Printable Promissory Note for a Car Document

Common Promissory Note for a Car Documents:

What Happens to a Promissory Note When the Lender Dies - Offers protections to the borrower against future claims on the same debt.

To ensure a smooth lending process, it is essential to utilize a Maryland Promissory Note form, which is a legal document that outlines a loan agreement between a borrower and a lender in the state of Maryland. It specifies the amount of money borrowed, the interest rate, and the repayment schedule. For your convenience, you can access the necessary documents at All Maryland Forms to fill out the form and make sure your loan is legally documented.

Similar forms

A Loan Agreement is similar to a Promissory Note for a Car because both documents outline the terms of a loan. They specify the amount borrowed, the repayment schedule, and the interest rate. In both cases, the borrower agrees to repay the lender under the conditions set forth in the document. However, a Loan Agreement may include additional clauses, such as collateral requirements and default conditions, which may not be present in a simple Promissory Note.

In understanding the various documents associated with vehicle financing, it's essential to recognize the role of the Promissory Note, which highlights the borrower's promise to repay the loan amount, as echoed in resources like nytemplates.com/blank-promissory-note-template. This document not only establishes the terms of repayment but also serves as a foundational element that complements other agreements such as the Bill of Sale and Security Agreement, ensuring a comprehensive approach to financing a vehicle.

A Sales Contract for a Vehicle is another document that shares similarities with a Promissory Note for a Car. This contract details the sale of a vehicle, including the purchase price and payment terms. While the Promissory Note focuses on the loan aspect, the Sales Contract addresses the transfer of ownership. Both documents are crucial in a vehicle transaction, ensuring that both parties understand their rights and obligations.

A Mortgage Note is akin to a Promissory Note for a Car in that it serves as a written promise to repay borrowed money. In a Mortgage Note, the borrower pledges real property as collateral, while a Promissory Note for a Car is secured by the vehicle itself. Both documents outline repayment terms and can lead to repossession if the borrower defaults.

An Installment Agreement is also similar, as it involves a series of payments over time. This type of agreement may be used for various purchases, including vehicles. Like a Promissory Note, it specifies the payment schedule, interest rate, and consequences for non-payment. The key difference lies in the broader application of Installment Agreements, which can cover more than just car loans.

A Credit Agreement can be compared to a Promissory Note for a Car, as both involve borrowing money. A Credit Agreement typically outlines the terms of a credit line, including limits and fees. While a Promissory Note is specific to a car loan, both documents establish the borrower's obligations and the lender's rights in case of default.

A Secured Loan Agreement is similar because it involves borrowing money with collateral. In this case, the vehicle serves as collateral for the loan. Both documents detail the loan amount, repayment terms, and consequences for failure to repay. The main distinction is that a Secured Loan Agreement may apply to various types of loans, not just for vehicles.

Lastly, a Lease Agreement for a Vehicle shares some characteristics with a Promissory Note for a Car. While a Lease Agreement allows for temporary use of the vehicle with monthly payments, the Promissory Note is focused on ownership through financing. Both documents require the lessee or borrower to make payments and outline the consequences of default, creating a structured financial commitment.

