Free Durable Power of Attorney Template for Ohio

Create Other Popular Durable Power of Attorney Forms for Different States

Power of Attorney Form Chicago - The Durable Power of Attorney allows for smooth management of your affairs during your absence.

For those exploring legal protections in Missouri, a thorough understanding of the Hold Harmless Agreement is vital for ensuring safety during activities. By utilizing this protective document, participants can secure their interests, and you can learn more about it by visiting our informative Hold Harmless Agreement guide.

North Carolina Power of Attorney Requirements - A Durable Power of Attorney can help reduce stress for your family during difficult times.

Texas Durable Power of Attorney Free Pdf - This form can empower individuals to make critical decisions about their assets without delay.

Does Durable Power of Attorney Cover Medical - A Durable Power of Attorney can help avoid the need for court interventions.

Similar forms

The Ohio Durable Power of Attorney (DPOA) form is similar to a standard Power of Attorney (POA) document. Both forms allow an individual, known as the principal, to designate another person, referred to as the agent, to make decisions on their behalf. The key difference lies in the durability aspect; while a standard POA may become invalid if the principal becomes incapacitated, a durable power of attorney remains effective even if the principal loses the ability to make decisions. This feature is particularly important for long-term planning and healthcare decisions.

A Healthcare Power of Attorney (HPOA) is another document akin to the DPOA. This specific form grants an agent the authority to make medical decisions for the principal when they are unable to do so. While the DPOA can cover a wide range of financial and legal decisions, the HPOA focuses exclusively on healthcare matters. Both documents empower an agent to act on behalf of the principal, but the HPOA is tailored to address situations involving medical care and treatment preferences.

In situations where mental well-being is a concern, having the appropriate documentation can make a significant difference. The Emotional Support Animal Letter form is one of the essential tools, as it provides certification for an emotional support animal, thus facilitating support for individuals. If you're interested in exploring this option, consider taking action by accessing the Fill PDF Forms today to initiate the process.

The Revocable Trust shares similarities with the Durable Power of Attorney in that both allow for the management of assets. A Revocable Trust enables the principal to place their assets into a trust, which can be managed by a trustee during their lifetime and distributed according to their wishes after death. While the DPOA grants authority to an agent to manage financial matters, a Revocable Trust serves as a mechanism to control and protect assets. Both documents are essential in estate planning, ensuring that an individual's wishes are honored.

The Financial Power of Attorney is closely related to the Durable Power of Attorney, focusing specifically on financial matters. This document allows an agent to handle various financial transactions, such as managing bank accounts, paying bills, and filing taxes. While the DPOA can encompass both financial and healthcare decisions, the Financial Power of Attorney is dedicated solely to financial affairs. This specialization can provide clarity and focus in managing the principal's financial interests.

Finally, the Guardianship document is another legal instrument that bears resemblance to the Durable Power of Attorney. Guardianship is a court-appointed role where an individual is designated to make decisions for another person, typically when that person is deemed incapacitated. Unlike the DPOA, which is created voluntarily by the principal, guardianship requires court intervention. However, both documents aim to protect the interests of individuals who may be unable to advocate for themselves, ensuring that their needs are met in accordance with their best interests.

