Printable Promissory Note Document

More Forms:

Notice of Termination of Lease - This form is instrumental in wrapping up your rental obligations efficiently.

An Emotional Support Animal Letter serves as an official document confirming the need for an emotional support animal to assist individuals dealing with mental or emotional challenges. This letter is pivotal for securing housing accommodations and access to various public areas. You can obtain this essential documentation by completing the necessary form at pdftemplates.info/, ensuring you take the next step towards receiving the support you need.

California Sdi - Filling out the EDD DE 2501 incorrectly may lead to denial or delays in receiving benefits.

Promissory Note - Tailored for Each State

Promissory Note Form Subtypes

Similar forms

A loan agreement is one document that closely resembles a promissory note. Both serve as written contracts outlining the terms of a loan. In a loan agreement, the details are often more comprehensive, covering aspects like repayment schedules, interest rates, and the rights of both the borrower and lender. While a promissory note is typically a simpler document that just states the borrower's promise to repay, a loan agreement includes more legal protections and obligations for both parties. This added detail makes loan agreements particularly useful for larger sums or more complex arrangements.

Another similar document is a mortgage. When you take out a mortgage, you are borrowing money to purchase real estate, and the mortgage serves as a security instrument for that loan. Like a promissory note, it outlines the borrower's commitment to repay the loan. However, a mortgage also includes the property as collateral, meaning that if the borrower fails to repay, the lender can take possession of the property. This added layer of security differentiates it from a standard promissory note, which does not involve collateral.

A personal guarantee can also be compared to a promissory note. This document is often used in business loans, where an individual agrees to be personally responsible for the debt if the borrowing entity defaults. While a promissory note is a straightforward promise to pay back a loan, a personal guarantee adds an extra layer of accountability by tying the borrower's personal assets to the loan. This makes it a valuable tool for lenders who want assurance that they can recover their funds, even if the business fails.

If you're considering applying for a position at Chick Fil A, the first step is to complete the necessary paperwork, including the Chick Fil A Job Application form, which is crucial for the hiring process. To get started on your application, you can visit Fill PDF Forms to easily fill out the required information and take your first step towards joining the team.

Lastly, a security agreement is another document that shares similarities with a promissory note. This agreement is used when a borrower offers collateral to secure a loan. Like a promissory note, it lays out the terms of the borrowing arrangement, but it goes a step further by detailing the specific assets that will serve as collateral. If the borrower defaults, the lender has the right to seize those assets. This combination of a promise to pay and a security interest makes security agreements a critical tool in lending situations where collateral is involved.

