Free Gift Deed Template for Texas

Create Other Popular Gift Deed Forms for Different States

How Much Does It Cost to Transfer Property Deeds? - A Gift Deed can be recorded with local government for public record.

To facilitate the completion of the California Motor Vehicle Bill of Sale form, you may want to visit Fill PDF Forms, which provides helpful resources to guide you through the process and ensure all necessary information is accurately recorded.

How to Transfer Property Deed in Georgia - A Gift Deed avoids the complications associated with wills for transferring property.

Similar forms

The Texas Gift Deed form shares similarities with a Warranty Deed. Both documents serve to transfer property from one party to another. A Warranty Deed guarantees that the grantor holds clear title to the property and has the right to sell it. In contrast, a Gift Deed does not provide such warranties, as it typically involves a voluntary transfer without any exchange of money. Both documents require notarization and must be filed with the county clerk to be effective, ensuring public record of the transaction.

Another document comparable to the Gift Deed is the Quitclaim Deed. Like the Gift Deed, a Quitclaim Deed transfers interest in a property without guaranteeing that the title is clear. This type of deed is often used between family members or in situations where the parties trust each other. While a Gift Deed is specifically for gifts, a Quitclaim Deed can be used for various purposes, including transferring property between co-owners or resolving title issues.

The Special Warranty Deed is also similar to the Gift Deed in that it transfers property ownership without full warranties. However, it does provide some limited guarantees regarding the period during which the grantor owned the property. This means that the grantor is only responsible for issues that arose during their ownership. Like the Gift Deed, it requires notarization and must be recorded to be effective.

A Deed of Trust bears some resemblance to a Gift Deed, particularly in the context of property transfers. While a Gift Deed conveys ownership without consideration, a Deed of Trust involves a borrower, lender, and trustee. The borrower conveys the property to a trustee as security for a loan. Although the purpose differs, both documents involve the transfer of property rights and require formal recording to protect the interests of the parties involved.

If you're looking for a reliable tool for your ATV transaction, the essential Missouri ATV Bill of Sale form is crucial for keeping a clear record of the sale and transfer of your vehicle. You can prepare for your sale by accessing the form through this link.

The Affidavit of Heirship is another document that shares characteristics with the Gift Deed. It is used to establish the heirs of a deceased person and can facilitate the transfer of property without going through probate. While a Gift Deed is a proactive transfer of property during the grantor's lifetime, an Affidavit of Heirship helps clarify ownership after death, making it easier for heirs to claim their inheritance.

A Lease Agreement can also be compared to a Gift Deed, although the purposes differ significantly. Both documents involve the transfer of property rights, but a Lease Agreement grants temporary rights to use the property in exchange for rent. In contrast, a Gift Deed permanently transfers ownership without any financial exchange. Nonetheless, both require clear terms and conditions to avoid disputes.

The Bill of Sale is similar to the Gift Deed in that it transfers ownership of personal property rather than real estate. Both documents can be used to gift items, such as vehicles or equipment, and require signatures from the parties involved. While a Gift Deed pertains to real property, a Bill of Sale is specifically designed for personal property transactions.

Another related document is the Power of Attorney. While not a deed, it allows one person to act on behalf of another in legal matters, including property transfers. A Power of Attorney can facilitate the execution of a Gift Deed if the grantor is unable to sign the document personally. Both documents require careful consideration and must be executed according to state laws.

The Real Estate Purchase Agreement can be likened to a Gift Deed in the context of property transactions. While the former involves a sale with consideration, both documents outline the terms of property transfer. A Gift Deed simplifies this process by eliminating the need for payment, but both require clear identification of the parties and the property being transferred.

Lastly, the Trust Agreement shares some similarities with the Gift Deed. A Trust Agreement establishes a legal entity that holds property for the benefit of others. Like a Gift Deed, it can involve the transfer of property rights, but a Trust Agreement typically involves ongoing management and distribution of assets according to specific terms. Both documents are essential for estate planning and require careful drafting to reflect the grantor's intentions.

