Printable Quitclaim Deed Document

Common Quitclaim Deed Documents:

Problems With Transfer on Death Deeds California - A Transfer-on-Death Deed allows property owners to designate beneficiaries who will inherit their property upon death.

A Non-disclosure Agreement (NDA) in Arizona is a legal document that protects confidential information shared between parties. This agreement ensures that sensitive information remains private and is not disclosed to unauthorized individuals. For more information, you can refer to the template available at https://arizonapdfs.com/non-disclosure-agreement-template/. By signing an NDA, parties can foster trust and encourage open communication while safeguarding their interests.

Corrective Deed California - A Corrective Deed helps create clarity for future property transactions.

Quitclaim Deed - Tailored for Each State

Similar forms

A Warranty Deed is a document that provides a guarantee from the seller to the buyer regarding the title of the property. Unlike a Quitclaim Deed, which offers no such guarantees, a Warranty Deed ensures that the seller has clear ownership and the right to transfer the property. This means that if any issues arise regarding the title, the seller is responsible for addressing them. Buyers often prefer Warranty Deeds for this added layer of security, as it protects them from potential claims or disputes over ownership that may surface after the sale.

A Grant Deed is another document similar to a Quitclaim Deed, but it comes with certain assurances. When a Grant Deed is used, the seller confirms that they have not sold the property to anyone else and that the property is free from undisclosed encumbrances. This provides a bit more protection to the buyer compared to a Quitclaim Deed, which offers no such assurances. While a Quitclaim Deed simply transfers whatever interest the seller has, a Grant Deed implies a level of warranty regarding the title, making it a more secure option for property transfers.

If you're considering a career at Chick Fil A, it's vital to complete the Chick Fil A Job Application form, which is designed to gather necessary personal information and work history for the hiring process. To start your journey, you can easily access the application by visiting Fill PDF Forms.

An Easement Agreement is a document that grants someone the right to use a portion of another person's property for a specific purpose. While it does not transfer ownership like a Quitclaim Deed, it is similar in that it can be used to formalize an interest in property. For instance, if a neighbor wants to use a path through your yard to access their property, an Easement Agreement will outline the terms of that use. Both documents involve property rights, but Easement Agreements focus on usage rather than ownership transfer.

