Printable Release of Promissory Note Document

Common Release of Promissory Note Documents:

Bill of Sale With Promissory Note for Automobile - Can include terms for prepayment or penalties for late payments.

A New York Promissory Note is a written promise to pay a specified amount of money to a designated party at a predetermined time. This legal document serves as a critical tool in various financial transactions, providing clarity and security for both lenders and borrowers. For those looking to draft or understand this important document, resources such as https://nytemplates.com/blank-promissory-note-template/ can be invaluable in navigating their financial obligations effectively.

Similar forms

The Release of Promissory Note form shares similarities with a Loan Agreement. Both documents outline the terms of a loan between a borrower and a lender. A Loan Agreement details the amount borrowed, the interest rate, and repayment terms. Once the loan is fully paid, the Release of Promissory Note confirms that the borrower has fulfilled their obligations, essentially closing the transaction. This ensures both parties have a clear understanding of their rights and responsibilities.

Another document that resembles the Release of Promissory Note is the Satisfaction of Mortgage. This document is used when a mortgage has been fully paid off. Just like the Release of Promissory Note, the Satisfaction of Mortgage serves to formally acknowledge that the debt has been settled. It provides proof to the borrower that they own their property free and clear, which is essential for any future transactions involving the property.

The Deed of Trust is also similar to the Release of Promissory Note. This document is used in real estate transactions to secure a loan with property as collateral. When the loan is paid off, the Release of Promissory Note acts like a Deed of Trust in that it releases the lender's claim on the property. Both documents play a crucial role in ensuring that the borrower receives clear title to the property once their financial obligations are met.

As you navigate the various documents related to financial agreements, it's important to understand their distinct roles, such as how documents like the Release of Promissory Note work in conjunction with other legal agreements. For those seeking to document their loan agreements in Maryland, you can easily find the necessary forms for your needs by visiting All Maryland Forms, ensuring that your financial obligations are properly recorded and enforced.

A Bill of Sale can be compared to the Release of Promissory Note as well. While a Bill of Sale is used to transfer ownership of personal property, both documents signify the completion of a financial obligation. When a buyer pays in full for an item, a Bill of Sale is issued to confirm the transfer. Similarly, the Release of Promissory Note confirms that the borrower has repaid their debt, effectively transferring the ownership of the financial obligation back to the borrower.

Lastly, the Certificate of Title is akin to the Release of Promissory Note in that it serves as proof of ownership. A Certificate of Title is often used in vehicle transactions to establish who owns a vehicle. Once the loan for the vehicle is paid off, the Release of Promissory Note confirms that the borrower is free from any liens or claims on the vehicle. Both documents provide assurance and clarity regarding ownership and the fulfillment of financial commitments.

