Printable Owner Financing Contract Document

Common Owner Financing Contract Documents:

Real Estate Contract Termination Letter - Signals the end of negotiations, allowing all to move forward.

Before finalizing a property transaction, it is essential to familiarize oneself with the Colorado Real Estate Purchase Agreement form, which can be accessed at coloradoforms.com/printable-real-estate-purchase-agreement. This important legal document not only specifies the terms and conditions of the deal but also serves to protect the interests of both the buyer and the seller throughout the process.

Purchase Agreement Addendum - A Purchase Agreement Addendum can address issues like repairs or additional inclusions.

Similar forms

The Owner Financing Contract is similar to a Mortgage Agreement. In both documents, the buyer borrows money from the seller to purchase a property. The Mortgage Agreement typically involves a lender and includes terms for repayment, interest rates, and consequences for default. In contrast, the Owner Financing Contract allows the seller to directly finance the purchase, often making it easier for buyers who may not qualify for traditional loans.

Another document that shares similarities is the Lease Purchase Agreement. This agreement allows a tenant to rent a property with the option to buy it later. Like the Owner Financing Contract, it provides a pathway to homeownership without requiring immediate full payment. Both documents outline the terms of payment and the responsibilities of each party, making them appealing to buyers who need time to secure financing.

A Land Contract, also known as a Contract for Deed, resembles the Owner Financing Contract in that it allows the buyer to make payments directly to the seller. In this arrangement, the seller retains the title until the buyer fulfills the payment obligations. This method can be beneficial for buyers who may struggle to obtain conventional financing, as it simplifies the transaction process.

The Promissory Note is another related document. While the Owner Financing Contract outlines the terms of the sale and financing, the Promissory Note serves as a promise from the buyer to repay the loan. It details the amount borrowed, the interest rate, and the repayment schedule. Together, these documents create a clear framework for both parties regarding the financial aspects of the transaction.

A Purchase Agreement is also similar, as it outlines the terms and conditions of a property sale. While the Owner Financing Contract specifically addresses how the buyer will finance the purchase, the Purchase Agreement covers the overall sale, including price, contingencies, and closing details. Both documents are essential in ensuring that the transaction proceeds smoothly and that both parties understand their obligations.

The Owner Financing Contract shares similarities with a Purchase Agreement, which is a foundational document in real estate transactions. Both documents outline the terms under which a sale occurs, detailing the purchase price, contingencies, and obligations of each party. However, while the Purchase Agreement is typically used when a buyer is securing traditional financing, the Owner Financing Contract specifically addresses scenarios where the owner provides the financing, allowing buyers to pay the seller directly over time. For more information on the legal documents used in these transactions, visit Fill PDF Forms.

The Seller Financing Addendum is closely related as well. This document can be attached to a standard Purchase Agreement to specify that the seller will finance part of the purchase price. It clarifies the terms of the financing arrangement, including payment amounts and timelines, similar to what is outlined in the Owner Financing Contract.

A Short Sale Agreement shares some common ground, particularly when a homeowner sells their property for less than what is owed on the mortgage. In situations where owner financing is involved, the seller may agree to finance the difference. Both documents require careful negotiation and understanding of the financial implications for all parties involved.

The Assignment of Contract is another document that can be relevant. It allows one party to transfer their rights and obligations under a contract to another party. If a buyer in an Owner Financing Contract wishes to assign their rights to a third party, this document would be necessary. It ensures that all parties are aware of the changes and that the financing terms remain intact.

Finally, a Real Estate Purchase Agreement is similar in that it formalizes the sale of property. While the Owner Financing Contract focuses on the financing aspect, the Real Estate Purchase Agreement includes all terms of the sale, such as the purchase price and closing date. Both documents are crucial in ensuring that the transaction is legally binding and that the interests of both the buyer and seller are protected.

