Printable Operating Agreement Document

More Forms:

Furniture Bill of Sale - Acts as a receipt for the buyer as proof of their purchase.

For those looking to ensure their legal protection, the "crucial Release of Liability" form offers essential coverage against unforeseen risks during activities. It allows participants to acknowledge potential hazards and safeguard against liability claims. To access the form, you can fill it out by visiting the link here.

Bill of Sale Template for Motorcycle - Includes space for both parties' signatures to validate the agreement.

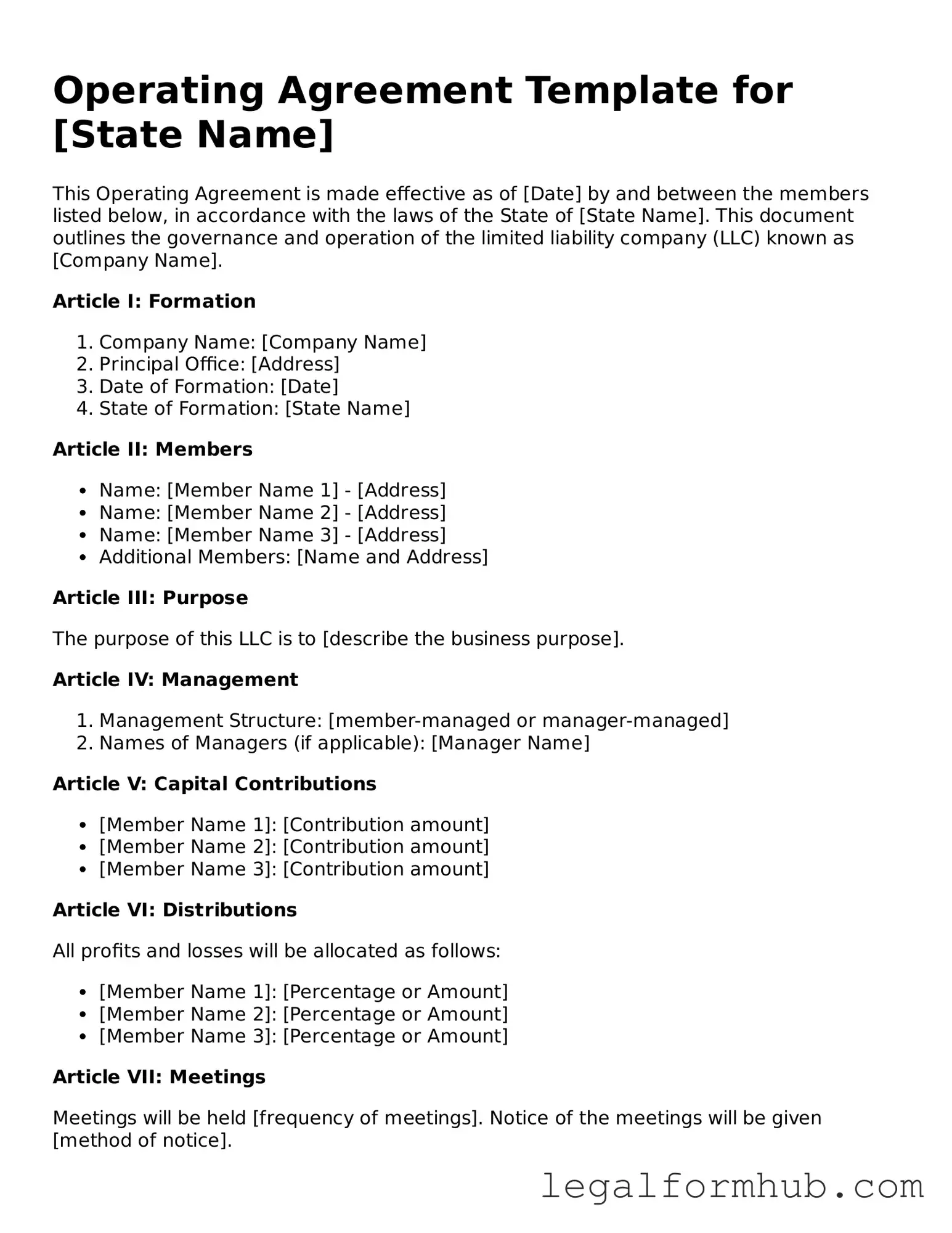

Operating Agreement - Tailored for Each State

Operating Agreement Form Subtypes

Similar forms

The Operating Agreement is often compared to a Partnership Agreement, which outlines the terms and conditions under which partners operate a business together. Both documents serve to clarify the roles, responsibilities, and financial arrangements among the parties involved. While a Partnership Agreement is specific to partnerships, the Operating Agreement serves a similar purpose for limited liability companies (LLCs). Each document helps ensure that all parties are on the same page, reducing the potential for disputes down the line.

Another document similar to the Operating Agreement is the Bylaws of a corporation. Bylaws govern the internal management of a corporation, detailing how decisions are made, how meetings are conducted, and the roles of officers and directors. Just like an Operating Agreement for an LLC, Bylaws help to establish a clear framework for operation and governance, ensuring that all members understand their rights and responsibilities within the corporate structure.

A Shareholder Agreement is also akin to an Operating Agreement, particularly in how it defines the relationship among shareholders in a corporation. This document outlines the rights and obligations of shareholders, including how shares can be bought or sold, and what happens in the event of a shareholder’s departure. Much like an Operating Agreement, a Shareholder Agreement aims to prevent misunderstandings and conflicts among stakeholders by establishing clear guidelines for ownership and management.

The Joint Venture Agreement shares similarities with the Operating Agreement in that it governs the terms of collaboration between two or more parties for a specific project or business endeavor. This document outlines each party's contributions, responsibilities, and profit-sharing arrangements. Just as an Operating Agreement delineates the workings of an LLC, a Joint Venture Agreement provides a structured approach to ensure that all parties understand their roles and the expectations for the venture.

