Fill Your Tax POA dr 835 Form

Different PDF Templates

Work Incident Report - Keeps a historical log of accidents for organizational review.

Puppy Health Record - Tracks the schedule for deworming treatments.

Employers in California must adequately prepare for the hiring process, which often involves confirming a new employee's eligibility through necessary documentation. One of the key forms involved in this process is the Employment Verification form, which provides vital details about the employee to ensure adherence to state and federal regulations. To streamline this process, you can access resources to assist with the necessary paperwork; for example, you can Fill PDF Forms that are specifically tailored for California employment needs.

Da - Each copy of the form serves as legal evidence of equipment transfer.

Similar forms

The IRS Form 2848, Power of Attorney and Declaration of Representative, is a document that allows individuals to appoint someone to represent them before the IRS. Similar to the Tax POA DR 835 form, it enables the designated representative to receive and inspect confidential tax information and represent the taxpayer in various tax matters. This form must be signed by the taxpayer and the representative, ensuring that both parties agree to the representation terms.

The IRS Form 8821, Tax Information Authorization, serves a different purpose but shares similarities with the Tax POA DR 835 form. While it allows individuals to authorize someone to receive their tax information, it does not grant the representative the authority to act on their behalf. This form is often used when a taxpayer wants to allow someone to view their tax records without giving them power of attorney.

The State Tax Power of Attorney forms, which vary by state, are similar to the Tax POA DR 835 form in that they allow individuals to designate someone to act on their behalf for state tax matters. These forms typically require the taxpayer's signature and specify the powers granted to the representative, such as filing returns and making payments.

For parents considering homeschooling, it is crucial to understand the necessary documentation involved, such as the Arizona Homeschool Letter of Intent. This formal document is essential for notifying the state of a family's decision to teach their children at home, ensuring compliance with educational regulations. To aid in this process, families can refer to resources like https://arizonapdfs.com/homeschool-letter-of-intent-template/, which provides a template for creating this important letter.

The IRS Form 4506, Request for Copy of Tax Return, can be considered similar in that it allows individuals to authorize the IRS to release their tax returns to a third party. While it does not grant the same level of representation as the Tax POA DR 835 form, it facilitates the sharing of tax information with a designated individual or entity.

The IRS Form 8822, Change of Address, is related in that it allows taxpayers to update their address with the IRS. Although it does not involve representation, it is crucial for ensuring that the IRS has the correct contact information for the taxpayer, which is essential for effective communication and representation.

The IRS Form 9465, Installment Agreement Request, shares a connection with the Tax POA DR 835 form in that it allows taxpayers to authorize a representative to negotiate payment plans with the IRS. While this form is specific to installment agreements, it highlights the importance of having someone act on behalf of the taxpayer in financial matters.

The IRS Form 1040, U.S. Individual Income Tax Return, is not a power of attorney form but is similar in that it is a critical document for taxpayers. It requires the taxpayer's signature and can include a designation of a third party to discuss the return with the IRS. This inclusion allows for some level of representation, although it is limited compared to the authority granted by the Tax POA DR 835 form.