Instructions on Writing Promissory Note

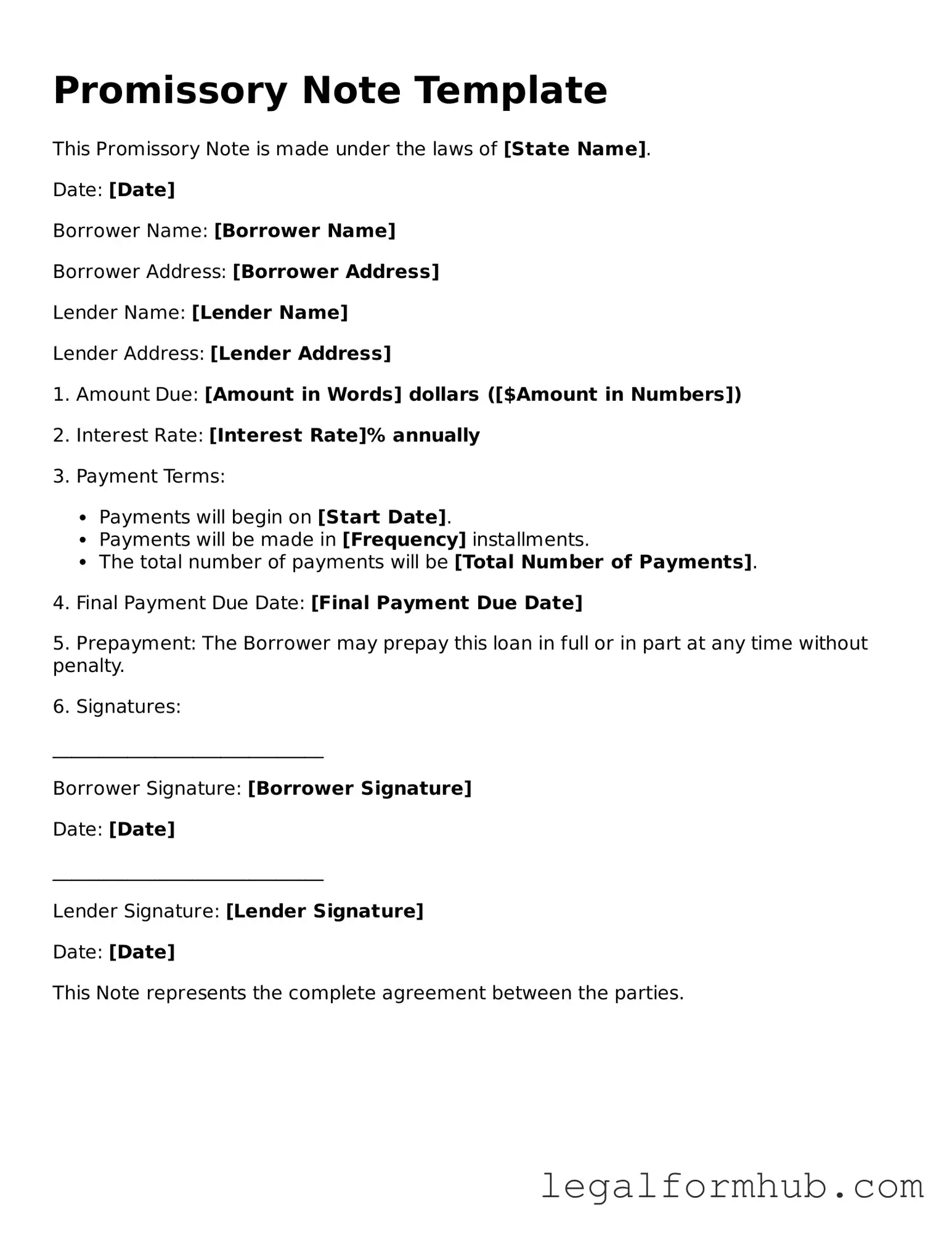

Once you have the Promissory Note form in front of you, the next step is to fill it out accurately. This document requires specific information to ensure clarity and legality. Follow these steps carefully to complete the form correctly.

- Start by entering the date at the top of the form. This should be the date you are completing the document.

- In the first blank space, write the name of the borrower. Make sure to use the full legal name.

- Next, in the following space, enter the borrower's address. This should include the street address, city, state, and zip code.

- Proceed to fill in the lender's name in the next blank. Again, use the full legal name.

- In the next section, write the lender's address, including street, city, state, and zip code.

- Specify the principal amount being borrowed. This should be a numerical value, clearly written.

- Indicate the interest rate. If applicable, write the percentage in the designated space.

- Next, state the repayment terms. This includes how often payments will be made (e.g., monthly, quarterly) and the duration of the loan.

- In the section for late fees, specify any penalties for late payments, if applicable.

- Sign and date the form at the bottom. The borrower should also print their name below the signature.

Once the form is filled out, review it for accuracy. Make copies for both the borrower and lender before any funds are exchanged. This ensures that both parties have a record of the agreement.

Misconceptions

Understanding the Promissory Note form can be tricky, especially with the many misconceptions that exist. Here’s a list of common misunderstandings and clarifications to help demystify this important document.

-

All Promissory Notes are the same.

This is not true. Promissory Notes can vary significantly in terms of terms, conditions, and legal language. Each note is tailored to the specific agreement between the lender and borrower.

-

A Promissory Note is only for large loans.

Many people believe that these notes are only necessary for significant amounts of money. However, they can be used for any loan amount, big or small.

-

You don’t need a lawyer to create a Promissory Note.

-

Signing a Promissory Note means the loan is guaranteed.

This is misleading. Signing the note does not guarantee repayment. It is simply a promise to repay the loan under the agreed-upon terms.

-

A Promissory Note is the same as a loan agreement.

While both documents involve borrowing money, a Promissory Note is typically simpler and focuses on the promise to pay, whereas a loan agreement may include more detailed terms and conditions.

-

Interest rates on Promissory Notes are fixed.

Many assume that the interest rate must be fixed. In reality, interest rates can be fixed or variable, depending on what the parties agree upon.

-

You cannot modify a Promissory Note once it’s signed.

This is a common myth. Modifications can be made, but they typically require the consent of both parties and should be documented properly.

-

Promissory Notes are only for personal loans.

While they are often used in personal lending situations, Promissory Notes are also used in business transactions and real estate deals.

-

All Promissory Notes must be notarized.

Notarization is not always required. However, having a note notarized can add an extra layer of authenticity and may be necessary for certain types of loans.

By clearing up these misconceptions, individuals can better navigate the world of Promissory Notes and make informed decisions regarding their financial agreements.

Key takeaways

When dealing with a Promissory Note, understanding the essential elements can make the process smoother. Here are some key takeaways:

- Define the Loan Amount: Clearly state the exact amount being borrowed. This prevents any confusion later on.

- Specify the Interest Rate: Include the interest rate, whether it’s fixed or variable. This detail is crucial for calculating repayments.

- Outline the Repayment Terms: Detail how and when payments will be made. This includes the payment schedule and due dates.

- Include Borrower and Lender Information: Both parties' names and contact information should be accurate and complete.

- State the Purpose of the Loan: Mentioning the reason for the loan can clarify the intent and context of the agreement.

- Address Default Conditions: Clearly outline what happens if the borrower fails to repay. This protects the lender’s interests.

- Sign and Date the Document: Both parties must sign and date the note for it to be legally binding. Without signatures, the agreement may not hold up in court.

By keeping these points in mind, you can ensure that your Promissory Note is comprehensive and effective.

File Overview

| Fact Name | Description |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated person at a specified time or on demand. |

| Parties Involved | There are typically two parties: the borrower (maker) who promises to pay and the lender (payee) who receives the payment. |

| Governing Law | In the United States, promissory notes are governed by the Uniform Commercial Code (UCC), specifically Article 3. |

| Key Elements | A valid promissory note includes the amount to be paid, the interest rate (if any), the due date, and the signatures of the parties involved. |

| Enforceability | To be enforceable, the note must be clear, unambiguous, and signed by the maker. Oral promises generally do not hold up in court. |

| Transferability | Promissory notes can be transferred to others. This means the lender can sell or assign the note to another party. |

| State-Specific Forms | Some states may have specific requirements or forms for promissory notes. Always check local laws to ensure compliance. |