Printable Real Estate Purchase Agreement Document

More Forms:

Ca Dmv Release of Liability Form - An important tool for anyone looking to sell their vehicle privately.

The FedEx Bill of Lading is a crucial document that confirms the terms of the shipment between the shipper and the carrier. It outlines essential details such as addresses, contact information, service types, and freight charges. To ensure a smooth shipping process, Fill PDF Forms to complete the necessary documentation efficiently.

How to Make a Waiver Letter - This form often must be signed for basic participation, highlighting its importance in risk management practices.

Online Media Release Form - Participation in events may result in visual documentation, as indicated here.

Real Estate Purchase Agreement - Tailored for Each State

Real Estate Purchase Agreement Form Subtypes

Similar forms

The Real Estate Purchase Agreement (REPA) shares similarities with the Lease Agreement, which outlines the terms under which a tenant may occupy a property owned by a landlord. Both documents serve as binding contracts, detailing essential elements such as the duration of the agreement, payment terms, and responsibilities of each party. While a REPA focuses on the sale of property, the Lease Agreement is concerned with temporary occupancy, yet both require clear communication of terms to avoid disputes. Understanding the nuances in these agreements can help parties navigate their respective rights and obligations effectively.

Another document akin to the REPA is the Option to Purchase Agreement. This agreement grants a potential buyer the right, but not the obligation, to purchase a property at a predetermined price within a specified timeframe. Like the REPA, it includes key details such as the purchase price and conditions for exercising the option. However, the Option to Purchase Agreement serves as a preliminary step, allowing buyers to secure a property without committing immediately, whereas the REPA finalizes the sale. Both documents necessitate clarity to ensure that all parties understand their rights and responsibilities.

The Purchase and Sale Agreement (PSA) is also similar to the REPA, as it facilitates the transfer of real estate from seller to buyer. Both documents outline the purchase price, property description, and contingencies that must be met before the sale is finalized. However, the PSA may include additional clauses that address specific conditions or requirements unique to the transaction. While the REPA is often used in residential transactions, the PSA is more commonly utilized in commercial real estate deals, demonstrating that both serve the fundamental purpose of detailing the terms of a property transfer.

In the realm of property transactions, the use of documents like the Quitclaim Deed form is essential for ensuring smooth transfers of ownership. While the Quitclaim Deed allows parties to convey property rights without warranty, it is crucial for individuals to understand their implications. For those looking to initiate such processes, the Quitclaim Deed form provides a straightforward way to formalize the transfer.

Additionally, the Listing Agreement bears resemblance to the REPA, as it establishes a relationship between a property owner and a real estate agent. This document outlines the agent's authority to market the property, the commission structure, and the duration of the listing. While the REPA is focused on the sale itself, the Listing Agreement is a precursor that sets the stage for the sale by facilitating the process of finding a buyer. Both agreements highlight the importance of clear expectations and responsibilities to ensure a smooth transaction.

Lastly, the Seller's Disclosure Statement is another document that complements the REPA. This statement provides prospective buyers with vital information about the property's condition, including any known defects or issues. While the REPA formalizes the sale, the Seller's Disclosure Statement plays a critical role in the due diligence process, allowing buyers to make informed decisions. Both documents emphasize transparency, which is essential in building trust between buyers and sellers throughout the real estate transaction.

