Free Deed in Lieu of Foreclosure Template for Texas

Create Other Popular Deed in Lieu of Foreclosure Forms for Different States

Foreclosure in Georgia - It safeguards both parties by providing a clear resolution to mortgage Default situations.

For those looking to formalize their vehicle sale, utilizing the California Vehicle Purchase Agreement is crucial, and you can access a template to help streamline this process at pdftemplates.info, ensuring all necessary details are covered for a smooth transaction.

Deed in Lieu of Foreclosure Ohio - Offers clarity on the responsibilities and expectations of both parties during the property transfer process.

Similar forms

A mortgage release or satisfaction document serves a similar purpose to the Texas Deed in Lieu of Foreclosure. When a borrower pays off their mortgage in full, this document is issued to confirm that the lender has relinquished their claim on the property. Like a deed in lieu, it signifies the end of the borrower's obligation to the lender, but it typically occurs after a successful payment rather than as a means to avoid foreclosure.

For those looking to complete a vehicle transaction smoothly, it is vital to have the proper documentation, such as a California Motor Vehicle Bill of Sale. This form acts as an official record of the sale and ensures that both parties understand the terms involved. If you need assistance in preparing this essential document, you can visit Fill PDF Forms for guidance.

A quitclaim deed also resembles the Texas Deed in Lieu of Foreclosure in that it transfers ownership of property. However, a quitclaim deed is often used between parties who may know each other, such as family members. In this case, the grantor gives up any claim to the property without guaranteeing that they hold clear title, which contrasts with the more formal nature of a deed in lieu.

A warranty deed provides another point of comparison. This document guarantees that the grantor holds clear title to the property and has the right to transfer ownership. While both a warranty deed and a deed in lieu transfer property, a warranty deed offers assurances about the property's title, whereas a deed in lieu is a voluntary transfer to avoid foreclosure.

A foreclosure notice is a document that initiates the foreclosure process, making it fundamentally different from a deed in lieu. While a deed in lieu is a proactive measure taken by a borrower to avoid foreclosure, a foreclosure notice indicates that the lender is beginning legal proceedings to reclaim the property due to non-payment. The two documents represent opposite ends of the foreclosure spectrum.

A short sale agreement also shares similarities with the Texas Deed in Lieu of Foreclosure. In a short sale, the lender agrees to accept less than the total amount owed on the mortgage when the property is sold. Both processes aim to relieve the borrower of their mortgage obligations, but a short sale involves selling the property to a third party, while a deed in lieu involves transferring the property directly back to the lender.

A loan modification agreement can be compared to the Texas Deed in Lieu of Foreclosure in terms of addressing mortgage difficulties. A loan modification alters the terms of an existing mortgage to make payments more manageable for the borrower. While a deed in lieu relinquishes the property entirely, a loan modification seeks to help the borrower retain ownership and avoid foreclosure.

Finally, a forbearance agreement is another document that can be likened to a deed in lieu. This agreement allows a borrower to temporarily pause or reduce mortgage payments due to financial hardship. While a deed in lieu is a final step in the process of dealing with mortgage default, a forbearance agreement provides the borrower with an opportunity to regain financial stability before taking more drastic actions.