A comprehensive understanding of various legal agreements can greatly enhance the efficiency of business operations. For those looking to manage their invoicing needs with ease, the Fill PDF Forms can be an invaluable resource. By utilizing such tools, businesses can streamline their transactions, ensuring clear communication and proper record-keeping is maintained.

A Non-Disclosure Agreement (NDA) can also be likened to an Operating Agreement in terms of its protective nature. While an Operating Agreement focuses on the operational aspects of a business, an NDA safeguards sensitive information shared between parties. Both documents are essential in establishing trust and confidentiality, ensuring that proprietary information is protected while the business operates smoothly.

Lastly, the Employment Agreement is another document that bears resemblance to the Operating Agreement, as it outlines the relationship between an employer and an employee. This agreement specifies job responsibilities, compensation, and the terms of employment. Similar to how an Operating Agreement clarifies the roles within an LLC, an Employment Agreement ensures that both parties understand their commitments and expectations, fostering a productive work environment.

Instructions on Writing Operating Agreement

Filling out the Operating Agreement form is an important step in establishing the framework for your business. This document outlines how your business will operate and sets expectations among the members. Here’s how to complete the form effectively.

- Start by entering the name of your business at the top of the form. Make sure it matches the name registered with your state.

- Next, list all members involved in the business. Include their full names and addresses.

- Specify the purpose of your business. Clearly describe what your business will do.

- Indicate the management structure. Will it be member-managed or manager-managed? Choose one and provide details as needed.

- Outline the voting rights of each member. Specify how decisions will be made and what percentage of votes is needed for approval.

- Detail the capital contributions of each member. List how much each member is investing in the business.

- Include provisions for profit and loss distribution. Explain how profits and losses will be shared among members.

- Address how new members can join the business. Outline the process for adding new members in the future.

- Finally, have all members sign and date the document. This makes the agreement official.

Once you have completed the form, review it carefully to ensure all information is accurate. It’s a good idea to keep a copy for your records. This document will serve as a guide for your business operations and member relationships.