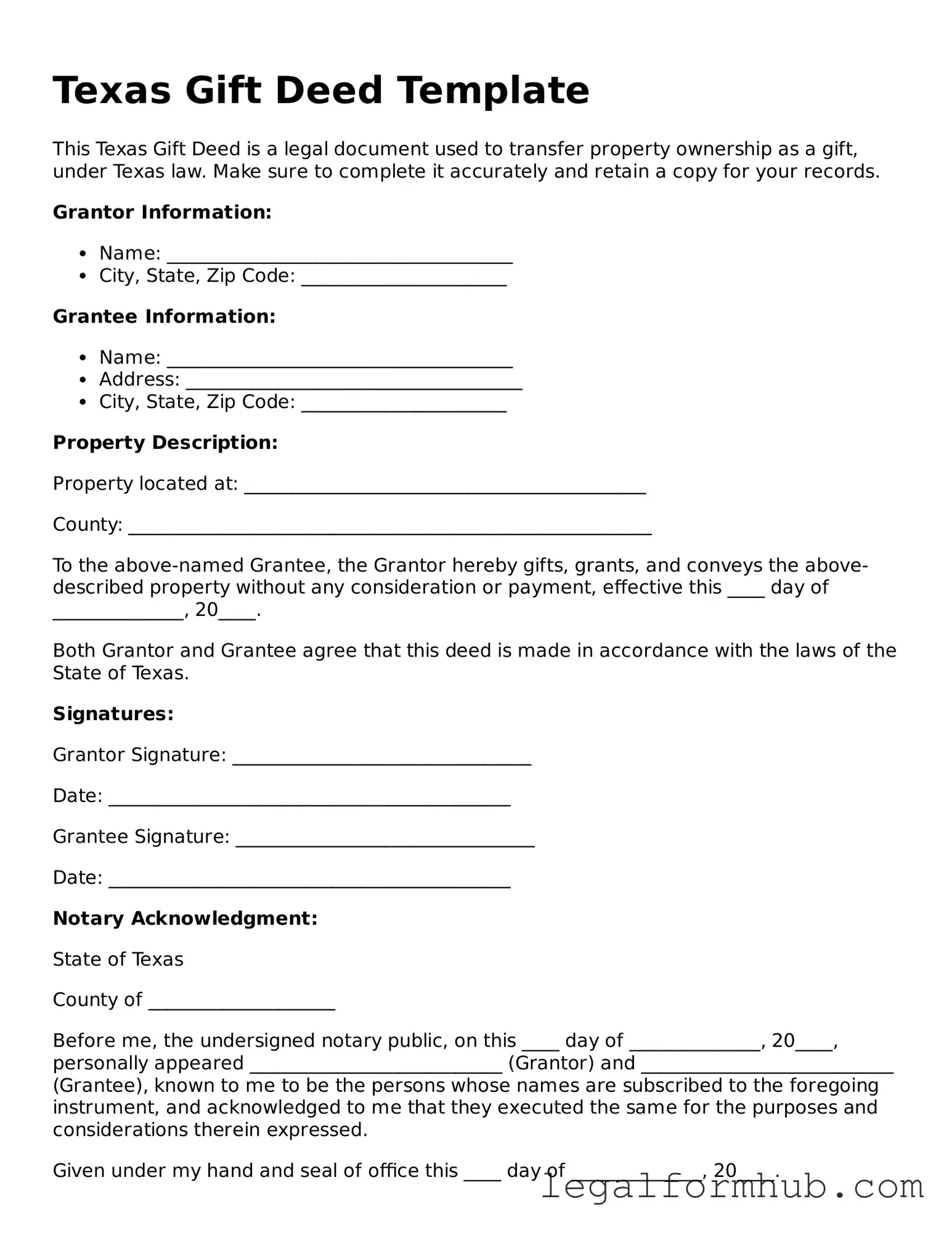

Instructions on Writing Texas Gift Deed

After obtaining the Texas Gift Deed form, the next step involves accurately filling out the necessary information. This process requires attention to detail to ensure that all required fields are completed correctly. Once the form is filled out, it will need to be signed and notarized before being filed with the appropriate county office.

- Obtain the Texas Gift Deed form from a reliable source, such as a legal website or local government office.

- Enter the full name of the donor (the person giving the gift) in the designated space.

- Provide the full name of the recipient (the person receiving the gift) in the appropriate section.