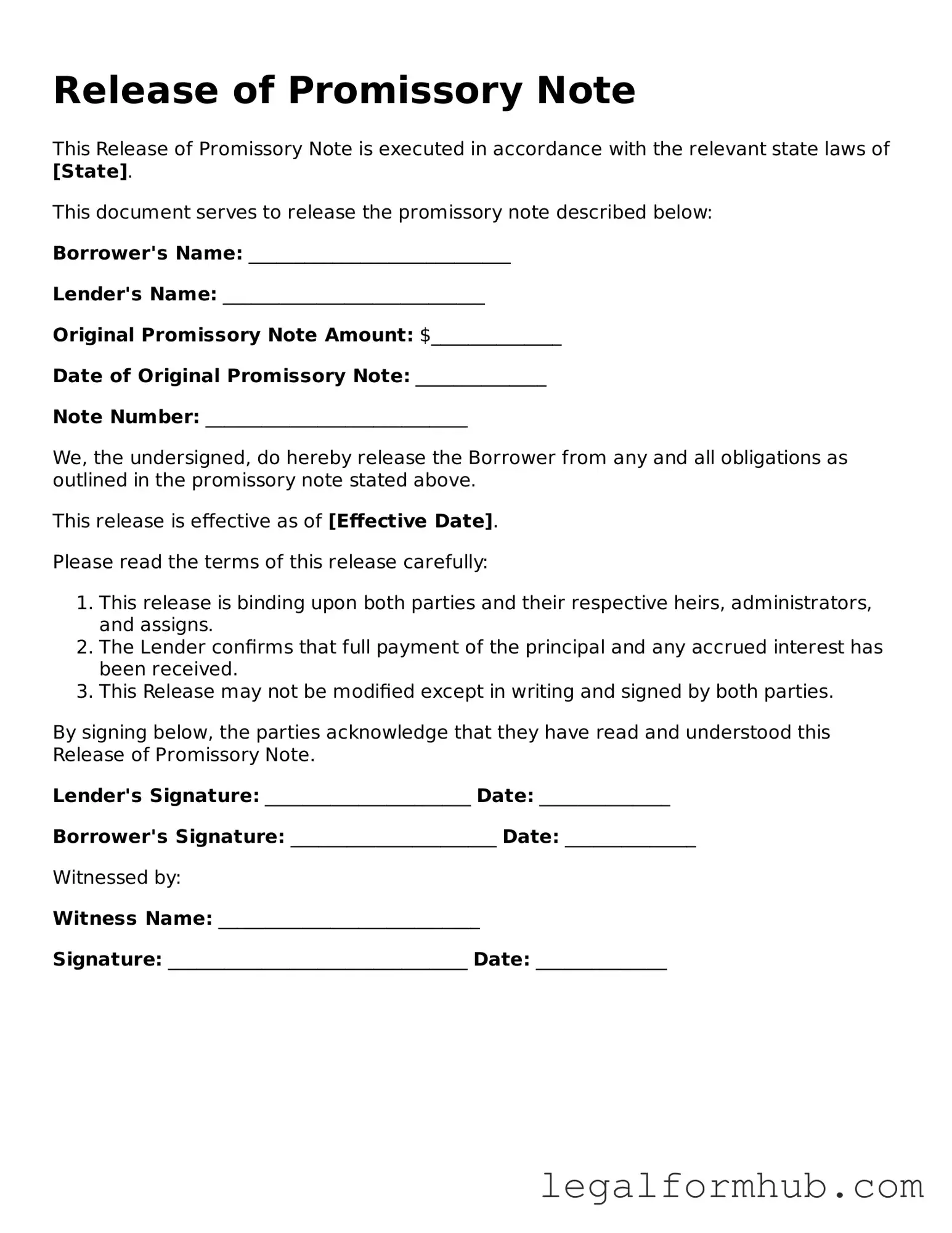

Instructions on Writing Release of Promissory Note

After completing the Release of Promissory Note form, you will need to submit it to the appropriate party or office. Make sure to keep a copy for your records. Follow these steps to fill out the form accurately.

- Begin by entering the date at the top of the form.

- Provide the names and addresses of both the borrower and the lender in the designated sections.

- Clearly state the amount of the promissory note that is being released.

- Include any relevant details about the original promissory note, such as the date it was issued and any reference numbers.

- Sign the form where indicated. Ensure that the signature matches the name of the party releasing the note.

- Have the other party sign the form as well, if required.

- Review the completed form for accuracy before submitting.

Misconceptions

Understanding the Release of Promissory Note form is essential for anyone involved in lending or borrowing money. However, several misconceptions surround this important document. Here are nine common misunderstandings:

- It is not necessary to release a promissory note. Some people believe that once a loan is paid off, a promissory note can be discarded. In reality, a formal release is crucial to ensure that the borrower is no longer liable for the debt.

- A verbal agreement suffices. Many assume that a simple verbal confirmation of payment is enough. However, a written release provides clear evidence of the transaction and protects both parties.

- Only lenders can initiate the release. While lenders typically prepare the release, borrowers can also request it. Both parties have a vested interest in documenting the completion of the loan.

- The form is only necessary for large loans. This misconception often leads to problems. Regardless of the loan amount, having a release is important to avoid future disputes.

- The release is the same as a cancellation. Some believe that releasing a promissory note simply cancels the debt. In fact, it formally acknowledges that the borrower has fulfilled their obligation.

- It is not legally binding. Many people think that a release has no legal weight. On the contrary, it is a legally binding document that can be enforced in court if necessary.

- Only the original lender can issue a release. This is not true. If the loan has been sold or transferred, the new lender can issue the release, provided they have the authority to do so.

- Filing the release is optional. Some individuals believe that simply signing the release is enough. However, filing it with the appropriate authority, such as a county recorder, is often necessary to ensure public record of the debt's satisfaction.

- Once released, the borrower can never borrow again. This is a common fear. A release does not prevent the borrower from obtaining future loans; it simply confirms that the previous debt has been settled.

Addressing these misconceptions is vital for both borrowers and lenders. A clear understanding of the Release of Promissory Note form can prevent potential legal issues and foster trust in financial transactions.

Key takeaways

When dealing with a Release of Promissory Note form, it's essential to understand its significance and proper usage. Here are some key takeaways to consider:

- Understand the Purpose: The form is used to officially acknowledge that a promissory note has been paid off or is no longer in effect.

- Correct Information: Ensure that all parties' names, the date, and details of the original note are accurately filled out.

- Signature Requirement: All parties involved must sign the release to make it legally binding. This includes both the lender and the borrower.

- Keep Copies: After the form is completed and signed, make copies for all parties involved. This ensures everyone has proof of the release.

- Legal Implications: Understand that signing the release means the lender relinquishes any future claims against the borrower regarding that specific note.

- Consult a Professional: If there are any uncertainties about the process or implications, consider consulting a legal expert for guidance.

- Filing the Release: Depending on your jurisdiction, you may need to file the release with a local government office or keep it for your records.

By following these guidelines, you can navigate the process of using a Release of Promissory Note form with greater confidence and clarity.

File Overview

| Fact Name | Description |

|---|---|

| Definition | A Release of Promissory Note is a legal document that signifies the cancellation of a promissory note, indicating that the borrower has fulfilled their obligations. |

| Purpose | This form protects both the lender and the borrower by formally acknowledging that the debt has been satisfied and that the borrower is no longer liable. |

| Governing Law | In the United States, the governing laws can vary by state. For example, in California, the relevant law is the California Civil Code Section 1478. |

| Signature Requirement | Typically, both the lender and the borrower must sign the document to validate the release. |

| Record Keeping | It is advisable for both parties to keep a copy of the signed release for their records, in case of future disputes. |

| Use in Real Estate | Often, this form is used in real estate transactions where a mortgage or promissory note is involved, ensuring clear title transfer. |

| State Variations | Some states may have specific forms or requirements for the release, such as Florida's requirement for notarization under Florida Statutes Section 697.04. |