Free Last Will and Testament Template for Ohio

Create Other Popular Last Will and Testament Forms for Different States

Illinois Last Will and Testament - Can include alternate beneficiaries if primary ones cannot inherit.

The Arizona Notice to Quit form is a legal document that a landlord uses to inform a tenant that they must vacate the rental property. This notice outlines the reasons for eviction and provides a timeline for the tenant to leave. For more information and a template, you can visit arizonapdfs.com/notice-to-quit-template/. Understanding this form is essential for both landlords and tenants navigating the eviction process in Arizona.

Free Will Template California - Facilitates the transfer of real estate ownership without complications.

Similar forms

The Ohio Last Will and Testament form shares similarities with a Living Will. A Living Will is a legal document that outlines an individual's preferences regarding medical treatment in the event they become incapacitated. Both documents serve to express an individual's wishes; however, while a Last Will and Testament focuses on the distribution of assets after death, a Living Will addresses healthcare decisions during a person's lifetime. Each document is crucial for ensuring that a person's desires are honored, though they apply to different aspects of life and death.

For individuals in California looking to claim disability benefits, understanding the EDD DE 2501 form is essential. This form plays a critical role in providing the Employment Development Department (EDD) with pertinent information regarding medical conditions and work history to facilitate access to financial support during periods of disability. To ensure that your application is completed accurately and efficiently, you can use resources like Fill PDF Forms to guide you through the process of filling out this important document.

Another document akin to the Ohio Last Will and Testament is a Durable Power of Attorney. This legal instrument allows an individual to designate someone else to make financial or legal decisions on their behalf if they become unable to do so. Like a Last Will, it provides a mechanism for control over personal affairs, but it operates during the individual’s lifetime rather than after death. Both documents emphasize the importance of appointing trusted individuals to carry out one's wishes, albeit in different contexts.

The Ohio Last Will and Testament also bears resemblance to a Trust. A Trust is an arrangement where one party holds property for the benefit of another. While a Last Will distributes assets upon death, a Trust can manage assets during a person's lifetime and after their passing. Trusts can provide more privacy and may avoid probate, which is a process that a Last Will typically undergoes. Both documents are essential tools in estate planning, allowing individuals to direct how their assets will be handled.

Lastly, a Codicil is another document that relates closely to the Last Will and Testament. A Codicil is an amendment or addition to an existing will, allowing individuals to make changes without drafting an entirely new document. Like a Last Will, a Codicil must meet specific legal requirements to be valid. Both documents work together to ensure that an individual's final wishes are accurately reflected and can be updated as circumstances change, such as the birth of a child or changes in financial status.