Instructions on Writing Real Estate Purchase Agreement

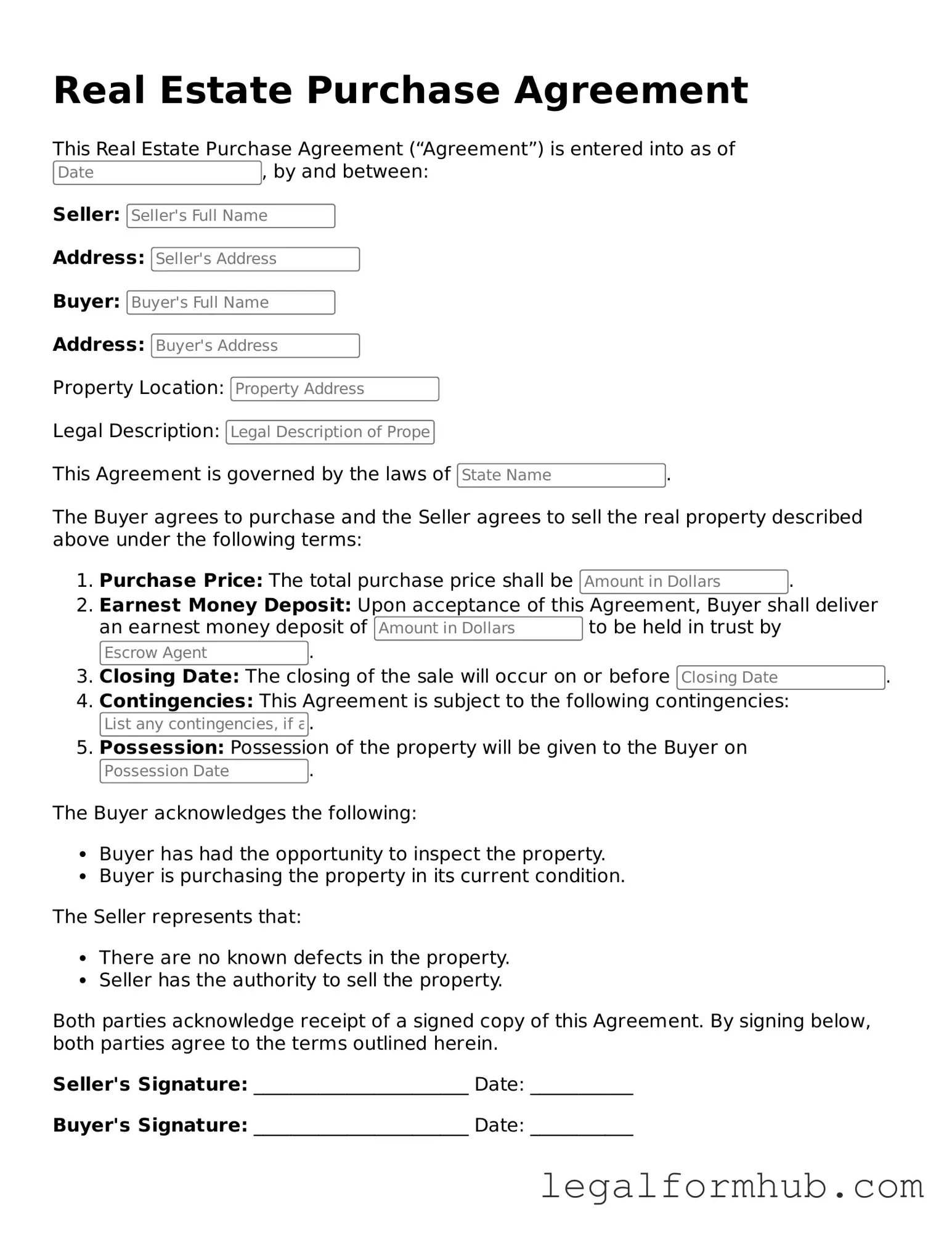

Completing the Real Estate Purchase Agreement form is an important step in the home buying process. After filling out this form, you will be able to move forward with negotiations and finalize the sale. Here are the steps to guide you through the process.

- Obtain the form: You can find the Real Estate Purchase Agreement form online or through your real estate agent.

- Fill in the date: Write the date when you are completing the agreement at the top of the form.

- Identify the parties: Enter the names and contact information of both the buyer and the seller.

- Property details: Provide the address and legal description of the property being purchased.

- Purchase price: Clearly state the total amount you are offering for the property.

- Earnest money deposit: Specify the amount of earnest money you will provide to show your commitment.

- Financing terms: Indicate how you plan to finance the purchase, whether through a mortgage or cash.

- Contingencies: List any conditions that must be met before the sale can proceed, such as inspections or financing approval.

- Closing date: Suggest a date for the closing of the sale, when the property will officially change hands.

- Signatures: Both the buyer and seller need to sign and date the agreement to make it legally binding.

Once you have completed the form, review it carefully to ensure all information is accurate. It is advisable to keep a copy for your records before submitting it to the appropriate parties.

Misconceptions

Understanding the Real Estate Purchase Agreement (REPA) is crucial for anyone involved in buying or selling property. However, several misconceptions often cloud the true nature of this important document. Below is a list of common misconceptions about the REPA, along with explanations to clarify each point.

- Misconception 1: The REPA is a legally binding contract only after both parties sign it.

- Misconception 2: The REPA is only necessary for residential property transactions.

- Misconception 3: The REPA does not require any disclosures from the seller.

- Misconception 4: Once the REPA is signed, it cannot be changed.

- Misconception 5: The REPA guarantees a successful closing.

- Misconception 6: The REPA is the same in every state.

- Misconception 7: The REPA is only for buyers and sellers; real estate agents do not need to be involved.

This is not entirely accurate. While signatures are essential, the agreement can be binding even before both parties sign if they have reached a mutual understanding and intent to enter into a contract.

Many believe the REPA applies solely to residential properties. In reality, it is used for all types of real estate transactions, including commercial and industrial properties.

This misconception overlooks the fact that sellers are often required to disclose certain information about the property, such as known defects or issues, which must be included in the agreement.

While the REPA is a formal agreement, amendments can be made if both parties agree to the changes. This flexibility allows for adjustments based on negotiations or new information.

Signing the REPA does not ensure that the transaction will close successfully. Various factors, such as financing issues or title problems, can prevent a closing from occurring.

Each state has its own laws and regulations governing real estate transactions, which means that the REPA can vary significantly from one state to another. It is important to use the correct form for the specific jurisdiction.

In many cases, real estate agents play a vital role in drafting and negotiating the REPA. Their expertise can help ensure that all necessary terms and conditions are included and that both parties understand their obligations.

Key takeaways

When filling out and using the Real Estate Purchase Agreement form, consider the following key takeaways:

- Understand the Purpose: This document outlines the terms of the sale between the buyer and seller, including the property details and purchase price.

- Provide Accurate Information: Ensure all details, such as names, addresses, and property descriptions, are correct to avoid future disputes.

- Include Contingencies: Specify any conditions that must be met for the sale to proceed, such as financing or inspection requirements.

- Review Deadlines: Pay attention to timelines for offers, acceptance, and contingencies to ensure compliance with the agreement.

- Signatures Required: Both parties must sign the agreement for it to be legally binding; electronic signatures may be acceptable in some jurisdictions.

- Consult Professionals: It is advisable to seek legal or real estate advice before finalizing the agreement to ensure all aspects are covered.

File Overview

| Fact Name | Description |

|---|---|

| Purpose | The Real Estate Purchase Agreement outlines the terms of a property sale between a buyer and a seller. |

| Parties Involved | The agreement includes the buyer and seller, both of whom must provide their legal names and contact information. |

| Property Description | A detailed description of the property being sold is included, such as its address and legal description. |

| Purchase Price | The total purchase price of the property is clearly stated, along with any deposit amounts. |

| Contingencies | Common contingencies, such as financing or inspection, can be included to protect the buyer. |

| Closing Date | The agreement specifies a closing date when the property transfer will take place. |

| Governing Law | The agreement is governed by state laws, which vary. For example, in California, it follows the California Civil Code. |

| Signatures | Both parties must sign the agreement for it to be legally binding. |