Misconceptions

Operating agreements are vital documents for limited liability companies (LLCs), yet many misconceptions surround them. Understanding these misunderstandings can help business owners navigate their responsibilities more effectively.

- Misconception 1: An operating agreement is not necessary if the LLC has only one member.

- Misconception 2: An operating agreement is the same as the articles of organization.

- Misconception 3: Operating agreements are only for large businesses.

- Misconception 4: Once created, an operating agreement cannot be changed.

- Misconception 5: All members must sign the operating agreement for it to be valid.

- Misconception 6: An operating agreement is only needed when starting a business.

- Misconception 7: Operating agreements are only for multi-member LLCs.

While single-member LLCs may not be legally required to have an operating agreement, it is still highly recommended. This document outlines the owner's rights and responsibilities, helping to establish clear boundaries and protect personal assets.

The articles of organization are filed with the state to officially form the LLC. In contrast, the operating agreement is an internal document that governs the LLC's operations. Each serves a different purpose and is essential in its own right.

Every LLC, regardless of size, can benefit from an operating agreement. This document helps clarify roles, decision-making processes, and profit distribution, which is crucial for both small and large businesses alike.

Operating agreements can be amended as the business evolves. Members can modify the agreement to reflect changes in management, ownership, or operational procedures, ensuring that it remains relevant and effective.

While it is best practice for all members to sign, an operating agreement can still be valid even if not all members have formally signed it. However, having all members' signatures provides clarity and reduces potential disputes.

Although it is wise to create an operating agreement at the outset, it should be reviewed and updated regularly. As the business grows or changes, so too should the agreement to ensure it reflects the current state of the LLC.

Even single-member LLCs can benefit from having an operating agreement. It serves to formalize the structure and operations of the business, providing clarity and legal protection for the owner.

Key takeaways

Filling out and using an Operating Agreement is crucial for any business entity, particularly limited liability companies (LLCs). Here are key takeaways to consider:

- Define Your Business Structure: Clearly outline the structure of your LLC, including member roles and responsibilities.

- Establish Ownership Percentages: Specify each member's ownership interest in the company to avoid future disputes.

- Outline Decision-Making Processes: Detail how decisions will be made, including voting rights and procedures.

- Include Profit and Loss Distribution: Clarify how profits and losses will be allocated among members.

- Address Member Changes: Provide guidelines for adding or removing members, including buyout procedures.

- Set Management Guidelines: Decide whether the LLC will be member-managed or manager-managed and outline the management structure.

- Include Dispute Resolution Mechanisms: Establish processes for resolving conflicts among members to minimize disruption.

- Ensure Compliance with State Laws: Verify that your Operating Agreement complies with the laws of the state where your LLC is formed.

- Review and Update Regularly: Revisit the agreement periodically to ensure it reflects any changes in the business or membership.

- Consult Legal Professionals: Seek advice from legal experts to ensure that the agreement meets all necessary legal requirements.

Utilizing an Operating Agreement effectively can safeguard your business interests and provide clarity for all members involved.

File Overview

| Fact Name | Description |

|---|---|

| Definition | An Operating Agreement outlines the management structure and operational procedures of a limited liability company (LLC). |

| Purpose | This document helps to clarify the roles of members, define profit distribution, and outline procedures for decision-making. |

| State-Specific Forms | Many states have specific requirements for Operating Agreements, which may vary in format and content. |

| Governing Law | The Operating Agreement is governed by the laws of the state in which the LLC is formed. |

| Flexibility | Members have the flexibility to customize the agreement to meet their unique business needs. |

| Legal Protection | Having a well-drafted Operating Agreement can protect members' personal assets from business liabilities. |

| Dispute Resolution | It often includes provisions for resolving disputes among members, which can prevent costly litigation. |

| Amendments | The agreement can typically be amended as the business evolves or as members' needs change. |

| Not Mandatory | While not required by all states, it is highly recommended to have an Operating Agreement for LLCs. |