Printable Real Estate Power of Attorney Document

Common Real Estate Power of Attorney Documents:

Revocation of Power of Attorney Template - Encourages principals to continually evaluate their decision-makers.

The importance of a structured approach to filling out a Power of Attorney form cannot be overstated, as it empowers individuals to designate trusted representatives to expertly handle important financial and legal decisions on their behalf. For those seeking guidance in this process, resources like Fill PDF Forms can provide the necessary tools and templates to ensure all details are managed appropriately, offering peace of mind during challenging times.

Similar forms

The Real Estate Power of Attorney form shares similarities with the General Power of Attorney. Both documents allow an individual, known as the principal, to appoint another person, referred to as the agent, to make decisions on their behalf. The General Power of Attorney covers a wide range of decisions, including financial and legal matters, while the Real Estate Power of Attorney specifically focuses on transactions related to real property. This distinction makes the Real Estate version more specialized, but both forms empower the agent to act in the principal's best interest.

Another document akin to the Real Estate Power of Attorney is the Durable Power of Attorney. This form remains effective even if the principal becomes incapacitated, ensuring that the agent can continue to make decisions regarding real estate and other matters. Like the Real Estate Power of Attorney, it grants significant authority to the agent, but the Durable Power of Attorney is broader in scope, covering various aspects of the principal's life, not just real estate transactions.

The Medical Power of Attorney is another related document, although it deals with healthcare decisions rather than real estate. This form allows an agent to make medical decisions for the principal if they are unable to do so themselves. While the focus is different, both documents share the fundamental purpose of empowering an agent to act in the principal's best interests during critical times, ensuring that their wishes are respected.

A Limited Power of Attorney is similar in that it grants specific powers to an agent, but it is typically used for a defined period or for particular transactions. For instance, a Limited Power of Attorney might allow someone to handle a single real estate sale or a specific financial transaction. In contrast, the Real Estate Power of Attorney is tailored to real estate matters but can also be limited in scope if specified by the principal.

The Quitclaim Deed is another document that often works in conjunction with the Real Estate Power of Attorney. This form is used to transfer property ownership without guaranteeing that the title is clear. When an agent acts under a Real Estate Power of Attorney, they may use a Quitclaim Deed to facilitate the transfer of property on behalf of the principal. Both documents are essential in real estate transactions, but they serve different purposes within the process.

The Warranty Deed, like the Quitclaim Deed, is related to real estate transactions. This document provides a guarantee that the property title is clear and free of liens or encumbrances. When an agent acts under a Real Estate Power of Attorney, they may execute a Warranty Deed to ensure that the buyer receives a secure title. While both deeds are important in property transfers, the Warranty Deed offers more protection to the buyer than the Quitclaim Deed.

A Trust Agreement is another document that can be compared to the Real Estate Power of Attorney. A Trust allows an individual to place assets, including real estate, into a legal entity managed by a trustee. The trustee can act on behalf of the trust's beneficiaries, similar to how an agent operates under a Power of Attorney. Both documents involve delegating authority, but a Trust Agreement typically has a broader focus on asset management over time.

In instances where you need to delegate authority effectively, understanding the options available for managing your affairs is crucial. The helpful Power of Attorney resources can guide you through the necessary processes, ensuring that you choose the right form for your needs.

The Living Will, while primarily concerned with end-of-life decisions, shares the theme of expressing one's wishes regarding health and property matters. A Living Will outlines preferences for medical treatment, while the Real Estate Power of Attorney allows for the management of real estate assets. Both documents ensure that a person's wishes are honored, even when they cannot communicate them directly.

The Bill of Sale is another document that can be related to real estate transactions. Although it primarily pertains to the sale of personal property, it can be used in conjunction with a Real Estate Power of Attorney when personal property is included in a real estate deal. Both documents facilitate the transfer of ownership, but the Bill of Sale is more focused on personal items rather than real estate itself.

Lastly, the Lease Agreement is similar in that it involves property but serves a different purpose. A Lease Agreement outlines the terms under which one party rents property from another. When an agent operates under a Real Estate Power of Attorney, they may negotiate or sign lease agreements on behalf of the principal. Both documents involve property management, but they apply to different scenarios within the real estate realm.