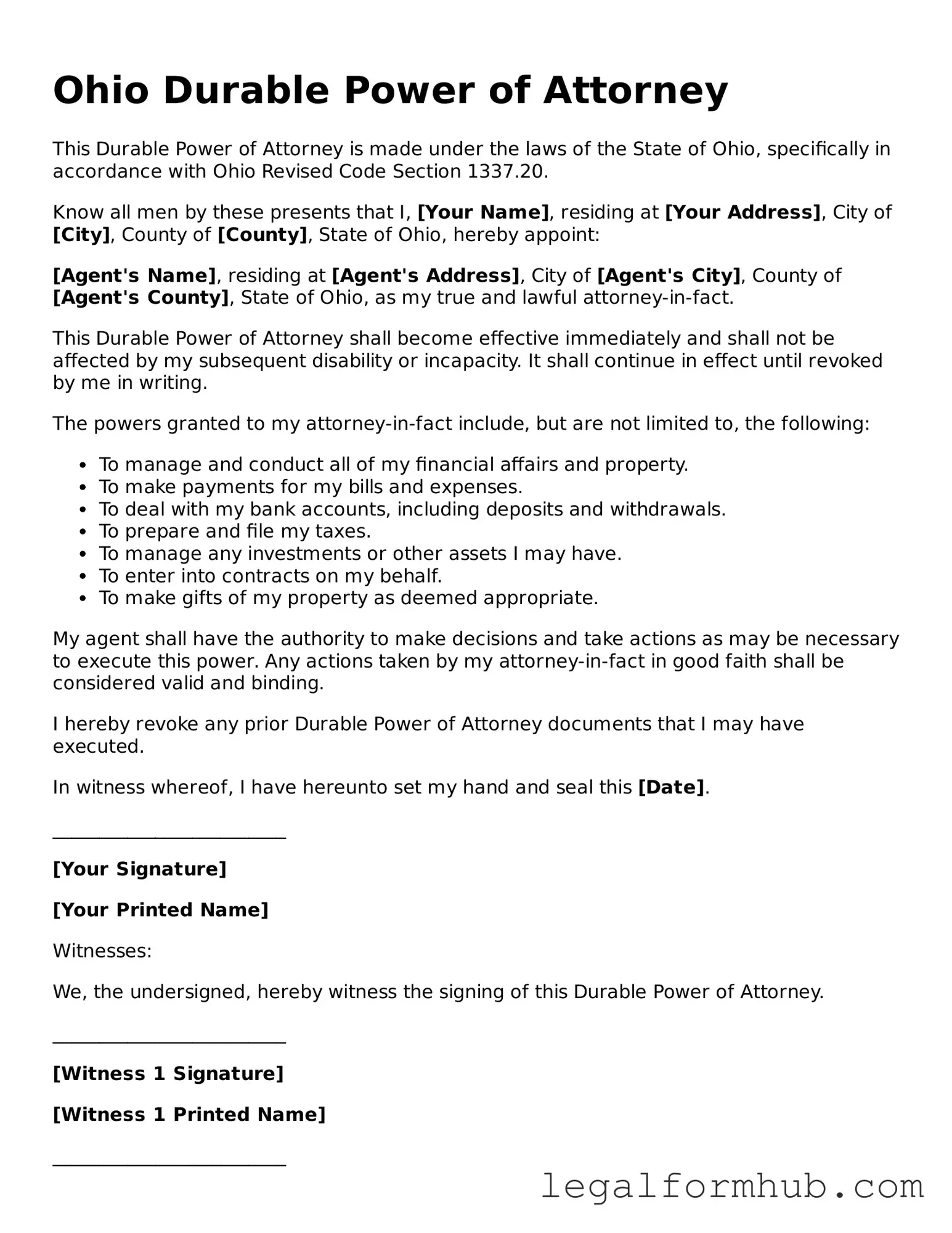

Instructions on Writing Ohio Durable Power of Attorney

Filling out the Ohio Durable Power of Attorney form is an important step in planning for your future. It allows you to designate someone to make decisions on your behalf if you become unable to do so. Here’s how to complete the form properly.

- Obtain the form: You can find the Ohio Durable Power of Attorney form online or at a local legal office.

- Fill in your information: Start by entering your name, address, and date of birth at the top of the form.

- Choose your agent: Clearly write the name and contact information of the person you are appointing as your agent. This person will act on your behalf.

- Specify powers: Indicate what powers you want to grant your agent. Be specific about financial decisions, healthcare choices, or any other areas where you want them to have authority.

- Include alternate agents: If you want, you can name an alternate agent in case your first choice is unable to serve.

- Sign the form: You must sign and date the form at the designated area. Make sure to do this in front of a notary public.

- Notarization: Have the form notarized. This adds an extra layer of validity to the document.

- Distribute copies: Provide copies of the completed form to your agent, alternate agent, and any relevant institutions, like banks or healthcare providers.

After completing these steps, keep the original document in a safe place. It’s wise to review the form periodically and make updates as necessary.

Misconceptions

Understanding the Ohio Durable Power of Attorney form is essential for anyone looking to designate someone to make decisions on their behalf. However, several misconceptions often arise regarding its use and implications. Here are four common misconceptions:

- Misconception 1: A Durable Power of Attorney is only for financial matters.

- Misconception 2: The agent can make decisions without any limitations.

- Misconception 3: The Durable Power of Attorney becomes invalid if the principal becomes incapacitated.

- Misconception 4: A Durable Power of Attorney is permanent and cannot be revoked.

This is not entirely accurate. While many people use the Durable Power of Attorney primarily for financial decisions, it can also be used for healthcare decisions. This means you can appoint someone to make medical choices on your behalf if you become unable to do so.

This is misleading. The agent you designate must act in your best interest and within the powers granted to them in the document. You can specify what decisions they can or cannot make, providing a level of control over their authority.

This is incorrect. The term "durable" indicates that the authority granted to the agent remains effective even if the principal becomes incapacitated. This is one of the key features that differentiates it from a regular Power of Attorney.

This is not true. The principal has the right to revoke or change the Durable Power of Attorney at any time, as long as they are mentally competent. It’s important to communicate any changes to the agent and any relevant institutions.

Key takeaways

Filling out and using the Ohio Durable Power of Attorney form is an important step in planning for your future. Here are some key takeaways to keep in mind:

- Understand the Purpose: A Durable Power of Attorney allows you to designate someone to make decisions on your behalf if you become unable to do so.

- Choose Your Agent Wisely: Select a trusted individual who understands your wishes and can act in your best interest.

- Specify Powers Clearly: Clearly outline the powers you are granting to your agent, whether they relate to finances, healthcare, or other matters.

- Consider Future Needs: Think about potential future scenarios and how your agent should handle them when filling out the form.

- Sign and Date the Document: Ensure that you sign and date the Durable Power of Attorney form in front of a notary public for it to be legally valid.

- Keep Copies Accessible: Make copies of the completed form and share them with your agent, family members, and relevant institutions.

- Review Regularly: Regularly review and update the form to reflect any changes in your circumstances or preferences.

- Know When It Takes Effect: Understand that the Durable Power of Attorney can be effective immediately or only when you become incapacitated, depending on your choice.

By keeping these takeaways in mind, you can ensure that your Durable Power of Attorney meets your needs and provides peace of mind for you and your loved ones.

File Overview

| Fact Name | Description |

|---|---|

| Definition | The Ohio Durable Power of Attorney form allows an individual to designate another person to make financial and legal decisions on their behalf. |

| Durability | This form remains effective even if the principal becomes incapacitated, ensuring continuous management of their affairs. |

| Governing Law | The form is governed by Ohio Revised Code Section 1337.22 through 1337.64, which outlines the legal framework for powers of attorney in the state. |

| Principal's Rights | The principal retains the right to revoke or amend the Durable Power of Attorney at any time, as long as they are competent. |

| Agent's Responsibilities | The agent must act in the best interest of the principal and adhere to the specific powers granted within the document. |

| Notarization | In Ohio, the Durable Power of Attorney must be signed in the presence of a notary public to be considered valid. |

| Healthcare Decisions | This form does not cover healthcare decisions; a separate Health Care Power of Attorney is needed for medical matters. |

| Revocation | To revoke the Durable Power of Attorney, the principal must provide written notice to the agent and any institutions relying on the power. |