Free Transfer-on-Death Deed Template for North Carolina

Create Other Popular Transfer-on-Death Deed Forms for Different States

Free Printable Transfer on Death Deed Form Georgia - A Transfer-on-Death Deed ensures that real estate assets are aligned with your estate planning goals.

Tod Form Ohio - This deed remains effective even if the property owner has a will, as the deed takes precedence upon death.

The Employment Verification Form is an essential document utilized to confirm an individual's employment history, job title, and salary from previous employers. This form is a crucial resource for prospective employers, offering them reliable information to assist in their hiring decisions. To streamline the hiring process, you can easily complete this verification by accessing the Fill PDF Forms link provided.

How to Avoid Probate in Illinois - This deed offers a sense of control over one’s assets, enabling owners to decide who will benefit from their property after their death.

Texas Transfer on Death Deed Form - Transfer-on-Death Deeds are recognized in many states, but it's important to verify specific state laws regarding their use.

Similar forms

The North Carolina Transfer-on-Death (TOD) Deed form shares similarities with the traditional Last Will and Testament. Both documents serve the purpose of transferring property upon the death of the owner. However, while a will typically goes through probate, a TOD deed allows for a more streamlined transfer process, bypassing the often lengthy and costly probate proceedings. This can make the TOD deed a more efficient option for individuals looking to pass on real estate to their heirs without the complications of probate court.

Another document akin to the TOD deed is the Revocable Living Trust. Like the TOD deed, a living trust facilitates the transfer of assets upon death without the need for probate. The key difference lies in the management of assets during the grantor's lifetime. A living trust can hold a variety of assets and can be altered or revoked at any time, while a TOD deed specifically addresses the transfer of real property and does not provide for asset management during the grantor's lifetime.

In Arizona, understanding various legal documents is vital, especially when considering the implications of appointing someone to make decisions on your behalf. The Power of Attorney form plays a crucial role in this regard, allowing individuals to delegate authority for various matters such as financial and healthcare decisions. Additionally, resources like arizonapdfs.com/power-of-attorney-template can provide guidance on creating a valid and comprehensive document to ensure that one's wishes are honored effectively.

The Beneficiary Designation form is also similar to the TOD deed, particularly in how it allows individuals to name beneficiaries for certain assets. Commonly used for financial accounts and insurance policies, this form enables the direct transfer of assets to the named beneficiaries upon the account holder's death. Unlike the TOD deed, which pertains specifically to real estate, the beneficiary designation can apply to a wider range of financial assets, providing a straightforward method for asset distribution without probate.

The Joint Tenancy with Right of Survivorship agreement bears resemblance to the TOD deed in that it allows for the automatic transfer of property upon the death of one owner to the surviving owner. This arrangement ensures that the property does not enter probate, similar to how a TOD deed functions. However, joint tenancy requires co-ownership during the lifetime of the owners, while a TOD deed allows the owner to retain full control until death.

A Life Estate deed also shares characteristics with the TOD deed, as both documents facilitate the transfer of property. In a life estate, the property owner retains the right to use the property during their lifetime while designating a remainderman to receive the property upon their death. This arrangement can complicate ownership rights during the life of the owner, contrasting with the more straightforward nature of a TOD deed, which only takes effect upon death.

The Power of Attorney (POA) document can be compared to the TOD deed in terms of transferring authority over assets. A POA allows an appointed agent to manage the principal's financial affairs, including real estate transactions, while the principal is alive. However, a TOD deed specifically addresses the transfer of property upon death, whereas a POA ceases to be effective once the principal passes away.

The Community Property Agreement is another document that bears resemblance to the TOD deed, particularly in states that recognize community property laws. This agreement allows spouses to manage and transfer property jointly. Upon the death of one spouse, the surviving spouse typically retains ownership of the property without probate. While both documents aim to simplify the transfer process, the community property agreement is specific to marital property and does not apply to individual ownership like a TOD deed.

The Assignment of Interest document is similar in that it allows for the transfer of ownership rights in property. This document can be used to assign interests in real estate or other assets to another party. However, unlike the TOD deed, which specifically facilitates the transfer of property upon death, an assignment of interest can occur at any time during the owner's life and may require additional legal steps to ensure the transfer is valid.

