Free Deed in Lieu of Foreclosure Template for Ohio

Create Other Popular Deed in Lieu of Foreclosure Forms for Different States

Deed in Lieu Vs Foreclosure - It offers an alternative pathway for homeowners to exit from a difficult situation with dignity.

The Arizona Hold Harmless Agreement is a legal document that protects one party from liability for damages or injuries incurred by another party. This form is commonly used in various contexts, including real estate transactions and event planning. By signing this agreement, individuals or organizations agree to assume responsibility for certain risks, thereby shielding others from potential legal claims. For more information, you can visit arizonapdfs.com/hold-harmless-agreement-template.

California Property Transfer Deed - The borrower willingly gives up their property to settle the mortgage debt.

Similar forms

A mortgage release is similar to a deed in lieu of foreclosure in that it allows a borrower to relinquish their property back to the lender. In this case, the lender agrees to release the borrower from the mortgage obligation, effectively canceling the debt. This process can be less damaging to the borrower’s credit than a foreclosure, as it indicates a mutual agreement rather than a court-ordered seizure of property.

A short sale is another document that shares similarities with a deed in lieu of foreclosure. In a short sale, the homeowner sells the property for less than the amount owed on the mortgage. The lender must agree to accept the lower amount, which allows the homeowner to avoid foreclosure. Like a deed in lieu, a short sale can help minimize the impact on the borrower’s credit score.

A loan modification agreement can also be compared to a deed in lieu of foreclosure. This document outlines changes to the original loan terms, such as interest rates or payment schedules, to make it more manageable for the borrower. While a deed in lieu involves giving up the property, a loan modification aims to help the homeowner keep their home by making the mortgage more affordable.

A forbearance agreement is another related document. This agreement allows a borrower to temporarily pause or reduce their mortgage payments without losing their home. While a deed in lieu results in the transfer of property ownership, forbearance offers a way for the borrower to retain their property while they recover financially.

A foreclosure notice is also relevant in this context. It is a legal document that informs a borrower that the lender intends to initiate foreclosure proceedings due to missed payments. While a deed in lieu is a proactive measure taken by the borrower to avoid foreclosure, a foreclosure notice represents the lender’s response to the borrower’s default.

A quitclaim deed is similar in that it transfers ownership of property but does not necessarily involve the lender's agreement. In a quitclaim deed, the current owner relinquishes any claim to the property, which can lead to complications if there are existing liens or mortgages. In contrast, a deed in lieu of foreclosure specifically addresses the mortgage obligation and is typically agreed upon by both parties.

An assumption agreement can also be compared to a deed in lieu of foreclosure. This document allows a new buyer to take over the existing mortgage of the seller. While a deed in lieu involves the borrower giving up the property, an assumption agreement enables the borrower to transfer their mortgage responsibility to another party, potentially avoiding foreclosure.

A property settlement agreement is another relevant document. This is often used in divorce cases to divide property and debts between spouses. While a deed in lieu of foreclosure focuses on the lender-borrower relationship, a property settlement agreement addresses the division of assets, which may include real estate. Both documents aim to resolve financial obligations but in different contexts.

To simplify the process of transferring ownership of pets, it is essential to understand the importance of proper documentation. For those needing assistance in creating legal documents, you can visit Fill PDF Forms to access the necessary forms that help facilitate a smooth exchange of pet ownership, ensuring both parties' rights are protected during the transaction.

Lastly, a bankruptcy filing can be compared to a deed in lieu of foreclosure. Filing for bankruptcy can halt foreclosure proceedings and provide the borrower with a fresh start. While a deed in lieu is a voluntary transfer of property to avoid foreclosure, bankruptcy is a legal process that can discharge debts, including mortgage obligations, but may also lead to the loss of the property.

