Free Bill of Sale Template for Texas

Create Other Popular Bill of Sale Forms for Different States

Mi Bill of Sale - It protects the seller by providing evidence that they have relinquished ownership of the item.

Simple Bill of Sale Georgia - The document can protect both parties by documenting the sale terms.

The important aspects of an Operating Agreement include defining roles and responsibilities, which are critical for ensuring smooth operations within an LLC. This document not only protects the interests of its members but also facilitates clear communication and decision-making processes.

Bill of Sale North Carolina - When buying a vehicle, a Bill of Sale is often required for registration purposes.

Similar forms

The Texas Bill of Sale form is similar to a Vehicle Title Transfer document. Both serve as proof of ownership transfer for a vehicle. When someone sells a car, the title must be signed over to the new owner, much like a bill of sale. This document includes vital information such as the vehicle identification number (VIN), the seller's and buyer's details, and the sale price. It provides a legal record that protects both parties in case of disputes regarding ownership or liability.

Another document comparable to the Texas Bill of Sale is the Lease Agreement. While a bill of sale is used for transferring ownership, a lease agreement establishes the terms under which one party can use another's property for a specified time. Both documents outline important details, such as the parties involved, the description of the property, and the terms of the transaction. They serve to protect the rights of both the lessor and lessee, ensuring clarity in the arrangement.

The Sales Agreement is also similar to the Texas Bill of Sale. This document details the terms of a sale, including the items being sold, the price, and the payment method. While the bill of sale is often a simpler version used for immediate transactions, a sales agreement can be more comprehensive, covering additional terms such as warranties or contingencies. Both documents aim to provide a clear understanding of the transaction between the buyer and seller.

In the realm of real estate, a Purchase Agreement bears similarities to the Texas Bill of Sale. This document outlines the terms of a property sale, including the purchase price, closing date, and any contingencies. Like the bill of sale, it serves as a formal agreement between the buyer and seller, ensuring that both parties are aware of their obligations and rights. It is essential for protecting the interests of both parties in the real estate transaction.

The Promissory Note is another document that shares characteristics with the Texas Bill of Sale. This note serves as a written promise to pay a specific amount of money to a designated party. Similar to a bill of sale, it includes key details such as the amount owed, the interest rate, and the repayment schedule. Both documents create a legal obligation, providing a framework for the transaction and helping to prevent misunderstandings.

A Receipt is also akin to the Texas Bill of Sale, as both serve as proof of a transaction. A receipt is typically issued immediately after payment is made, confirming that goods or services were exchanged. While a bill of sale may contain more detailed information regarding the item sold, both documents validate that a transaction has occurred and can be used for record-keeping purposes.

The Inventory List can be compared to the Texas Bill of Sale, particularly when selling multiple items. An inventory list details all items included in a sale, providing clarity about what is being transferred. While the bill of sale may summarize the transaction, the inventory list offers a more exhaustive breakdown. Both documents help prevent disputes by ensuring that all parties are aware of what is included in the sale.

For those looking to streamline their billing process, the Fill PDF Forms is an ideal option that allows individuals and businesses to create invoices effortlessly, ensuring accurate record-keeping and facilitating prompt payments.

The Donation Receipt is another document that resembles the Texas Bill of Sale. While a bill of sale is used for transactions involving payment, a donation receipt acknowledges the transfer of ownership of property or goods without compensation. Both documents serve as proof of transfer and include details about the items being transferred and the parties involved. They help establish a clear record for both the donor and the recipient.

Lastly, the Warranty Deed shares similarities with the Texas Bill of Sale in the context of real estate transactions. A warranty deed transfers ownership of property and guarantees that the seller holds clear title to the property. While the bill of sale is often used for personal property, both documents serve to confirm the transfer of ownership and protect the rights of the new owner. They are essential for ensuring that all legal aspects of the transfer are properly addressed.

