Free Tractor Bill of Sale Template for Ohio

Create Other Popular Tractor Bill of Sale Forms for Different States

Does a Tractor Have a Title - Some states may require specific information to be on the Bill of Sale.

Completing the California Lease Agreement form accurately is crucial for both landlords and tenants to prevent misunderstandings and ensure compliance with rental laws. For those looking to simplify this process, resources like Fill PDF Forms can provide the necessary assistance in creating a well-structured lease agreement.

Do Tractors Need to Be Registered - Ensures both parties have a written account of the sale agreement.

Tractor Bill of Sale Word Template - Using a Tractor Bill of Sale protects both the buyer and seller during the transaction.

Similar forms

The Ohio Vehicle Bill of Sale is a document that serves a similar purpose as the Tractor Bill of Sale. It is used to transfer ownership of a vehicle from one party to another. Both documents include essential information such as the buyer's and seller's names, addresses, and signatures. Additionally, they provide details about the vehicle, including make, model, year, and Vehicle Identification Number (VIN). This ensures that both parties have a clear understanding of the transaction and protects them in case of disputes.

The Ohio Boat Bill of Sale is another document that parallels the Tractor Bill of Sale. This form is specifically designed for the sale of watercraft. Like the Tractor Bill of Sale, it captures vital information about the seller, buyer, and the boat being sold. Both documents require signatures from both parties, ensuring that the transfer of ownership is legally recognized. This helps to prevent any future claims regarding ownership or disputes over the sale.

The Ohio Motorcycle Bill of Sale is similar in function to the Tractor Bill of Sale, as it facilitates the transfer of ownership of a motorcycle. Both documents outline the details of the transaction, including the motorcycle's specifications and the parties involved. They serve as proof of the sale and can be used to register the motorcycle with the state. This provides security for both the buyer and seller, confirming that the transaction was legitimate.

For those navigating the complexities of medical decisions, understanding the significance of appointing a trusted individual is crucial. A resourceful tool in this process is the Arizona Medical Power of Attorney form, which enables individuals to designate someone to make healthcare decisions on their behalf when they are unable to do so. This form not only grants authority to the appointed agent to communicate with healthcare providers but also ensures that the individual’s preferences in treatment are respected. To learn more about this critical document, you can visit arizonapdfs.com/medical-power-of-attorney-template/.

The Ohio Mobile Home Bill of Sale is another comparable document. This form is used for the sale of mobile homes and contains similar elements to the Tractor Bill of Sale. It includes information about the buyer and seller, as well as specific details regarding the mobile home. Both documents help establish a clear transfer of ownership and can be used in legal contexts to verify the transaction.

The Ohio RV Bill of Sale serves a similar purpose for recreational vehicles. It captures the necessary details of the sale, including the names of the buyer and seller, the RV's specifications, and the sale price. Just like the Tractor Bill of Sale, it provides a written record of the transaction, which can be crucial for registration and tax purposes. This document ensures that both parties are protected and have a clear understanding of the sale.

The Ohio Snowmobile Bill of Sale is also akin to the Tractor Bill of Sale. This document is specifically tailored for the sale of snowmobiles. It includes the same basic information about the buyer and seller, as well as details about the snowmobile itself. Both documents serve as evidence of the transaction and can be used to resolve any disputes that may arise in the future.

The Ohio ATV Bill of Sale is another document that mirrors the Tractor Bill of Sale. It is used for the transfer of ownership of all-terrain vehicles. Similar to the Tractor Bill of Sale, it outlines the necessary details of the transaction and requires signatures from both parties. This helps to ensure that the sale is legally binding and provides protection for both the buyer and seller.

Lastly, the Ohio General Bill of Sale can be considered similar to the Tractor Bill of Sale in that it serves as a catch-all document for the sale of various types of personal property. This document can be used for items beyond vehicles, such as equipment or furniture. It includes the names and signatures of both parties, along with a description of the item being sold. While it may not be as specialized as the Tractor Bill of Sale, it still provides a formal record of the transaction, which is essential for legal protection.

