Free Articles of Incorporation Template for Texas

Create Other Popular Articles of Incorporation Forms for Different States

Llc Online Application Michigan - Detail the process for electing directors.

For individuals seeking to understand their rights and responsibilities, the Missouri Lease Agreement is a crucial document. Accessing the necessary details is simplified through the thorough Missouri lease agreement form guide, ensuring that all parties are well-informed before signing.

Nc Articles of Incorporation - Lists the registered agent for the corporation’s legal documents.

Similar forms

The Texas Articles of Incorporation form is similar to the Certificate of Incorporation used in many states. Both documents serve as foundational legal papers that establish a corporation's existence. They typically include essential information such as the corporation's name, purpose, and the address of its registered office. While the specific requirements may vary by state, the overall function of these documents remains consistent, providing a formal recognition of the corporation by the state government.

Another document comparable to the Texas Articles of Incorporation is the Articles of Organization, which is utilized for limited liability companies (LLCs). Like the Articles of Incorporation, the Articles of Organization outline key details about the entity, such as its name, registered agent, and business purpose. Both documents are filed with the state and are critical for legal recognition, though they cater to different types of business structures.

The Bylaws of a corporation share similarities with the Texas Articles of Incorporation in that they both govern the internal operations of a corporation. While the Articles of Incorporation establish the corporation's existence, the Bylaws provide the rules and procedures for managing the corporation. These rules often cover aspects such as the election of directors, the holding of meetings, and the rights of shareholders, creating a comprehensive framework for corporate governance.

The Statement of Information is another document that bears resemblance to the Texas Articles of Incorporation. This document is often required in various states to provide updated information about a corporation, including its address, officers, and registered agent. While the Articles of Incorporation serve as the initial filing to create a corporation, the Statement of Information ensures that the state has current and accurate details about the business as it evolves.

In some jurisdictions, the Certificate of Formation is used interchangeably with the Articles of Incorporation. This document serves a similar purpose, as it officially establishes a corporation and includes essential details such as the name, duration, and purpose of the business. The terminology may differ, but both documents fulfill the same fundamental role in the formation of a corporation.

The Partnership Agreement is akin to the Texas Articles of Incorporation in that it lays out the foundational structure for a business entity. While the Articles of Incorporation focus on corporations, the Partnership Agreement details the roles, responsibilities, and profit-sharing arrangements among partners in a partnership. Both documents are crucial for establishing the legal framework within which the respective entities operate.

The Employment Application PDF form is a standardized document used by employers to gather essential information about job applicants. This form typically includes sections for personal details, work history, and educational background, facilitating a streamlined hiring process. To get started, fill out the form by clicking the button below or visit Fill PDF Forms for more details.

In some cases, the Operating Agreement for an LLC can be compared to the Texas Articles of Incorporation. Like the Articles of Incorporation, the Operating Agreement outlines the management structure and operational procedures of the LLC. It includes details such as member responsibilities, voting rights, and distribution of profits, serving as an internal document that complements the formation papers filed with the state.

Lastly, the Foreign Corporation Registration is similar to the Texas Articles of Incorporation in that it allows a corporation formed in one state to operate in another state. This registration process requires the corporation to provide information similar to what is included in the Articles of Incorporation, such as its name, business purpose, and registered agent. This document ensures that the corporation complies with the laws of the new state while retaining its original incorporation status.

