Free Lady Bird Deed Template for Texas

Create Other Popular Lady Bird Deed Forms for Different States

How to File a Lady Bird Deed in Michigan - This deed empowers property owners with flexibility over their property decisions in life and death.

Understanding the eviction process is crucial for both landlords and tenants, especially when it comes to the New York Notice to Quit form, which serves as a formal request for a tenant to vacate the property. To ensure all parties are informed and prepared, it's important for landlords to provide clear communication, which is why you should read the form carefully before taking any further action.

Similar forms

The Texas Lady Bird Deed is often compared to a traditional warranty deed. Both documents serve to transfer property ownership from one party to another. However, a warranty deed provides a guarantee that the property is free from any liens or encumbrances, whereas a Lady Bird Deed allows the property owner to retain certain rights, such as the ability to live on the property and sell it during their lifetime. This means that while both documents facilitate the transfer of property, the Lady Bird Deed offers more flexibility and control to the original owner.

An additional document similar to the Lady Bird Deed is the transfer-on-death (TOD) deed. Like the Lady Bird Deed, a TOD deed allows property to pass directly to a designated beneficiary upon the owner's death without going through probate. The key difference lies in the fact that a TOD deed does not allow the property owner to retain control during their lifetime. Once the owner passes away, the beneficiary automatically takes ownership, whereas the Lady Bird Deed permits the original owner to maintain their rights until death.

A durable power of attorney for real estate transactions can also be likened to the Lady Bird Deed. This document allows one person to act on behalf of another regarding real estate matters. While a power of attorney grants authority to manage property, it does not transfer ownership. In contrast, the Lady Bird Deed directly affects ownership and allows the original owner to maintain control over the property until their death, thus providing a different level of engagement and authority.

The Chick-fil-A Job Application form is a crucial step for those aiming to work at Chick-fil-A restaurants. This form gathers necessary information including personal details, work history, and availability, which helps the hiring team in making well-informed decisions. To commence your application process, visit pdftemplates.info/ and fill out the form to begin your journey with this well-known fast-food chain.

Lastly, a revocable living trust can be compared to the Lady Bird Deed in terms of estate planning. Both tools are designed to help individuals manage their property during their lifetime and dictate how it should be handled after death. A revocable living trust allows for the transfer of property into the trust, which can avoid probate. However, unlike the Lady Bird Deed, a living trust requires the property to be retitled, which can be more cumbersome. The Lady Bird Deed allows for a more straightforward transfer while still providing the original owner with rights and control during their lifetime.

