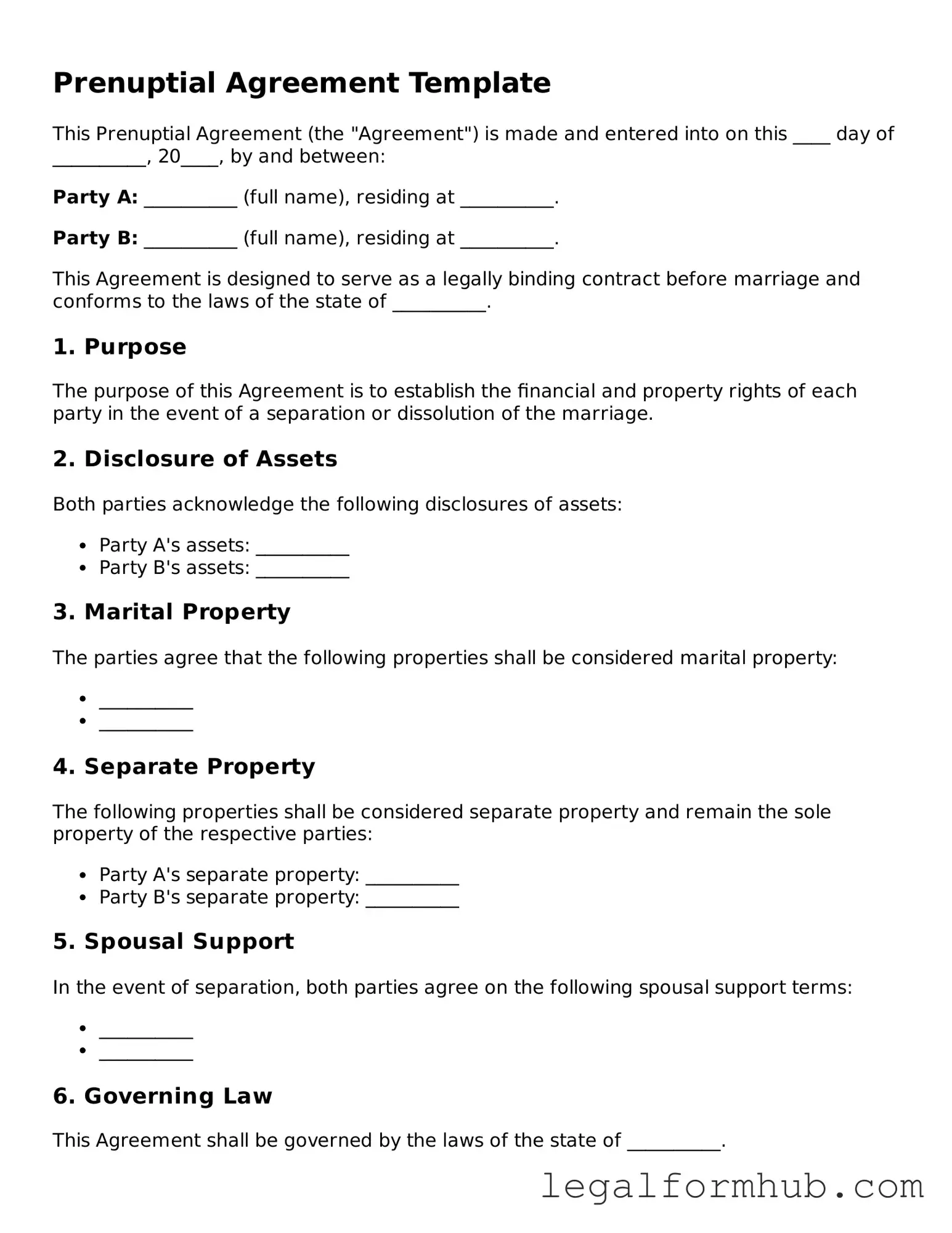

Printable Prenuptial Agreement Document

More Forms:

Affixture - It is common for local jurisdictions to require this affidavit in specific cases before issuing permits.

For anyone looking to initiate a transaction, utilizing a clear and structured Missouri bill of sale document can make all the difference. Ensure you understand the specifics and implications of the transfer by reviewing our detailed guide on the Missouri bill of sale process.

Florida 4 Point Inspection Form - Include any additional comments regarding the overall inspection findings as needed.

How to Fix Written Mistake on Car Title When Selling - The final waiver can help to resolve any misunderstandings about financial obligations between parties.

Prenuptial Agreement - Tailored for Each State

Similar forms

A Cohabitation Agreement is similar to a prenuptial agreement in that it outlines the rights and responsibilities of partners who live together but are not married. This document can address financial matters, property ownership, and how assets will be divided in the event of a breakup. Just like a prenuptial agreement, a cohabitation agreement helps clarify expectations and can prevent disputes down the road.

If you are looking to buy or sell a trailer in California, understanding the necessary documentation is essential. The California Trailer Bill of Sale serves as a crucial legal form that establishes the transfer of ownership, protecting both parties involved in the transaction. To streamline the process, you can easily create the document you need by visiting Fill PDF Forms, ensuring all details are accurately captured for a successful sale.