Instructions on Writing Tax POA dr 835

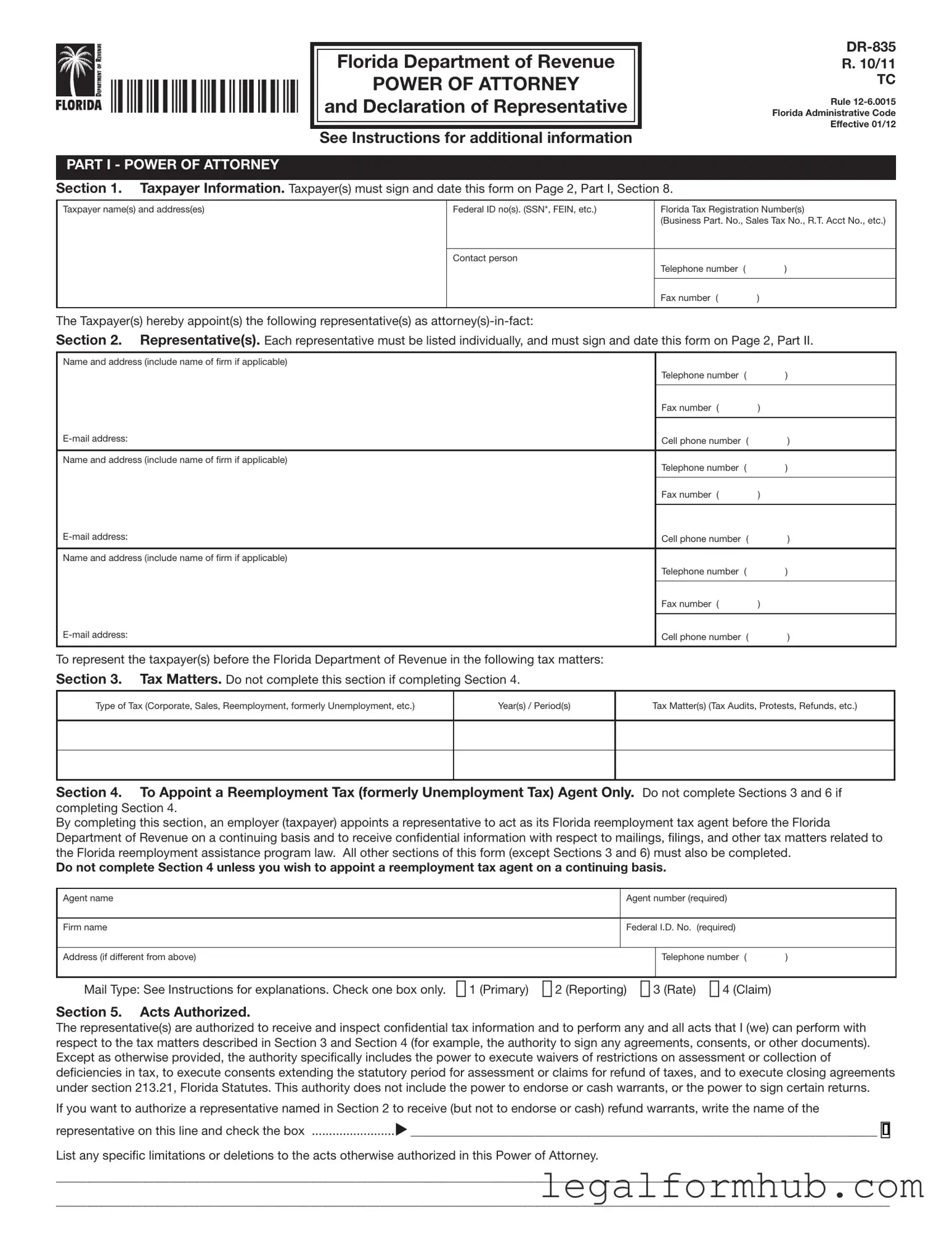

After gathering the necessary information, you are ready to fill out the Tax POA DR 835 form. This form allows you to designate someone to act on your behalf regarding tax matters. Follow these steps carefully to ensure accurate completion.

- Begin by entering your name in the designated field at the top of the form.

- Provide your Social Security Number or Employer Identification Number, depending on your status.

- Fill in your address, including city, state, and ZIP code.

- In the next section, write the name of the person you are authorizing as your representative.

- Include the representative’s address and phone number for contact purposes.

- Specify the type of tax matters for which you are granting authority. Be clear and concise.

- Indicate the tax years or periods that the authorization covers.

- Sign and date the form at the bottom to validate your authorization.

Once you have completed these steps, review the form for accuracy. After ensuring all information is correct, you can submit it to the appropriate tax authority. This will enable your representative to act on your behalf regarding the specified tax matters.

