Free Loan Agreement Template for Texas

Create Other Popular Loan Agreement Forms for Different States

Georgia Promissory Note Template - Default clauses can lead to serious consequences if not understood.

To streamline the process of transferring ownership, it's important to utilize the California Motorcycle Bill of Sale form that captures all necessary details. For assistance in completing this essential document, you can Fill PDF Forms tailored for your needs.

Similar forms

The Texas Promissory Note is a document that outlines the borrower's promise to repay a specific amount of money to the lender. Similar to the Texas Loan Agreement, it details the loan amount, interest rate, and repayment schedule. However, a promissory note is typically simpler and focuses primarily on the borrower's commitment, while a loan agreement may include more extensive terms and conditions.

The Security Agreement is another document that resembles the Texas Loan Agreement. This agreement is used when a borrower pledges collateral to secure a loan. Like the loan agreement, it defines the obligations of both parties, but it specifically addresses the collateral involved. The terms of default and the rights of the lender in the event of non-payment are also clearly stated.

A Texas Mortgage Agreement is closely related to the loan agreement, especially in real estate transactions. This document secures a loan with the property itself as collateral. It includes terms about the loan amount, interest, and repayment but also specifies the consequences of default, such as foreclosure. Both documents serve to protect the lender's interests while outlining the borrower's responsibilities.

The Loan Modification Agreement is similar in that it alters the terms of an existing loan agreement. When borrowers face financial difficulties, they may seek to modify their loan terms. This document outlines the new terms, such as changes in interest rates or payment schedules. Like the original loan agreement, it requires mutual consent and is legally binding.

When considering the transaction process for vehicles in Arizona, it's important to utilize the Motor Vehicle Bill of Sale form, which serves as a crucial legal document for transferring ownership. This form not only provides proof of the sale but also includes essential details about the vehicle being sold. To understand the necessary components for proper completion of this document, buyers and sellers can refer to the comprehensive template available at arizonapdfs.com/motor-vehicle-bill-of-sale-template/, ensuring a smooth and legally sound transfer process.

A Personal Guarantee is akin to a loan agreement in that it provides assurance to the lender regarding the borrower's obligations. This document involves a third party who agrees to repay the loan if the borrower defaults. It shares the same goal of protecting the lender but focuses on the personal responsibility of the guarantor, which can add another layer of security for the lender.

The Loan Application is another document that shares similarities with the Texas Loan Agreement. While the loan application is used to initiate the loan process, it collects essential information about the borrower and their financial situation. This information helps the lender assess the risk of lending. Once approved, the loan agreement formalizes the terms of the loan based on the application.

Finally, a Loan Disclosure Statement provides important information about the loan terms and conditions. It is often provided alongside the loan agreement and ensures that borrowers understand their financial commitments. While the loan agreement details the terms, the disclosure statement summarizes key points, such as fees and penalties, making it easier for borrowers to comprehend their obligations.