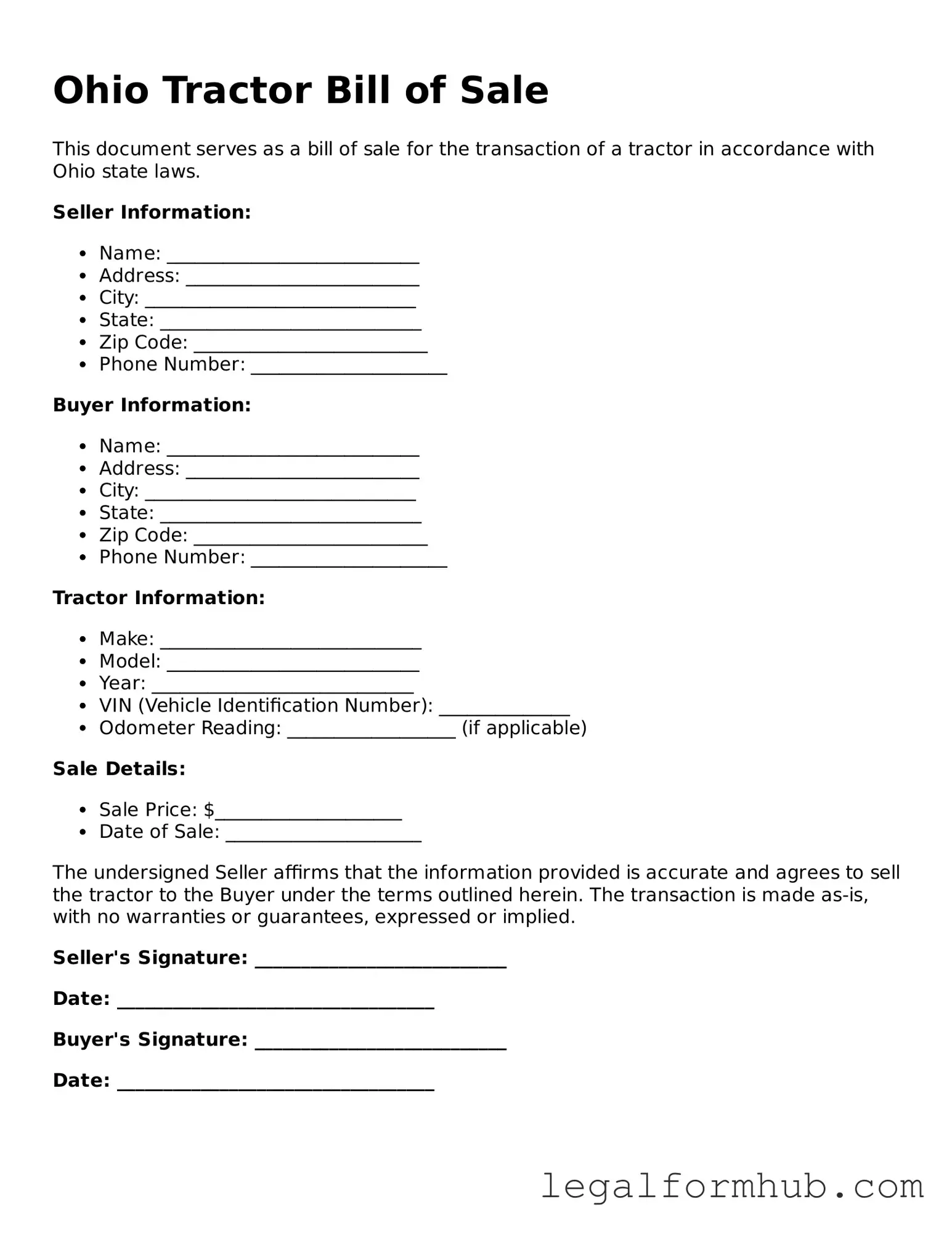

Instructions on Writing Ohio Tractor Bill of Sale

After obtaining the Ohio Tractor Bill of Sale form, you will need to provide specific information about the transaction. This includes details about the tractor, the buyer, and the seller. Follow these steps to complete the form accurately.

