Fill Your Profit And Loss Form

Different PDF Templates

Work Incident Report - Ensures accountability for reported accidents and incidents.

The FedEx Bill of Lading is a crucial document that confirms the terms of the shipment between the shipper and the carrier. It outlines essential details such as addresses, contact information, service types, and freight charges. To ensure a smooth shipping process, you can easily complete the necessary information by using the Fill PDF Forms.

Making a Family Crest - Sometimes features historical events relevant to the family.

Similar forms

The Profit and Loss form is similar to a Balance Sheet. Both documents provide a snapshot of a company’s financial health. While the Profit and Loss form focuses on revenues and expenses over a specific period, the Balance Sheet summarizes the company’s assets, liabilities, and equity at a single point in time. Together, they offer a comprehensive view of a business's financial situation.

Another document that shares similarities with the Profit and Loss form is the Cash Flow Statement. This statement tracks the flow of cash in and out of a business. Like the Profit and Loss form, it helps assess financial performance, but it emphasizes cash management. Understanding both documents can provide insights into profitability and liquidity.

The Income Statement is often used interchangeably with the Profit and Loss form. Both documents detail a company’s revenues and expenses, ultimately showing net income or loss. The Income Statement is typically more formal and may include additional sections, but the core information remains the same, focusing on profitability over a specific period.

The Statement of Retained Earnings is another document that complements the Profit and Loss form. It outlines how profits are retained or distributed among shareholders. While the Profit and Loss form shows how much profit a company made, the Statement of Retained Earnings explains what happens to that profit. This connection helps stakeholders understand the company’s growth and reinvestment strategies.

When finalizing your sale, consider utilizing a helpful document like the detailed Motorcycle Bill of Sale template. This form assists in recording the essential details of the motorcycle transaction, ensuring a clear transfer of ownership.

The Budget Report also bears resemblance to the Profit and Loss form. A Budget Report outlines projected revenues and expenses, serving as a financial plan for the future. While the Profit and Loss form reflects actual performance, the Budget Report allows businesses to set financial goals and measure their success against those targets.

Lastly, the Trial Balance is a document that aligns with the Profit and Loss form in terms of financial accuracy. The Trial Balance lists all account balances to ensure that debits and credits are equal. While it does not provide a summary of income and expenses, it serves as a foundational document that ensures the accuracy of the figures reported in the Profit and Loss form.

Instructions on Writing Profit And Loss

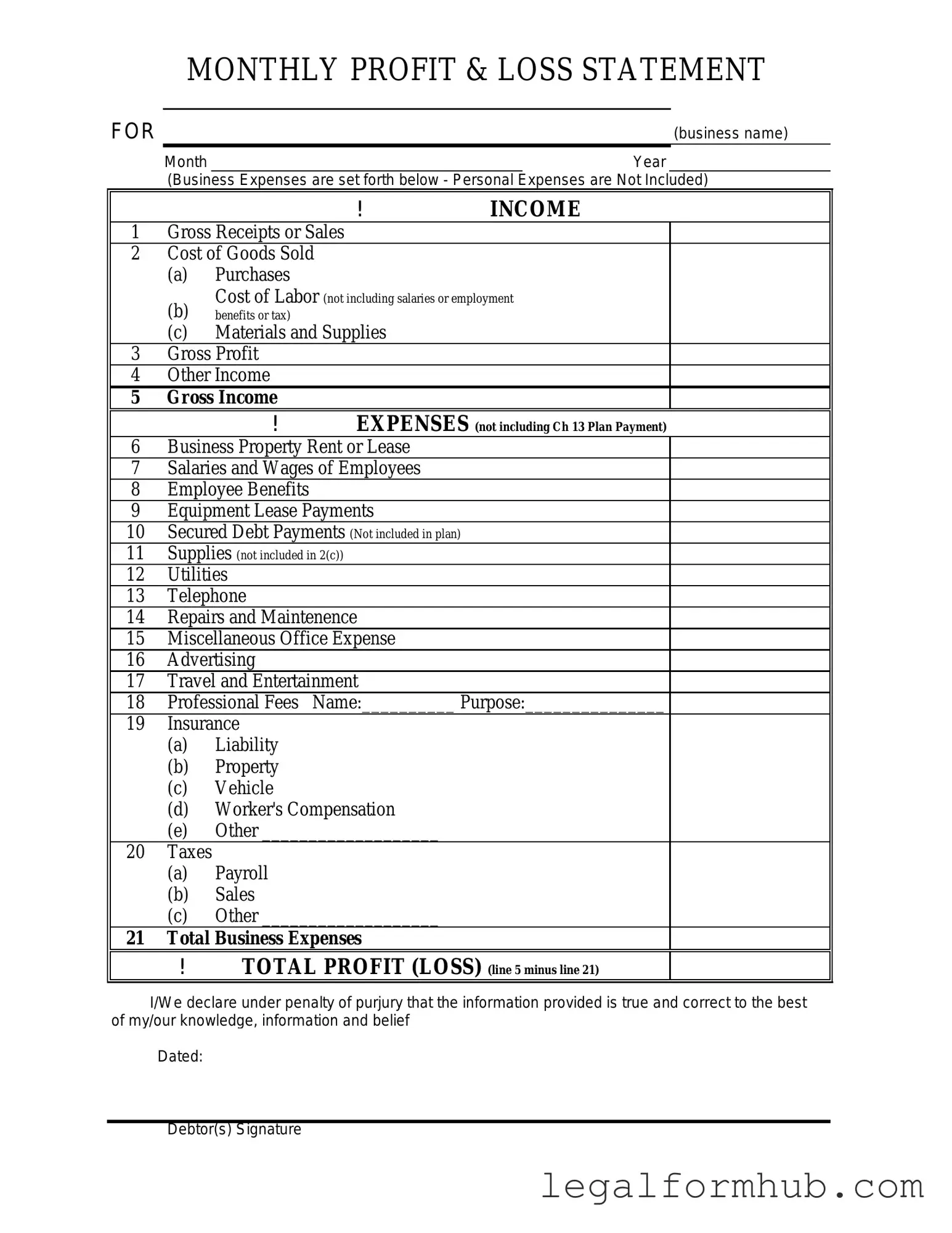

Once you have gathered all the necessary financial information, you're ready to fill out the Profit and Loss form. This form is essential for tracking your business's income and expenses over a specific period. Completing it accurately will provide valuable insights into your financial health.

