Free Quitclaim Deed Template for North Carolina

Create Other Popular Quitclaim Deed Forms for Different States

Quitclaim Deed Georgia - A quitclaim deed can expedite the gifting of property without needing a formal sale process.

The process of claiming disability benefits through the Employment Development Department (EDD) requires accurate documentation, making the EDD DE 2501 form an essential part of the application. For those who need guidance in completing this form, Fill PDF Forms offers valuable resources to ensure that all necessary information is correctly provided.

Quit Claim Deed Form Free - The simplicity of a Quitclaim Deed can be appealing, but it is important to understand its limitations.

Similar forms

A warranty deed serves a similar purpose to a quitclaim deed but offers a higher level of protection for the buyer. In a warranty deed, the seller guarantees that they hold clear title to the property and have the right to sell it. This means that if any issues arise regarding ownership or claims against the property, the seller is legally responsible for resolving them. The assurance provided by a warranty deed can be crucial for buyers who want to ensure their investment is secure.

Another document that bears resemblance to the quitclaim deed is the bargain and sale deed. This type of deed implies that the seller has the right to transfer the property but does not provide any warranties against encumbrances. While it may not offer the same level of protection as a warranty deed, it still indicates that the seller has a claim to the property. Buyers should be cautious, as the lack of guarantees means they assume more risk in the transaction.

A special warranty deed is also similar to a quitclaim deed, though it offers a limited warranty. In this document, the seller guarantees that they have not encumbered the property during their ownership. However, it does not protect against any claims that may have arisen before the seller acquired the property. This type of deed can provide some assurance to buyers, but it is essential to understand the limitations it carries.

When navigating property ownership and potential eviction scenarios, understanding legal documents is crucial. For instance, the Arizona Notice to Quit is a vital form that landlords use to notify tenants of the need to vacate. This form can clarify intentions and provide necessary timelines, ensuring all parties are aware of their rights and responsibilities, which can be further understood through resources such as arizonapdfs.com/notice-to-quit-template.

Additionally, a deed of trust, while primarily a security instrument, shares similarities with a quitclaim deed in that it transfers interest in property. In a deed of trust, the borrower conveys the property to a trustee as security for a loan. If the borrower defaults, the trustee can sell the property to satisfy the debt. Although it serves a different function, the act of transferring property rights is a common thread between these documents.

Finally, a leasehold deed can also be compared to a quitclaim deed in terms of transferring rights. A leasehold deed conveys the right to use and occupy a property for a specified period. While it does not transfer ownership in the same way a quitclaim deed does, it reflects a temporary interest in the property. Understanding the nuances of these documents is crucial for anyone involved in real estate transactions.

