Free Employment Verification Template for Ohio

Create Other Popular Employment Verification Forms for Different States

Texas Job Verification Letter - Use this document to confirm job title and duration of employment.

In situations where individuals may be unable to make their own healthcare decisions, utilizing the Arizona Medical Power of Attorney form is crucial for ensuring that their preferences are respected. This legal document empowers a designated agent to act on behalf of the individual, making important medical choices and communicating with healthcare providers. For those considering this important step in planning their future healthcare needs, accessing resources such as https://arizonapdfs.com/medical-power-of-attorney-template can provide valuable guidance on how to proceed.

Similar forms

The I-9 form, or Employment Eligibility Verification form, is similar to the Ohio Employment Verification form in that both are used to confirm an employee’s eligibility to work in the United States. The I-9 requires employers to verify the identity and employment authorization of individuals hired for employment. Just like the Ohio form, it asks for specific documentation that proves the employee’s identity and right to work. Both forms help employers comply with federal regulations regarding employment verification.

The W-4 form, used for tax withholding, shares similarities with the Ohio Employment Verification form in that it requires personal information from the employee. While the Ohio form verifies employment status, the W-4 determines how much federal income tax should be withheld from an employee’s paycheck. Both documents are crucial for ensuring that the employer has the correct information to manage payroll and tax obligations effectively.

The Form 1099 is another document that relates to employment verification. It is used to report income received by independent contractors and freelancers. While the Ohio Employment Verification form is typically used for employees, the 1099 serves a similar purpose for those who are self-employed or work as independent contractors. Both documents ensure that the proper income information is reported for tax purposes, although they apply to different employment situations.

In navigating the complexities of vehicle transactions, it is imperative to have a solid understanding of documentation requirements. A California Motor Vehicle Bill of Sale serves as an essential record for buyers and sellers alike, ensuring that critical information about the vehicle and the sale terms are accurately documented. For those looking to simplify the process, you can rely on resources such as Fill PDF Forms to facilitate the completion of this important document.

The Paystub, or pay slip, is also comparable to the Ohio Employment Verification form in that it provides a record of employment and earnings. While the Ohio form is primarily for verifying employment status, a paystub offers details about hours worked, deductions, and net pay. Both documents serve as proof of employment and are often required for various applications, such as loans or rental agreements.