Misconceptions

The Tax Power of Attorney (POA) Form DR 835 often generates confusion among taxpayers. This document allows individuals to appoint someone else to represent them before the tax authorities. However, several misconceptions persist regarding its purpose and use. Below are five common misunderstandings about the Tax POA DR 835 form.

- Misconception 1: The form is only for tax professionals.

- Misconception 2: Submitting the form automatically grants unlimited authority.

- Misconception 3: The form needs to be submitted every year.

- Misconception 4: The form can be used for any tax-related issue.

- Misconception 5: Only the taxpayer can revoke the POA.

Many people believe that only certified tax professionals can use the Tax POA DR 835 form. In reality, any taxpayer can appoint a representative, whether that person is a tax professional, a family member, or a friend. The key requirement is that the appointed individual must be willing to act on behalf of the taxpayer.

Some individuals think that completing the form gives the representative unlimited power over their tax matters. However, the authority granted is specific to the tax issues outlined in the form. Taxpayers can limit the scope of representation, ensuring that their appointed representative can only act within certain boundaries.

Another common belief is that taxpayers must submit the Tax POA DR 835 form annually. This is not the case. Once the form is filed, it remains in effect until the taxpayer revokes it or the representative no longer wishes to act on behalf of the taxpayer. Therefore, unless circumstances change, there is no need for annual resubmission.

Some people assume that the Tax POA DR 835 form is applicable to all tax matters. While it is a powerful tool, it is essential to understand that it may not cover all situations. Certain specific tax issues may require different forms or procedures, so it is crucial to verify the appropriateness of this form for particular circumstances.

Lastly, there is a belief that only the taxpayer has the authority to revoke the Power of Attorney. In fact, if a representative wishes to withdraw from their role, they can also submit a revocation notice. This flexibility allows for a smoother transition if either party decides to change their representation.

Understanding these misconceptions can empower taxpayers to use the Tax POA DR 835 form effectively. By clarifying these points, individuals can navigate their tax representation with greater confidence and accuracy.

Key takeaways

Filling out and using the Tax POA DR 835 form can be straightforward if you understand the key aspects. Here are some essential takeaways to consider:

- Purpose of the Form: The Tax POA DR 835 form is used to grant authority to another individual or entity to represent you before the tax authorities.

- Eligibility: Ensure that the person you designate as your representative is qualified and understands your tax situation.

- Complete Information: Fill out all required fields accurately. This includes your personal information, the representative's details, and the specific tax matters involved.

- Signature Requirement: Your signature is necessary to validate the form. Without it, the form will not be accepted by the tax authorities.

- Limitations of Authority: You can specify the extent of the authority granted. Consider whether you want to limit the representative’s actions to specific issues or give them broader powers.

- Submission Process: After completing the form, submit it according to the guidelines provided by the tax authority. Keep a copy for your records.

Understanding these key points will help ensure that your use of the Tax POA DR 835 form is effective and compliant with tax regulations.

File Information

| Fact Name | Description |

|---|---|

| Purpose | The Tax POA DR 835 form is used to authorize an individual or organization to represent a taxpayer before the state tax authority. |

| Governing Law | This form is governed by state tax laws, which may vary by jurisdiction. Always check the specific laws applicable in your state. |

| Eligibility | Any taxpayer, whether an individual or business entity, can use the DR 835 form to designate a representative. |

| Information Required | The form typically requires the taxpayer's name, address, and tax identification number, as well as the representative's details. |

| Submission Process | After filling out the form, it must be submitted to the appropriate state tax authority, either by mail or electronically, depending on state guidelines. |

| Duration of Authorization | The authorization granted by the DR 835 form usually remains in effect until revoked by the taxpayer or until the specific tax matter is resolved. |

| Revocation | Taxpayers can revoke the authorization at any time by submitting a written notice to the state tax authority, following the prescribed procedure. |