- Start by entering the business name at the top of the form. This should be the official name of your business.

- Next, fill in the reporting period. Specify the start and end dates for the period you are reporting on.

- List your total income. Include all revenue generated during the reporting period. Be sure to capture all sources of income.

- Move on to cost of goods sold (COGS). This section should include all direct costs associated with producing the goods or services sold.

- Calculate your gross profit by subtracting COGS from total income. Enter this amount in the designated area.

- Now, detail your operating expenses. This includes rent, utilities, salaries, and any other expenses necessary to run your business.

- Next, calculate your operating profit by subtracting total operating expenses from gross profit.

- Include any other income or expenses that occurred during the period. This could be interest income, investment gains, or losses.

- Finally, determine your net profit or loss by adding other income and subtracting other expenses from operating profit. This final figure represents your overall financial performance for the period.

Misconceptions

Understanding the Profit and Loss (P&L) form is crucial for anyone involved in business finance. However, several misconceptions can cloud its importance and functionality. Here are ten common misconceptions about the Profit and Loss form, along with clarifications.

-

The P&L form only shows revenue.

This is incorrect. The P&L form provides a comprehensive overview of a company's revenues and expenses, ultimately showing net profit or loss.

-

Only large businesses need a P&L form.

In reality, all businesses, regardless of size, can benefit from maintaining a P&L statement. It helps in tracking financial performance and making informed decisions.

-

The P&L form is the same as a balance sheet.

These are distinct financial statements. While the P&L focuses on income and expenses over a specific period, a balance sheet provides a snapshot of assets, liabilities, and equity at a specific point in time.

-

Profit and loss statements are only for accountants.

Business owners and managers can also use P&L statements to understand their financial health. Familiarity with this document empowers better decision-making.

-

All expenses are deductible.

Not every expense can be deducted. Only those that are ordinary and necessary for business operations qualify, and it’s essential to consult tax guidelines for specifics.

-

Profit means cash in hand.

Profit does not equate to cash flow. A business can show a profit on its P&L but still face cash flow issues due to timing differences in revenue and expenses.

-

Once completed, the P&L form doesn’t need to be revisited.

This is a misconception. Regularly updating and reviewing the P&L statement is vital for ongoing financial analysis and strategic planning.

-

The P&L form is only useful for tax purposes.

While it is helpful during tax season, the P&L form serves broader purposes, such as budgeting, forecasting, and assessing business performance.

-

Profit and Loss statements are only relevant for internal use.

External stakeholders, such as investors and lenders, also find P&L statements valuable for assessing a company’s financial viability.

-

Creating a P&L form is a one-time task.

In fact, a P&L statement should be prepared regularly, such as monthly or quarterly, to provide ongoing insights into financial performance.

By addressing these misconceptions, individuals can better appreciate the significance of the Profit and Loss form in managing a business’s financial health.

Key takeaways

Filling out and using the Profit and Loss form is essential for tracking financial performance. Here are key takeaways to consider:

- Understand the purpose of the form. It summarizes revenues and expenses over a specific period.

- Gather all financial data before starting. This includes income, costs, and any other relevant financial information.

- Be accurate with figures. Ensure all numbers are correct to avoid misleading results.

- Use clear categories for income and expenses. This helps in analyzing the data effectively.

- Include all sources of income. Don’t overlook any revenue streams, no matter how small.

- Track expenses meticulously. Every cost, from operational to administrative, should be accounted for.

- Review the form regularly. Frequent updates will help maintain an accurate financial picture.

- Use the form to identify trends. Look for patterns in income and expenses over time.

- Consult with a financial advisor if needed. They can provide insights on how to interpret the results.

- Utilize the data for decision-making. The Profit and Loss form is a valuable tool for planning and budgeting.

By keeping these points in mind, the Profit and Loss form can serve as an effective tool for managing finances.

File Information

| Fact Name | Description |

|---|---|

| Definition | A Profit and Loss form summarizes a business's revenues and expenses over a specific period. |

| Purpose | This form helps businesses assess their financial performance and profitability. |

| Components | The form typically includes sections for income, cost of goods sold, gross profit, operating expenses, and net profit. |

| Frequency | Businesses usually prepare Profit and Loss statements monthly, quarterly, or annually. |

| Importance for Taxes | The Profit and Loss form is crucial for tax preparation, as it provides necessary financial information to tax authorities. |

| State-Specific Forms | Some states require specific formats or additional information based on local laws, such as California's Business and Professions Code. |

| GAAP Compliance | In many cases, businesses should prepare their forms in accordance with Generally Accepted Accounting Principles (GAAP). |

| Review Process | It is advisable for business owners to review their Profit and Loss statements regularly to make informed decisions. |

| Software Tools | Various accounting software programs can help generate Profit and Loss forms easily and accurately. |