Free Real Estate Purchase Agreement Template for North Carolina

Create Other Popular Real Estate Purchase Agreement Forms for Different States

Ohio Real Estate Purchase Agreement - Both parties should keep a copy of the signed agreement for their records.

To ensure a smooth transition in boat ownership, it is important to understand the benefits of having a complete Boat Bill of Sale document. This form not only facilitates the sale but also provides the necessary legal backing for the transaction, making it a vital step in the process. For more information, visit our essential guide on the Boat Bill of Sale.

Texas Real Estate Contract - Sets requirements for notifying either party about changes or notices related to the sale.

Purchase Agreement Michigan Template - It should clarify who is responsible for closing costs.

Purchase Contract for Home - This document can be complex, requiring careful review and potentially legal advice.

Similar forms

The North Carolina Real Estate Purchase Agreement form shares similarities with the Residential Purchase Agreement. Both documents outline the terms and conditions under which a buyer agrees to purchase a property from a seller. They include essential details such as the purchase price, financing terms, and contingencies. Just like the North Carolina form, the Residential Purchase Agreement is designed to protect the interests of both parties while providing a clear framework for the transaction.

Another document that resembles the North Carolina Real Estate Purchase Agreement is the Commercial Purchase Agreement. While the context may differ, both agreements serve the same purpose of facilitating a real estate transaction. They detail the purchase price, property description, and any special conditions that must be met. The Commercial Purchase Agreement often includes additional considerations related to zoning laws and business operations, but the fundamental structure remains similar.

The Offer to Purchase and Contract is also comparable to the North Carolina Real Estate Purchase Agreement. This document is typically used by buyers to formally present their offer to the seller. It includes key elements such as the offer price, closing date, and any contingencies. Once accepted, it transitions into a binding contract, much like the North Carolina form, ensuring both parties are clear on their obligations.

A Lease Agreement can also be likened to the North Carolina Real Estate Purchase Agreement, although it serves a different purpose. Both documents establish terms regarding property use, but while a purchase agreement leads to ownership transfer, a lease agreement outlines the rental terms between a landlord and tenant. Each document emphasizes the importance of clear terms and mutual consent, ensuring all parties understand their rights and responsibilities.

The Exclusive Right to Sell Agreement is another document that shares similarities with the North Carolina Real Estate Purchase Agreement. This agreement is used by real estate agents to secure a commitment from sellers. It outlines the terms of the agent's representation, including commission rates and the duration of the agreement. Like the purchase agreement, it aims to protect the interests of the parties involved while facilitating a successful transaction.

When engaging in vehicle transactions, it's essential to have a well-structured agreement in place, much like the detailed documents used in real estate purchases. Just as the California Vehicle Purchase Agreement outlines specific terms between a buyer and seller, ensuring protection and clarity, you can enhance your vehicle purchase experience by utilizing the Fill PDF Forms service to complete your agreement accurately and efficiently.

Lastly, the Seller Disclosure Statement is akin to the North Carolina Real Estate Purchase Agreement in that it provides critical information about the property being sold. While the purchase agreement focuses on the transaction terms, the disclosure statement informs the buyer about the property's condition and any known issues. Both documents are essential for ensuring transparency and building trust between buyers and sellers.