Instructions on Writing Owner Financing Contract

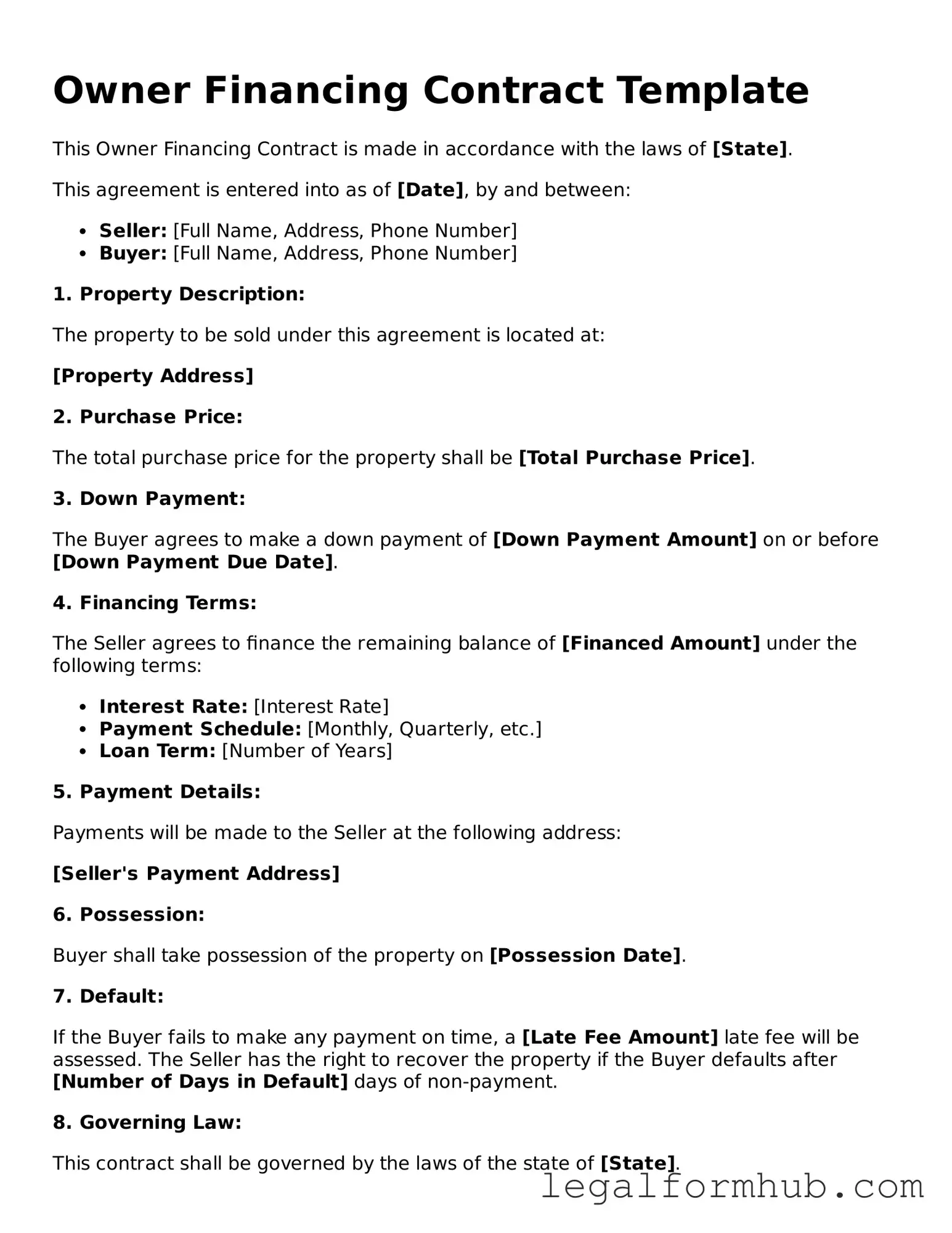

Completing the Owner Financing Contract form requires careful attention to detail. This form outlines the terms of the financing agreement between the seller and the buyer. Follow these steps to ensure accurate completion.

- Begin by entering the date at the top of the form.