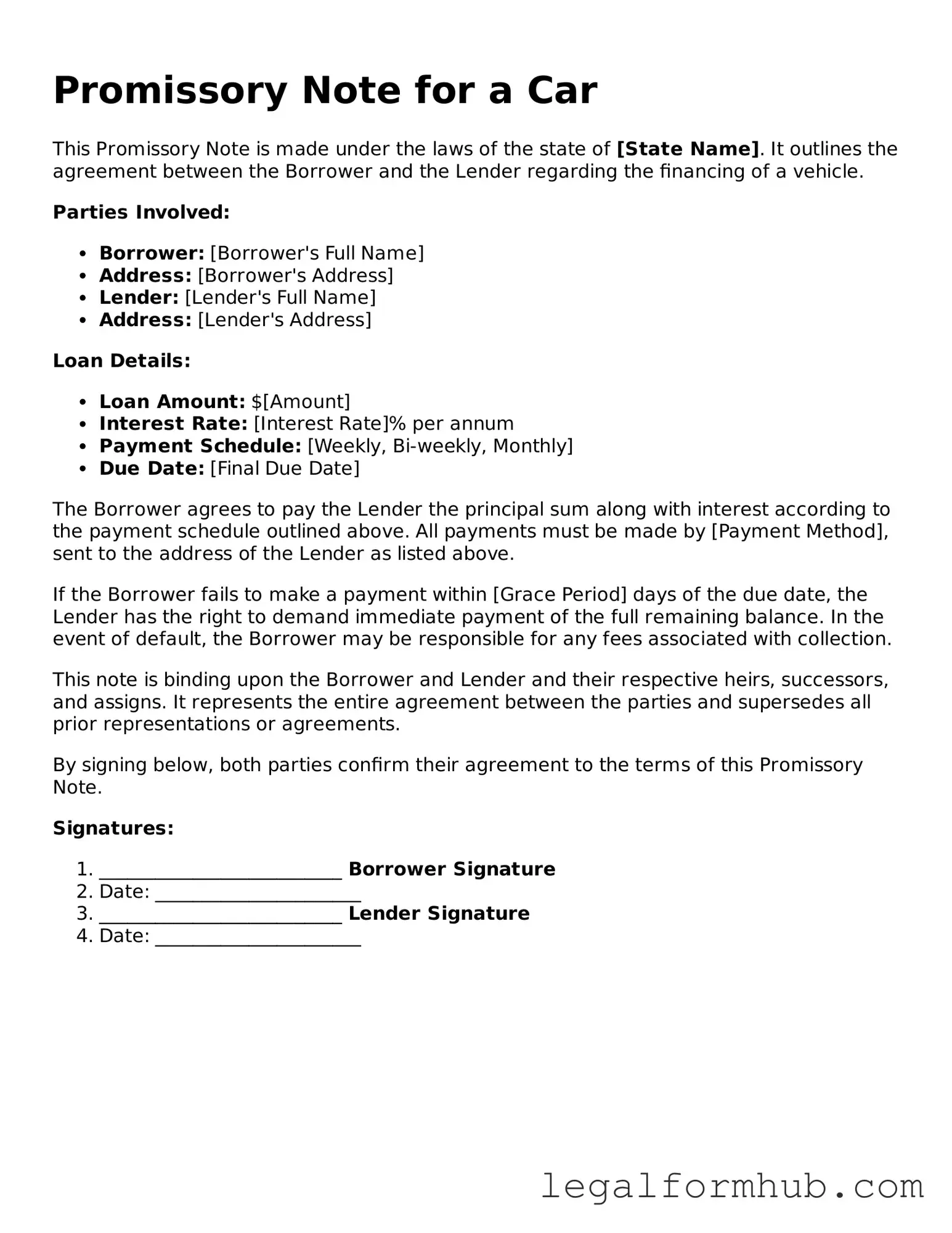

Instructions on Writing Promissory Note for a Car

After obtaining the Promissory Note for a Car form, it’s essential to complete it accurately to ensure a smooth transaction. Follow the steps below to fill out the form correctly.

- Begin by entering the date at the top of the form.

- Provide the full name and address of the borrower. Make sure to include any necessary contact information.

- Next, enter the lender’s name and address. This is typically the individual or financial institution providing the loan.

- Specify the loan amount. Clearly state the total amount being borrowed for the car purchase.

- Detail the interest rate. If applicable, indicate whether it is fixed or variable.

- Fill in the repayment terms. Include the number of payments, the frequency (monthly, bi-weekly, etc.), and the due date for the first payment.

- Include any late payment penalties or fees, if relevant. Be clear about the consequences of missed payments.

- Sign and date the form. Ensure that both the borrower and lender sign to validate the agreement.

Once the form is filled out, review it for accuracy. Both parties should keep a copy for their records. This will facilitate communication and ensure all terms are understood moving forward.

Misconceptions

Understanding the Promissory Note for a Car form is essential for both buyers and sellers. However, several misconceptions can lead to confusion. Here are seven common misconceptions:

- A Promissory Note is the same as a car title. The Promissory Note is a financial agreement outlining the terms of the loan, while the car title proves ownership of the vehicle.

- Only banks can issue Promissory Notes. Individuals can create a Promissory Note for a car sale. It is not limited to financial institutions.

- A Promissory Note does not require signatures. Signatures from both parties are crucial. They signify agreement to the terms laid out in the note.

- Once signed, a Promissory Note cannot be changed. Modifications can be made if both parties agree. However, it's best to document any changes in writing.

- A Promissory Note guarantees payment. While it outlines the obligation to pay, it does not guarantee that the borrower will follow through. Lenders should be aware of this risk.

- The Promissory Note is only needed for large loans. Even smaller loans can benefit from a Promissory Note. It provides clarity and protection for both parties.

- Once the loan is paid, the Promissory Note is irrelevant. It is advisable to keep the Promissory Note even after payment. It serves as proof of the transaction and can be important for record-keeping.

Addressing these misconceptions can help ensure a smoother transaction when buying or selling a vehicle. Understanding the role of the Promissory Note is key to protecting both parties involved.

Key takeaways

When filling out and using the Promissory Note for a Car form, it’s important to keep several key points in mind. These takeaways will help ensure clarity and security in the agreement.

- Understand the Purpose: A promissory note is a legal document that outlines the borrower's promise to repay the loan for the car.

- Complete All Sections: Fill in all required fields accurately. Missing information can lead to disputes later.

- Include Payment Details: Specify the loan amount, interest rate, and payment schedule clearly.

- Signatures Matter: Ensure both parties sign the document. This makes it legally binding.

- Keep Copies: Both the lender and borrower should retain copies of the signed note for their records.

- Consider Legal Advice: If unsure about any terms, seeking legal advice can provide clarity and peace of mind.

- Review Before Signing: Read through the entire document before signing to avoid any misunderstandings.

File Overview

| Fact Name | Description |

|---|---|

| Definition | A promissory note for a car is a written promise to pay a specific amount of money for the purchase of a vehicle. |

| Key Components | This document typically includes the buyer's and seller's names, the vehicle details, the amount financed, and the repayment terms. |

| Governing Laws | In the U.S., promissory notes are generally governed by the Uniform Commercial Code (UCC), which varies slightly by state. |

| Importance | Having a promissory note protects both the buyer and seller by clearly outlining the terms of the loan and repayment schedule. |