Free Deed Template for Ohio

Create Other Popular Deed Forms for Different States

How Do I Get My Deed to My House - Can protect against unauthorized claims by third parties.

To streamline the process of completing the necessary documentation, you can easily access and utilize the Fill PDF Forms for your California Motor Vehicle Bill of Sale, ensuring all details are accurately captured for a successful transaction.

Warranty Deed Form North Carolina - The completion of a Deed is an essential step in the legal process of buying or selling real estate.

Similar forms

The Ohio Deed form shares similarities with a Warranty Deed. A Warranty Deed provides a guarantee that the property title is clear and free of any encumbrances. This document assures the buyer that the seller has the legal right to transfer ownership and that the property will not face any future claims. Both forms serve to transfer property ownership, but the Warranty Deed offers additional protection through its guarantees regarding the title.

In navigating the complexities of real estate documentation, understanding the nuances of related legal forms is vital for parties involved in property transactions. For instance, for individuals looking to secure their healthcare choices, they might explore medical-related legal documents such as the Medical Power of Attorney form available at arizonapdfs.com/medical-power-of-attorney-template, as this ensures their preferences are respected in the event they cannot voice them themselves.

Another document comparable to the Ohio Deed form is the Quitclaim Deed. Unlike the Warranty Deed, a Quitclaim Deed transfers whatever interest the seller has in the property without any guarantees. This means that the seller does not promise that the title is clear. While both documents facilitate the transfer of property, the Quitclaim Deed is often used in situations where the parties know each other, such as family transfers, due to its lack of warranties.

The Ohio Deed form is also similar to a Special Purpose Deed. This type of deed is often used for specific situations, such as transferring property into a trust or as part of a divorce settlement. Both documents serve the purpose of transferring ownership, but the Special Purpose Deed is tailored to meet particular legal requirements that may arise in unique circumstances.

A Bargain and Sale Deed is another document that shares characteristics with the Ohio Deed form. This deed implies that the seller has the right to sell the property but does not provide warranties regarding the title. It is often used in real estate transactions involving foreclosures or tax sales. While both documents facilitate ownership transfer, the Bargain and Sale Deed does not assure the buyer of a clear title.

The Ohio Deed form is also akin to a Grant Deed. A Grant Deed transfers ownership and includes implied warranties that the property has not been sold to anyone else and that it is free of undisclosed encumbrances. Both forms facilitate the transfer of property, but the Grant Deed offers some level of assurance regarding the title, similar to a Warranty Deed but less comprehensive.

Another related document is the Trustee’s Deed. This deed is used when a property is transferred by a trustee, often during a foreclosure process or as part of a trust. The Trustee’s Deed conveys the property without warranties, similar to a Quitclaim Deed. Both documents are used in specific contexts where the transfer of ownership is necessary but does not include guarantees about the title.

The Ohio Deed form also resembles a Personal Representative’s Deed. This type of deed is utilized when property is transferred as part of an estate settlement. The Personal Representative acts on behalf of the deceased, transferring ownership to heirs or beneficiaries. Like the Ohio Deed, it facilitates the transfer of property ownership, but it specifically pertains to estate matters.

Lastly, the Ohio Deed form can be compared to a Deed of Trust. Although primarily used for securing a loan, a Deed of Trust involves transferring property interest to a trustee until the borrower repays the loan. Both documents involve property ownership transfers, but a Deed of Trust is specifically tied to financing and serves a different purpose in the realm of real estate transactions.

