Free Operating Agreement Template for Texas

Create Other Popular Operating Agreement Forms for Different States

Llc Operating Agreement Michigan - An Operating Agreement outlines the management structure of a business entity.

How to Write an Operating Agreement - Outlines interaction with third parties and contractual obligations.

To facilitate a smooth transaction, consider utilizing a proper Missouri Motor Vehicle Bill of Sale template that ensures the necessary details are documented correctly.

How to Write an Operating Agreement - The agreement could clarify how disagreements will be handled before escalating to legal actions.

How to Make an Operating Agreement - An Operating Agreement can help prevent disputes among members.

Similar forms

The Texas Operating Agreement is similar to a Partnership Agreement, which outlines the relationship between partners in a business. Like the Operating Agreement, a Partnership Agreement specifies each partner's roles, responsibilities, and profit-sharing arrangements. Both documents aim to prevent misunderstandings and disputes by clearly defining the terms of the partnership. They serve as foundational documents that guide the operations of the business, ensuring that all parties are on the same page regarding their commitments and expectations.

The Employment Verification form is a crucial document serving to confirm an employee's work history and eligibility for employment. Employers use it to protect their interests while affirming the rights of employees, thereby ensuring compliance and smooth operational processes. For those looking to complete this process efficiently, you can begin by accessing the necessary resources to help you get started; for example, you can Fill PDF Forms to facilitate the filling out of the Employment Verification form.

Another document that shares similarities with the Texas Operating Agreement is the Bylaws of a corporation. Bylaws govern the internal management of a corporation, detailing the structure of the organization, the roles of directors and officers, and the procedures for meetings and decision-making. Much like an Operating Agreement, Bylaws help establish order and clarity within the organization. They ensure that all members understand their rights and obligations, fostering a cooperative environment for decision-making and governance.

The Limited Liability Company (LLC) Agreement also closely resembles the Texas Operating Agreement. An LLC Agreement serves as the governing document for an LLC, outlining the management structure, member contributions, and distribution of profits and losses. Both documents are essential for ensuring that all members are aware of their rights and responsibilities. They help protect the interests of the members and provide a framework for resolving disputes should they arise.

Lastly, a Shareholder Agreement is akin to the Texas Operating Agreement in that it defines the relationship between shareholders in a corporation. This document details the rights and obligations of shareholders, including how shares can be transferred and how decisions are made. Similar to an Operating Agreement, a Shareholder Agreement aims to minimize conflicts by establishing clear guidelines for governance and the handling of various scenarios that may affect the business. Both documents are vital for maintaining harmony among stakeholders and ensuring the smooth operation of the business.