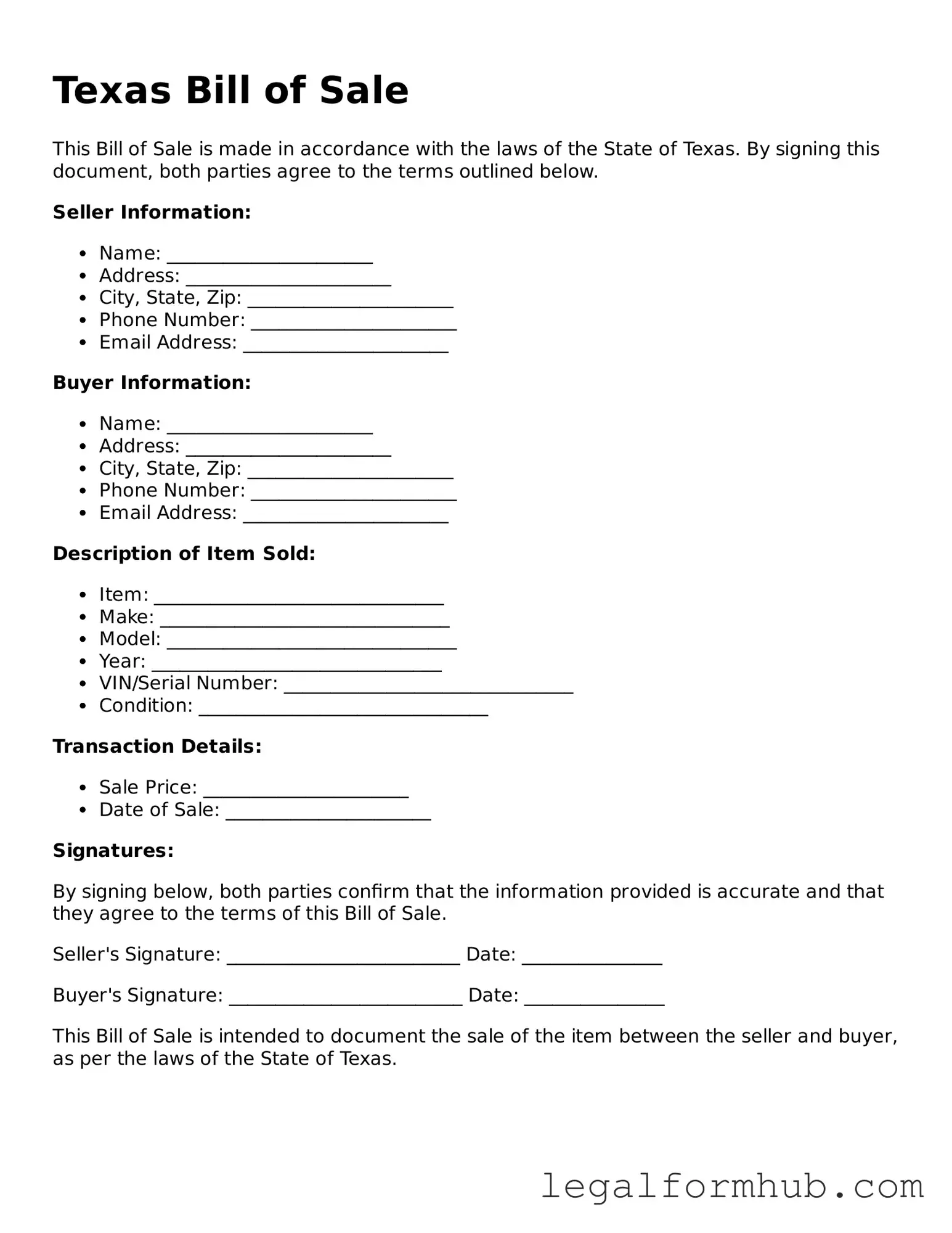

Instructions on Writing Texas Bill of Sale

Filling out the Texas Bill of Sale form is straightforward and helps ensure that the transfer of ownership is documented properly. Once you have completed the form, make sure to keep a copy for your records and provide one to the buyer or seller as needed.

- Begin by entering the date of the transaction at the top of the form.

- Fill in the names and addresses of both the seller and the buyer. Make sure the information is accurate.

- Provide a detailed description of the item being sold. This may include make, model, year, and any identifying numbers, such as a VIN for vehicles.

- Specify the sale price of the item clearly. This is the amount agreed upon by both parties.

