Fill Your Texas Odometer Statement Form

Different PDF Templates

Doctors Prescription Pad - Supports responsible medication management initiatives.

The Doctors Excuse Note form is not only essential for validating a patient's absence from work or school due to health-related issues, but it can also be accessed easily online. For those in need of this helpful document, it is important to understand how to fill it out correctly, and you can find more information and get started at https://pdftemplates.info/.

Geico Supplement Request - Agents at Geico will review the submitted form upon receipt.

Similar forms

The Texas Odometer Statement form shares similarities with the Federal Odometer Disclosure Statement, often required during vehicle sales across the United States. Like the Texas form, the Federal version mandates that sellers disclose the accurate mileage of a vehicle at the time of transfer. Both documents aim to protect buyers from potential fraud by ensuring that the odometer reading is truthful. The Federal form also includes options for sellers to indicate if the mileage exceeds mechanical limits or if the odometer reading is not actual, mirroring the choices available in the Texas version.

For those engaging in activities that may involve risk, understanding the legal implications is essential, particularly concerning liability waivers. One key document is the California Release of Liability form, which allows individuals to relinquish the right to sue for injuries or damages during the activity. Participants must be aware of this form's significance to ensure they are protected and fully informed. To streamline the process, you can easily complete it by visiting Fill PDF Forms.

Another document that resembles the Texas Odometer Statement is the Vehicle Title Application. This application is necessary when a new owner seeks to register a vehicle with the state. Similar to the Odometer Statement, it requires information about the vehicle, including its identification number and the seller's details. The Vehicle Title Application also includes a section where the seller must affirm the accuracy of the odometer reading, thus serving the same purpose of preventing fraudulent claims regarding a vehicle's mileage.

The Bill of Sale is yet another document that aligns closely with the Texas Odometer Statement. This document serves as a receipt for the transaction and typically includes details about the vehicle, such as its make, model, and identification number. Like the Odometer Statement, the Bill of Sale often contains a section where the seller certifies the accuracy of the odometer reading. This ensures that both parties are aware of the mileage at the time of sale, providing an additional layer of protection against potential disputes.

Lastly, the Application for Texas Title and/or Registration also bears similarities to the Texas Odometer Statement. This application is submitted when a vehicle is being registered for the first time in Texas or when ownership is transferred. It requires similar information about the vehicle and includes a certification regarding the odometer reading. Both documents emphasize the importance of accurate mileage reporting, reinforcing legal obligations to disclose truthful information during vehicle transactions.

