Free Motor Vehicle Bill of Sale Template for Texas

Create Other Popular Motor Vehicle Bill of Sale Forms for Different States

Nc Bill of Sale - Promotes responsible ownership transfer by ensuring all details are highlighted.

With the Free And Invoice PDF form, users can simplify the invoice creation process, ensuring that all necessary information is included for accurate billing. To get started on your path to streamlined invoicing, consider utilizing resources to assist with form filling. One such option is to Fill PDF Forms, which can guide you through the process effortlessly.

Michigan Bill of Sale Car - Serves as proof of sale between the buyer and seller of a motor vehicle.

Ga Dmv Bill of Sale - Complete this form to ensure a smooth transaction and avoid misunderstandings.

Similar forms

The Vehicle Title Transfer form is closely related to the Texas Motor Vehicle Bill of Sale. This document is used when ownership of a vehicle changes hands. It officially transfers the title from the seller to the buyer, ensuring that the new owner is recognized by the state. Both documents serve to document the sale, but the title transfer form is specifically focused on updating the vehicle's registration records.

When engaging in any transaction involving personal property, such as vehicles, it is essential to ensure all necessary documents are in order. This includes the comprehensive Employment Verification form, which serves to confirm a candidate's employment history, thereby supporting transparency and credibility in the buying process.

The Odometer Disclosure Statement is another important document. This statement is required when a vehicle is sold and helps to confirm the mileage on the odometer at the time of sale. It protects buyers from odometer fraud and is often included with the bill of sale. While the bill of sale records the sale itself, the odometer disclosure focuses on the vehicle's mileage, ensuring transparency in the transaction.

The Vehicle Registration Application is similar in that it is necessary for the legal operation of a vehicle. After purchasing a vehicle, the new owner must register it with the state. This application includes details about the vehicle and the owner. While the bill of sale proves the sale occurred, the registration application is essential for getting the vehicle legally on the road.

The Affidavit of Heirship is another document that can be relevant when transferring vehicle ownership, particularly in cases where the vehicle was inherited. This affidavit provides proof of ownership when a vehicle is passed down through a will or estate. It is similar to the bill of sale in that it helps establish who has the right to sell or transfer the vehicle.

The Power of Attorney form can also come into play during vehicle transactions. This document allows one person to act on behalf of another in legal matters, including vehicle sales. If the seller cannot be present, they may grant someone else the authority to complete the sale. The bill of sale would still be required, but the Power of Attorney facilitates the process when the seller is unavailable.

The Warranty Deed is somewhat different but still relevant in property transactions, including vehicles. It serves to transfer ownership of property and can include vehicles if they are part of a real estate transaction. While the bill of sale is specific to vehicles, the warranty deed can sometimes encompass the sale of a vehicle when it is bundled with real estate.

Finally, the Sales Tax Receipt is another document that relates to the purchase of a vehicle. After buying a vehicle, the buyer typically pays sales tax, and this receipt serves as proof of that payment. It complements the bill of sale by confirming that the buyer has fulfilled their tax obligations, which is often necessary for registration purposes.

