Fill Your Stock Transfer Ledger Form

Different PDF Templates

How to Create a Job Application - Reliable transportation to the work location must be confirmed.

To ensure a smooth transfer of ownership when selling or buying a motorcycle, it's important to use a California Motorcycle Bill of Sale form. This document not only outlines the necessary details about the motorcycle, such as its make, model, year, and VIN, but also serves as a vital record for both parties. You can get started by utilizing resources like Fill PDF Forms to access the required form and facilitate the transaction.

Planned Parenthood Abortion Paperwork - Patients are asked to provide an email address, which will not be used for test results.

Similar forms

The Stock Certificate is a document that represents ownership of shares in a corporation. Similar to the Stock Transfer Ledger, it includes details about the stockholder, the number of shares owned, and the certificate number. This document serves as proof of ownership and is crucial for tracking the transfer of shares. When shares are sold or transferred, the stock certificate must be updated or surrendered, just like the entries in the Stock Transfer Ledger.

The Shareholder Register is another important document that maintains a list of all shareholders in a corporation. Like the Stock Transfer Ledger, it records essential information such as the names of stockholders, their addresses, and the number of shares they own. This document is essential for corporate governance, as it helps ensure that all shareholders are accounted for and can participate in corporate decisions, much like the way the Stock Transfer Ledger tracks share ownership and transfers.

To apply for a position at Chick-fil-A and begin your career with this renowned fast-food chain, it is important to familiarize yourself with the Chick-fil-A Job Application form, which you can find conveniently online at https://pdftemplates.info/. This form collects essential information such as personal details, work experience, and availability, helping the hiring team make informed decisions.

The Dividend Payment Record is similar in that it tracks financial transactions related to shares. This document details the dividends paid to each stockholder, including the date of payment and the amount distributed. Just as the Stock Transfer Ledger records the transfer of shares and ownership, the Dividend Payment Record ensures that shareholders receive their rightful earnings based on their ownership stake in the company.

The Corporate Bylaws outline the rules and procedures governing a corporation, including how shares can be issued and transferred. While not a transactional document like the Stock Transfer Ledger, the bylaws provide the framework within which the transfer of shares must occur. They establish the rights of stockholders and the process for transferring ownership, ensuring that all transactions comply with the corporation's established rules, similar to how the Stock Transfer Ledger documents those transactions.