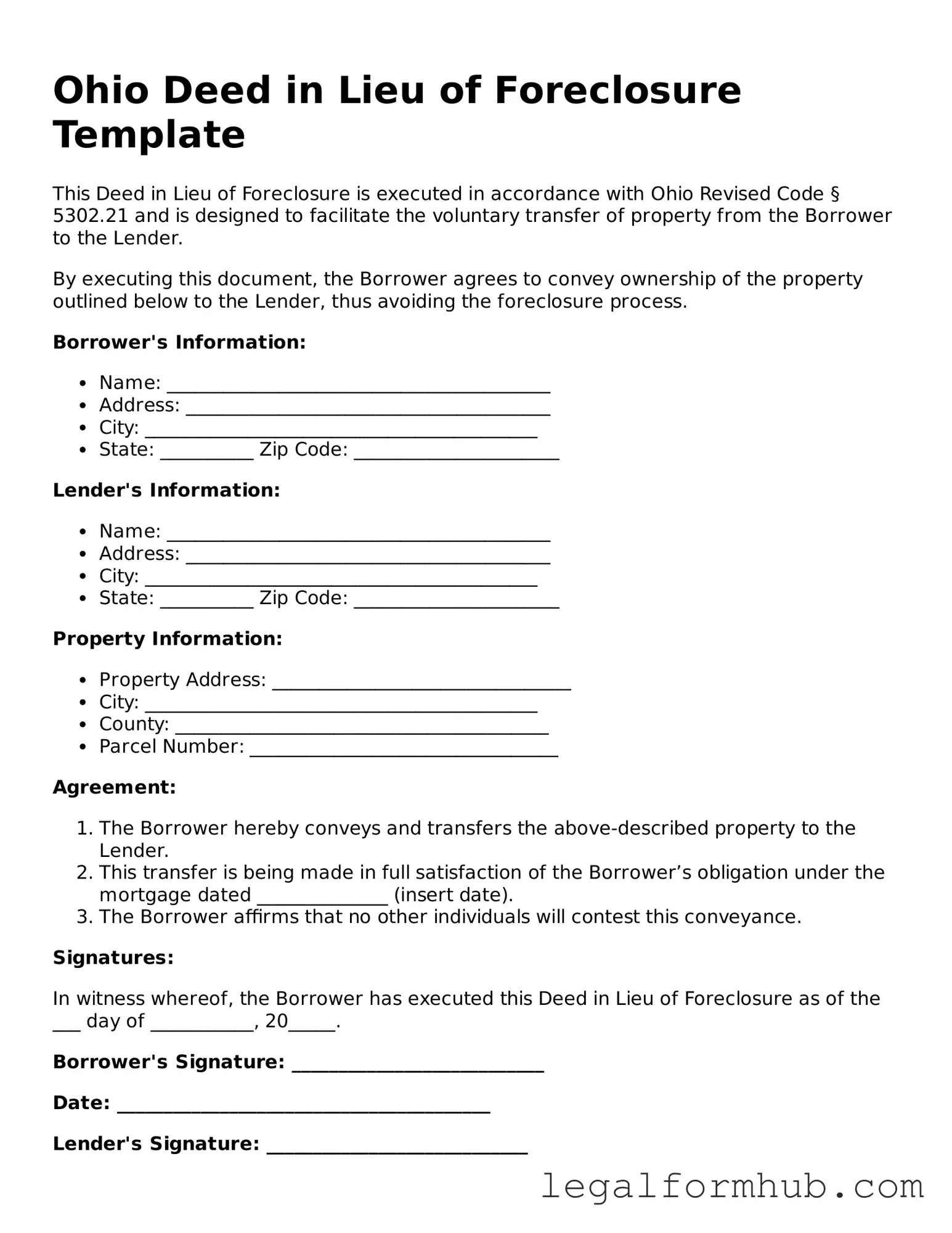

Instructions on Writing Ohio Deed in Lieu of Foreclosure

After completing the Ohio Deed in Lieu of Foreclosure form, the next steps involve submitting it to the appropriate parties. Typically, this means delivering the signed document to the lender and ensuring that all necessary parties are aware of the transfer of ownership. Following this, the lender will process the deed, and you may want to consult with legal counsel to understand any implications that may arise from this action.

- Obtain the Ohio Deed in Lieu of Foreclosure form from a reliable source, such as a legal website or your lender.

- Fill in the names of the parties involved. This includes the borrower (you) and the lender. Make sure the names are spelled correctly and match the names on the mortgage.

- Provide the property address. Clearly write the full address of the property that is subject to the deed.

- Include the legal description of the property. This is often found on your mortgage documents or can be obtained from your local county recorder's office.

- State the date of the transfer. This is the date you are signing the deed.

- Sign the form. Ensure that you sign where indicated. If there are multiple borrowers, all must sign.

- Have the deed notarized. This step is crucial as it verifies the authenticity of your signature.

- Make copies of the completed and notarized form for your records.

- Submit the original deed to your lender. Confirm that they have received it and keep a record of this communication.

