Free Employment Verification Template for Texas

Create Other Popular Employment Verification Forms for Different States

I9 Verification - The form may require signatures from both the employee and employer.

A Durable Power of Attorney (DPOA) is a legal document that allows you to designate someone to make decisions on your behalf if you become incapacitated. In Arizona, this form is essential for ensuring your financial and medical matters are handled according to your wishes. For those looking to get started, resources such as arizonapdfs.com/durable-power-of-attorney-template/ can provide guidance on how to properly complete and execute this document, which is crucial for protecting your interests.

State of Ohio Employment Verification - Employers fill out this form to provide confirmation of a worker's employment credentials.

E-verify Georgia Requirements - Aids in the retention of employee documentation standards.

Similar forms

The I-9 Employment Eligibility Verification form is a federal document used by employers to verify the identity and employment authorization of individuals hired for work in the United States. Like the Texas Employment Verification form, the I-9 requires employees to provide personal information and documentation to prove their eligibility. Both forms serve to protect employers from hiring individuals who are not authorized to work, ensuring compliance with employment laws.

The W-4 form, or Employee's Withholding Certificate, is another important document that shares similarities with the Texas Employment Verification form. While the W-4 focuses on tax withholding, it also requires personal information from the employee. Employers use this form to determine the amount of federal income tax to withhold from an employee's paycheck. Both forms are essential for accurate record-keeping and compliance with federal regulations.

The Texas Workforce Commission (TWC) forms, such as the TWC Employment Verification form, are also comparable to the Texas Employment Verification form. These documents are used to confirm employment status and wages for various purposes, including unemployment benefits. Both forms aim to provide verification of employment details, although the TWC forms may have a broader focus on state-specific requirements.

The Social Security Administration (SSA) form for wage reporting is similar in its purpose of verifying employment. Employers use this form to report employee wages for Social Security benefits. Like the Texas Employment Verification form, it requires accurate information about the employee's earnings and employment status, ensuring that proper benefits are allocated based on verified income.

To ensure that your employment transactions are documented properly, it is essential to use the appropriate forms, such as the Fill PDF Forms for bill of sale or other legal documents that validate ownership and work eligibility.

The Form 1099 is another document that shares similarities, particularly for independent contractors. This form reports income earned by non-employees and is essential for tax purposes. While the Texas Employment Verification form pertains to employees, both documents require accurate reporting of income and employment status, which is crucial for tax compliance.

The background check authorization form is also relevant, as it often accompanies employment verification processes. This document allows employers to conduct background checks on potential hires. Like the Texas Employment Verification form, it serves to confirm information about the individual, ensuring that hiring decisions are based on verified data.

The employee onboarding checklist is another document that aligns with the Texas Employment Verification form. This checklist often includes various forms and documents that new hires must complete, including employment verification. Both documents are part of the onboarding process, ensuring that employers have all necessary information to comply with legal requirements.

Finally, the state-specific employment verification letters are similar as they serve to confirm an employee’s job status and details. These letters may be required for various purposes, such as loan applications or rental agreements. Like the Texas Employment Verification form, they provide essential verification of employment information, helping individuals navigate personal and financial matters.