The Quitclaim Deed is another document that shares similarities with the TOD deed. A quitclaim deed allows an individual to transfer their interest in a property to another person without guaranteeing that the title is clear. While both documents facilitate the transfer of property, the quitclaim deed is typically used during the owner's lifetime and does not provide the same posthumous transfer benefits as the TOD deed.

Lastly, the Family Limited Partnership agreement may also be compared to the TOD deed. This document allows family members to pool their assets and manage them collectively, often used for estate planning purposes. While both documents can help with the transfer of property and assets, the family limited partnership focuses on ongoing management and control during the lifetime of the partners, whereas the TOD deed solely addresses the transfer of real property upon death.

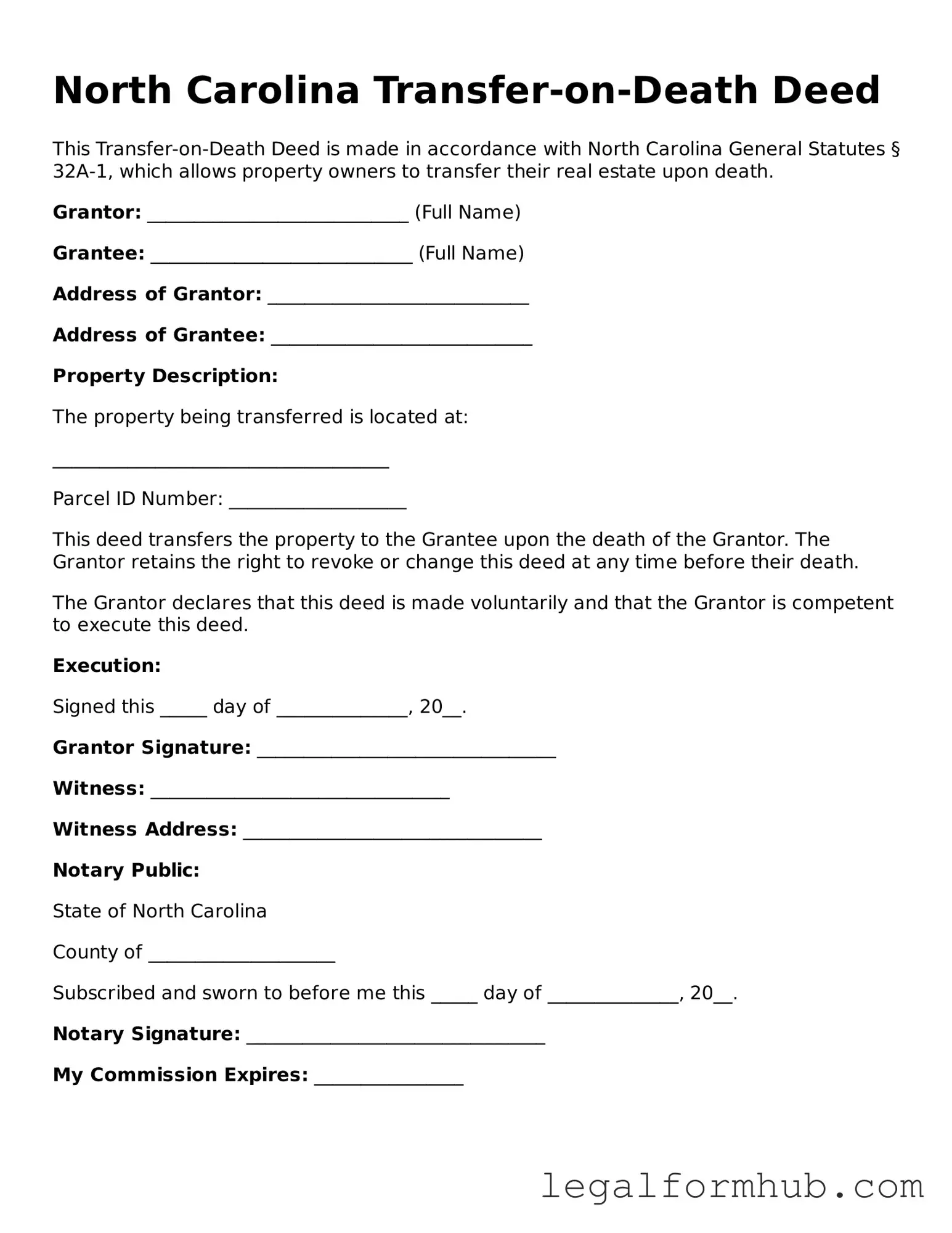

Instructions on Writing North Carolina Transfer-on-Death Deed

Filling out the North Carolina Transfer-on-Death Deed form is a straightforward process that ensures your property is transferred to your chosen beneficiary after your passing. Follow the steps below to complete the form accurately.

