Free Operating Agreement Template for Ohio

Create Other Popular Operating Agreement Forms for Different States

North Carolina Operating Agreement - It can also provide for the succession of ownership in case of a member’s death.

The process of obtaining an Emotional Support Animal Letter is essential for those who require the companionship of an emotional support animal to help manage their mental health, making it crucial for securing necessary accommodations and allowing access to places that may otherwise be restricted. For those interested in leveraging this support, resources such as pdftemplates.info/ provide a convenient way to begin the process.

State Filing Fee for Llc in Texas - This agreement can include terms for selling or transferring membership interests.

Similar forms

The Ohio Operating Agreement is similar to the Limited Liability Company (LLC) Agreement, which outlines the management structure and operational procedures of an LLC. Both documents serve to clarify the roles of members and managers, detailing how decisions are made and profits are distributed. Like the Operating Agreement, the LLC Agreement is essential for ensuring that all members are on the same page regarding the operation of the business, thereby minimizing potential conflicts.

Another comparable document is the Partnership Agreement. This agreement governs the relationship between partners in a business partnership. Similar to the Ohio Operating Agreement, it specifies each partner's contributions, responsibilities, and the distribution of profits and losses. Both documents aim to establish clear guidelines that help maintain a harmonious business environment.

The Corporate Bylaws document serves a similar purpose for corporations. It outlines the rules and procedures for corporate governance, including the roles of directors and officers. Like the Operating Agreement, Corporate Bylaws provide a framework for decision-making and operational guidelines, ensuring that all stakeholders understand their rights and obligations.

The Shareholders’ Agreement is another related document. This agreement is designed for corporations and outlines the rights and responsibilities of shareholders. It is similar to the Operating Agreement in that it sets forth the rules for how the company will be run and how decisions will be made, particularly concerning the sale or transfer of shares.

For those interested in completing a transaction, understanding the requirements for a boat transfer is crucial. You can find a detailed resource on the comprehensive Missouri Boat Bill of Sale form which provides guidance on the necessary documentation and procedures.

The Joint Venture Agreement is also akin to the Ohio Operating Agreement. This document outlines the terms of collaboration between two or more parties in a joint venture. It specifies each party's contributions, management structure, and profit-sharing arrangements, much like how an Operating Agreement does for an LLC.

A Franchise Agreement bears similarities as well. This document outlines the relationship between a franchisor and franchisee. It includes operational guidelines and responsibilities, akin to the way an Operating Agreement details the management and operational procedures for an LLC.

The Employment Agreement is another document that shares commonalities. While it focuses on the relationship between an employer and employee, it often includes terms related to job responsibilities, compensation, and dispute resolution. Like the Operating Agreement, it establishes expectations and obligations for all parties involved.

The Non-Disclosure Agreement (NDA) is also relevant. While its primary purpose is to protect confidential information, it can include clauses that define the operational aspects of a business relationship. Both documents aim to protect the interests of the parties involved, ensuring that sensitive information is handled appropriately.

The Operating Agreement is also similar to the Articles of Organization, which is a foundational document for forming an LLC. While the Articles of Organization primarily serve to establish the existence of the LLC with the state, the Operating Agreement details how that LLC will function on a day-to-day basis. Together, they provide a comprehensive understanding of the business structure.

Lastly, the Business Plan can be considered similar in that it outlines the strategy and operational plan for a business. While it is more focused on goals and projections, it often incorporates elements that are addressed in the Operating Agreement, such as management structure and financial arrangements. Both documents are essential for guiding the business's direction and ensuring all members are aligned in their objectives.

