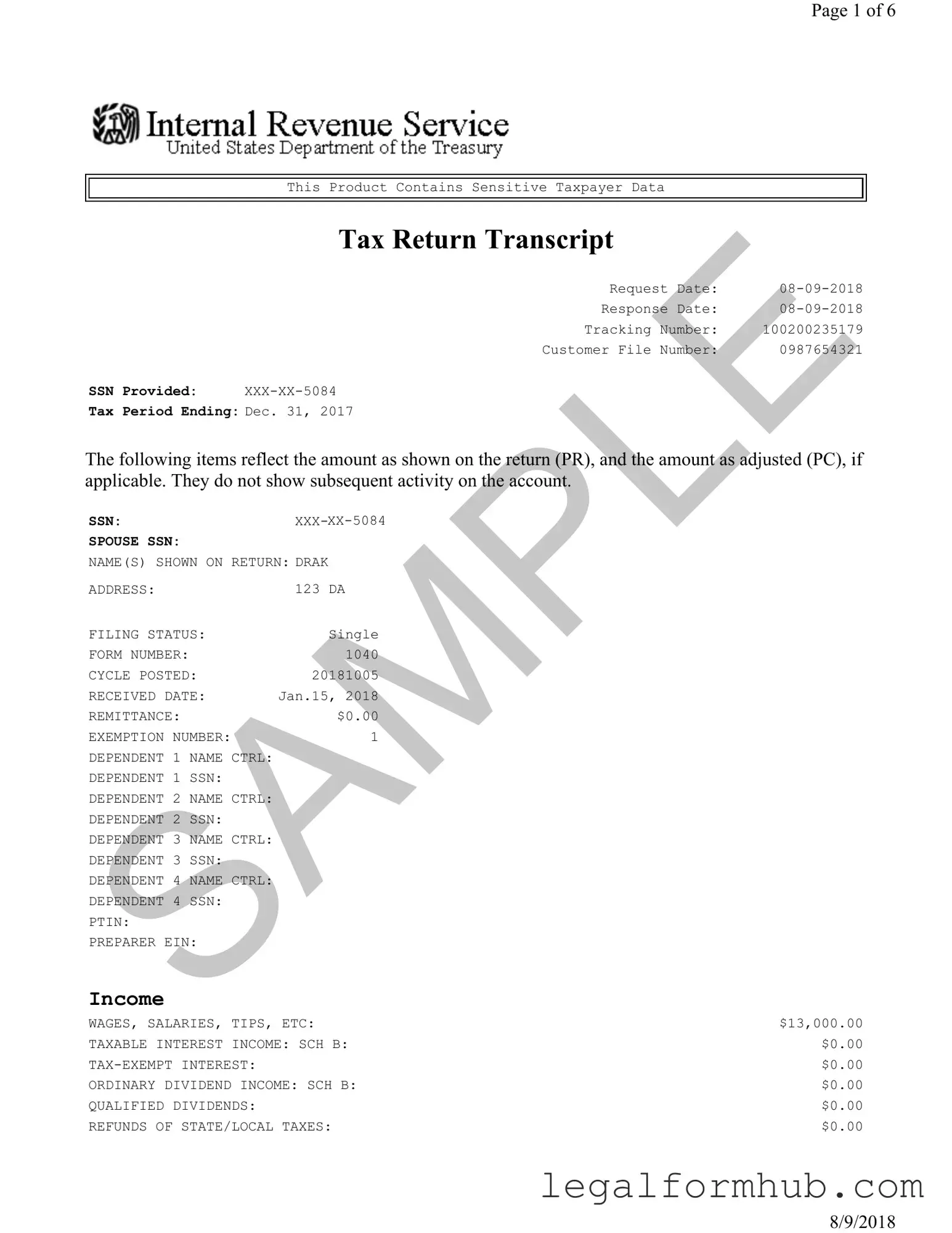

The Sample Tax Return Transcript form is similar to the IRS Form 1040, which is the standard individual income tax return form used by U.S. taxpayers. Both documents provide a comprehensive overview of an individual's income, deductions, and tax liability for a specific tax year. The 1040 form includes detailed sections for reporting various types of income, such as wages, dividends, and business income, much like the transcript, which summarizes these figures without the full detail of the original return.

Another similar document is the IRS Form 1040A, which is a simplified version of the 1040. This form allows for reporting of income and deductions but has certain limitations, such as not allowing itemized deductions. Like the Sample Tax Return Transcript, it provides a snapshot of taxable income and credits, though it is designed for taxpayers with less complex financial situations.

The IRS Form 1040EZ is also comparable, as it is the simplest form available for individual taxpayers. It is intended for those with basic tax situations, such as single filers or married couples filing jointly with no dependents. The Sample Tax Return Transcript captures essential income data and tax calculations, similar to how the 1040EZ presents a straightforward summary of tax information.

The IRS Form W-2 is another related document. This form reports an employee's annual wages and the taxes withheld from their paycheck. While the Sample Tax Return Transcript summarizes income, the W-2 provides detailed information about employment income, making it a critical component for filling out the tax return that the transcript reflects.

The Florida Motor Vehicle Bill of Sale is a crucial document that serves as proof of ownership transfer between a seller and a buyer for a vehicle. This form contains essential information about the vehicle and the parties involved, ensuring a clear record of the transaction. Properly completing this form not only safeguards both parties but also complies with state regulations. For further assistance in this process, you can Fill PDF Forms to facilitate your vehicle transaction.

Form 1099 is also similar, particularly for self-employed individuals or those receiving income from sources other than traditional employment. This form reports various types of income, such as freelance earnings or interest income. The Sample Tax Return Transcript includes these income categories, showing how they contribute to the overall tax picture.

The IRS Form 4506-T is another document worth mentioning. This form is used to request a transcript of tax return information, similar to what the Sample Tax Return Transcript provides. It allows taxpayers or third parties to obtain copies of tax data for various purposes, including loan applications or financial reviews.

Form 4868 is relevant as it is used to request an extension for filing a tax return. While it does not provide income details, it is part of the same tax process and can lead to the generation of a tax return transcript once the actual return is filed. The Sample Tax Return Transcript would reflect the outcome of any extension granted.

The IRS Form 8862 is also noteworthy. This form is used to claim the Earned Income Tax Credit (EITC) after it has been disallowed in a prior year. The Sample Tax Return Transcript includes information about credits claimed, including the EITC, making it useful for taxpayers who need to demonstrate eligibility for this credit.

Lastly, the IRS Form 8888 is similar in that it allows taxpayers to allocate their tax refund to multiple accounts. While the Sample Tax Return Transcript summarizes tax outcomes, the 8888 form details how refunds can be divided, showing another aspect of tax filing that may be reflected in the transcript.