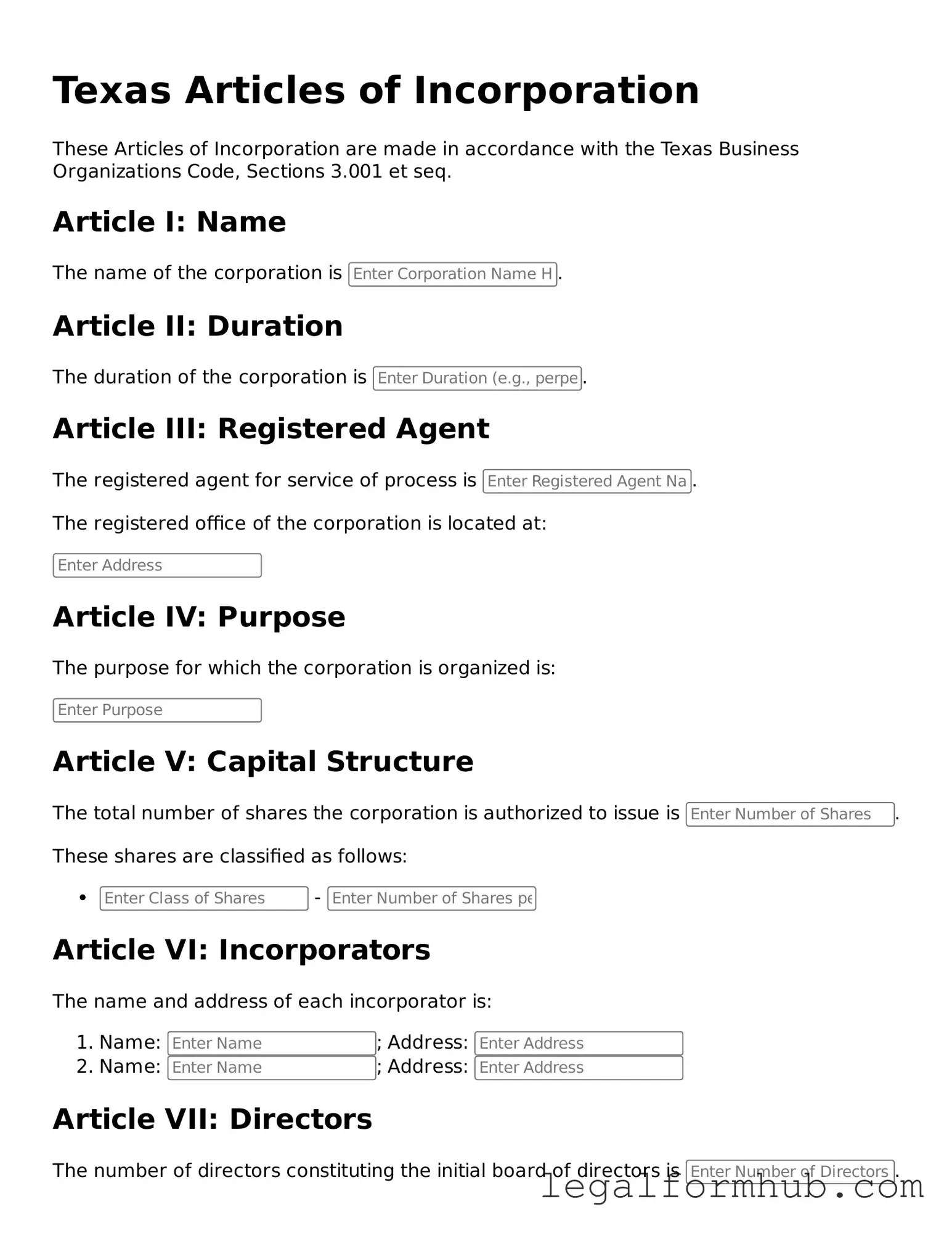

Instructions on Writing Texas Articles of Incorporation

Once you have the Texas Articles of Incorporation form ready, you will need to complete it accurately. This process involves providing essential information about your business. After filling out the form, you will submit it to the Texas Secretary of State along with the required filing fee.

- Download the Texas Articles of Incorporation form from the Texas Secretary of State's website.

- Begin by entering the name of your corporation. Ensure the name complies with Texas naming requirements.

- Provide the duration of the corporation. Most corporations are set to exist perpetually unless specified otherwise.

- Fill in the purpose of the corporation. Be clear and concise about the business activities you plan to engage in.

- Enter the registered agent's name and address. This person or entity will receive legal documents on behalf of the corporation.

- List the initial directors of the corporation, including their names and addresses.

- Indicate the number of shares the corporation is authorized to issue. Specify the classes of shares if applicable.

- Provide the name and address of the incorporator. This is the person responsible for submitting the form.

- Review all information for accuracy. Correct any errors before proceeding.

- Sign and date the form. Ensure the signature is from the incorporator.

- Prepare the filing fee. Check the Texas Secretary of State’s website for the current fee amount.

- Submit the completed form and payment to the Texas Secretary of State, either online or by mail.

Misconceptions

Misconceptions about the Texas Articles of Incorporation form can lead to confusion for those looking to establish a corporation. Here are four common misunderstandings:

- All corporations must use the same Articles of Incorporation form. Many believe that there is a one-size-fits-all form for all corporations. In reality, while there is a standard template, the specific requirements can vary based on the type of corporation and its intended activities.

- Filing the Articles of Incorporation guarantees business success. Some individuals think that simply submitting this form will ensure their business thrives. However, success depends on various factors, including market demand, management decisions, and financial planning.

- The Articles of Incorporation are the only document needed to start a business. Many assume that completing this form is sufficient for establishing a corporation. In fact, additional documents, such as bylaws and initial resolutions, are often necessary to fully operationalize the business.

- Once filed, the Articles of Incorporation cannot be changed. A common belief is that these documents are permanent and unchangeable. In truth, amendments can be made to the Articles of Incorporation, allowing corporations to adapt to changing circumstances or needs.

Key takeaways

When filling out and using the Texas Articles of Incorporation form, there are several important points to keep in mind. Understanding these can help ensure a smoother process.

- Purpose of Incorporation: Clearly state the purpose of your business. This helps define what your organization will do.

- Choose a Name: Select a unique name for your corporation. Make sure it complies with Texas naming rules and is not already in use.

- Registered Agent: Designate a registered agent. This person or entity will receive legal documents on behalf of your corporation.

- Incorporator Information: Provide the name and address of the incorporator. This individual is responsible for filing the Articles of Incorporation.

- Duration: Indicate the duration of your corporation. Most corporations are set up to exist indefinitely, but you can specify a limited duration if needed.

- Initial Directors: List the names and addresses of the initial directors. This information is crucial for the governance of the corporation.

- Filing Fees: Be prepared to pay the required filing fees. These fees can vary, so check the current rates before submission.

By keeping these key takeaways in mind, you can navigate the process of incorporating your business in Texas more effectively.

File Overview

| Fact Name | Description |

|---|---|

| Governing Law | The Texas Business Organizations Code governs the Articles of Incorporation in Texas. |

| Purpose | Articles of Incorporation establish a corporation as a legal entity in Texas. |

| Required Information | The form requires the corporation's name, duration, registered agent, and purpose. |

| Filing Fee | A filing fee is required when submitting the Articles of Incorporation to the state. |

| Submission Method | Forms can be submitted online, by mail, or in person to the Texas Secretary of State. |

| Approval Time | Approval typically takes 3 to 5 business days, depending on the method of submission. |

| Amendments | Corporations may amend their Articles of Incorporation by filing a certificate of amendment. |