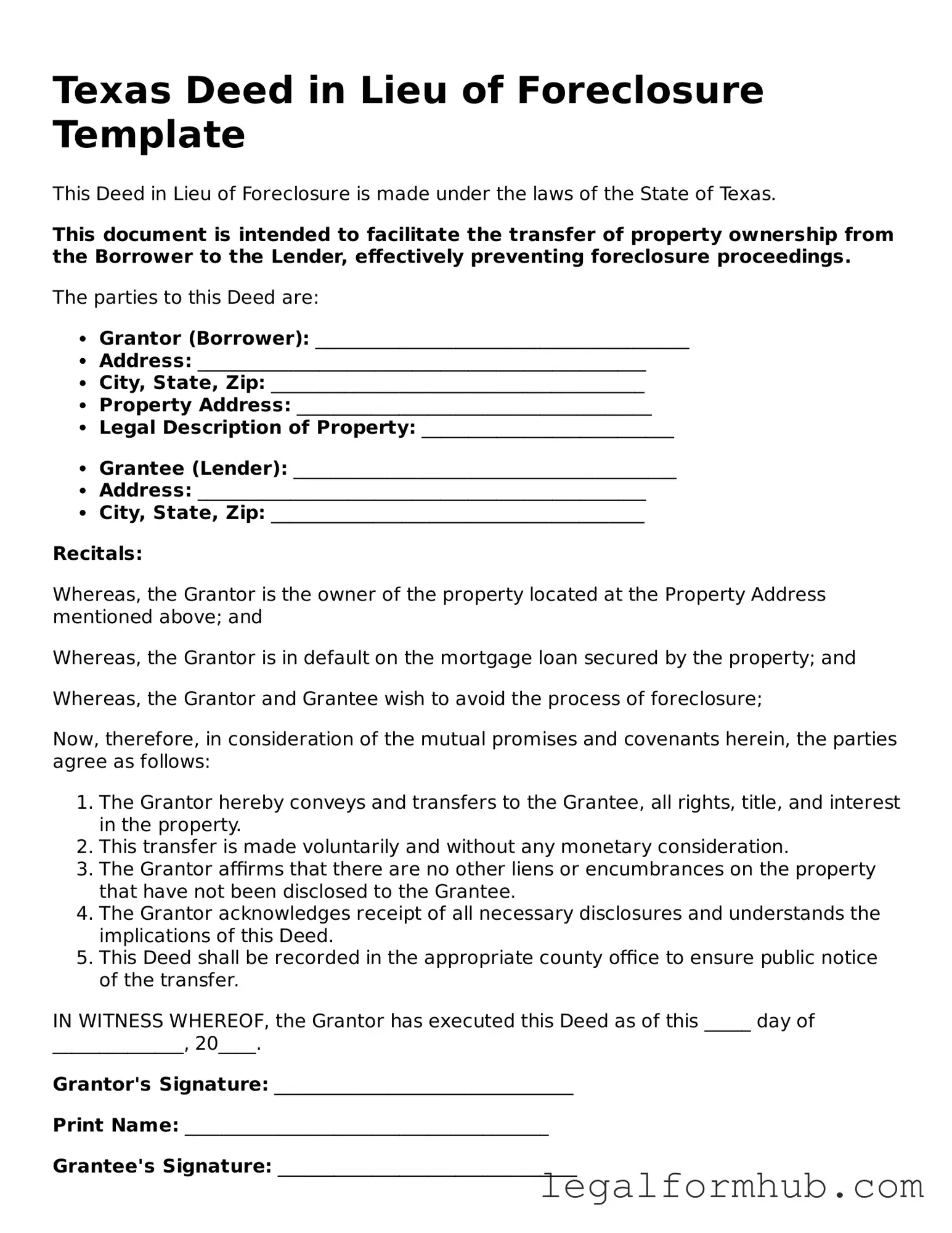

Instructions on Writing Texas Deed in Lieu of Foreclosure

After completing the Texas Deed in Lieu of Foreclosure form, the next steps involve submitting the document to the appropriate parties and ensuring all necessary signatures are obtained. It is important to keep copies of the completed form for personal records and to confirm that the deed has been recorded with the county clerk's office.

- Obtain the Texas Deed in Lieu of Foreclosure form from a reliable source.

- Fill in the date at the top of the form.

- Provide the name and address of the property owner (grantor).

- Include the name and address of the lender or mortgage holder (grantee).

- Describe the property being transferred, including the legal description and address.

- State the reason for the transfer in the designated section.

- Sign the form in the presence of a notary public.

- Ensure that the notary public completes their section and affixes their seal.

- Make copies of the signed and notarized form for your records.

- Submit the original form to the county clerk’s office for recording.

Misconceptions

The Texas Deed in Lieu of Foreclosure is often misunderstood. Here are ten common misconceptions about this process:

- It eliminates all debt immediately. Many believe that signing a Deed in Lieu automatically wipes out all mortgage debt. However, it only transfers ownership of the property to the lender, and any remaining debts may still need to be addressed.

- It is the same as a short sale. Some confuse a Deed in Lieu with a short sale. In a short sale, the property is sold for less than the mortgage balance, while a Deed in Lieu involves transferring the property back to the lender without a sale.

- It does not affect credit scores. Many think that this option has no impact on credit. In reality, a Deed in Lieu can still negatively affect credit scores, though typically less than a foreclosure.

- It is a quick process. Some believe that the Deed in Lieu process is fast. In fact, it can take time for lenders to review and accept the deed, as they may require specific documentation and conditions.

- It is available to everyone. Not all homeowners qualify for a Deed in Lieu. Lenders often have specific criteria that must be met before they will consider this option.

- It absolves all liability. Homeowners often think that signing a Deed in Lieu releases them from all financial obligations. However, if there are other liens on the property, those may still remain.

- It is a legal loophole. Some view a Deed in Lieu as a way to avoid foreclosure without consequences. In reality, it is a formal process that involves legal documentation and lender approval.

- It guarantees a fresh start. Many believe that a Deed in Lieu guarantees a fresh start. While it can help avoid foreclosure, it does not guarantee that lenders will not pursue any remaining debts.

- It is only for homeowners in severe distress. While many use it as a last resort, homeowners in various financial situations may consider a Deed in Lieu as a proactive measure to avoid future complications.

- It is a straightforward decision. Some think that opting for a Deed in Lieu is simple. However, it involves careful consideration of financial implications and potential long-term effects.

Key takeaways

When considering a Deed in Lieu of Foreclosure in Texas, it’s important to understand the process and implications. Here are some key takeaways:

- Understand the Purpose: A Deed in Lieu of Foreclosure allows a homeowner to transfer their property to the lender voluntarily, avoiding the lengthy foreclosure process.

- Eligibility Matters: Not all homeowners qualify. Lenders typically look for a good faith effort to sell the home or demonstrate financial hardship.

- Documentation is Key: Be prepared to provide financial documents and a hardship letter to support your request.

- Property Condition: The property must be in good condition. Lenders may refuse the deed if significant repairs are needed.

- Consult a Professional: It’s wise to speak with a real estate attorney or financial advisor before proceeding to understand your rights and options.

- Impact on Credit: While a Deed in Lieu may be less damaging than foreclosure, it can still negatively affect your credit score.

Taking these points into account can help you navigate the Deed in Lieu of Foreclosure process more effectively.

File Overview

| Fact Name | Description |

|---|---|

| Purpose | A Deed in Lieu of Foreclosure allows a borrower to voluntarily transfer their property to the lender to avoid foreclosure proceedings. |

| Governing Laws | This form is governed by Texas Property Code, particularly Sections 51.001 to 51.015. |

| Process | The borrower must obtain the lender's consent, complete the deed, and ensure that all liens are addressed before transferring the property. |

| Benefits | This process can help borrowers avoid the negative impact of foreclosure on their credit score and may lead to a smoother transition out of the property. |