Fill Your P 45 It Form

Different PDF Templates

Voided Check Citibank - The Citibank Direct Deposit form allows for both one-time and recurring deposits.

The California Bill of Sale form serves as a legal document that records the transfer of ownership of personal property from one individual to another. This form is crucial for providing evidence of the transaction and outlining the details of the sale, such as the buyer, seller, and item description. To ensure your transaction is documented properly, consider filling out the form by clicking the button below or visiting Fill PDF Forms.

Dl 933 Form California Dmv - Remember: submitting false information on the DL 44 can lead to serious legal consequences.

Similar forms

The P45 form has several similarities with the W-2 form, which is used in the United States. Both documents serve as official records of an employee's earnings and tax withholdings for a specific period. The W-2 is issued by employers at the end of the tax year and summarizes the employee's total wages and the amount of federal, state, and other taxes withheld. Like the P45, the W-2 is essential for employees when filing their annual tax returns, ensuring that they report accurate income and tax information to the IRS.

When considering various employment-related documents, it's essential to also understand legal forms like the Durable Power of Attorney, which designates someone to make decisions on your behalf in case of incapacitation. This document plays a vital role in ensuring that your wishes regarding financial and medical matters are respected. For those in Arizona looking for guidance, you can find a valuable resource at https://arizonapdfs.com/durable-power-of-attorney-template.

Another document comparable to the P45 is the 1099 form, specifically the 1099-MISC or 1099-NEC. This form is typically used for independent contractors or freelancers who are not classified as employees. Similar to the P45, the 1099 form reports income earned during the tax year, along with any taxes withheld. Both forms help the recipient understand their income status and tax obligations, although the 1099 is used in a different employment context.

The Pay Stub is another document that shares characteristics with the P45. Pay stubs provide a breakdown of an employee's earnings for each pay period, including gross pay, deductions, and net pay. While the P45 summarizes income and tax information for the entire employment period, pay stubs offer a more granular view of earnings and deductions for each paycheck. Both documents are vital for tracking income and ensuring accurate tax reporting.

The IRS Form 1040 is also relevant when discussing documents similar to the P45. This form is used for individual income tax returns in the U.S. and requires information about total income, deductions, and credits. Like the P45, the 1040 helps individuals report their earnings and determine their tax liabilities. While the P45 is issued by employers, the 1040 is completed by individuals, making them complementary in the tax filing process.

Another similar document is the Social Security Statement, which details an individual’s earnings history and estimates future benefits. While the P45 focuses on tax information related to employment, the Social Security Statement provides insights into contributions made towards social security benefits. Both documents are crucial for understanding an individual’s financial and tax standing over time.

Lastly, the Employment Verification Letter can be compared to the P45. This letter is often used when an employee applies for loans or rental agreements to verify their employment status and income. Like the P45, it provides important information about the employee’s earnings and employment history, although it is not a tax document. Both serve to establish credibility and financial stability in various professional and personal contexts.