- Include any additional terms or conditions of the sale, if applicable. This could cover warranties or stipulations about the item.

- Have both the seller and buyer sign and date the form at the bottom. This indicates agreement to the terms of the sale.

- Make copies of the completed form for both parties to keep for their records.

Misconceptions

Understanding the Texas Bill of Sale form is crucial for anyone engaging in the buying or selling of personal property in the state. However, several misconceptions can lead to confusion. Below is a list of common misunderstandings regarding this important document.

- It is not legally required for all transactions. Many people believe that a Bill of Sale is mandatory for every sale. In Texas, while it is not required for all transactions, it is highly recommended for significant purchases, such as vehicles, to provide proof of ownership.

- It only applies to vehicles. Some think the Bill of Sale is exclusively for motor vehicles. In reality, this form can be used for various personal property transactions, including boats, trailers, and even furniture.

- It must be notarized. There is a common belief that a Bill of Sale must be notarized to be valid. While notarization can add an extra layer of authenticity, it is not a requirement in Texas for the document to be legally binding.

- It serves as a warranty. Many assume that a Bill of Sale guarantees the quality or condition of the item sold. However, this document typically serves as proof of the transaction and does not imply any warranties unless explicitly stated.

- Only sellers need a Bill of Sale. Some individuals think that only the seller requires a Bill of Sale. In fact, both parties should keep a copy of the document for their records, as it protects the interests of both the buyer and the seller.

- It can be a verbal agreement. There is a misconception that a verbal agreement suffices in lieu of a written Bill of Sale. While verbal agreements may hold some weight, having a written document is always advisable for clarity and legal protection.

- All Bills of Sale are the same. People often believe that a Bill of Sale is a one-size-fits-all document. In truth, the form can vary based on the type of transaction, and it is essential to ensure that it includes all necessary details relevant to the sale.

By addressing these misconceptions, individuals can better navigate the process of buying and selling personal property in Texas, ensuring that their transactions are smooth and legally sound.

Key takeaways

When engaging in a transaction involving the sale of personal property in Texas, it is essential to understand the significance of the Bill of Sale form. This document serves as a record of the transfer of ownership and can protect both the buyer and the seller. Here are some key takeaways to consider when filling out and using the Texas Bill of Sale form:

- Accurate Information: Ensure that all information provided on the form is accurate. This includes the names and addresses of both the buyer and seller, as well as a detailed description of the item being sold.

- Item Description: Provide a thorough description of the item. Include details such as the make, model, year, and any identifying numbers, such as a Vehicle Identification Number (VIN) for cars.

- Purchase Price: Clearly state the purchase price of the item. This amount should reflect the agreed-upon price between the buyer and seller.

- Date of Sale: Include the date when the sale is taking place. This is important for record-keeping and may be relevant for tax purposes.

- Signatures: Both parties must sign the Bill of Sale. Signatures signify that both the buyer and seller agree to the terms outlined in the document.

- Notarization: While notarization is not required for all transactions, having the Bill of Sale notarized can provide an additional layer of security and legitimacy.

- Keep Copies: After completing the Bill of Sale, both the buyer and seller should retain copies for their records. This can help resolve any disputes that may arise in the future.

- Legal Compliance: Ensure that the transaction complies with Texas laws. Some items, such as vehicles, may have specific requirements for the transfer of ownership.

By keeping these points in mind, individuals can navigate the process of completing a Bill of Sale in Texas with confidence. Properly executed, this document can facilitate a smooth transaction and provide peace of mind for both parties involved.

File Overview

| Fact Name | Description |

|---|---|

| Purpose | The Texas Bill of Sale form is used to document the sale of personal property between a buyer and a seller. |

| Governing Law | This form is governed by Texas law, specifically under the Texas Business and Commerce Code. |

| Property Types | The form can be used for various types of personal property, including vehicles, boats, and equipment. |

| Notarization | While notarization is not required, it is recommended for added legal protection. |

| Buyer and Seller Information | Both parties must provide their names, addresses, and signatures on the form. |

| Payment Details | The form should specify the purchase price and payment method agreed upon by both parties. |

| Record Keeping | It is advisable for both the buyer and seller to keep a copy of the Bill of Sale for their records. |