Instructions on Writing Ohio Deed

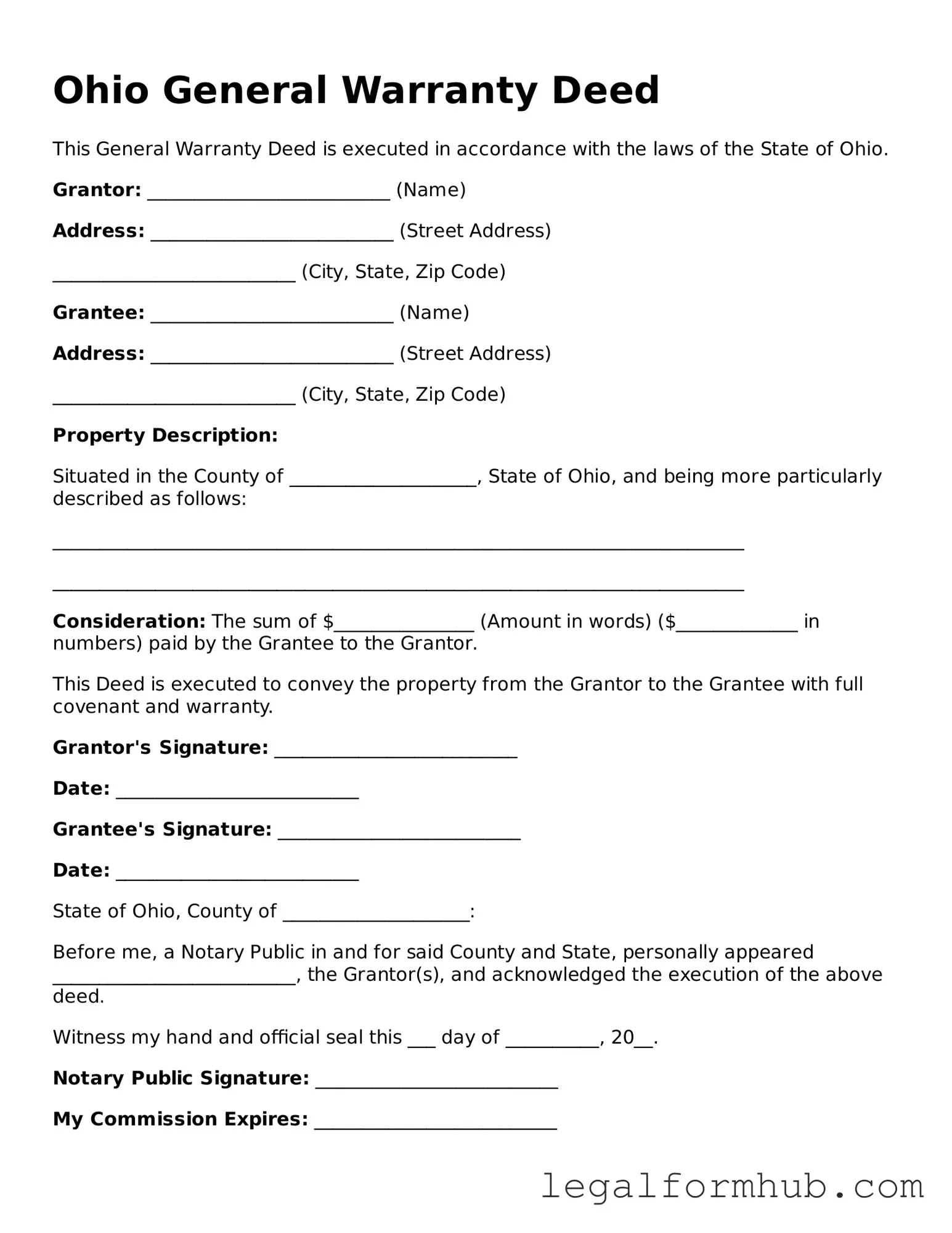

After gathering the necessary information, you're ready to fill out the Ohio Deed form. This process involves careful attention to detail to ensure all information is accurately recorded. Once completed, the deed will need to be signed and notarized before being filed with the appropriate county office.

- Begin by identifying the type of deed you are using. Common options include warranty deeds, quitclaim deeds, and others.

- At the top of the form, write the name of the county where the property is located.

- Fill in the names of the grantor(s) (the person or entity transferring the property) and grantee(s) (the person or entity receiving the property). Ensure that all names are spelled correctly.

- Provide the property address, including street number, street name, city, and zip code. This ensures that the property is easily identifiable.