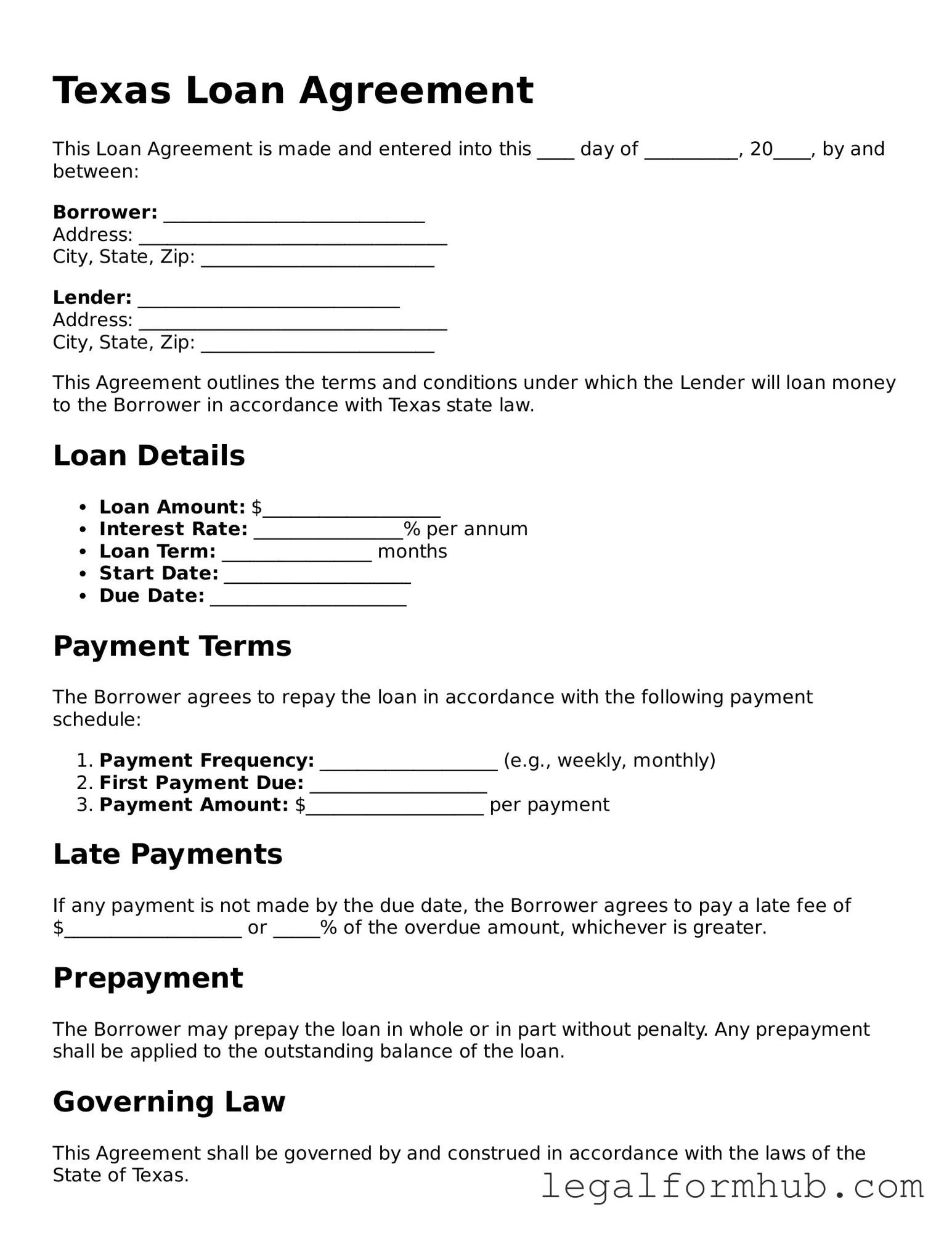

Instructions on Writing Texas Loan Agreement

After gathering all necessary information, you are ready to complete the Texas Loan Agreement form. Ensure that you have accurate details to avoid any issues later. Follow these steps to fill out the form correctly.

- Begin by entering the date at the top of the form.

- Provide the full name and address of the borrower in the designated fields.

- Enter the lender's full name and address next.

- Specify the loan amount in the appropriate section.

- Indicate the interest rate that will apply to the loan.

- Fill in the repayment terms, including the duration of the loan and payment schedule.

- Include any fees associated with the loan, if applicable.

- Sign and date the form at the bottom, ensuring that both parties do the same.

Misconceptions

-

Misconception 1: The Texas Loan Agreement form is only for large loans.

This is not true. The Texas Loan Agreement can be used for loans of various sizes, whether small or large. It is a flexible document that accommodates different lending needs.

-

Misconception 2: A loan agreement is unnecessary if the borrower is a friend or family member.

Even informal loans should be documented. A written agreement helps prevent misunderstandings and protects both parties, regardless of their relationship.

-

Misconception 3: Once signed, the terms of the loan cannot be changed.

This is incorrect. Loan terms can be modified if both parties agree to the changes. It is essential to document any amendments to avoid future disputes.

-

Misconception 4: The Texas Loan Agreement form is only valid if notarized.

While notarization can add an extra layer of validation, it is not a requirement for the agreement to be legally binding. The signature of both parties suffices.

-

Misconception 5: The Texas Loan Agreement form is the same as a promissory note.

This is a common misunderstanding. A loan agreement outlines the terms of the loan, while a promissory note is a specific promise to repay the borrowed amount. They serve different purposes.

-

Misconception 6: All loan agreements in Texas are governed by the same laws.

Loan agreements can be subject to different regulations based on the type of loan and the parties involved. It is crucial to understand the specific laws that apply to your situation.

Key takeaways

When filling out and using the Texas Loan Agreement form, it is essential to keep several key points in mind. These takeaways will help ensure clarity and compliance throughout the process.

- Accurate Information: Provide accurate details about both the borrower and the lender. This includes names, addresses, and contact information.

- Loan Amount: Clearly state the total amount being borrowed. Ensure this figure is correct and matches any discussions prior to filling out the form.

- Interest Rate: Specify the interest rate applied to the loan. This should be clearly defined to avoid confusion later on.

- Repayment Terms: Outline the repayment schedule. Include the frequency of payments and the due date for each installment.

- Late Fees: Include any penalties for late payments. Clearly outline the terms under which these fees apply.

- Default Conditions: Define what constitutes a default on the loan. This may include missed payments or failure to comply with other terms.

- Governing Law: State that the agreement is governed by Texas law. This is crucial for legal clarity and enforcement.

- Signatures: Ensure that both parties sign the agreement. This confirms that all parties understand and agree to the terms outlined in the document.

Review the completed form carefully before finalizing any agreements. Proper attention to detail can prevent misunderstandings and legal issues down the road.

File Overview

| Fact Name | Description |

|---|---|

| Governing Law | The Texas Loan Agreement is governed by the Texas Business and Commerce Code. |

| Parties Involved | The agreement typically involves a lender and a borrower, both of whom must be clearly identified. |

| Loan Amount | The form specifies the total amount of money being loaned to the borrower. |

| Interest Rate | The agreement outlines the interest rate applicable to the loan, which must comply with state regulations. |

| Repayment Terms | It details the repayment schedule, including due dates and payment amounts. |

| Default Provisions | The form includes clauses addressing what happens in the event of a default on the loan. |