- Fill in the names and addresses of both the seller and the buyer. Ensure all spelling is correct.

- Specify the property address being financed. Include the full address, including city, state, and zip code.

- Detail the purchase price of the property. Clearly state the total amount agreed upon by both parties.

- Indicate the down payment amount. This should be a percentage or a fixed dollar amount of the purchase price.

- Outline the financing terms. Include the interest rate, loan term, and payment schedule.

- Include any additional terms or conditions that apply to the financing agreement.

- Both parties should review the completed form for accuracy.

- Sign and date the form where indicated. Ensure both the seller and buyer have signed it.

- Make copies of the signed contract for both parties’ records.

Misconceptions

- Owner financing is only for buyers with poor credit. Many people believe that owner financing is a last resort for those who cannot secure traditional financing. In reality, it can be a viable option for buyers with good credit who prefer more flexible terms.

- All owner financing agreements are the same. This is a misconception. Each owner financing contract can vary significantly based on the agreement between the buyer and seller. Terms such as interest rates, payment schedules, and length of the contract can differ widely.

- Owner financing eliminates the need for a real estate agent. While some buyers and sellers choose to bypass agents, having a real estate professional can help navigate the complexities of owner financing and ensure that all legalities are properly handled.

- Owner financing is risky for the seller. Although there are risks involved, sellers can mitigate these by conducting thorough background checks on potential buyers and setting clear terms in the contract. Properly structured agreements can provide security for sellers.

- Buyers have no legal protections in owner financing. This is not true. Buyers have rights under the contract, and many states have laws that protect them in owner financing arrangements. Understanding these rights is crucial.

- Owner financing is only available for residential properties. While it is common in residential real estate, owner financing can also be utilized in commercial transactions. This option can be appealing for various types of properties.

- Once an owner financing contract is signed, it cannot be changed. Contracts can often be amended if both parties agree to the changes. Flexibility exists, and discussions about modifications can lead to a more satisfactory arrangement for both sides.

- Owner financing is a complicated process. While it may seem daunting, many resources are available to help both buyers and sellers understand the process. With the right information and guidance, it can be a straightforward transaction.

Key takeaways

When considering owner financing, it's essential to understand how to properly fill out and utilize the Owner Financing Contract form. Here are some key takeaways to keep in mind:

- Clear Identification: Ensure that all parties involved, including the buyer and seller, are clearly identified with their full names and contact information.

- Property Description: Provide a detailed description of the property being financed, including its address, legal description, and any relevant features.

- Financing Terms: Clearly outline the financing terms, including the purchase price, down payment, interest rate, and payment schedule. This information is crucial for both parties to understand their obligations.

- Default Clauses: Include provisions that address what happens in the event of a default. This can help protect the seller's interests and clarify the buyer's responsibilities.

- Legal Compliance: Ensure that the contract complies with local and state laws. This might involve reviewing regulations that govern owner financing in your area.

- Signatures Required: Both parties must sign the contract to make it legally binding. Ensure that all necessary signatures are obtained before proceeding.

- Consult Professionals: Consider consulting with a real estate attorney or a financial advisor. Their expertise can help you navigate the complexities of owner financing and ensure that the contract is properly executed.

File Overview

| Fact Name | Description |

|---|---|

| Definition | An Owner Financing Contract allows a seller to finance the purchase of their property directly to the buyer, bypassing traditional mortgage lenders. |

| Governing Law | Owner financing agreements are subject to state laws, which can vary significantly. For example, in California, the California Civil Code governs these contracts. |

| Down Payment | Typically, the buyer is required to make a down payment, which can vary based on the agreement between the buyer and seller. |

| Interest Rates | Interest rates in owner financing contracts can be negotiated and may differ from conventional mortgage rates. |

| Default Consequences | If the buyer defaults on the contract, the seller may have the right to foreclose on the property, similar to traditional mortgages. |

| Benefits | Owner financing can provide benefits such as quicker closings, less stringent qualification requirements, and potential tax advantages for sellers. |