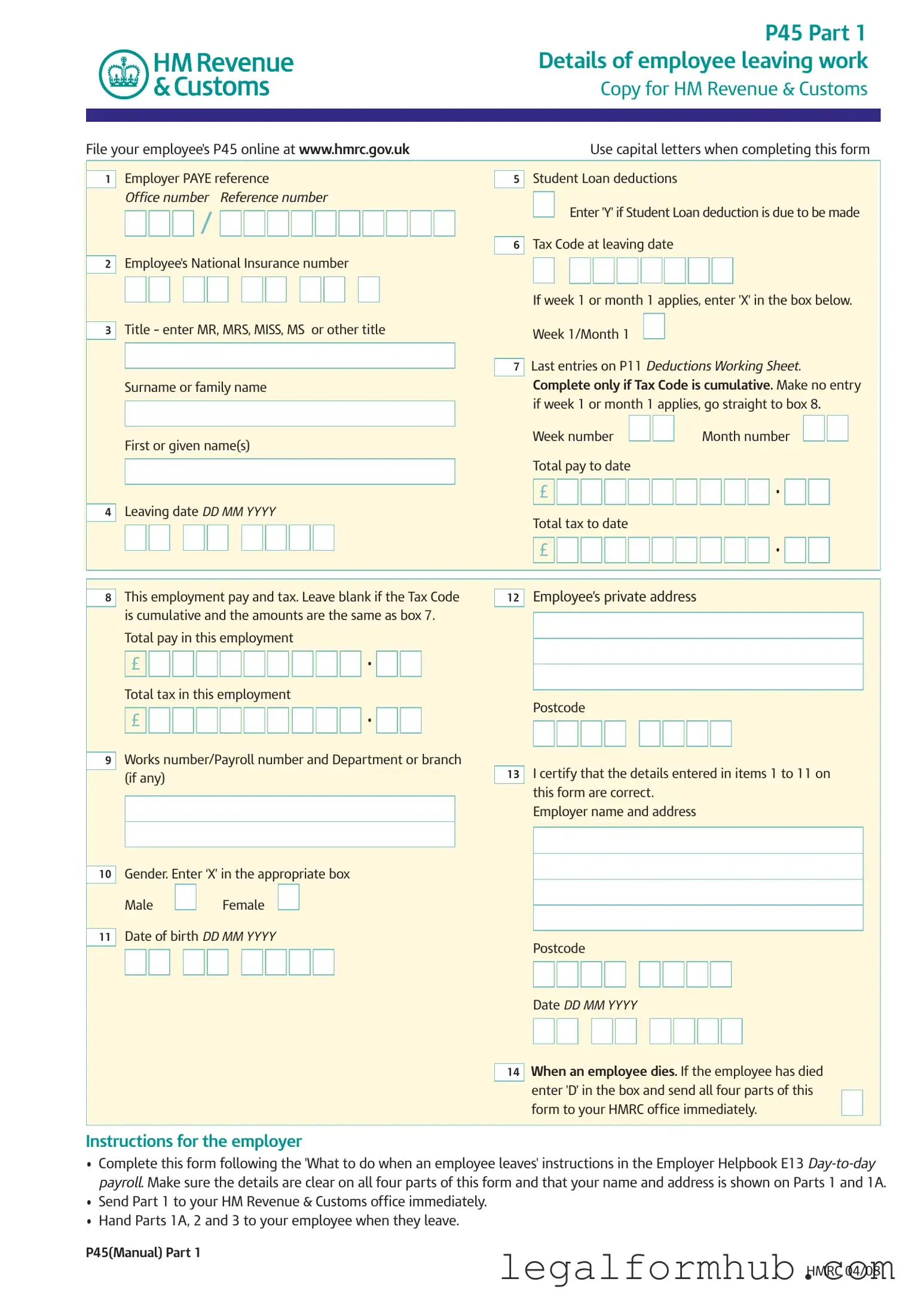

Instructions on Writing P 45 It

Filling out the P45 form is a straightforward process. This form is essential for both employers and employees when someone leaves a job. After completing the P45, ensure that all parts are distributed correctly. This will help the employee transition smoothly to their next employment or claim benefits if needed.

- Use capital letters to fill out the form.

- In section 1, enter the Employer PAYE reference, Office number, and Reference number.

- Provide the employee's National Insurance number.

- Indicate the Title of the employee (MR, MRS, MISS, MS, etc.).

- Fill in the employee's Surname or family name and First or given name(s).

- Enter the Leaving date in the format DD MM YYYY.

- Complete the Total pay to date and Total tax to date fields.

- For Student Loan deductions, enter 'Y' if applicable.

- If the employee's tax code is cumulative, complete the relevant fields; otherwise, leave them blank.

- Fill in the employee’s private address and Postcode.

- Indicate the employee's Gender by marking 'X' in the appropriate box.

- Provide the employee's Date of birth in the format DD MM YYYY.

- Sign and date the form to certify that the details are correct.

- Send Part 1 to HM Revenue & Customs immediately.

- Hand Parts 1A, 2, and 3 to the employee upon their departure.

Misconceptions

Here are seven misconceptions about the P45 form, along with clarifications for each:

- The P45 is only for employees who leave their job voluntarily. This is not true. The P45 is also required when an employee is dismissed or when they pass away.

- Only the employer needs to fill out the P45. This is incorrect. Both the employer and the employee have responsibilities for completing different parts of the form.

- The P45 is not needed if the employee starts a new job immediately. This is a misconception. The new employer requires the P45 to ensure correct tax deductions.

- Once the P45 is issued, the employee cannot claim tax refunds. This is false. Employees can still claim tax refunds even after receiving a P45.

- It is acceptable to lose the P45 and request a new one. This is misleading. Copies of the P45 are not available, so it is crucial to keep it safe.

- The P45 is only relevant for tax purposes. This is not accurate. The P45 is also important for benefits claims, such as Jobseeker's Allowance.

- Filling out the P45 is optional. This is incorrect. Completing the P45 is a legal requirement for employers when an employee leaves.

Key takeaways

Understanding the P45 form is essential for both employers and employees when transitioning from one job to another. Here are some key takeaways:

- Complete Details Accurately: Ensure all employee information, including National Insurance number and tax code, is filled out correctly. This helps avoid tax issues later.

- Use Capital Letters: When filling out the form, always use capital letters. This ensures clarity and legibility.

- Submit Promptly: Employers should send Part 1 of the P45 to HM Revenue & Customs (HMRC) immediately after an employee leaves. Timely submission is crucial.

- Keep Parts Safe: Employees must retain Parts 1A, 2, and 3 of the P45. These parts are important for tax returns and future employment.

- Handle Student Loans Carefully: If applicable, indicate student loan deductions accurately. This ensures the correct amount is deducted from future paychecks.

- Notify Changes: If an employee's circumstances change, such as starting a new job or going abroad, they should inform HMRC to avoid overpaying taxes.

By following these guidelines, both employers and employees can navigate the P45 process smoothly.

File Information

| Fact Name | Description |

|---|---|

| Purpose | The P45 form is used to provide details about an employee's tax and pay when they leave a job. |

| Parts of the Form | The P45 consists of three parts: Part 1 for HM Revenue & Customs, Part 1A for the employee, and Parts 2 and 3 for the new employer. |

| Employee Information | Essential employee details include their National Insurance number, leaving date, and total pay and tax to date. |

| Student Loan Deductions | The form allows for the indication of whether student loan deductions are applicable at the time of leaving. |

| Tax Code | Employees must provide their tax code at the time of leaving, which affects how much tax they owe. |

| Employer Responsibilities | Employers must complete the form accurately and send Part 1 to HM Revenue & Customs immediately after an employee leaves. |

| Important Notes for Employees | Employees should keep Part 1A safe, as it may be needed for future tax returns or when starting a new job. |