Misconceptions

When facing financial difficulties, many homeowners consider a deed in lieu of foreclosure as a potential solution. However, several misconceptions about this process can lead to confusion and poor decision-making. Here are ten common misunderstandings regarding the Ohio Deed in Lieu of Foreclosure form:

-

It eliminates all debt immediately.

While a deed in lieu can help you avoid foreclosure, it does not automatically wipe out all your debt. You may still owe money if the property sells for less than what you owe on your mortgage.

-

It is the same as a short sale.

A deed in lieu of foreclosure and a short sale are not interchangeable. In a short sale, the lender agrees to accept less than the full amount owed, while a deed in lieu involves transferring ownership back to the lender.

-

All lenders accept deeds in lieu.

Not every lender will agree to a deed in lieu of foreclosure. Each lender has its policies, and some may prefer to go through the foreclosure process instead.

-

It has no impact on your credit score.

A deed in lieu of foreclosure can still negatively affect your credit score, although it may be less damaging than a full foreclosure. It’s essential to understand the potential impact on your credit history.

-

You can just walk away from the property.

Homeowners cannot simply abandon the property. A formal agreement must be reached with the lender to transfer ownership legally.

-

It absolves you of all liability.

While a deed in lieu can relieve you of your mortgage obligation, it may not eliminate other liens on the property, such as tax liens or second mortgages.

-

It is a quick process.

The deed in lieu process can take time. Homeowners must complete paperwork and negotiate with their lender, which can extend the timeline significantly.

-

It’s only for homeowners with bad credit.

Homeowners facing financial hardship, regardless of their credit score, can consider a deed in lieu of foreclosure as a viable option.

-

Legal representation is unnecessary.

While it’s possible to navigate the process without an attorney, having legal representation can help ensure that your rights are protected and that you understand all implications.

-

Once you sign, you cannot change your mind.

While it is true that signing the deed in lieu is a significant commitment, homeowners may have options to negotiate or withdraw under certain circumstances before the process is finalized.

Understanding these misconceptions can empower homeowners to make informed decisions about their financial futures. It’s essential to explore all options and consult with professionals who can provide guidance tailored to individual situations.

Key takeaways

When considering a Deed in Lieu of Foreclosure in Ohio, it is important to understand the process and implications. Here are key takeaways to keep in mind:

- Understand the Purpose: A Deed in Lieu of Foreclosure allows a homeowner to transfer property ownership to the lender to avoid foreclosure.

- Eligibility Requirements: Confirm that you meet the lender's criteria for this option, including being in default on your mortgage.

- Consult with Professionals: Seek advice from a real estate attorney or housing counselor to understand your rights and options.

- Gather Necessary Documents: Prepare financial statements, mortgage documents, and any other relevant paperwork required by the lender.

- Communicate with Your Lender: Contact your lender to discuss your situation and express your interest in a Deed in Lieu of Foreclosure.

- Negotiate Terms: Be prepared to negotiate the terms of the deed transfer, including any potential forgiveness of remaining debt.

- Complete the Form Accurately: Fill out the Deed in Lieu of Foreclosure form carefully, ensuring all information is correct.

- Sign in Front of a Notary: After completing the form, sign it in the presence of a notary public to validate the document.

- Record the Deed: Submit the signed deed to the county recorder’s office to officially transfer ownership.

- Understand the Consequences: Be aware that a Deed in Lieu of Foreclosure may impact your credit score and future home buying opportunities.

By following these steps, you can navigate the Deed in Lieu of Foreclosure process with greater confidence and clarity.

File Overview

| Fact Name | Description |

|---|---|

| Definition | A deed in lieu of foreclosure is a legal document that allows a homeowner to transfer their property title to the lender to avoid foreclosure proceedings. |

| Governing Law | Ohio Revised Code Section 5301.01 governs the transfer of real property, including deeds in lieu of foreclosure. |

| Eligibility | Homeowners must be facing financial hardship and unable to continue making mortgage payments to qualify for a deed in lieu of foreclosure. |

| Benefits | This process can help homeowners avoid the lengthy and costly foreclosure process, allowing for a smoother transition out of the property. |

| Impact on Credit | While a deed in lieu of foreclosure is less damaging than a foreclosure, it can still negatively impact the homeowner's credit score. |

| Process | The homeowner must negotiate with the lender, complete the necessary paperwork, and ensure that all liens on the property are resolved. |