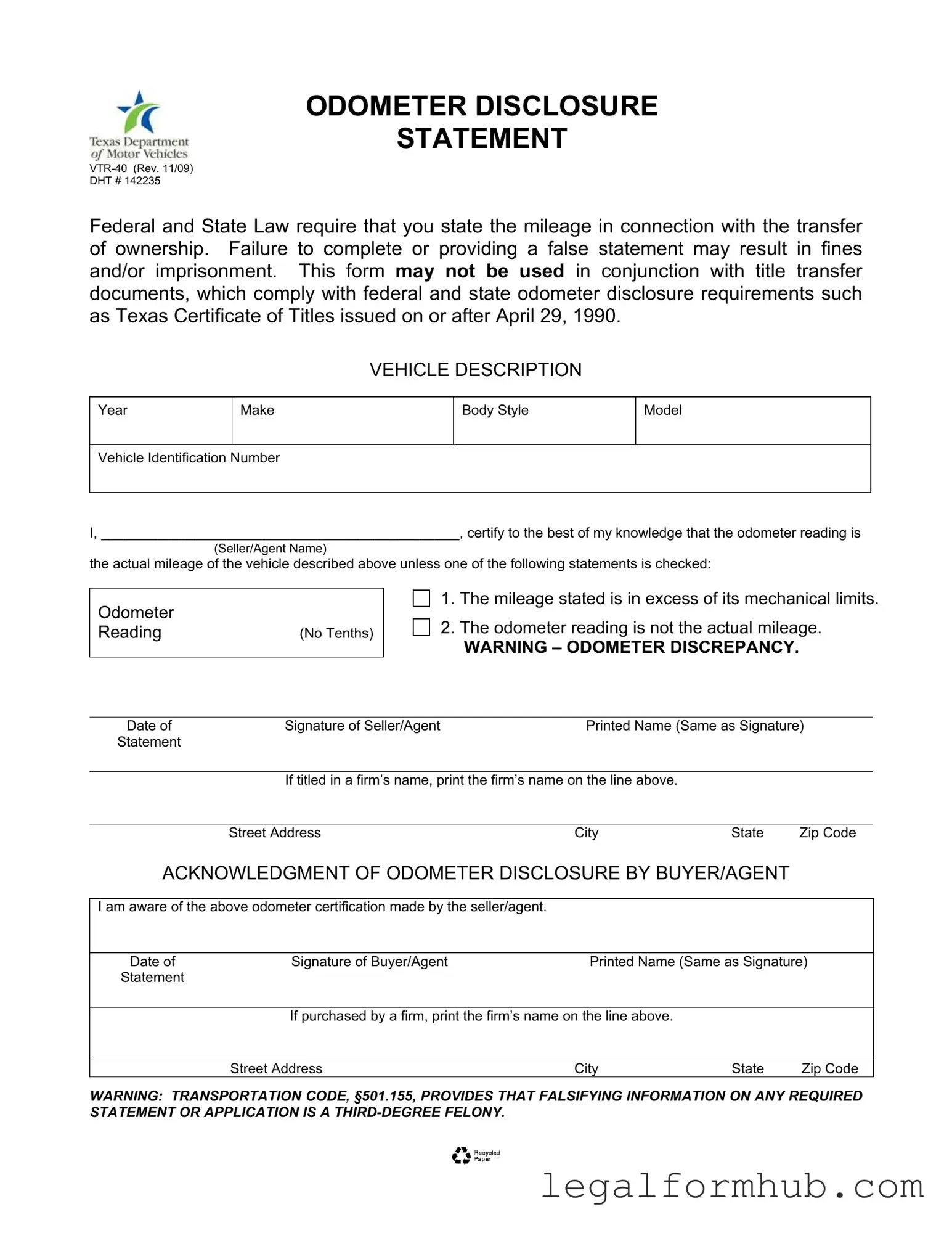

Instructions on Writing Texas Odometer Statement

Once you have the Texas Odometer Statement form in hand, it's important to fill it out accurately. This form is a legal document that must be completed when transferring ownership of a vehicle. Take your time to ensure that all information is correct, as inaccuracies can lead to serious consequences.

- Begin by entering the name of the seller or agent at the top of the form.

- Fill in the vehicle description section with the following details:

- Year

- Make

- Body Style

- Model

- Vehicle Identification Number (VIN)

- In the section labeled "Odometer Reading," write the current mileage of the vehicle. Do not include tenths of a mile.

- Check one of the boxes to indicate if:

- The mileage stated is in excess of its mechanical limits.

- The odometer reading is not the actual mileage.

- Sign and date the form in the "Signature of Seller/Agent" section. Print your name exactly as you signed it.

- If the vehicle is titled in a firm's name, write the firm's name where indicated.

- Provide your street address, city, state, and zip code in the designated fields.

- The buyer or agent must acknowledge the odometer disclosure. They should sign and date the form in the "Signature of Buyer/Agent" section and print their name.

- If the vehicle is purchased by a firm, the firm's name should be printed where indicated.

- Finally, the buyer or agent must fill out their street address, city, state, and zip code.

Misconceptions

Misconceptions about the Texas Odometer Statement form can lead to confusion during vehicle transactions. Understanding the facts can help both buyers and sellers navigate the process more effectively. Below is a list of common misconceptions:

- The form is optional for all vehicle sales. Many believe that the Texas Odometer Statement form is optional. In reality, it is required by federal and state law when transferring ownership of a vehicle.

- Only the seller needs to sign the form. Some assume that only the seller’s signature is necessary. However, both the seller and the buyer or agent must acknowledge the odometer disclosure.

- It can be used for title transfers after April 29, 1990. Many think the form can be used for title transfers of vehicles titled after this date. This is incorrect; the form cannot be used in conjunction with title transfer documents that meet federal and state requirements.

- Providing an inaccurate odometer reading is a minor issue. Some individuals underestimate the seriousness of providing false information. In fact, it may result in significant penalties, including fines and imprisonment.

- The odometer reading must always be exact. There is a misconception that the odometer reading must be precise. The form allows for disclosures indicating that the mileage is not the actual mileage or is in excess of mechanical limits.

- Buyers are not responsible for checking the odometer reading. Some buyers believe they have no obligation regarding the odometer reading. Buyers should be aware of the certification made by the seller and should verify the information provided.

- Filling out the form is a quick and simple process. While the form may seem straightforward, it requires careful attention to detail. Errors or omissions can lead to legal complications.

- The form is only necessary for used vehicles. There is a common belief that the form is only applicable to used cars. However, it is required for all vehicle transactions where ownership is being transferred.

- Once signed, the form cannot be changed. Some think that after signing the form, it cannot be modified. In fact, if errors are discovered, the form can be corrected, but both parties must agree to the changes.

Understanding these misconceptions can help ensure that both buyers and sellers comply with the law and protect their interests during the vehicle transfer process.

Key takeaways

When filling out the Texas Odometer Statement form, there are several important points to keep in mind:

- Legal Requirement: Both federal and state laws mandate that you disclose the vehicle's mileage during ownership transfer.

- Accuracy is Crucial: Providing false information or failing to complete the form can lead to serious penalties, including fines and imprisonment.

- Not for Title Transfers: This form cannot be used with title transfer documents that already meet federal and state odometer disclosure requirements.

- Odometer Reading: You must accurately state the odometer reading, and check any applicable statements regarding the mileage.

- Buyer Acknowledgment: The buyer or agent must acknowledge the odometer disclosure by signing the form, confirming they are aware of the seller's certification.

File Information

| Fact Name | Description |

|---|---|

| Form Purpose | The Texas Odometer Statement form (VTR-40) is used to disclose the mileage of a vehicle during ownership transfer. |

| Legal Requirement | Federal and state laws mandate that sellers provide accurate odometer readings when transferring vehicle ownership. |

| Consequences of False Information | Providing false information on the form can lead to fines and/or imprisonment under Texas law. |

| Exclusions | This form cannot be used with title transfer documents that meet federal and state odometer disclosure requirements, such as titles issued after April 29, 1990. |

| Legal Reference | Transportation Code, §501.155 states that falsifying information on required statements or applications is a third-degree felony. |