- Begin by downloading the Transfer-on-Death Deed form from a reliable source or obtain a hard copy from your local register of deeds office.

- Fill in your name as the owner of the property in the designated section. Ensure that your name matches the title on the property deed.

- Provide the address of the property you wish to transfer. Include the full street address, city, state, and zip code.

- Identify your beneficiary by writing their full legal name in the appropriate section. Be sure to include their address as well.

- Include a legal description of the property. This information can usually be found on your current property deed or tax records.

- Sign the form in the presence of a notary public. The notary will verify your identity and witness your signature.

- Have the notary public complete their section of the form, including their signature and seal.

- Submit the completed form to the local register of deeds office in the county where the property is located. There may be a filing fee, so check in advance.

Once the form is submitted and recorded, it will take effect according to North Carolina law. Your beneficiary will be able to claim the property without going through probate, simplifying the transfer process.

Misconceptions

The North Carolina Transfer-on-Death (TOD) Deed form is a useful tool for estate planning, allowing property owners to designate beneficiaries who will receive their property upon their death. However, several misconceptions surround this form that can lead to confusion and potential legal issues. Here are four common misconceptions:

- Misconception 1: The Transfer-on-Death Deed is the same as a will.

- Misconception 2: You cannot change the beneficiaries once the TOD Deed is executed.

- Misconception 3: The property is immediately transferred to the beneficiary upon signing the TOD Deed.

- Misconception 4: A TOD Deed can be used for any type of property.

This is not true. A TOD Deed allows for the direct transfer of property to beneficiaries without going through probate, while a will takes effect only after death and requires probate to distribute assets.

In reality, property owners can revoke or modify their TOD Deed at any time before their death. This flexibility allows for changes in circumstances, such as changes in relationships or financial situations.

This is a misunderstanding. The property does not transfer until the property owner passes away. Until then, the owner retains full control and ownership of the property.

This is partially incorrect. While TOD Deeds can be used for many types of real estate, they cannot be used for personal property or certain types of financial accounts. Understanding what can and cannot be included is essential for effective estate planning.

Key takeaways

When considering the Transfer-on-Death (TOD) Deed in North Carolina, it is essential to understand the key aspects of this legal tool. Below are important takeaways regarding the use and completion of the TOD Deed form.

- The Transfer-on-Death Deed allows property owners to designate beneficiaries who will receive the property upon the owner's death.

- This deed must be executed during the property owner's lifetime and requires the owner's signature.

- It is crucial to record the TOD Deed with the county register of deeds where the property is located to ensure its validity.

- Beneficiaries named in the deed do not have any ownership rights or responsibilities until the death of the property owner.

- Property owners can revoke or change the TOD Deed at any time before their death, provided they follow the proper legal procedures.

- The TOD Deed can help avoid probate, simplifying the transfer of property to beneficiaries.

- It is advisable to consult with a legal professional to ensure the TOD Deed is filled out correctly and meets all legal requirements.

- Understanding the implications of the TOD Deed on estate planning is vital, as it may affect other aspects of an individual's estate.

File Overview

| Fact Name | Details |

|---|---|

| Definition | A Transfer-on-Death (TOD) Deed allows property owners in North Carolina to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The TOD Deed is governed by North Carolina General Statutes, specifically Chapter 32A. |

| Eligibility | Any individual who owns real property can create a TOD Deed, provided they are of sound mind and at least 18 years old. |

| Beneficiary Designation | Property owners can designate one or more beneficiaries, and they can change or revoke the deed at any time before their death. |

| Execution Requirements | The deed must be signed by the property owner and witnessed by at least one person, and it must be recorded in the county where the property is located. |

| Tax Implications | Transfer-on-Death Deeds do not trigger gift taxes during the property owner's lifetime, but beneficiaries may be subject to estate taxes upon the owner's death. |

| Revocation Process | A property owner can revoke a TOD Deed by executing a new deed that explicitly states the revocation or by recording a written revocation. |