Instructions on Writing Ohio Last Will and Testament

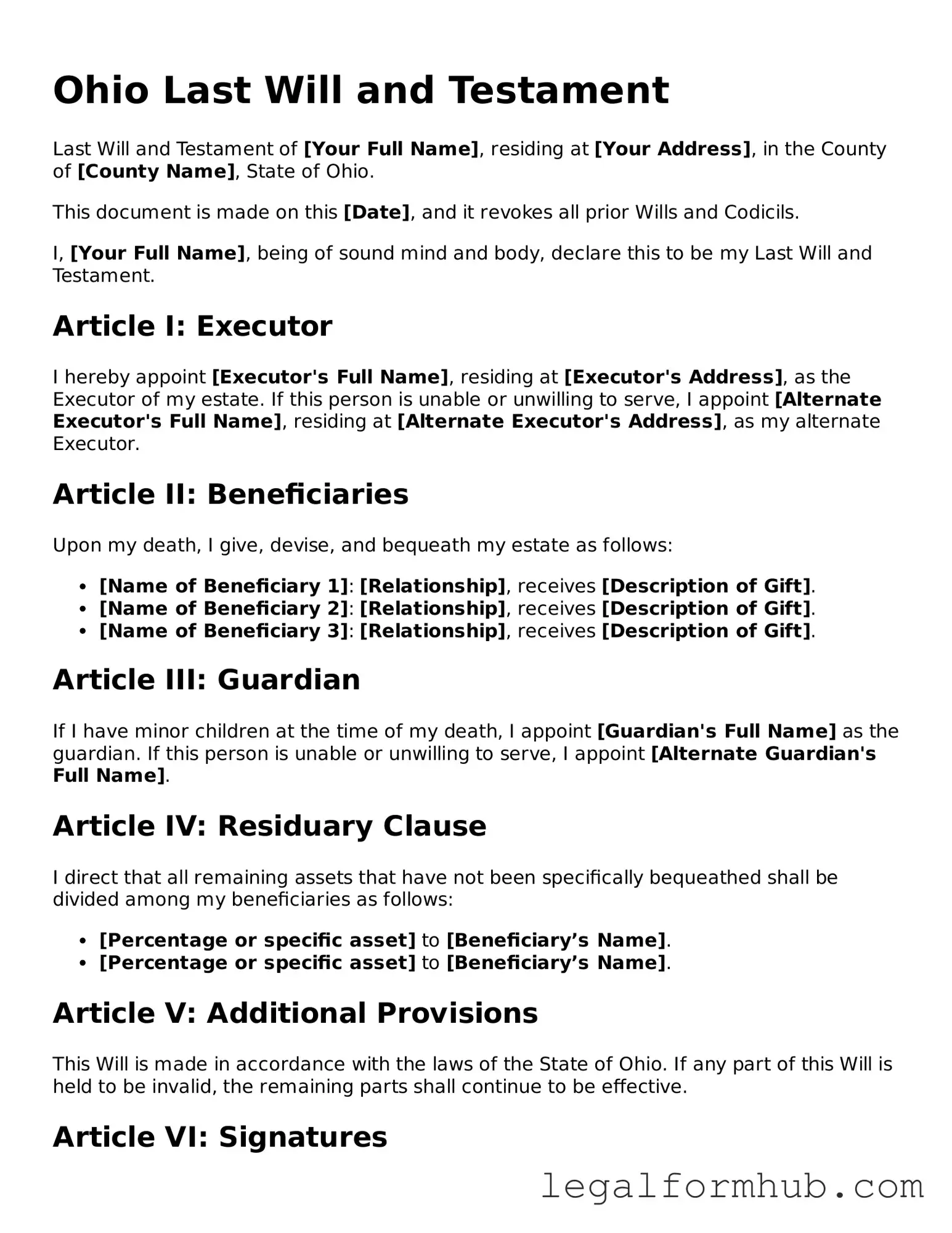

Completing the Ohio Last Will and Testament form is an important step in ensuring your wishes are respected after your passing. Once you have filled out the form, it will need to be signed and witnessed to be legally binding. Follow these steps carefully to ensure accuracy.

- Begin by entering your full name at the top of the form.

- Provide your address, including city, state, and zip code.

- Clearly state that this document is your Last Will and Testament.

- Identify any previous wills you may have created and declare that they are revoked.

- List your beneficiaries, including their names and relationships to you.

- Designate an executor who will carry out the terms of your will. Include their name and contact information.

- Specify how you would like your assets to be distributed among your beneficiaries.

- If you have minor children, appoint a guardian for them and provide the guardian's details.

- Review the entire document for any errors or omissions.

- Sign the form in the presence of at least two witnesses who are not beneficiaries.

- Have your witnesses sign the document, including their names and addresses.

After completing these steps, keep the signed document in a safe place. Inform your executor and trusted family members about its location to ensure your wishes can be followed. Proper storage and communication are essential for the effectiveness of your will.

Misconceptions

When it comes to creating a Last Will and Testament in Ohio, several misconceptions can lead to confusion. Here are seven common misunderstandings that people often have:

-

Anyone can write a will without legal help.

While it's true that you can write your own will, having legal assistance ensures that it meets all state requirements. A poorly drafted will can lead to complications during probate.

-

Wills are only for wealthy individuals.

This is a myth. Everyone, regardless of their financial situation, should have a will to ensure their wishes are honored after they pass away.

-

Verbal wills are legally binding.

In Ohio, verbal wills, also known as nuncupative wills, are not recognized unless specific conditions are met. Written documentation is essential for clarity and legality.

-

Once a will is created, it never needs to be changed.

Life changes, such as marriage, divorce, or the birth of children, may require updates to your will. Regular reviews are crucial to ensure it reflects your current wishes.

-

All assets automatically go to the beneficiaries named in the will.

Not necessarily. Some assets, like those in a trust or jointly owned property, may bypass the will and go directly to other parties. Understanding asset distribution is vital.

-

Only a judge can validate a will.

While a judge will ultimately oversee the probate process, a will can be validated by following proper signing and witnessing procedures. This can help avoid unnecessary court involvement.

-

Wills are the same as trusts.

Wills and trusts serve different purposes. A will outlines how to distribute your assets after death, while a trust can manage your assets during your lifetime and beyond.

Understanding these misconceptions can help you make informed decisions about your estate planning in Ohio. Taking the time to create a well-structured will is an important step in securing your legacy.

Key takeaways

When filling out and using the Ohio Last Will and Testament form, keep the following key takeaways in mind:

- Understand the Purpose: A will outlines how you want your assets distributed after your death. It can also name guardians for minor children.

- Eligibility Requirements: You must be at least 18 years old and of sound mind to create a valid will in Ohio.

- Clear Language: Use straightforward language. Clearly state your wishes to avoid confusion or disputes among your heirs.

- Signature Requirements: You must sign the will in the presence of two witnesses. They must also sign the document to validate it.

- Revocation of Previous Wills: If you create a new will, it automatically revokes any prior wills. Make sure to destroy old copies to prevent confusion.

- Regular Updates: Review and update your will regularly, especially after major life events like marriage, divorce, or the birth of a child.

File Overview

| Fact Name | Details |

|---|---|

| Definition | A Last Will and Testament is a legal document that outlines how a person's assets will be distributed after their death. |

| Governing Law | The Ohio Revised Code, specifically Section 2107, governs the creation and execution of wills in Ohio. |

| Age Requirement | In Ohio, individuals must be at least 18 years old to create a valid will. |

| Witnesses | Ohio law requires that a will be signed by at least two witnesses who are not beneficiaries of the will. |

| Revocation | A will can be revoked in Ohio by creating a new will or by physically destroying the original document. |

| Holographic Wills | Ohio recognizes holographic wills, which are handwritten and signed by the testator, but they must meet certain criteria. |

| Self-Proving Wills | A self-proving will includes a notarized affidavit, allowing it to be accepted in probate court without needing witness testimony. |

| Executor Appointment | The will allows the testator to appoint an executor, who will be responsible for managing the estate after death. |

| Minor Children | Parents can designate guardians for minor children in their will, providing peace of mind regarding their care. |

| Digital Assets | Ohio law permits individuals to include instructions for the management of digital assets in their will. |