Free Mobile Home Bill of Sale Template for Texas

Create Other Popular Mobile Home Bill of Sale Forms for Different States

How to Hand Write a Bill of Sale - Providing a Bill of Sale gives peace of mind to both the buyer and seller.

A Non-disclosure Agreement (NDA) in Arizona is a legal document that protects confidential information shared between parties. This agreement ensures that sensitive information remains private and is not disclosed to unauthorized individuals. By signing an NDA, parties can foster trust and encourage open communication while safeguarding their interests. For those looking for a template, you can find one at arizonapdfs.com/non-disclosure-agreement-template.

Printable Simple Mobile Home Purchase Agreement - Can be used in various state jurisdictions with minor adjustments.

Mobile Home Title California - Ensures both parties have a copy for their records.

Similar forms

The Texas Vehicle Bill of Sale is a document used to transfer ownership of a motor vehicle. Like the Mobile Home Bill of Sale, it provides essential details about the buyer, seller, and the vehicle itself. Both documents require information such as the purchase price, vehicle identification number (VIN), and signatures from both parties. This ensures that the transaction is legally binding and protects the interests of both the buyer and the seller.

The Texas Boat Bill of Sale serves a similar purpose for the sale of boats. It includes key information about the boat, such as the hull identification number, and details about the buyer and seller. Just like the Mobile Home Bill of Sale, it formalizes the transfer of ownership and can be used for registration purposes. Both documents provide a clear record of the transaction, which is important for future reference.

The Texas Trailer Bill of Sale is another document that shares similarities with the Mobile Home Bill of Sale. This form is used to transfer ownership of a trailer, whether it's a utility trailer or a recreational trailer. It contains details about the trailer, including its identification number and the sale price. Both documents help in establishing clear ownership and can be useful for registration and titling processes.

The Texas RV Bill of Sale is specifically for recreational vehicles. It includes the same essential elements as the Mobile Home Bill of Sale, such as the buyer's and seller's information, the RV's identification number, and the sale price. Both documents are important for legal ownership transfer and may be required for registration with the state.

The Texas Firearm Bill of Sale is another similar document, used for the sale of firearms. While the subject matter differs, the structure remains consistent. It includes the buyer's and seller's details, a description of the firearm, and the sale price. Both the firearm and mobile home bills of sale serve to protect both parties and provide a record of the transaction.

If you're interested in fast food industry opportunities, the Chick Fil A Job Application form will guide you through the necessary steps to begin your career with this beloved chain. It encompasses crucial details such as personal information, work experience, and availability for work. To get started on your journey, simply Fill PDF Forms and take the first step toward joining a dynamic team.

The Texas Business Bill of Sale is used when transferring ownership of a business. It outlines the details of the sale, including the names of the buyer and seller, the purchase price, and any assets included in the sale. Like the Mobile Home Bill of Sale, it formalizes the transfer of ownership and provides documentation for both parties involved in the transaction.

The Texas Equipment Bill of Sale is used for the sale of heavy machinery or other equipment. This document contains similar information as the Mobile Home Bill of Sale, including the buyer's and seller's details, a description of the equipment, and the sale price. Both documents ensure that ownership is transferred legally and provide a record for future reference.

The Texas Livestock Bill of Sale is specifically for the sale of livestock. It includes details about the animals being sold, as well as the buyer and seller information. Similar to the Mobile Home Bill of Sale, it serves to document the transaction and protect the rights of both parties involved.

Lastly, the Texas Personal Property Bill of Sale is used for the sale of various personal items. It includes the names of the buyer and seller, a description of the item, and the sale price. Like the Mobile Home Bill of Sale, it creates a legal record of the transaction, ensuring both parties have proof of the sale.