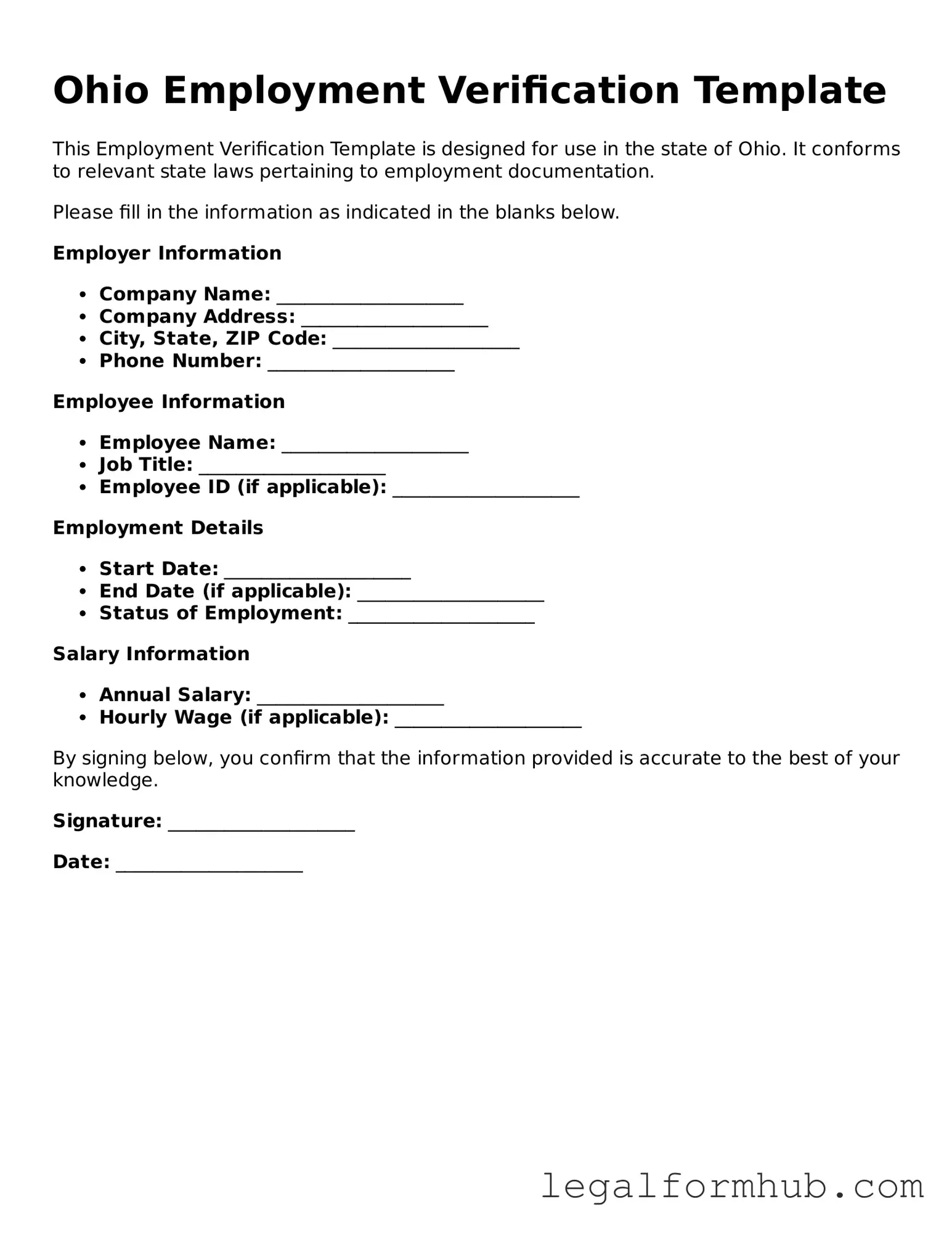

Instructions on Writing Ohio Employment Verification

Completing the Ohio Employment Verification form is a straightforward process. After filling out the form, it will be submitted to the appropriate party for processing. Make sure to double-check all information for accuracy before sending it off.

- Begin by downloading the Ohio Employment Verification form from the official website or obtaining a physical copy from your employer.

- Fill in your personal information, including your full name, address, and contact details. Ensure that everything is accurate.

- Provide your employment details. This includes your job title, department, and the dates of your employment.

- If applicable, include your supervisor's name and contact information. This may help verify your employment more efficiently.

- Sign and date the form at the designated area. Your signature is essential for validating the information provided.

- Review the completed form for any errors or missing information. Accuracy is crucial.

- Submit the form according to the instructions provided, whether electronically or via mail.

Misconceptions

Understanding the Ohio Employment Verification form can be challenging. Here are six common misconceptions about this form, along with clarifications.

- Misconception 1: The form is only required for new hires.

- Misconception 2: Employers must fill out the form for every employee.

- Misconception 3: The form is only for full-time employees.

- Misconception 4: The information provided is confidential and cannot be shared.

- Misconception 5: There is a specific format that must be followed.

- Misconception 6: The form must be submitted to a government agency.

This is incorrect. While the form is often associated with new employees, it can also be used for existing employees in various situations, such as verification for loans or housing applications.

Employers are not required to complete the form for every employee. It is typically used when an employee requests verification or when it is needed for a specific purpose.

This is a misunderstanding. The Ohio Employment Verification form can be used for both full-time and part-time employees, as long as verification is necessary.

While the form contains personal information, it can be shared with third parties if the employee provides consent. Employers should ensure they follow proper protocols when sharing this information.

There is no mandated format for the form, but it should include essential details such as the employee's name, position, and employment dates. Employers can create their own version as long as it meets the necessary criteria.

This is false. The Ohio Employment Verification form is typically retained by the employer and provided to the employee or authorized third parties as needed. It does not need to be submitted to any government agency.

Key takeaways

Filling out and using the Ohio Employment Verification form is an important process for both employees and employers. Here are some key takeaways to keep in mind:

- The Ohio Employment Verification form is used to confirm an individual's employment status, job title, and other relevant details.

- Employers must provide accurate and up-to-date information on the form to avoid potential legal issues.

- Employees should review the information for accuracy before submission, as discrepancies can lead to delays.

- It is essential to include the correct employer contact information to ensure that verification requests can be processed smoothly.

- Both parties should be aware of the privacy implications; sensitive information should be handled with care.

- Employers are encouraged to respond promptly to verification requests to maintain a positive relationship with current and former employees.

- Filling out the form may require additional documentation, such as pay stubs or tax forms, to support the verification process.

- Employees may need to provide consent for the release of their employment information, depending on the situation.

- Understanding the purpose of the form can help both employees and employers navigate the verification process more effectively.

File Overview

| Fact Name | Details |

|---|---|

| Purpose | The Ohio Employment Verification form is used to confirm an individual's employment status and details. |

| Governing Law | This form is governed by Ohio Revised Code Section 4111.14, which outlines employer responsibilities for verifying employment. |

| Who Uses It | Employers and employees use this form for various purposes, including loan applications and background checks. |

| Required Information | The form typically requires the employee's name, position, dates of employment, and salary information. |

| Submission Process | Employers may submit the completed form directly to the requesting party, such as a bank or rental agency. |

| Confidentiality | Employers must handle the information on this form with care to protect employee privacy. |

| Validity | The employment verification is generally valid for a limited time, often specified by the requesting party. |