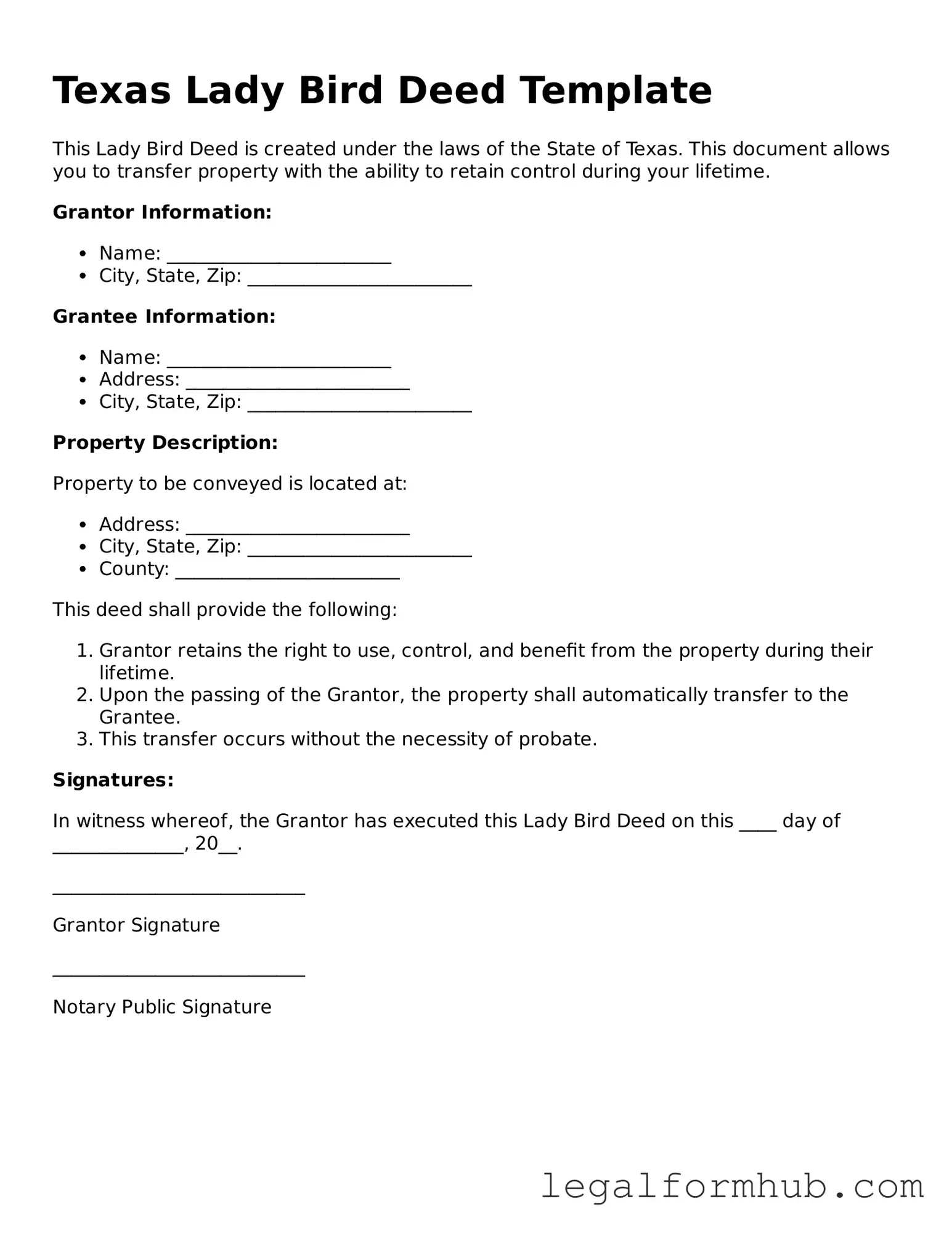

Instructions on Writing Texas Lady Bird Deed

Filling out the Texas Lady Bird Deed form is a straightforward process that allows you to transfer property while retaining certain rights. After completing the form, you will need to file it with the appropriate county office to ensure it is legally recognized.

- Begin by downloading the Texas Lady Bird Deed form from a reliable source.

- Enter the name of the current property owner(s) at the top of the form.

- Provide the legal description of the property. This can usually be found on your property tax statement or deed.

- List the name(s) of the beneficiary or beneficiaries who will receive the property upon your passing.

- Specify any conditions or limitations regarding the transfer of the property, if applicable.

- Sign and date the form in the designated area. Ensure that all owners sign if there is more than one.

- Have the form notarized. This step is essential for the deed to be valid.

- Make copies of the completed and notarized form for your records.

- File the original form with the county clerk’s office where the property is located.

Misconceptions

The Texas Lady Bird Deed is a powerful estate planning tool, yet many people hold misconceptions about its purpose and functionality. Here are eight common misunderstandings:

- It’s only for wealthy individuals. Many believe that the Lady Bird Deed is only useful for those with significant assets. In reality, it can benefit anyone looking to simplify the transfer of property.

- It avoids all taxes. While the Lady Bird Deed can help avoid probate, it does not exempt the property from taxes. Property taxes and capital gains taxes may still apply.

- It’s the same as a traditional deed. A Lady Bird Deed differs significantly from a standard deed. It allows the property owner to retain control during their lifetime while also facilitating a smooth transfer upon death.

- It can only be used for residential property. Many think the Lady Bird Deed is limited to homes. However, it can be applied to various types of real estate, including land and commercial properties.

- It automatically transfers property to beneficiaries. The deed does not transfer ownership until the original owner passes away. Until then, the owner maintains full control of the property.

- It’s too complicated to set up. While it’s important to understand the process, many find that creating a Lady Bird Deed is straightforward, especially with the help of a legal professional.

- It can be revoked only through a legal process. In fact, a Lady Bird Deed can be revoked or altered by the original owner at any time during their lifetime without needing to go through a court.

- All states recognize the Lady Bird Deed. This deed is specific to Texas. Other states have different laws and forms for transferring property, so it’s essential to check local regulations.

Understanding these misconceptions can help individuals make informed decisions about their estate planning. The Texas Lady Bird Deed offers flexibility and control, making it a valuable option for many property owners.

Key takeaways

The Texas Lady Bird Deed is a unique estate planning tool that can simplify the transfer of property. Here are some key takeaways to consider when filling out and using this form:

- Retain Control: The property owner retains the right to use, sell, or mortgage the property during their lifetime.

- Automatic Transfer: Upon the owner's death, the property automatically transfers to the designated beneficiaries without going through probate.

- Tax Benefits: This deed can help minimize potential capital gains taxes for beneficiaries, as the property receives a step-up in basis.

- Flexibility: The owner can change beneficiaries or revoke the deed at any time while they are alive.

- Simple Process: Filling out the form is straightforward, but it is important to ensure all information is accurate and complete.

- Consultation Recommended: It’s advisable to consult with a legal professional to ensure that the deed aligns with your overall estate planning goals.

File Overview

| Fact Name | Description |

|---|---|

| What is a Lady Bird Deed? | A Lady Bird Deed allows property owners in Texas to transfer their property to beneficiaries while retaining control during their lifetime. |

| Governing Law | The Lady Bird Deed is governed by Texas Property Code, specifically Section 255.001. |

| Benefits | This type of deed helps avoid probate, allowing for a smoother transfer of property upon the owner's death. |

| Retained Rights | Property owners can sell, mortgage, or change the property as they wish, even after executing the deed. |

| Tax Implications | There are generally no immediate tax consequences when using a Lady Bird Deed, but beneficiaries may face tax considerations later. |

| Revocability | Owners can revoke the deed at any time, maintaining flexibility in their estate planning. |

| Eligibility | Only real property, such as land and homes, can be transferred using a Lady Bird Deed in Texas. |

| Execution Requirements | The deed must be signed by the property owner and must be recorded in the county where the property is located. |