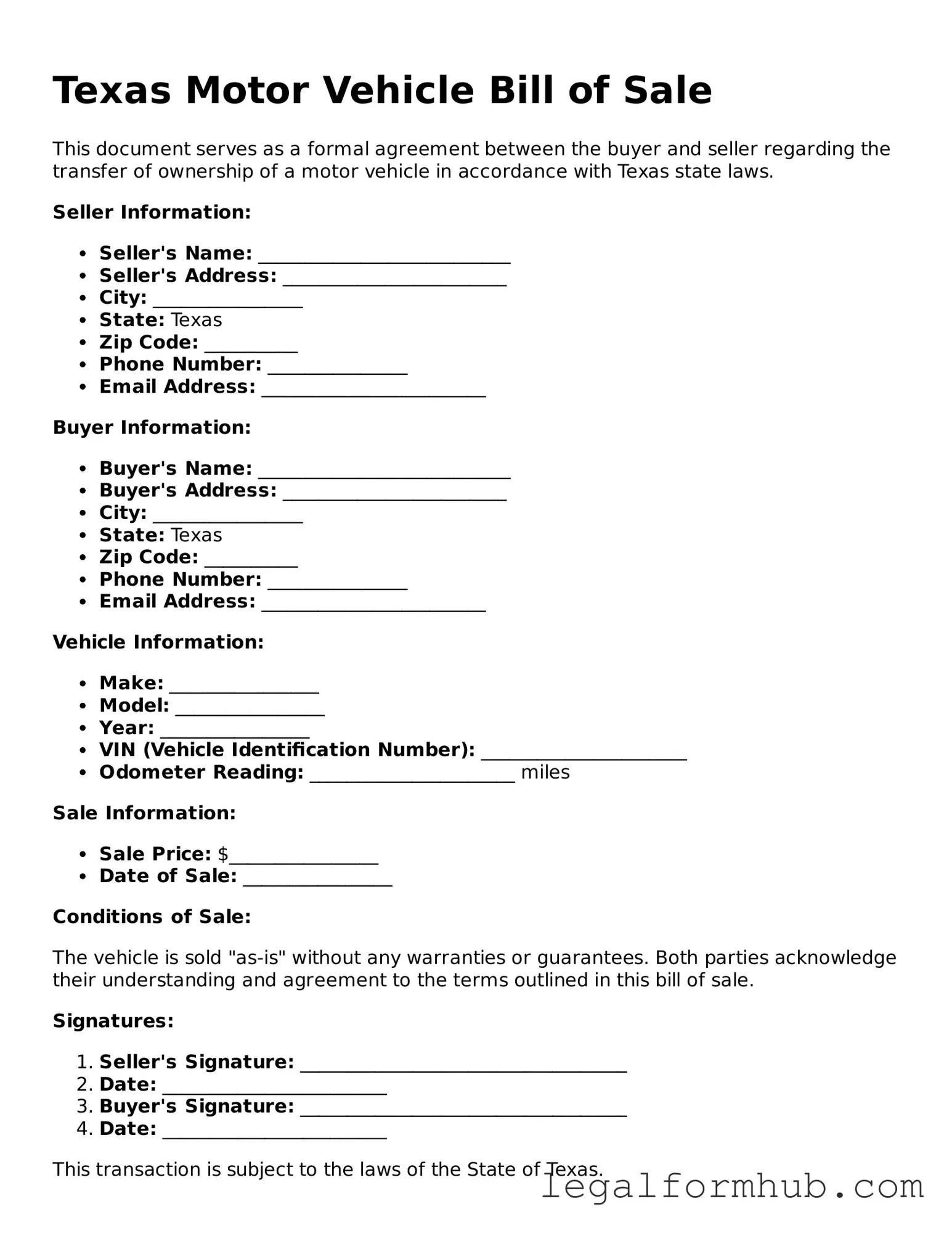

Instructions on Writing Texas Motor Vehicle Bill of Sale

Completing the Texas Motor Vehicle Bill of Sale form is an essential step in transferring ownership of a vehicle. Once you have filled out the form, it will be important to keep a copy for your records and provide the other party with their copy. This document serves as proof of the transaction and can be helpful for both the buyer and the seller in the future.

- Begin by downloading the Texas Motor Vehicle Bill of Sale form from the Texas Department of Motor Vehicles website or obtain a physical copy from a local DMV office.

- Fill in the date of the sale at the top of the form. This is the date when the transaction takes place.

- Provide the seller's information. Include the full name, address, and contact number of the seller.

- Next, enter the buyer's information. This should include the full name, address, and contact number of the buyer.

- In the vehicle description section, list the make, model, year, vehicle identification number (VIN), and odometer reading at the time of sale.

- Indicate the sale price of the vehicle. This is the amount the buyer is paying to the seller.

- Both the seller and buyer should sign and date the form at the designated areas to validate the transaction.

- Make copies of the completed form for both parties to keep for their records.

Misconceptions

The Texas Motor Vehicle Bill of Sale form is an important document for anyone buying or selling a vehicle in Texas. However, several misconceptions can lead to confusion. Here are six common misunderstandings about this form:

- It is not necessary for private sales. Many people believe that a Bill of Sale is only required for transactions involving dealerships. In fact, a Bill of Sale is crucial for private sales as it provides proof of the transaction.

- It does not need to be notarized. Some individuals think that notarization is mandatory for all Bill of Sale forms. While notarization is not required in Texas, having a notary can add an extra layer of authenticity to the document.

- It can be a verbal agreement. A common misconception is that a verbal agreement suffices for the sale of a vehicle. However, a written Bill of Sale is essential for legal protection and clarity in the transaction.

- It is only for the buyer's protection. Many assume that the Bill of Sale primarily protects the buyer. In reality, it also safeguards the seller by documenting the transfer of ownership and releasing them from liability.

- All information is optional. Some people think that they can leave out certain details on the form. However, including specific information such as the vehicle identification number (VIN) and sale price is vital for the document's validity.

- It is the same as a title transfer. Lastly, many confuse the Bill of Sale with the vehicle title. While both are important, the Bill of Sale serves as proof of the transaction, while the title transfer officially changes ownership in the state's records.

Understanding these misconceptions can help individuals navigate the vehicle sale process more effectively and ensure a smoother transaction.

Key takeaways

When filling out and using the Texas Motor Vehicle Bill of Sale form, keep the following key takeaways in mind:

- The form serves as a legal document that records the sale of a vehicle between a buyer and a seller.

- Both parties must provide accurate information, including names, addresses, and vehicle details such as make, model, and VIN.

- It is essential to include the sale price of the vehicle to establish a clear transaction record.

- Both the buyer and seller should sign the form to validate the transaction.

- Make copies of the completed Bill of Sale for both parties for their records.

- This document may be required for vehicle registration and title transfer with the Texas Department of Motor Vehicles.

- Ensure that any liens on the vehicle are resolved before completing the sale.

- The Bill of Sale can also serve as proof of ownership in case of disputes or legal issues in the future.

File Overview

| Fact Name | Description |

|---|---|

| Purpose | The Texas Motor Vehicle Bill of Sale serves as a legal document to record the sale of a vehicle between a buyer and a seller. |

| Governing Law | This form is governed by the Texas Transportation Code, specifically Sections 501.001 - 501.005. |

| Required Information | The form must include details such as the vehicle identification number (VIN), make, model, year, and odometer reading. |

| Signatures | Both the buyer and seller must sign the document to validate the transaction. |

| Notarization | While notarization is not required, it is recommended to add an extra layer of authenticity. |

| Transfer of Ownership | The Bill of Sale facilitates the transfer of ownership and can be used to register the vehicle with the Texas Department of Motor Vehicles. |

| Record Keeping | Both parties should keep a copy of the Bill of Sale for their records, as it may be needed for future reference. |

| Tax Implications | The sale may have tax implications; buyers should be aware of potential sales tax obligations when registering the vehicle. |