- Begin by entering the date of the sale at the top of the form.

- Provide the seller's name and address. Make sure to include both the street address and city.

- Next, fill in the buyer's name and address using the same format as the seller's information.

- In the section for the tractor details, include the make, model, and year of the tractor.

- Record the Vehicle Identification Number (VIN) or serial number of the tractor.

- Specify the purchase price of the tractor in both numeric and written form.

- Both the seller and buyer should sign and date the form at the designated areas.

Once you have filled out the form, make copies for both parties. This ensures that each person has a record of the transaction. Keep the original in a safe place for future reference.

Misconceptions

Understanding the Ohio Tractor Bill of Sale form can be tricky. Here are nine common misconceptions that people often have about it:

- It’s only for new tractors. Many believe this form is only necessary for new tractor sales. However, it is also used for used tractors, ensuring that all transactions are documented properly.

- Only dealers need a Bill of Sale. Some think that only dealerships require a Bill of Sale. In reality, private sellers and buyers also need this document to protect their interests.

- It’s not legally binding. Many assume that a Bill of Sale is just a formality. In fact, it is a legally binding document that can be used in court if disputes arise.

- It doesn’t need to be notarized. Some people believe notarization is optional. While not always required, having the document notarized can add an extra layer of security.

- All states use the same form. There’s a misconception that one form works for all states. Each state, including Ohio, has its own specific requirements and forms.

- It’s only for the sale of tractors. People often think this form is exclusive to tractors. However, it can also be used for other agricultural equipment.

- Only the seller needs to sign it. Many believe that only the seller's signature is necessary. In fact, both the buyer and seller should sign to validate the transaction.

- It’s not important for tax purposes. Some think that the Bill of Sale has no tax implications. However, it can be important for reporting sales tax and proving ownership.

- It can be verbal. Lastly, some believe a verbal agreement suffices. A written Bill of Sale is crucial for clarity and legal protection.

By clearing up these misconceptions, you can navigate the process of buying or selling a tractor in Ohio more confidently.

Key takeaways

When filling out and using the Ohio Tractor Bill of Sale form, it is important to keep several key points in mind. Here are some essential takeaways:

- Complete Information: Ensure all required fields are filled out completely. This includes the names and addresses of both the buyer and seller.

- Accurate Description: Provide a detailed description of the tractor, including make, model, year, and Vehicle Identification Number (VIN).

- Purchase Price: Clearly state the purchase price of the tractor. This is important for both parties and for tax purposes.

- Signatures Required: Both the buyer and seller must sign the form. This validates the sale and protects both parties.

- Date of Sale: Include the date of the transaction. This helps establish when the sale occurred.

- As-Is Condition: If the tractor is sold "as-is," make sure to note this on the form. This means the buyer accepts the tractor in its current condition.

- Record Keeping: Keep a copy of the completed bill of sale for your records. This can be useful for future reference.

- Local Regulations: Check with local authorities for any additional requirements related to tractor sales in your area.

- Tax Implications: Be aware of any tax implications associated with the sale. Both parties may need to report the sale to the IRS.

Following these guidelines will help ensure a smooth transaction. Take your time to fill out the form accurately, and do not hesitate to ask questions if you need clarification on any point.

File Overview

| Fact Name | Description |

|---|---|

| Purpose | The Ohio Tractor Bill of Sale form is used to document the sale and transfer of ownership of a tractor in Ohio. |

| Governing Law | The sale of tractors in Ohio is governed by the Ohio Revised Code, specifically Section 4505.04, which outlines requirements for vehicle titles. |

| Parties Involved | The form requires information from both the seller and the buyer, including names and addresses. |

| Vehicle Information | Details about the tractor, such as make, model, year, and Vehicle Identification Number (VIN), must be included. |

| Payment Details | The form should indicate the purchase price and any terms of payment agreed upon by both parties. |

| Signatures | Both the seller and the buyer must sign the form to validate the transaction and acknowledge the transfer of ownership. |