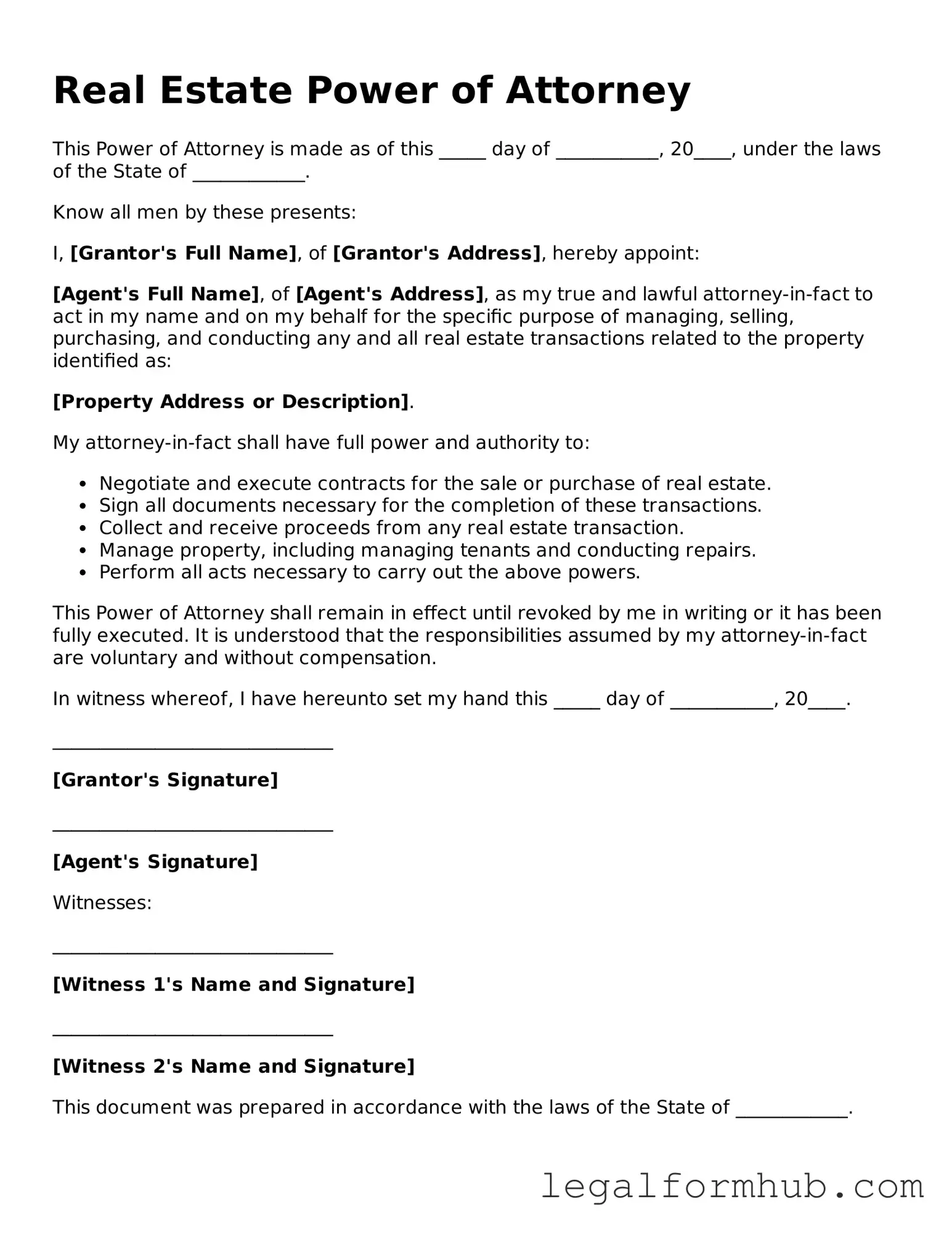

Instructions on Writing Real Estate Power of Attorney

Completing a Real Estate Power of Attorney form is an important step in designating someone to handle real estate transactions on your behalf. Once you have filled out the form, it will need to be signed and possibly notarized, depending on your state’s requirements. Follow these steps carefully to ensure everything is filled out correctly.