Instructions on Writing Ohio Operating Agreement

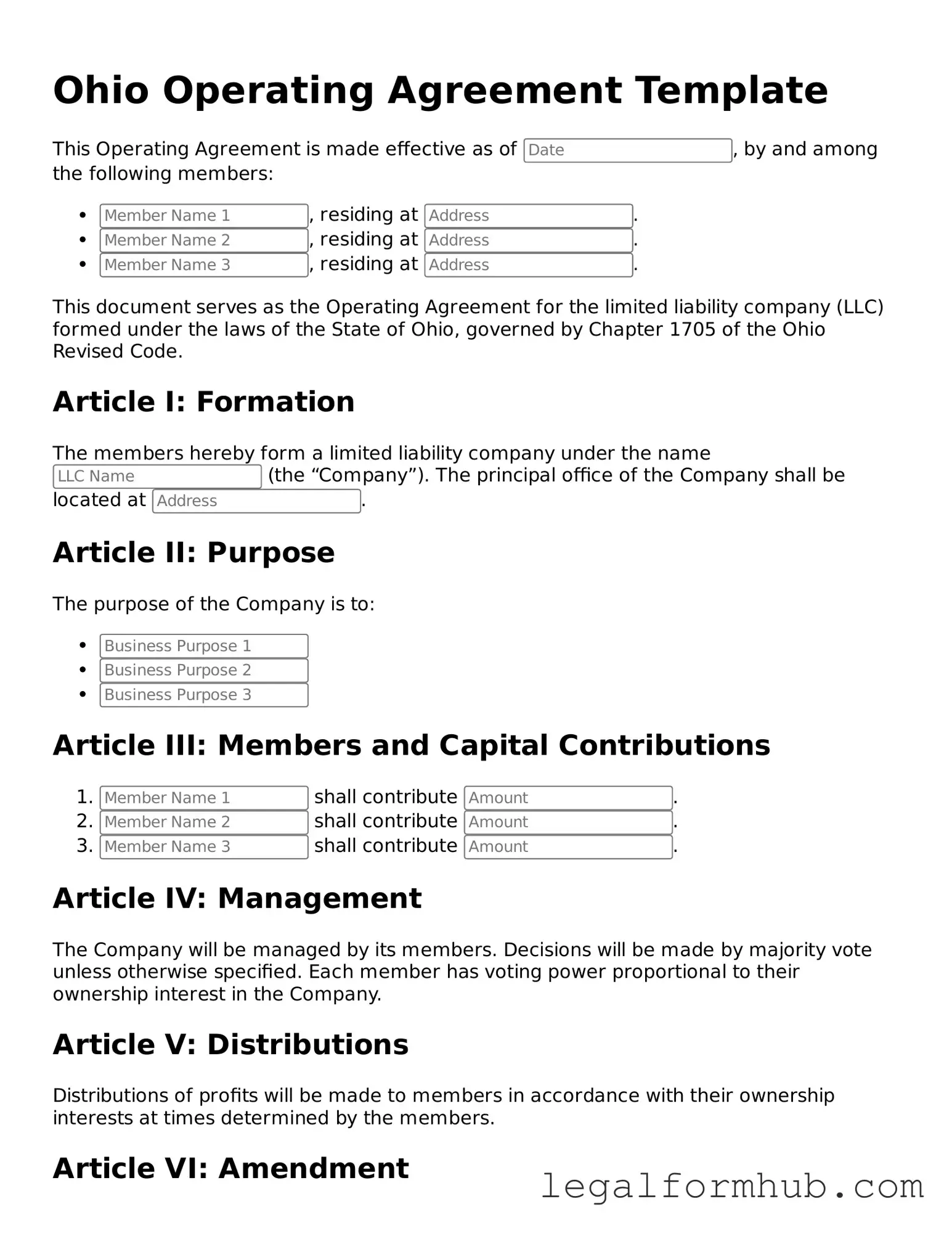

Completing the Ohio Operating Agreement form is an important step in formalizing the structure and operations of your business. After filling out the form, you will be able to establish clear guidelines for management, ownership, and the responsibilities of members within the organization.

- Begin by gathering the necessary information about your business, including the name, address, and purpose of the LLC.

- Identify all members of the LLC and their respective ownership percentages. Ensure you have their full names and contact information ready.

- Decide on the management structure of the LLC. Determine whether it will be member-managed or manager-managed.

- Outline the roles and responsibilities of each member or manager in the agreement.

- Include provisions for profit distribution among members. Specify how profits and losses will be shared.

- Detail the process for adding new members or transferring ownership interests in the future.

- Specify how decisions will be made within the LLC. Include voting rights and procedures for major decisions.

- Review the completed form for accuracy and completeness. Make any necessary corrections.

- Have all members sign the agreement to make it official. Consider having the document notarized for added legal validity.

- Store the signed agreement in a safe place, and provide copies to all members for their records.

Misconceptions

Understanding the Ohio Operating Agreement form is crucial for business owners, yet several misconceptions can lead to confusion. Here are six common misunderstandings:

-

It is not necessary for all LLCs.

Many believe that an Operating Agreement is optional for Limited Liability Companies (LLCs) in Ohio. However, having one is highly recommended, as it outlines the management structure and operational procedures, even if it is not legally required.

-

It must be filed with the state.

Some people think that the Operating Agreement needs to be submitted to the Ohio Secretary of State. In reality, this document is kept internally and does not require state filing, allowing flexibility in its terms.

-

All members must sign the agreement.

While it is best practice for all members to sign the Operating Agreement, it is not a legal requirement. A well-drafted agreement can still be enforceable even if not all members have signed it.

-

It can be a verbal agreement.

Some believe that a verbal agreement suffices. However, an Operating Agreement should be written to ensure clarity and provide a reference point in case of disputes.

-

It cannot be changed once created.

There is a misconception that an Operating Agreement is set in stone. In fact, it can be amended as needed, allowing members to adapt to changing circumstances or preferences.

-

It only addresses ownership percentages.

While ownership percentages are important, the Operating Agreement covers much more. It includes provisions for management, decision-making processes, and procedures for adding or removing members.

Clearing up these misconceptions can help ensure that your business operates smoothly and in accordance with your intentions.

Key takeaways

When filling out and utilizing the Ohio Operating Agreement form, consider these key takeaways:

- Understand the Purpose: The Operating Agreement outlines the management structure and operational procedures of your business. It serves as a foundational document for your LLC.

- Customize for Your Needs: Tailor the agreement to reflect the specific needs and goals of your business. This document is flexible and should accurately represent the members' intentions.

- Clarify Member Roles: Clearly define the roles and responsibilities of each member. This helps to prevent misunderstandings and ensures smooth operations.

- Include Financial Provisions: Detail how profits and losses will be distributed among members. This section is crucial for financial transparency and planning.

- Review Regularly: As your business evolves, revisit and update the Operating Agreement. Regular reviews ensure that the document remains relevant and effective.

File Overview

| Fact Name | Description |

|---|---|

| Purpose | The Ohio Operating Agreement outlines the management structure and operational procedures of a limited liability company (LLC). |

| Governing Law | This agreement is governed by the Ohio Revised Code, specifically Chapter 1705. |

| Member Roles | It defines the roles and responsibilities of members and managers within the LLC. |

| Profit Distribution | The agreement specifies how profits and losses will be distributed among members. |

| Amendments | It outlines the process for making amendments to the agreement, ensuring flexibility as the business evolves. |

| Dispute Resolution | The document may include provisions for resolving disputes among members, promoting harmony within the LLC. |

| Initial Capital Contributions | It details the initial capital contributions required from each member, establishing a financial foundation. |

| Duration | The agreement can specify the duration of the LLC, whether it is perpetual or for a defined term. |

| Compliance | Having an operating agreement helps ensure compliance with state laws and can protect members' personal assets. |