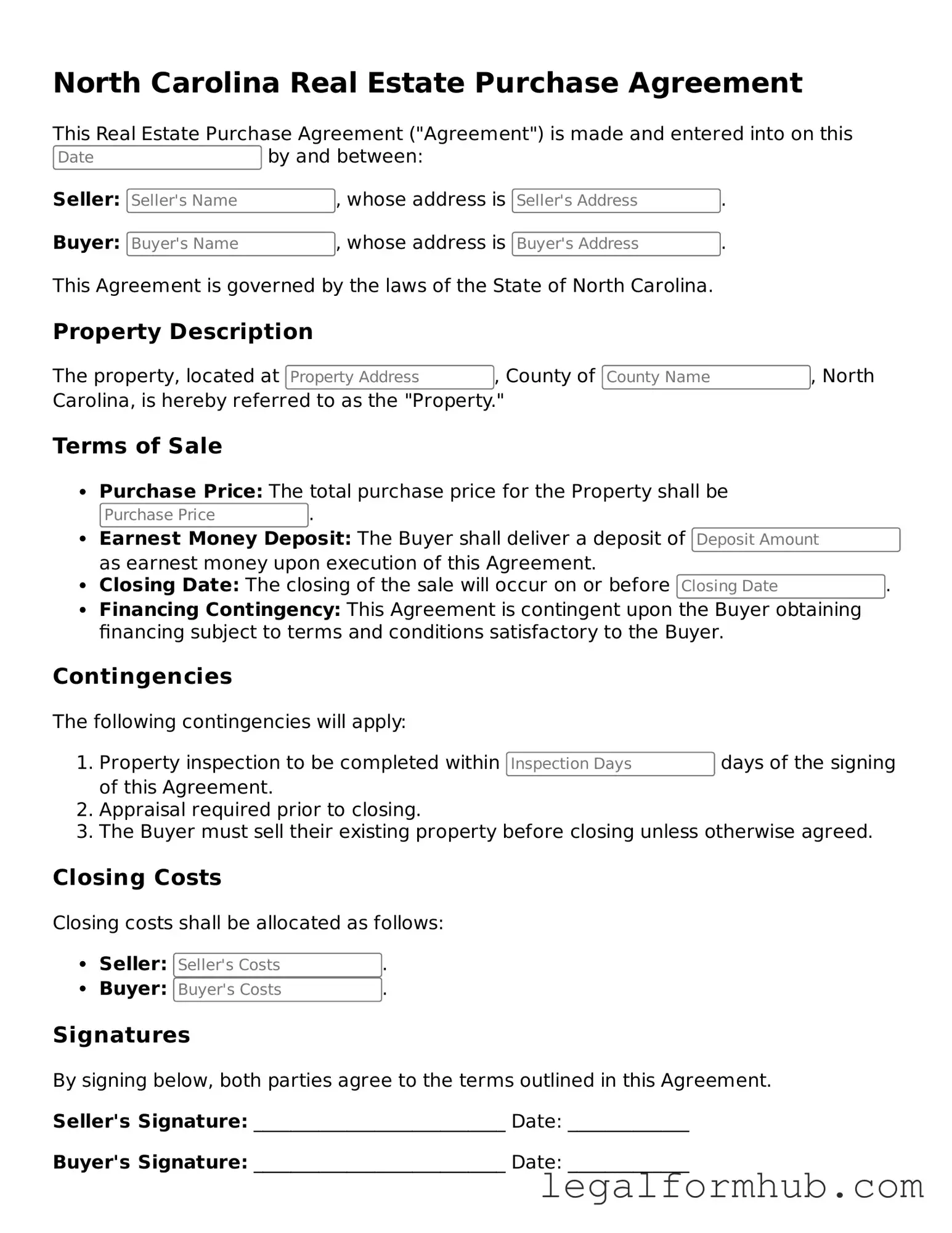

Instructions on Writing North Carolina Real Estate Purchase Agreement

Once you have the North Carolina Real Estate Purchase Agreement form in hand, it’s time to fill it out accurately. This form will help facilitate the sale of property between the buyer and seller. Follow these steps to complete the form correctly.

- Start with the date at the top of the form. Write the current date.

- Enter the names of the buyer(s) in the designated section. Make sure to include all legal names.

- Next, fill in the seller(s) information, including their full names.

- Provide the property address, including the city, state, and ZIP code. Double-check for accuracy.

- Specify the purchase price of the property. Clearly state the amount in both numbers and words.

- Indicate the amount of earnest money the buyer will provide. This shows the buyer's commitment to the purchase.

- Fill in the closing date. This is when the sale will be finalized.

- Include any contingencies that apply, such as financing or inspection requirements. Be specific about the terms.

- Have both parties sign and date the form at the bottom. Ensure that all signatures are in the appropriate places.

- Make copies of the completed form for all parties involved.

After filling out the form, review it carefully to ensure all information is accurate. Once all parties have signed, proceed with the next steps in the buying process, such as securing financing or scheduling inspections.

Misconceptions

Understanding the North Carolina Real Estate Purchase Agreement form is crucial for anyone involved in real estate transactions in the state. However, several misconceptions can lead to confusion. Here are four common misconceptions:

- The form is only for buyers. Many people believe that the Real Estate Purchase Agreement is solely for the buyer's benefit. In reality, this document protects the interests of both buyers and sellers. It outlines the terms of the sale and ensures that both parties understand their rights and obligations.

- Once signed, the agreement cannot be changed. Another misconception is that the agreement is set in stone once both parties sign it. In fact, amendments can be made if both the buyer and seller agree to the changes. This flexibility allows for adjustments based on negotiations or new circumstances.

- Only real estate agents can use the form. Some individuals think that only licensed real estate agents can fill out the Real Estate Purchase Agreement. However, anyone can use the form as long as they understand the terms and conditions. It’s important for buyers and sellers to be informed about what they are signing.

- The agreement guarantees a sale. Many believe that signing the Real Estate Purchase Agreement guarantees that the sale will go through. While it is a significant step in the process, various factors can still prevent the sale from being completed, such as financing issues or inspection problems.

By addressing these misconceptions, individuals can approach the North Carolina Real Estate Purchase Agreement with a clearer understanding, leading to more informed decisions during their real estate transactions.

Key takeaways

When filling out and using the North Carolina Real Estate Purchase Agreement form, consider the following key takeaways:

- Ensure all parties' names and contact information are accurately listed. Clarity in identification helps prevent disputes.

- Detail the property description thoroughly. Include the address, parcel number, and any relevant legal descriptions to avoid ambiguity.

- Understand the terms of the agreement, including the purchase price, earnest money deposit, and any contingencies. This knowledge is crucial for a smooth transaction.

- Review the closing timeline and procedures carefully. Knowing the steps involved will facilitate a more efficient closing process.

File Overview

| Fact Name | Description |

|---|---|

| Governing Law | The North Carolina Real Estate Purchase Agreement is governed by North Carolina General Statutes, particularly Chapter 47. |

| Parties Involved | The agreement typically involves a buyer and a seller, both of whom must be identified clearly in the document. |

| Property Description | A detailed description of the property being sold must be included, ensuring clarity about what is being transferred. |

| Purchase Price | The total purchase price must be stated, along with any earnest money deposits that are required. |

| Contingencies | Common contingencies may include financing, inspections, and appraisal, which protect the buyer's interests. |

| Closing Date | The agreement specifies a closing date, which is the date when the property ownership officially transfers from the seller to the buyer. |

| Disclosures | North Carolina law requires sellers to provide certain disclosures about the property, such as known defects or issues. |

| Signatures | The agreement must be signed by both parties to be legally binding, demonstrating mutual consent to the terms outlined. |