Free Promissory Note Template for Ohio

Create Other Popular Promissory Note Forms for Different States

Create Promissory Note - In the event of default, the Promissory Note can be used in court to enforce repayment.

Georgia Promissory Note - A promissory note is a written promise to pay a specific amount of money on demand or at a set time.

To assist you with the documentation, you can easily access the necessary resources by visiting Fill PDF Forms, which will guide you through creating the California Dog Bill of Sale form accurately.

Loan Agreement Template Texas - The borrower should keep a copy of the signed note for their records.

Similar forms

A loan agreement is a document that outlines the terms and conditions under which one party lends money to another. Like a promissory note, it specifies the amount borrowed, the interest rate, and the repayment schedule. However, a loan agreement often includes additional details, such as collateral, default terms, and the responsibilities of both parties. This makes it more comprehensive than a basic promissory note, which primarily focuses on the promise to repay the loan.

To understand the process of establishing a corporation effectively, it is essential to review the Missouri Articles of Incorporation form, which sets the foundation for your business structure and details its purpose. You can find valuable insights and detailed instructions on how to complete this necessary document in our comprehensive guide on the Articles of Incorporation.

A mortgage is another document that shares similarities with a promissory note. When a borrower takes out a mortgage to buy a home, they sign a promissory note promising to repay the loan. The mortgage document, however, secures the loan by placing a lien on the property. If the borrower defaults, the lender can foreclose on the home. Both documents are essential in real estate transactions, but the mortgage provides security for the lender beyond the borrower's promise.

A personal guarantee is a document that can accompany a promissory note, especially in business loans. It involves a third party agreeing to be responsible for the debt if the primary borrower fails to pay. While a promissory note outlines the repayment obligation, a personal guarantee adds another layer of security for the lender. This document can enhance the lender's confidence, as it provides a secondary source of repayment should the borrower default.

An installment agreement is similar to a promissory note in that it outlines the repayment terms for a loan. However, an installment agreement typically involves multiple payments over time, often with set intervals. While a promissory note can also include installment terms, an installment agreement usually emphasizes the payment schedule and may include penalties for late payments. Both documents serve to formalize the borrowing arrangement, but they differ in their focus on payment structure.