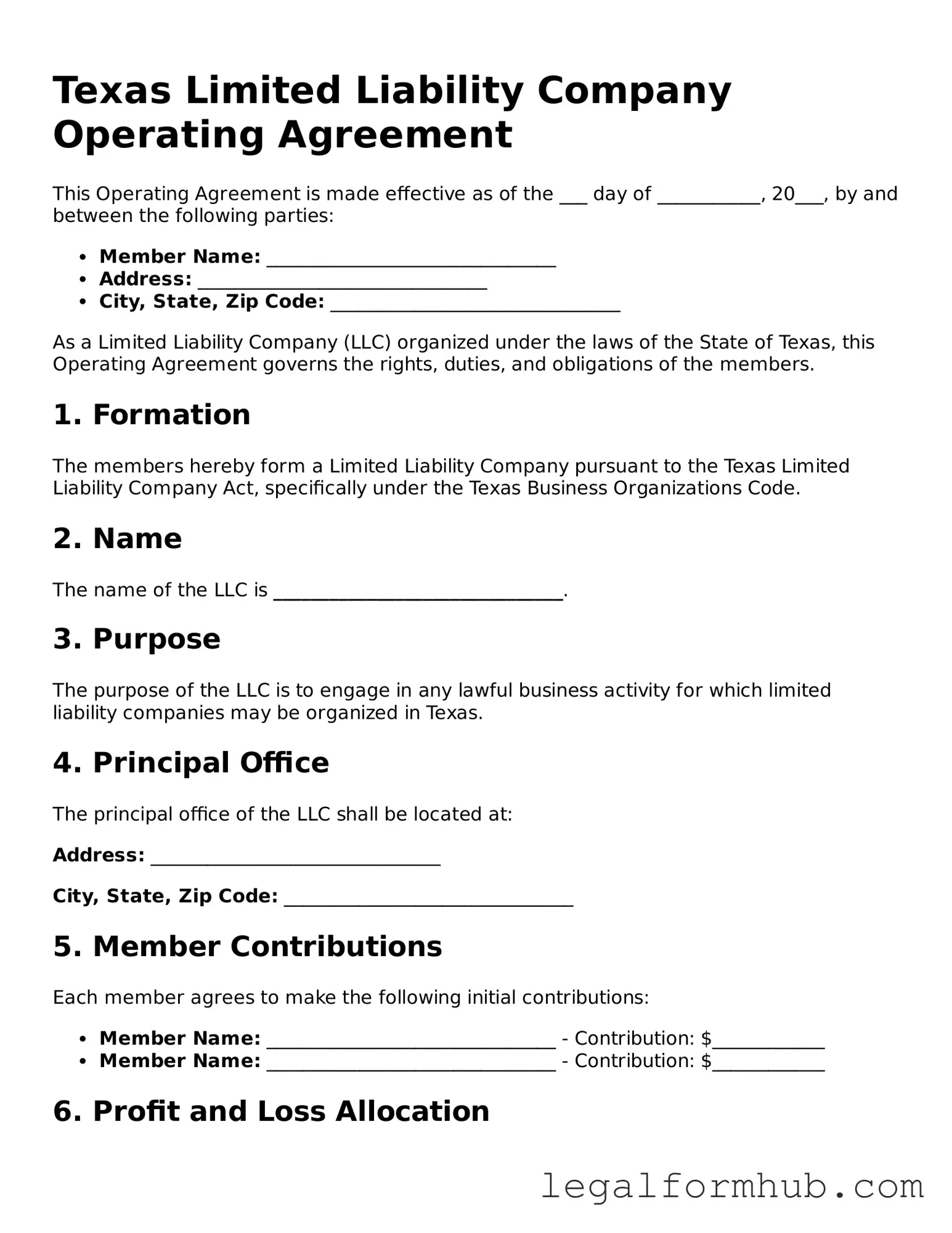

Instructions on Writing Texas Operating Agreement

Completing the Texas Operating Agreement form is an important step for any business entity operating in Texas. This document outlines the management structure and operating procedures for your company. Once the form is filled out, it should be kept with your business records and may need to be shared with members or stakeholders.

- Begin by gathering all necessary information about your business, including the name, address, and the purpose of the company.

- Identify the members of the LLC. List their full names and addresses. Ensure that all members are included.

- Determine the management structure. Decide if the LLC will be member-managed or manager-managed and indicate this on the form.

- Outline the capital contributions. Specify how much each member is contributing to the business and any additional terms regarding these contributions.

- Detail the distribution of profits and losses. Clearly state how profits and losses will be allocated among members.

- Include provisions for meetings. Specify how often meetings will be held and any requirements for notice of these meetings.

- Address the process for adding or removing members. Outline the steps that need to be followed if a member wishes to join or leave the LLC.

- Review the entire form for accuracy. Ensure that all information is correct and complete.

- Once satisfied, have all members sign the document. Make sure to date the signatures.

- Keep a copy of the signed Operating Agreement in your business records for future reference.

Misconceptions

Misconceptions about the Texas Operating Agreement form can lead to confusion among business owners. Here are six common misunderstandings:

-

All LLCs are required to have an Operating Agreement.

While it is highly recommended for LLCs to have an Operating Agreement, Texas does not legally require it. However, having one can help clarify ownership and management roles.

-

The Operating Agreement is filed with the state.

The Operating Agreement is an internal document and does not need to be filed with the Texas Secretary of State. It is kept among the members of the LLC.

-

Only members of the LLC can create the Operating Agreement.

While members typically draft the agreement, outside parties, such as attorneys, can assist in creating it to ensure it meets all necessary requirements.

-

Once created, the Operating Agreement cannot be changed.

Operating Agreements can be amended. Members can revise the document as needed, following the procedures outlined within the agreement itself.

-

The Operating Agreement covers all aspects of the business.

The Operating Agreement primarily addresses ownership and management issues. Other aspects, such as employment policies or operational procedures, may need separate documentation.

-

Having an Operating Agreement guarantees protection from personal liability.

While an Operating Agreement helps establish the LLC's structure, it does not automatically shield members from personal liability. Proper business practices must also be followed.

Key takeaways

Filling out and utilizing the Texas Operating Agreement form is an essential step for any limited liability company (LLC) operating in Texas. Here are some key takeaways to consider:

- Purpose of the Agreement: The Operating Agreement outlines the management structure and operational procedures of the LLC, serving as a foundational document.

- Member Rights: It specifies the rights and responsibilities of each member, ensuring clarity in decision-making and profit-sharing.

- Flexibility: Texas law allows LLCs significant flexibility in structuring their Operating Agreements, which can be tailored to fit specific needs.

- Written vs. Oral Agreements: While an oral agreement may be valid, having a written Operating Agreement is highly recommended for legal protection and clarity.

- Default Rules: In the absence of an Operating Agreement, Texas law imposes default rules that may not align with the members' intentions.

- Amendments: The agreement can be amended as needed, allowing for changes in membership or operational procedures over time.

- Capital Contributions: It should detail the capital contributions of each member, clarifying how funds are contributed and distributed.

- Dispute Resolution: Including a section on how disputes will be resolved can prevent conflicts and provide a clear path forward if disagreements arise.

- Compliance: Regularly reviewing and updating the Operating Agreement ensures ongoing compliance with Texas laws and regulations.

- Not a Public Document: Unlike articles of organization, the Operating Agreement is not filed with the state, offering privacy regarding the LLC’s internal operations.

By understanding these key elements, members can better navigate the complexities of managing their LLC in Texas, fostering a more organized and legally sound business environment.

File Overview

| Fact Name | Description |

|---|---|

| Purpose | The Texas Operating Agreement outlines the management structure and operational procedures of a limited liability company (LLC). |

| Governing Law | This agreement is governed by the Texas Business Organizations Code. |

| Member Rights | It details the rights and responsibilities of members, including profit distribution and decision-making processes. |

| Flexibility | The agreement allows members to customize provisions according to their specific needs and preferences. |

| Amendments | Members can amend the Operating Agreement, provided that the amendment process is clearly defined within the document. |

| Dispute Resolution | The agreement may include provisions for resolving disputes among members, which can help avoid litigation. |

| Not Mandatory | While it is not legally required to have an Operating Agreement in Texas, it is highly recommended for clarity and protection. |