Fill Your Payroll Check Form

Different PDF Templates

Llc Membership Certificate Template - Support seamless membership transitions with detailed records.

To obtain the necessary certification for your emotional support animal, you can begin the process by utilizing the Fill PDF Forms, which will guide you through the essential steps to secure your letter and ensure you receive the support you need for your mental well-being.

Abn Form Medicare - The form can prompt discussions about potentially unnecessary or alternative services with healthcare providers.

Similar forms

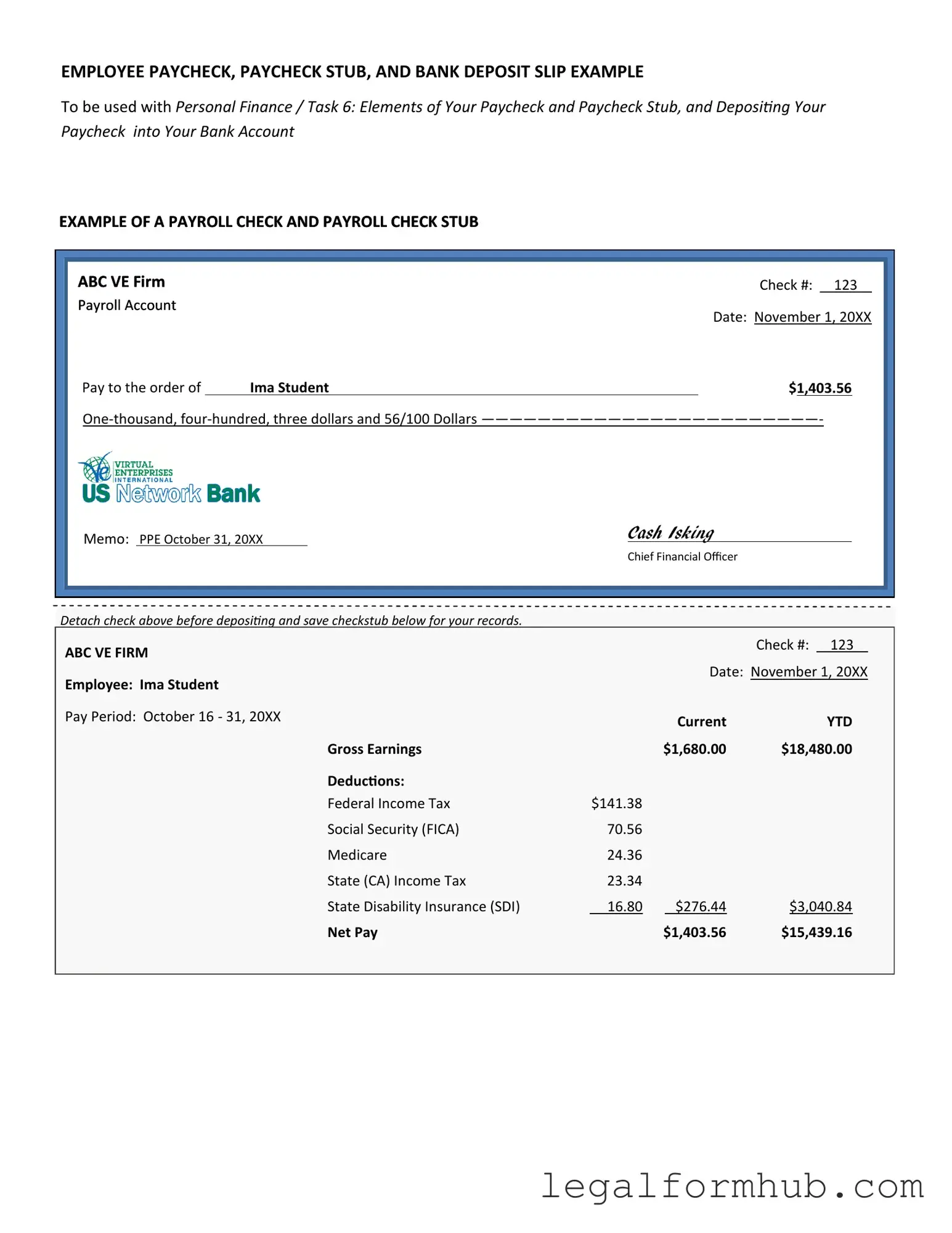

The Payroll Check form is similar to the Pay Stub, which provides employees with a detailed breakdown of their earnings for a specific pay period. The Pay Stub includes information such as gross pay, deductions, and net pay, much like the Payroll Check form. Both documents serve to inform employees about their compensation, ensuring transparency regarding how their pay is calculated and what amounts are withheld for taxes and other contributions.

Another document similar to the Payroll Check form is the Direct Deposit Authorization form. This form allows employees to authorize their employer to deposit their pay directly into their bank account. Like the Payroll Check form, it is essential for processing payroll efficiently. Both documents facilitate the payment process, but the Direct Deposit Authorization focuses more on the method of payment rather than the specifics of the paycheck itself.

The W-2 form also shares similarities with the Payroll Check form. The W-2 summarizes an employee's annual earnings and the taxes withheld over the year. While the Payroll Check form details individual pay periods, the W-2 provides an overview of total compensation for the year. Both documents are crucial for tax reporting purposes, helping employees understand their income and tax obligations.

The Time Sheet is another document that aligns closely with the Payroll Check form. It records the hours worked by an employee during a pay period, which is essential for calculating the amount owed. The Payroll Check form reflects the final compensation based on the hours logged in the Time Sheet. Both documents work together to ensure that employees are paid accurately for their time and effort.