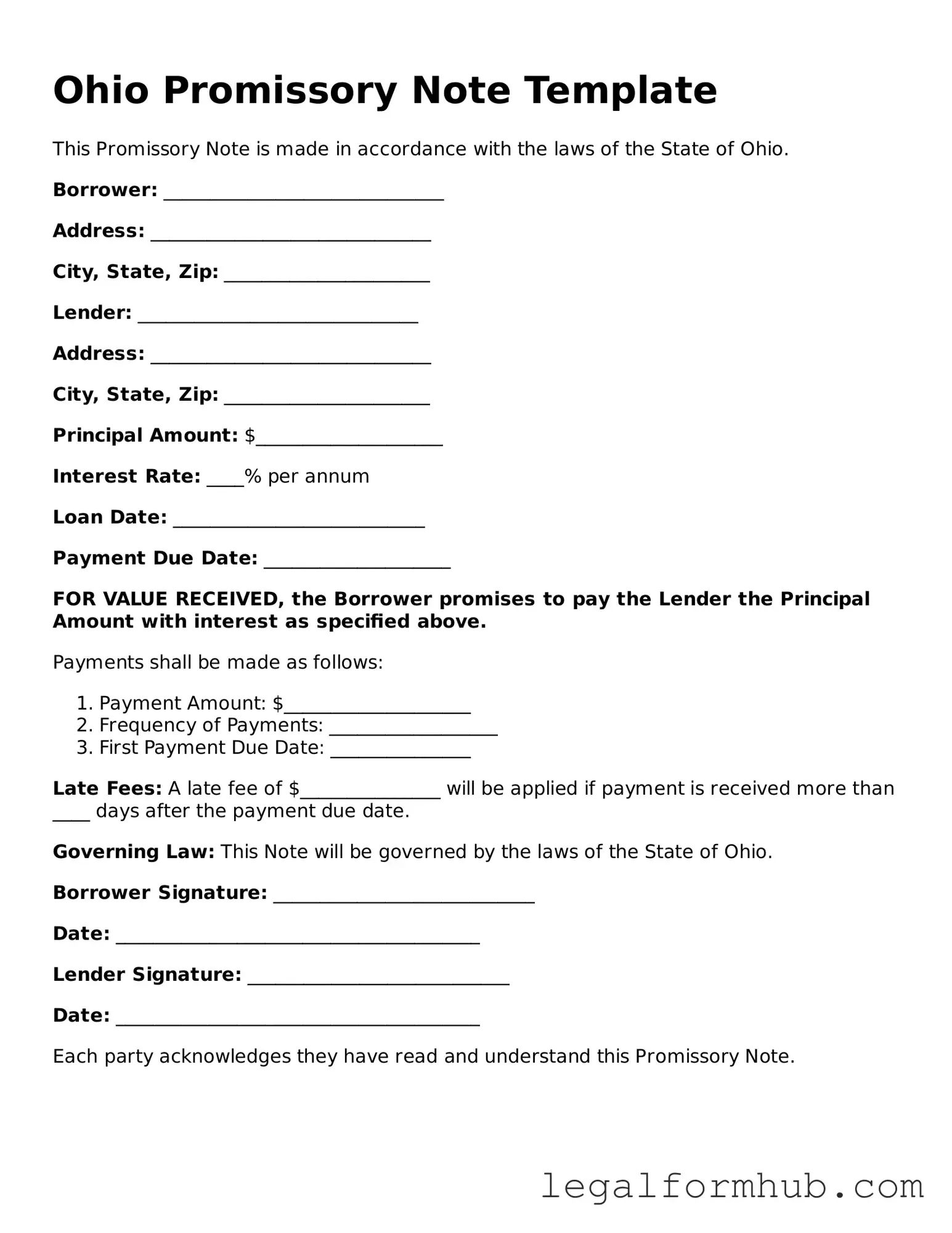

Instructions on Writing Ohio Promissory Note

After obtaining the Ohio Promissory Note form, you will need to complete it accurately to ensure its validity. Follow the steps below to fill out the form correctly.

- Start with the date. Write the date on which the note is being created at the top of the form.

- Next, identify the borrower. Write the full name and address of the person or entity borrowing the money.

- Now, provide the lender's information. Include the full name and address of the person or entity lending the money.

- Specify the loan amount. Clearly state the total amount being borrowed in both numerical and written form.

- Detail the interest rate. Indicate the interest rate that will apply to the loan, if any.

- Outline the repayment terms. Describe how and when the borrower will repay the loan. Include due dates and payment amounts.

- Include any late fees. If applicable, specify any fees that will be charged if payments are not made on time.

- Sign the document. Both the borrower and lender must sign the form to make it legally binding.

- Consider having the signatures notarized. While not always required, notarization can add an extra layer of validity to the document.

Misconceptions

Misconceptions about the Ohio Promissory Note form can lead to confusion and mismanagement of financial agreements. Here are six common misconceptions:

- All promissory notes must be notarized. Many believe that notarization is a requirement for all promissory notes. In Ohio, notarization is not mandatory for a promissory note to be valid, although it can provide additional legal protection.

- Promissory notes are only for large loans. Some think that promissory notes are only applicable for significant amounts of money. In reality, they can be used for any amount, regardless of size, as long as both parties agree to the terms.

- A promissory note must be written by a lawyer. There is a misconception that only a lawyer can draft a promissory note. While legal assistance can be helpful, individuals can create a valid promissory note on their own, provided it includes essential elements.

- Interest rates must be included in the note. Some assume that every promissory note must specify an interest rate. However, a promissory note can be interest-free if the parties agree to that term.

- Promissory notes are unenforceable in court. There is a belief that promissory notes lack enforceability. This is incorrect; a properly executed promissory note is a legally binding document and can be enforced in court.

- Once signed, a promissory note cannot be changed. Many think that modifications to a promissory note are impossible after signing. In fact, parties can amend the terms of a promissory note, but such changes should be documented in writing and signed by both parties.

Key takeaways

When dealing with financial agreements in Ohio, understanding the Promissory Note form is essential. Here are some key takeaways to consider:

- Purpose of the Note: A Promissory Note serves as a written promise to pay a specified amount of money to a lender or creditor.

- Parties Involved: The document should clearly identify the borrower and the lender, including their full names and addresses.

- Loan Amount: Specify the exact amount being borrowed. This clarity helps prevent disputes in the future.

- Interest Rate: If applicable, include the interest rate. This should be expressed as an annual percentage rate (APR).

- Payment Terms: Clearly outline the repayment schedule, including due dates and the number of installments.

- Default Conditions: Define what constitutes a default and the consequences that follow, such as late fees or acceleration of the loan.

- Signatures: Ensure that both parties sign and date the document. This step is crucial for the note to be legally binding.

By keeping these points in mind, individuals can navigate the process of using a Promissory Note in Ohio with greater confidence and clarity.

File Overview

| Fact Name | Description |

|---|---|

| Definition | An Ohio Promissory Note is a written promise to pay a specified amount of money to a designated party at a future date or on demand. |

| Governing Law | The Ohio Promissory Note is governed by the Ohio Revised Code, specifically sections 1303.01 to 1303.99. |

| Key Elements | Essential elements include the principal amount, interest rate, payment terms, and signatures of the involved parties. |

| Enforceability | For the note to be enforceable, it must be signed by the borrower and contain clear terms regarding repayment. |

| Usage | Commonly used in personal loans, business transactions, and real estate financing to formalize a loan agreement. |