically, the note involves two parties: the borrower (maker) and the lender (payee). |

| Interest Rate | The interest rate can be fixed or variable, but must be clearly stated in the note. |

| Payment Terms | Payment terms must specify the amount due, payment schedule, and due dates. |

| Default Conditions | Default conditions should be outlined, detailing the consequences if payments are missed. |

| Signatures | The note must be signed by the borrower for it to be enforceable. |