A Postnuptial Agreement serves a similar purpose to a prenuptial agreement but is created after the couple is already married. It can address the same issues regarding asset division and financial responsibilities. Couples may choose to create a postnuptial agreement to reflect changes in their circumstances or to solidify their financial arrangements, ensuring both parties are protected.

A Marriage Contract is similar to a prenuptial agreement in that it also lays out the financial and legal responsibilities of each partner. This document can cover a variety of topics, including property rights, spousal support, and other financial arrangements. Both types of agreements serve to protect individual interests and create a clear understanding between partners.

A Trust Agreement can be compared to a prenuptial agreement in terms of asset protection. This document establishes a trust to manage assets for beneficiaries. Just like a prenuptial agreement, a trust agreement can help safeguard wealth and ensure that assets are distributed according to the individual's wishes, providing peace of mind for both parties.

An Estate Plan shares similarities with a prenuptial agreement as it outlines how assets will be handled after one partner's death. Both documents aim to provide clarity and prevent disputes among heirs. An estate plan can include wills, trusts, and powers of attorney, ensuring that each partner's wishes are honored and reducing potential conflicts.

A Financial Disclosure Statement is akin to a prenuptial agreement in that it involves transparency about each partner's financial situation. This document requires both parties to disclose their assets, debts, and income. Just as a prenuptial agreement encourages open communication about finances, a financial disclosure statement helps build trust and understanding between partners before entering into a marriage.

Instructions on Writing Prenuptial Agreement

Filling out a prenuptial agreement form is an important step for couples considering marriage. This process helps clarify financial matters and expectations before tying the knot. To ensure accuracy and completeness, follow these steps carefully.

- Begin by gathering all necessary personal information. This includes full names, addresses, and contact information for both parties.

- Next, list all assets owned by each party. Include real estate, bank accounts, investments, and personal property.

- Identify any debts each person has. This could be student loans, credit card debt, or mortgages.

- Discuss and outline how assets and debts will be handled during the marriage. Be clear about ownership and management.

- Consider including provisions for what happens in the event of divorce or separation. This might involve asset division or spousal support.

- Review any state-specific requirements that may apply to prenuptial agreements. Ensure that the form complies with local laws.

- Both parties should read the document thoroughly. Make sure that all terms are understood and agreed upon.

- Sign the agreement in the presence of a notary public. This step adds a layer of legal validity to the document.

- Keep copies of the signed agreement in a safe place. Each party should have their own copy for reference.

Misconceptions

Many people have misunderstandings about prenuptial agreements. Here are six common misconceptions:

-

Prenuptial agreements are only for the wealthy.

This is not true. Anyone can benefit from a prenuptial agreement, regardless of their financial status. It helps clarify expectations and protect both parties’ interests.

-

Prenuptial agreements are unromantic.

While discussing finances before marriage might feel awkward, a prenuptial agreement can actually strengthen a relationship. It encourages open communication about money and expectations.

-

Prenuptial agreements are only about divorce.

These agreements can address a variety of issues, including how to manage finances during the marriage. They can also outline responsibilities and expectations, promoting harmony.

-

Prenuptial agreements are not enforceable.

This is incorrect. As long as the agreement is fair and both parties fully understand it, courts typically uphold prenuptial agreements.

-

Prenuptial agreements can cover anything.

While they can address many financial matters, there are limitations. For instance, they cannot dictate child custody arrangements or child support, as these issues are determined based on the child's best interests.

-

Prenuptial agreements are only necessary for first marriages.

This is a misconception. Individuals entering second or subsequent marriages often have more complex financial situations and may benefit even more from a prenuptial agreement.

Key takeaways

When considering a prenuptial agreement, it is essential to understand its purpose and implications. Here are some key takeaways to keep in mind:

- A prenuptial agreement is a legal document that outlines how assets will be divided in the event of a divorce.

- Both parties should fully disclose their financial situations to ensure fairness and transparency.

- It is advisable for each party to seek independent legal advice to understand their rights and obligations.

- The agreement must be signed voluntarily by both parties, without any coercion or undue pressure.

- Clear and specific language should be used to avoid ambiguity and potential disputes in the future.

- Regularly reviewing and updating the agreement is important, especially if significant life changes occur.

- While prenuptial agreements can help prevent conflicts, they should also be approached with open communication and mutual respect.

- Finally, ensure that the agreement complies with state laws, as requirements can vary by jurisdiction.

File Overview

| Fact Name | Details |

|---|---|

| Definition | A prenuptial agreement is a contract between two individuals before marriage, outlining the division of assets and responsibilities in the event of divorce or separation. |

| Purpose | These agreements help protect individual assets, clarify financial responsibilities, and can reduce conflict in case of a divorce. |

| State-Specific Forms | Each state may have its own specific requirements for prenuptial agreements. For example, California requires full disclosure of assets. |

| Governing Law | In New York, prenuptial agreements are governed by the Domestic Relations Law. |

| Enforceability | For a prenuptial agreement to be enforceable, it must be in writing, signed by both parties, and entered into voluntarily. |

| Modification | Couples can modify a prenuptial agreement after marriage, but changes must also be in writing and signed by both parties. |