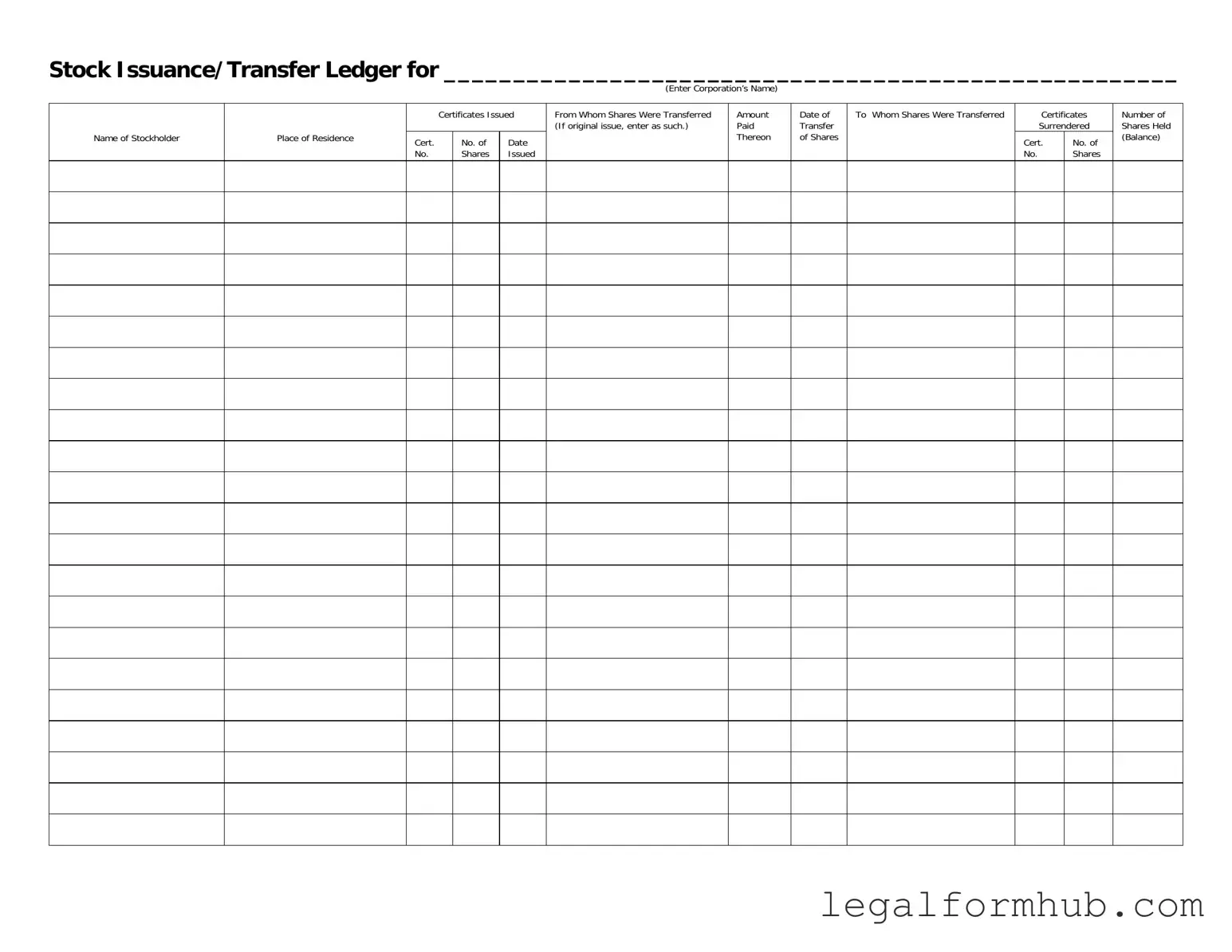

Instructions on Writing Stock Transfer Ledger

Once you have gathered all necessary information, you can begin filling out the Stock Transfer Ledger form. Ensure that you have the correct details at hand for accuracy. Follow these steps carefully to complete the form.

- In the first blank, enter the full name of the corporation.

- Under "Name of Stockholder," write the name of the stockholder involved in the transfer.

- In the "Place of Residence" section, provide the stockholder's residential address.

- For "Certificates Issued," indicate the number of certificates that have been issued to the stockholder.

- In the "Cert. No." field, fill in the certificate number associated with the issued shares.

- Enter the "Date" when the shares were issued.

- In the "No. Shares Issued" section, specify the total number of shares that were issued to the stockholder.

- For "From Whom Shares Were Transferred," write the name of the individual or entity from whom the shares were originally issued. If this is the original issue, note that accordingly.

- In the "Amount Paid Thereon" field, indicate the amount that was paid for the shares.

- Record the "Date of Transfer of Shares" to document when the transfer took place.

- In the "To Whom Shares Were Transferred" section, enter the name of the individual or entity to whom the shares are being transferred.

- For "Certificates Surrendered," indicate the number of certificates that were surrendered during the transfer process.

- In the "Cert. No. of" field, provide the certificate number of the surrendered shares.

- Next, in the "No. Shares" section, indicate the number of shares that were surrendered.

- Finally, in the "Number of Shares Held (Balance)" field, enter the total number of shares the stockholder holds after the transfer.

Misconceptions

Misconceptions about the Stock Transfer Ledger form can lead to confusion regarding its purpose and usage. Here are seven common misconceptions:

- The Stock Transfer Ledger is only for tracking stock ownership. Many believe this form solely tracks ownership, but it also records the history of stock transfers, including dates and amounts paid.

- Only corporations need to use the Stock Transfer Ledger. While corporations are the primary users, partnerships and other business entities may also utilize this form to document stock transfers.

- The form is only required for large transactions. This is inaccurate. The Stock Transfer Ledger should be maintained for all stock transfers, regardless of size, to ensure accurate record-keeping.

- Once completed, the Stock Transfer Ledger does not need to be updated. This misconception overlooks the necessity of updating the ledger with every transfer to maintain accurate records of current ownership.

- All stock transfers must be conducted in person. While in-person transfers are common, stock transfers can also occur electronically, provided proper documentation is maintained in the ledger.

- The Stock Transfer Ledger is a public document. In fact, this ledger is typically a private record maintained by the corporation or entity, accessible only to authorized personnel.

- There is no standard format for the Stock Transfer Ledger. Although variations exist, most ledgers follow a similar format to ensure all necessary information is captured consistently.

Key takeaways

When filling out and using the Stock Transfer Ledger form, consider the following key takeaways:

- Accurate Information: Always ensure that the corporation’s name is entered correctly at the top of the form. This establishes the document's validity.

- Stockholder Details: Clearly list the name and place of residence of each stockholder. This information is crucial for maintaining accurate records.

- Certificate Tracking: Record the certificate numbers and the number of shares issued. This helps in tracking ownership and transfers efficiently.

- Transfer Documentation: When shares are transferred, note from whom the shares were transferred. If it's an original issue, make sure to indicate that clearly.

- Payment Records: Document the amount paid for the shares. This information is important for financial records and potential audits.

- Date of Transfer: Always include the date when shares were transferred. This provides a timeline for ownership changes.

- Surrender of Certificates: If certificates are surrendered during a transfer, make sure to list their numbers. This ensures that the records reflect the current ownership.

- Balance of Shares: Keep track of the number of shares held after each transfer. This helps in understanding the current distribution of shares within the corporation.

File Information

| Fact Name | Details |

|---|---|

| Purpose | The Stock Transfer Ledger tracks the issuance and transfer of shares within a corporation. |

| Corporation Name | The form requires the name of the corporation at the top for identification. |

| Stockholder Information | It includes the name and place of residence of each stockholder. |

| Certificates Issued | Details about the certificates issued, including certificate numbers and dates, are recorded. |

| Transfer Details | The form captures from whom shares were transferred and to whom they were transferred. |

| Amount Paid | It includes the amount paid for the shares, ensuring financial records are clear. |

| Governing Law | In many states, corporate governance laws dictate the use of this ledger, such as the Delaware General Corporation Law. |

| Certificates Surrendered | The form notes any certificates surrendered during the transfer process. |

| Balance of Shares | It shows the number of shares held by each stockholder after transfers, providing a clear balance. |