- Include a legal description of the property. This may involve a lot number, block number, or metes and bounds description. Refer to previous deeds or property records for accuracy.

- Specify the consideration (the amount paid for the property). If the property is a gift, indicate that as well.

- Sign the deed in the presence of a notary public. Both grantors must sign if there is more than one.

- Have the deed notarized. The notary will complete their section, confirming the identities of the signers.

- Make copies of the completed and notarized deed for your records.

- File the original deed with the county recorder's office where the property is located. Be prepared to pay any associated filing fees.

Misconceptions

Many people have misunderstandings about the Ohio Deed form. Here are nine common misconceptions:

- All deeds are the same. Different types of deeds serve various purposes. Warranty deeds, quitclaim deeds, and others have distinct legal implications.

- You don’t need to record a deed. While it is not mandatory, recording a deed is crucial. It protects ownership rights and provides public notice of the transaction.

- Only attorneys can prepare a deed. Individuals can prepare their own deeds. However, seeking legal advice can help ensure accuracy and compliance with state laws.

- A deed is the same as a title. A deed transfers ownership, while a title proves ownership. They are related but not interchangeable.

- Once a deed is signed, it cannot be changed. A deed can be amended or revoked under certain conditions, but the process must follow legal requirements.

- Deeds do not require witnesses. In Ohio, most deeds must be signed in the presence of a notary public, but witnesses are not always required.

- All property transfers require a new deed. Some transfers, like those between spouses, may not require a new deed if they are recorded properly.

- There are no fees associated with recording a deed. Recording a deed typically incurs fees, which vary by county in Ohio.

- Deeds can be verbal. Deeds must be in writing to be legally enforceable. Oral agreements regarding property transfers are not valid.

Understanding these misconceptions can help clarify the process of using the Ohio Deed form effectively.

Key takeaways

When filling out and using the Ohio Deed form, it’s important to keep a few key points in mind. Here are some takeaways to help you navigate the process:

- Understand the Purpose: A deed is a legal document that transfers ownership of property from one person to another.

- Identify the Parties: Clearly list the names of the current owner (grantor) and the new owner (grantee) on the form.

- Provide Accurate Property Description: Include a detailed description of the property being transferred. This can include the address and parcel number.

- Choose the Right Type of Deed: Different types of deeds serve different purposes. Ensure you select the appropriate one for your needs, such as a warranty deed or quitclaim deed.

- Signatures Are Essential: All parties involved must sign the deed. Make sure the signatures are dated and properly witnessed if required.

- Notarization: Most deeds need to be notarized to be legally valid. A notary public will verify the identities of the signers.

- Filing the Deed: After completion, file the deed with the county recorder's office where the property is located. This step is crucial for the transfer to be recognized legally.

- Keep Copies: Always keep copies of the completed deed for your records. This can be important for future reference or disputes.

- Consult a Professional: If you have questions or feel unsure, consider seeking help from a real estate attorney or a professional familiar with Ohio property laws.

By following these guidelines, you can ensure that the process of filling out and using the Ohio Deed form goes smoothly.

File Overview

| Fact Name | Details |

|---|---|

| Definition | An Ohio deed form is a legal document used to transfer ownership of real property from one party to another. |

| Types of Deeds | Ohio recognizes several types of deeds, including warranty deeds, quitclaim deeds, and special warranty deeds. |

| Governing Laws | The Ohio Revised Code, specifically sections 5301.01 to 5301.47, governs the use and requirements of deed forms in Ohio. |

| Signature Requirements | For a deed to be valid in Ohio, it must be signed by the grantor (the person transferring the property) and acknowledged before a notary public. |

| Recording | To provide public notice of the property transfer, the deed must be recorded in the county where the property is located. |

| Consideration | While not always required, it is common to include a statement of consideration (the value exchanged) in the deed. |

| Legal Description | The deed must contain a legal description of the property, which precisely identifies the boundaries and location of the real estate. |

| Transfer Tax | Ohio imposes a conveyance fee on property transfers, which must be paid at the time of recording the deed. |