- Begin by clearly writing your full name in the designated area. This identifies you as the principal.

- Next, provide your address. This should be your current residential address.

- Identify the agent you are appointing. Write their full name in the appropriate section.

- Include the agent's address. Ensure this is accurate, as it helps in future communications.

- Specify the powers you are granting. You may need to check specific boxes or write out the powers clearly, depending on the form's format.

- Indicate the duration of the power of attorney. You can specify a start and end date or state that it is effective until revoked.

- Sign the form in the designated signature area. This confirms your agreement and intent.

- Have the form notarized, if required by your state. A notary public will verify your identity and witness your signature.

After completing these steps, review the form to ensure all information is accurate. Make copies for your records and provide a copy to your agent. This will help facilitate any transactions they need to handle on your behalf.

Misconceptions

Understanding the Real Estate Power of Attorney form is crucial for making informed decisions in real estate transactions. However, several misconceptions can lead to confusion. Here are four common misunderstandings:

- Misconception 1: A Power of Attorney can only be used for financial transactions.

- Misconception 2: The person granting Power of Attorney loses all control over their property.

- Misconception 3: A Power of Attorney is only valid if notarized.

- Misconception 4: A Power of Attorney is a permanent arrangement.

This is not true. While many people associate Power of Attorney with financial matters, it can also grant authority for real estate transactions. This includes buying, selling, or managing property on behalf of another person.

This is a common fear. In reality, the individual granting Power of Attorney retains the right to revoke it at any time, as long as they are mentally competent. They can also specify the extent of the authority given.

While notarization is often recommended and may be required in some states, not all jurisdictions mandate it for a Power of Attorney to be valid. It's essential to check local laws to ensure compliance.

This is misleading. A Power of Attorney can be set up as either durable or non-durable. A durable Power of Attorney remains in effect even if the person becomes incapacitated, while a non-durable one ceases when the individual is no longer able to make decisions.

Key takeaways

Filling out and using a Real Estate Power of Attorney form can be a straightforward process if you keep a few key points in mind. Here are some important takeaways to consider:

- Understand the Purpose: A Real Estate Power of Attorney allows you to designate someone to act on your behalf in real estate transactions. This can be especially useful if you are unable to be present.

- Choose the Right Agent: Select a trusted individual as your agent. This person will have significant authority regarding your property, so choose wisely.

- Specify Powers Clearly: Clearly outline the powers you are granting. This can include buying, selling, or managing property. The more specific you are, the better.

- Consider Limitations: You may want to limit the scope of authority. For instance, you could specify that the agent can only act on certain properties or within a certain timeframe.

- Signatures Matter: Ensure that the form is signed by you and, if required, notarized. Some states require notarization for the document to be legally binding.

- Keep Copies Accessible: After completing the form, make copies and keep them in a secure location. Provide a copy to your agent and any relevant parties involved in real estate transactions.

- Review Periodically: Life circumstances change, and so might your needs. Review the Power of Attorney regularly to ensure it still meets your requirements.

File Overview

| Fact Name | Description |

|---|---|

| Definition | A Real Estate Power of Attorney form allows one person to authorize another to act on their behalf in real estate transactions. |

| Purpose | This form is used to facilitate property sales, purchases, and management without the principal's direct involvement. |

| Principal and Agent | The person granting authority is called the principal, while the person receiving authority is known as the agent or attorney-in-fact. |

| State-Specific Forms | Each state may have its own specific form and requirements for a Real Estate Power of Attorney. Check your state's laws for details. |

| Governing Law | In many states, the governing laws for Power of Attorney are found in the Uniform Power of Attorney Act. |

| Durability | A Real Estate Power of Attorney can be durable, meaning it remains effective even if the principal becomes incapacitated. |

| Revocation | The principal can revoke the Power of Attorney at any time, as long as they are competent to do so. |

| Notarization | Most states require the Real Estate Power of Attorney to be notarized for it to be legally binding. |