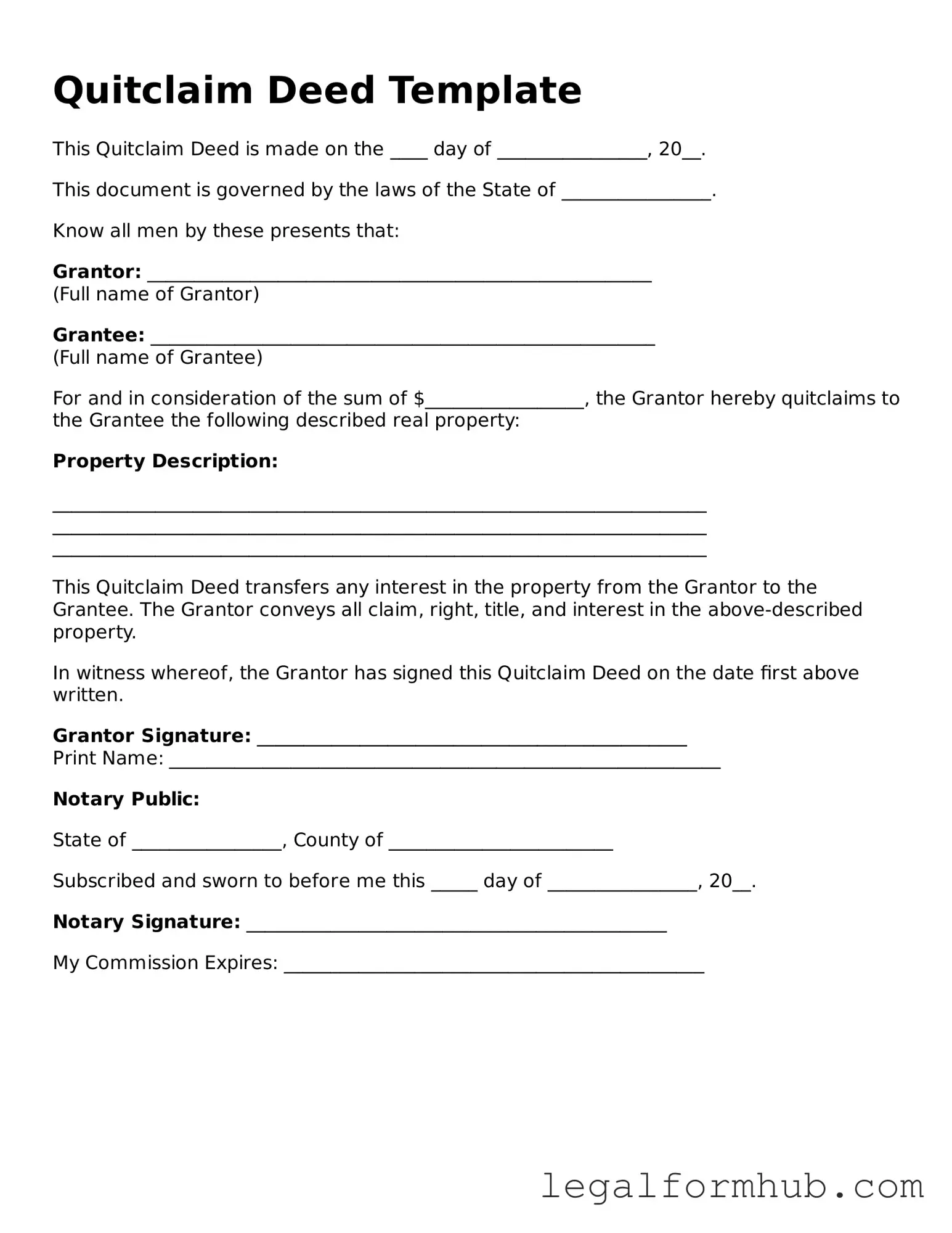

Instructions on Writing Quitclaim Deed

After obtaining the Quitclaim Deed form, it’s essential to fill it out accurately to ensure a smooth transfer of property rights. Once completed, the form needs to be signed and notarized before it can be recorded with the appropriate local government office.

- Begin by entering the date at the top of the form.

- In the section for the grantor, write the full name of the person transferring the property.

- Next, provide the address of the grantor.

- In the grantee section, fill in the full name of the person receiving the property.

- Include the address of the grantee.

- Describe the property being transferred. This should include the full legal description, which can often be found on the property’s deed or tax records.

- Check the appropriate box to indicate whether the transfer is made with or without consideration (payment).

- Both the grantor and grantee should sign the form. If there are multiple grantors, each must sign.

- Have the signatures notarized. This step is crucial for the document to be legally binding.

- Finally, submit the completed form to the local recording office to finalize the transfer.

Misconceptions

Understanding the Quitclaim Deed form is essential for anyone involved in property transactions. However, several misconceptions can lead to confusion. Here are five common misconceptions:

-

A Quitclaim Deed transfers ownership of property.

This is misleading. A Quitclaim Deed transfers whatever interest the grantor has in the property, but it does not guarantee that the grantor has any legal ownership. If the grantor has no interest, the deed offers no value.

-

A Quitclaim Deed is the same as a Warranty Deed.

Many believe these two types of deeds are interchangeable. However, a Warranty Deed provides a guarantee of clear title, while a Quitclaim Deed does not offer any such assurances. It simply conveys whatever rights the grantor possesses.

-

A Quitclaim Deed can only be used between family members.

This is not true. While Quitclaim Deeds are often used in family transactions, they can be utilized in any situation where property interests are being transferred. This includes sales, gifts, or transfers between unrelated parties.

-

A Quitclaim Deed eliminates all liens on the property.

This misconception can lead to significant financial issues. A Quitclaim Deed does not remove existing liens or debts attached to the property. Buyers should conduct thorough due diligence to uncover any encumbrances before proceeding.

-

Using a Quitclaim Deed is a quick and easy way to transfer property.

While the process may seem straightforward, it is crucial to understand the implications of using a Quitclaim Deed. Legal advice is often recommended to ensure that all parties fully comprehend their rights and responsibilities.

Key takeaways

When dealing with a Quitclaim Deed, it is important to understand several key points to ensure a smooth process. Here are five essential takeaways:

- Purpose of the Quitclaim Deed: This document is used to transfer ownership of property from one person to another without guaranteeing that the title is clear. It simply conveys whatever interest the grantor has in the property.

- Filling Out the Form: Ensure that all required fields are completed accurately. This includes the names of the grantor and grantee, the property description, and the date of the transfer.

- Signatures: The Quitclaim Deed must be signed by the grantor. Depending on state laws, it may also need to be notarized to be valid.

- Recording the Deed: After completing the form, it is advisable to file the Quitclaim Deed with the appropriate county office. This step provides public notice of the property transfer.

- Legal Advice: While a Quitclaim Deed is straightforward, consulting with a legal professional can help clarify any uncertainties and ensure that the deed is executed properly.

Understanding these points can help individuals navigate the process of using a Quitclaim Deed more effectively.

File Overview

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed is a legal document used to transfer ownership of real property from one party to another without any warranties or guarantees. |

| Use Cases | Commonly used in situations such as divorce settlements, transferring property between family members, or clearing up title issues. |

| State-Specific Forms | Each state has its own specific quitclaim deed form, which may include unique requirements or language. For example, California's quitclaim deed must comply with California Civil Code Section 1092. |

| Warranties | Unlike other types of deeds, a quitclaim deed does not guarantee that the grantor holds clear title to the property. The grantee accepts the property "as is." |

| Recording | To ensure the transfer is legally recognized, the quitclaim deed should be recorded with the local county recorder’s office. |

| Tax Implications | Transferring property through a quitclaim deed may have tax implications, including potential gift tax considerations if the property is transferred without compensation. |

| Revocation | A quitclaim deed cannot be revoked once it is executed and recorded. The transfer of ownership is final. |

| Legal Advice | It is advisable to consult with a legal professional before executing a quitclaim deed to understand the implications and ensure proper completion. |