Instructions on Writing Texas Mobile Home Bill of Sale

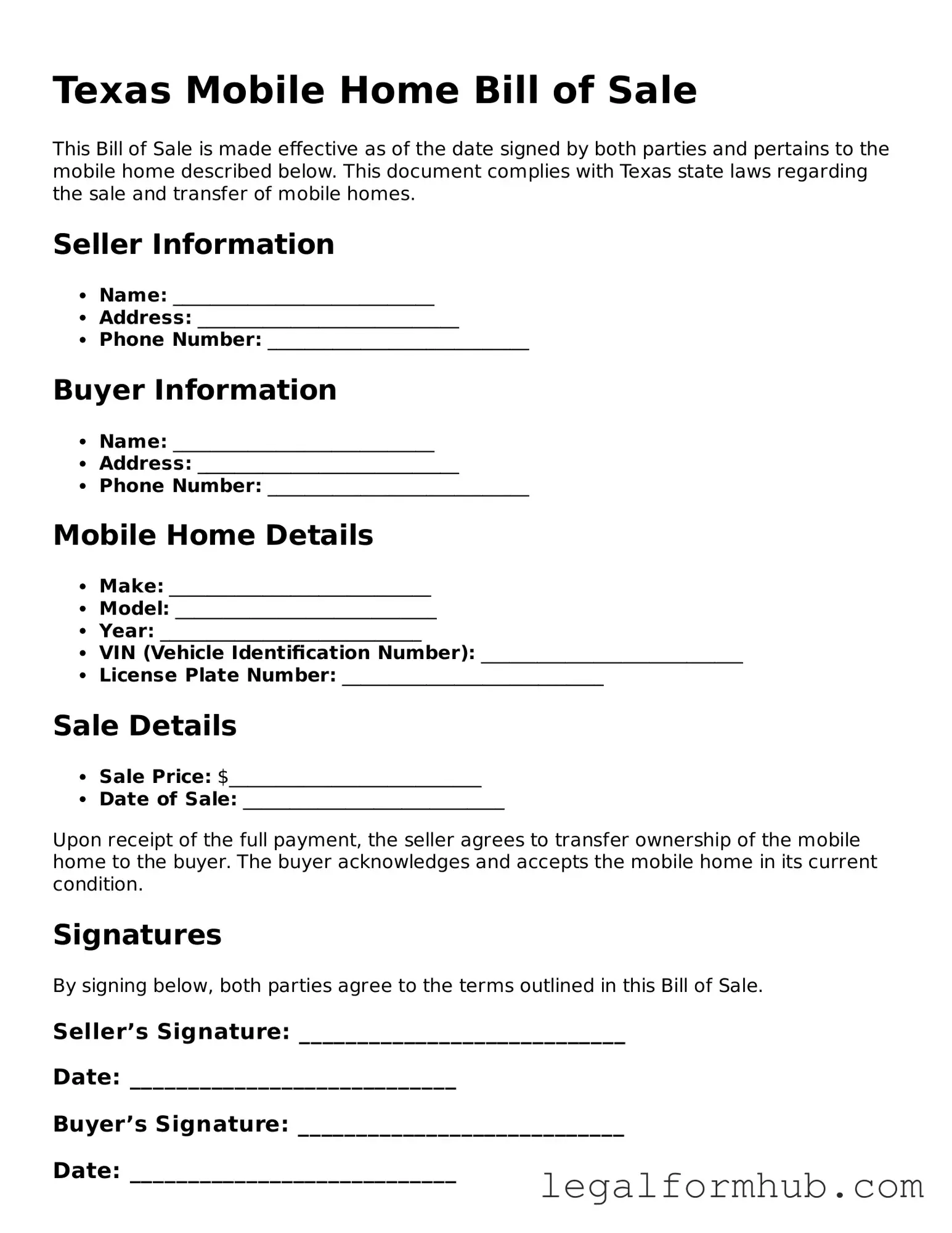

Filling out the Texas Mobile Home Bill of Sale form is a straightforward process. Once completed, this document will serve as a record of the sale and transfer of ownership of a mobile home. Make sure to gather all necessary information before you begin.

- Begin by entering the date of the sale at the top of the form.

- Fill in the seller's name and address. Ensure that the information is accurate and complete.

- Next, provide the buyer's name and address. Double-check for any spelling errors.

- In the section for the mobile home details, include the make, model, year, and vehicle identification number (VIN).

- Specify the sale price of the mobile home. This should reflect the agreed-upon amount between the buyer and seller.

- If applicable, indicate any additional items included in the sale, such as appliances or furniture.

- Both the seller and buyer should sign and date the form at the bottom. Signatures confirm the agreement.

- Make a copy of the completed form for your records before submitting it to the appropriate authorities.

Misconceptions

The Texas Mobile Home Bill of Sale form is often misunderstood. Here are seven common misconceptions:

-

It is only necessary for new mobile home purchases.

This form is required for both new and used mobile home transactions. Whether buying or selling, it serves as proof of ownership transfer.

-

It does not need to be notarized.

While notarization is not always mandatory, having the document notarized can provide additional legal protection and authenticity.

-

It can be filled out after the sale is completed.

The form should be completed at the time of the sale. Delaying this can lead to ownership disputes or issues with registration.

-

Only the seller needs to sign the form.

Both the seller and the buyer must sign the form to ensure that the transfer of ownership is valid and acknowledged by both parties.

-

It is not necessary if the mobile home is being moved to a different location.

The Bill of Sale is still required regardless of whether the mobile home is being relocated. It documents the change of ownership.

-

All sales of mobile homes are exempt from sales tax.

Sales tax may apply to mobile home transactions, depending on the circumstances. It is important to check local regulations.

-

Once the form is submitted, it cannot be changed.

If there are errors or changes needed, a new Bill of Sale can be created to correct the information. Always ensure accuracy to avoid complications.

Key takeaways

When filling out and using the Texas Mobile Home Bill of Sale form, keep these key takeaways in mind:

- Ensure all parties involved are clearly identified. This includes the seller and the buyer, along with their contact information.

- Provide accurate details about the mobile home. Include the make, model, year, and Vehicle Identification Number (VIN).

- Clearly state the sale price. This should be agreed upon by both the buyer and seller.

- Include any terms and conditions of the sale. This can cover aspects like payment methods and any warranties.

- Both parties should sign and date the form. This step is crucial for the validity of the transaction.

- Consider having the document notarized. While not always necessary, notarization can add an extra layer of security.

- Keep a copy for your records. This will be useful for future reference or in case of disputes.

File Overview

| Fact Name | Description |

|---|---|

| Purpose | The Texas Mobile Home Bill of Sale form is used to document the sale of a mobile home between a seller and a buyer. |

| Governing Law | This form is governed by the Texas Property Code, specifically Chapter 1201, which pertains to manufactured housing. |

| Required Information | Essential details include the names and addresses of both the seller and buyer, the mobile home's identification number, and the sale price. |

| Signatures | Both the seller and the buyer must sign the form to validate the transaction. |

| Notarization | Although notarization is not required, having the document notarized can provide additional legal protection. |

| Transfer of Ownership | The Bill of Sale serves as proof of ownership transfer, which is essential for registering the mobile home with the state. |

| Tax Implications | Sales tax may apply to the transaction, and it is the responsibility of the buyer to pay any applicable taxes. |

| Record Keeping | Both parties should retain a copy of the Bill of Sale for their records to resolve any future disputes. |