The Arizona Notice to Quit form is a legal document that a landlord uses to inform a tenant that they must vacate the rental property. This notice outlines the reasons for eviction and provides a timeline for the tenant to leave. Understanding this form is essential for both landlords and tenants navigating the eviction process in Arizona. For more information on how to effectively utilize this form, you can visit the following link: https://arizonapdfs.com/notice-to-quit-template/.

Finally, the Employee Earnings Record is similar to the Payroll Check form as it tracks an employee's earnings over time. This record includes details of each paycheck issued, including dates, amounts, and deductions. While the Payroll Check form pertains to a specific pay period, the Employee Earnings Record provides a comprehensive view of an employee's financial history with the company. Together, they help maintain accurate payroll records and support financial planning for employees.

Instructions on Writing Payroll Check

Completing the Payroll Check form is an important step in ensuring that employees receive their payments accurately and on time. Follow these steps carefully to fill out the form correctly, ensuring all necessary information is provided.

- Begin by entering the date at the top of the form. Use the format MM/DD/YYYY.

- In the employee name section, write the full name of the employee receiving the payment.

- Next, fill in the employee ID number. This is usually a unique identifier assigned by the company.

- Enter the amount to be paid. Make sure to write this in both numerical and written form to avoid confusion.

- In the pay period section, indicate the start and end dates for the pay period being processed.

- Provide the department name where the employee works. This helps in tracking expenses accurately.

- Sign the form in the authorized signature section. This confirms that the payment has been approved.

- Finally, make a copy of the completed form for your records before submitting it to the payroll department.

Misconceptions

The Payroll Check form is an essential document in the realm of payroll processing. However, several misconceptions surround it. Below is a list of common misunderstandings about the Payroll Check form, along with clarifications to enhance understanding.

-

Misconception 1: The Payroll Check form is only necessary for hourly employees.

This is incorrect. The Payroll Check form is required for both hourly and salaried employees, as it ensures accurate payment processing for all types of compensation.

-

Misconception 2: Payroll Check forms are the same across all states.

In reality, Payroll Check forms can vary by state due to different tax regulations and labor laws. It is crucial to use the correct form for the specific state in which the employee works.

-

Misconception 3: Once submitted, the Payroll Check form cannot be changed.

This is not true. While changes may require additional documentation or approvals, corrections can often be made if errors are identified after submission.

-

Misconception 4: Payroll Check forms are only used for direct deposit payments.

This is a misconception. Payroll Check forms are utilized for both direct deposits and physical checks, ensuring that all payment methods are accounted for.

-

Misconception 5: The Payroll Check form is only filled out once per year.

In fact, the form may need to be updated frequently, especially if there are changes in employee status, pay rates, or tax withholding preferences.

-

Misconception 6: Employers do not need to keep records of Payroll Check forms.

This is incorrect. Employers are required to maintain records of Payroll Check forms for tax and compliance purposes, often for several years.

-

Misconception 7: Payroll Check forms are only relevant for large companies.

Small businesses also need to utilize Payroll Check forms. Regardless of company size, proper payroll documentation is essential for compliance and accurate employee compensation.

-

Misconception 8: Payroll Check forms are outdated and no longer necessary.

This is misleading. While electronic payroll systems are common, the Payroll Check form remains a vital component for record-keeping and payment processing.

-

Misconception 9: All information on the Payroll Check form is optional.

In fact, certain fields on the Payroll Check form are mandatory. Missing information can lead to delays in processing payments.

-

Misconception 10: Payroll Check forms are only for tracking wages.

This is not entirely accurate. They also track deductions, taxes withheld, and other important financial information related to employee compensation.

Understanding these misconceptions can help ensure that Payroll Check forms are filled out correctly and used effectively, contributing to a smoother payroll process.

Key takeaways

Filling out and using the Payroll Check form is crucial for ensuring employees are paid accurately and on time. Here are some key takeaways to keep in mind:

- Always double-check employee information. Ensure names, addresses, and Social Security numbers are correct to avoid payment delays.

- Fill in the pay period dates accurately. This helps in tracking hours worked and ensuring compliance with labor laws.

- Calculate gross pay carefully. This includes regular hours, overtime, and any bonuses or commissions. Mistakes here can lead to significant issues.

- Deduct the correct taxes and withholdings. Familiarize yourself with current tax rates to ensure compliance and prevent underpayment or overpayment.

- Keep a copy of the completed Payroll Check form. This serves as a record for both the employer and the employee, providing transparency and accountability.

File Information

| Fact Name | Description |

|---|---|

| Purpose | The Payroll Check form is used to distribute employee wages and salaries accurately and legally. |

| Components | Typically includes employee name, address, Social Security number, pay period, and total earnings. |

| Frequency | Payroll checks can be issued weekly, bi-weekly, or monthly, depending on company policy. |

| State-Specific Forms | Some states require specific payroll forms that comply with local laws, such as California's Labor Code Section 226. |

| Tax Deductions | Payroll checks must account for federal, state, and local tax deductions, including Social Security and Medicare. |

| Record Keeping | Employers are required to keep payroll records for a minimum of three years, as mandated by the Fair Labor Standards Act. |

| Direct Deposit | Many employers offer direct deposit as an option for payroll checks, providing convenience for employees. |

| Employee Rights | Employees have the right to receive clear information about their pay, including deductions and overtime calculations. |

| Compliance | Employers must ensure compliance with both federal and state labor laws when issuing payroll checks. |