- Clearly describe the property being gifted, including its address and any relevant legal descriptions.

- State the date on which the gift is being made.

- Include any additional terms or conditions related to the gift, if applicable.

- Sign the form in the presence of a notary public to ensure its validity.

- Have the notary public complete their section, including their signature and seal.

- Make copies of the completed and notarized form for your records.

- File the original Gift Deed form with the county clerk's office in the county where the property is located.

Misconceptions

Understanding the Texas Gift Deed form can be challenging due to various misconceptions. Here are ten common misunderstandings, along with clarifications:

-

Gift Deeds are only for family members.

This is not true. While many people use gift deeds to transfer property to relatives, they can also be used to give property to friends or charitable organizations.

-

A Gift Deed does not need to be recorded.

Recording the deed is essential to protect the recipient's ownership rights. If the deed is not recorded, others may claim ownership or challenge the transfer.

-

You cannot revoke a Gift Deed.

While gift deeds are generally irrevocable once executed and delivered, there are specific circumstances under which a donor may have grounds to challenge the deed.

-

Gift Deeds are only for real estate.

This is a misconception. Gift deeds can be used for various types of property, including personal belongings, vehicles, and other assets.

-

There are no tax implications for using a Gift Deed.

Gift deeds may have tax consequences. Depending on the value of the gift, the donor may need to file a gift tax return.

-

A Gift Deed does not require a witness or notarization.

In Texas, a gift deed must be signed by the grantor and typically requires notarization to be legally binding.

-

All Gift Deeds are the same.

Gift deeds can vary significantly based on the specific terms and conditions set by the donor. Customization may be necessary to fit individual situations.

-

Once a Gift Deed is signed, the donor loses all rights to the property.

While the intent is to transfer ownership, the donor may retain certain rights if specified in the deed, such as the right to use the property during their lifetime.

-

Gift Deeds are only for transferring ownership.

Gift deeds can also include specific conditions or restrictions on how the property may be used, adding flexibility to the transfer.

-

Using a Gift Deed is a complicated process.

While there are legal considerations, the process can be straightforward with the right guidance. Many people successfully navigate it with minimal effort.

Key takeaways

Filling out and using a Texas Gift Deed form can be a straightforward process, but it is essential to understand the key components involved. Here are some important takeaways to consider:

- Definition of a Gift Deed: A Gift Deed is a legal document that allows one person to transfer property ownership to another without expecting anything in return.

- Intent is Crucial: Clearly express the intent to make a gift. The donor must intend to give the property away without any conditions.

- Complete the Form Accurately: Ensure that all required fields are filled out completely, including the names of both the donor and the recipient, as well as a description of the property.

- Consideration is Not Required: Unlike a sale, a gift does not require payment or consideration. This distinguishes a Gift Deed from other types of property transfers.

- Signatures Matter: The donor must sign the Gift Deed in front of a notary public. This signature validates the document and confirms the donor's intention.

- Recording the Deed: After signing, it is advisable to file the Gift Deed with the county clerk's office where the property is located. This step provides public notice of the transfer.

- Tax Implications: Be aware of potential gift tax implications. While the recipient may not owe taxes, the donor may need to file a gift tax return if the value exceeds certain limits.

- Revocation of Gift: Once a Gift Deed is executed and recorded, it generally cannot be revoked. The donor should be certain of their decision before proceeding.

- Legal Advice is Beneficial: Consulting with a legal professional can help ensure that the Gift Deed is executed correctly and that all legal requirements are met.

Understanding these key points can help ensure a smooth process when filling out and using a Texas Gift Deed form.

File Overview

| Fact Name | Description |

|---|---|

| Definition | A Texas Gift Deed is a legal document used to transfer property ownership without any exchange of money, signifying a gift from one party to another. |

| Governing Law | The Texas Gift Deed is governed by the Texas Property Code, particularly Chapter 5, which outlines the requirements for property transfers. |

| Requirements | For a Gift Deed to be valid in Texas, it must be in writing, signed by the donor, and must be acknowledged before a notary public. |

| Tax Implications | Gift Deeds may have tax implications for both the giver and the recipient, including potential gift tax liabilities, which should be considered before executing the deed. |