Instructions on Writing Texas Employment Verification

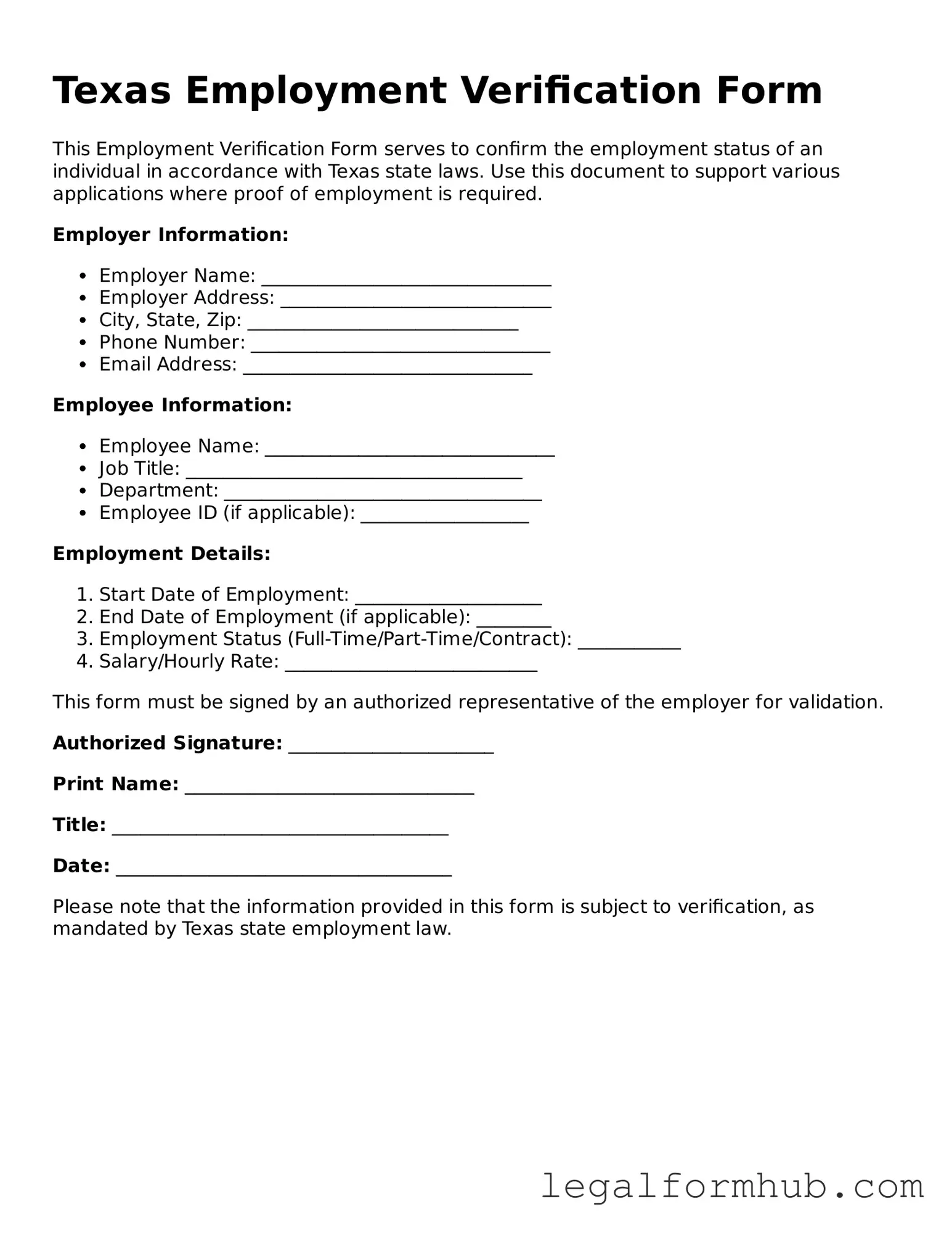

After obtaining the Texas Employment Verification form, it is important to complete it accurately to ensure a smooth verification process. Follow these steps to fill out the form correctly.

- Start by entering the employee's full name in the designated field.

- Provide the employee's Social Security number. This information is crucial for identification purposes.

- Fill in the employee's job title. Be sure to use the official title as it appears in company records.

- Indicate the employee's start date with the company. This should reflect the first day of employment.

- Record the employee's current employment status. This may include options such as full-time, part-time, or terminated.

- List the employee's salary or hourly wage. If the employee is paid hourly, specify the rate clearly.

- Provide the name and contact information of the person completing the form. This ensures that any follow-up questions can be directed to the right individual.

- Sign and date the form at the bottom. This confirms that the information provided is accurate and complete.

Once the form is completed, it should be submitted to the appropriate entity as required. Ensure that a copy is kept for your records.

Misconceptions

Understanding the Texas Employment Verification form is essential for both employers and employees. However, several misconceptions can lead to confusion. Here are five common misunderstandings:

-

It is mandatory for all employers to use the Texas Employment Verification form.

While many employers choose to use this form for consistency, it is not legally required for all businesses. Employers may opt for other methods of verifying employment, provided they comply with applicable laws.

-

The form is only for new hires.

This form can be used at various stages of employment, not just for new hires. Employers may request it for verification purposes during employment or when an employee is seeking a loan or rental agreement.

-

Employers must provide the form to every employee.

Employers are not obligated to provide the form to every employee. They typically issue it only when requested or when it is necessary for specific situations, such as background checks or loan applications.

-

The Texas Employment Verification form guarantees employment.

Using the form does not guarantee that an employee will retain their job or that they will be hired. It serves solely as a verification tool and does not imply any job security.

-

Only employers can fill out the form.

While employers usually complete the form, employees can also provide information. The form may require the employee's input, especially regarding their job title and length of employment.

By clarifying these misconceptions, both employers and employees can navigate the employment verification process with greater confidence and understanding.

Key takeaways

Filling out and using the Texas Employment Verification form can be straightforward if you keep a few key points in mind. Here are some essential takeaways to guide you through the process:

- Understand the Purpose: The Texas Employment Verification form is used to confirm an individual's employment status, including job title, dates of employment, and salary information.

- Gather Necessary Information: Before completing the form, collect all relevant details such as the employee's full name, Social Security number, and the employer's contact information.

- Complete the Form Accurately: Ensure that all sections of the form are filled out correctly. Mistakes can lead to delays or complications in the verification process.

- Use Clear Language: Avoid jargon or complex terms. The information should be easy to understand for anyone reviewing the form.

- Keep It Confidential: Handle personal information with care. Protect the employee's privacy by limiting access to the completed form.

- Know Who to Submit To: Identify the appropriate recipient for the completed form, whether it’s a bank, landlord, or other requesting party.

- Follow Up: After submitting the form, it’s wise to follow up with the requesting party to ensure they received it and that everything is in order.

- Be Aware of Legal Obligations: Familiarize yourself with any legal requirements related to employment verification in Texas to avoid potential issues.

- Keep Copies: Always retain a copy of the completed form for your records. This can be useful for future reference.

- Seek Assistance if Needed: If you encounter difficulties while filling out the form, don’t hesitate to ask for help from HR or legal professionals.

By keeping these takeaways in mind, you can navigate the Texas Employment Verification form with confidence and ease.

File Overview

| Fact Name | Description |

|---|---|

| Purpose | The Texas Employment Verification form is used to confirm an individual's employment status and details with an employer. |

| Governing Law | This form is governed by Texas Labor Code § 61.051, which outlines the requirements for employment verification. |

| Who Uses It? | Employers, employees, and sometimes government agencies or financial institutions utilize this form. |

| Required Information | The form typically requires the employee's name, job title, dates of employment, and salary information. |

| Employee Consent | Employers must obtain the employee's consent before providing employment verification to third parties. |

| Format | The form can be submitted in various formats, including paper and electronic submissions, depending on the employer's preference. |

| Confidentiality | Information disclosed on the form is subject to privacy laws and must be handled with confidentiality. |

| Common Uses | This form is often used for loan applications, rental agreements, and background checks. |

| Retention Period | Employers are advised to retain completed forms for a minimum of four years for record-keeping purposes. |

| Legal Implications | Providing false information on the form can lead to legal consequences for both the employer and the employee. |