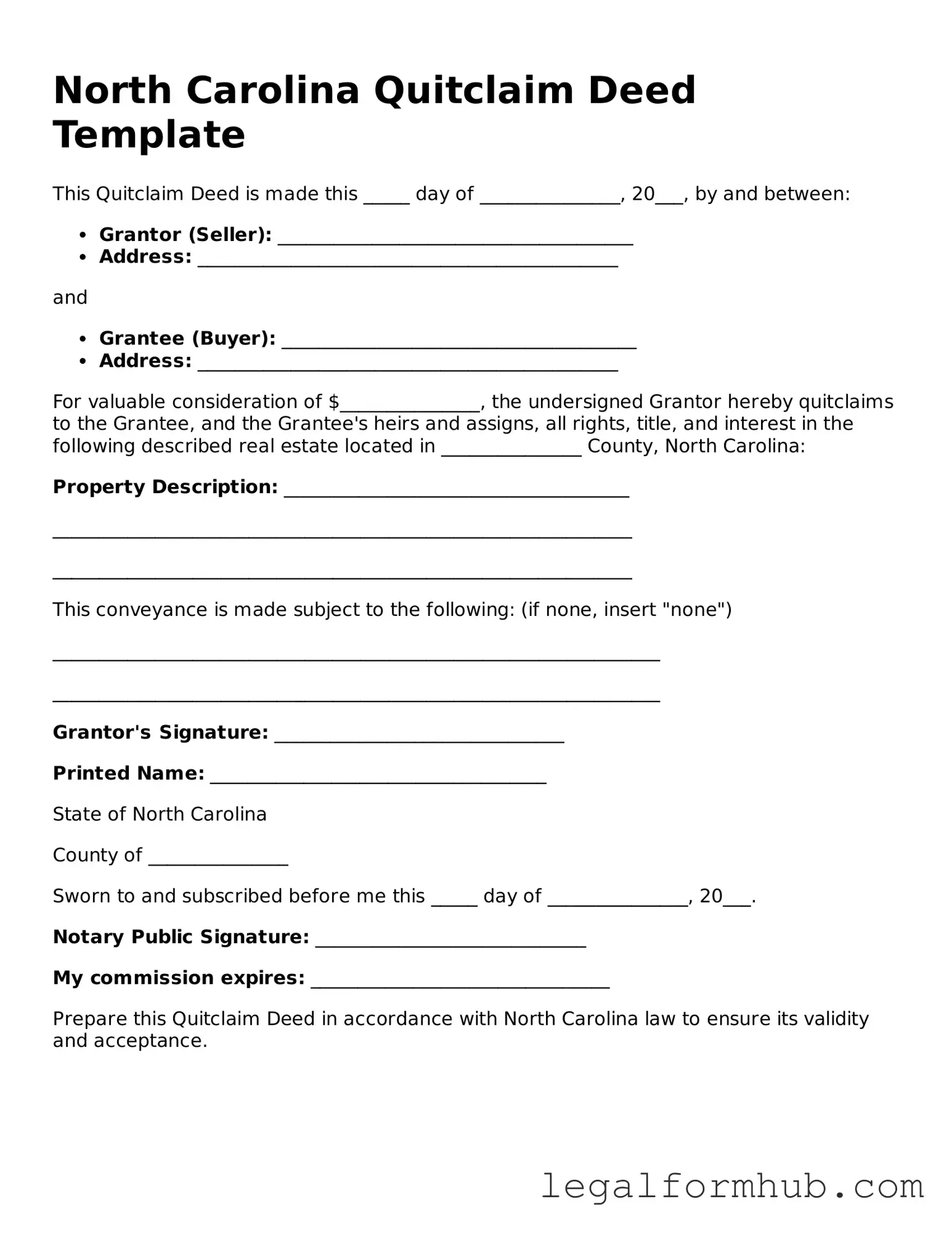

Instructions on Writing North Carolina Quitclaim Deed

Once you have the North Carolina Quitclaim Deed form in hand, it's time to fill it out carefully. Ensure that all information is accurate and complete to avoid any issues later. After completing the form, it will need to be signed and notarized before it can be filed with the appropriate county office.

- Obtain the Form: Download the Quitclaim Deed form from a reliable source or visit your local county office to get a physical copy.

- Identify the Grantor: Fill in the name of the person or entity transferring the property. This is the individual who currently holds the title.

- Identify the Grantee: Enter the name of the person or entity receiving the property. Ensure the name is spelled correctly and matches official identification.

- Describe the Property: Provide a clear description of the property being transferred. This should include the address, parcel number, and any legal description if applicable.

- Consideration: State the amount of money or value exchanged for the property. If it is a gift, you can indicate that as well.

- Sign the Form: The grantor must sign the form in the designated area. If there are multiple grantors, each must sign.

- Notarization: Take the signed form to a notary public. The notary will verify the identities of the signers and notarize the document.

- File the Deed: Submit the completed and notarized Quitclaim Deed to the county Register of Deeds office where the property is located.

Misconceptions

Many people hold misconceptions about the North Carolina Quitclaim Deed form. Understanding these misconceptions can help individuals make informed decisions regarding property transfers. Here are four common misunderstandings:

- Misconception 1: A quitclaim deed guarantees ownership.

- Misconception 2: A quitclaim deed is only for transferring property between family members.

- Misconception 3: A quitclaim deed can remove liens or encumbrances on the property.

- Misconception 4: A quitclaim deed does not need to be recorded.

In reality, a quitclaim deed transfers whatever interest the grantor has in the property but does not guarantee that the grantor actually owns the property. If the grantor has no legal claim, the recipient receives nothing.

This is not true. While quitclaim deeds are often used in family transactions, they can be used in any situation where a property interest needs to be transferred, regardless of the relationship between the parties.

This misconception is misleading. A quitclaim deed does not eliminate any existing liens or encumbrances. If there are outstanding debts or claims against the property, those will remain even after the transfer.

While it is not legally required to record a quitclaim deed in North Carolina, failing to do so can lead to complications. Recording the deed provides public notice of the property transfer, which is essential for establishing ownership and protecting against future claims.

Key takeaways

When filling out and using the North Carolina Quitclaim Deed form, consider the following key takeaways:

- Purpose: A quitclaim deed transfers ownership of property from one person to another without any warranties or guarantees.

- Parties Involved: The deed requires the names of the grantor (the person transferring the property) and the grantee (the person receiving the property).

- Property Description: A complete and accurate legal description of the property must be included. This often includes the parcel number and physical address.

- Consideration: The form typically requires a statement of consideration, which is the value exchanged for the property, even if it is nominal.

- Signature Requirement: The grantor must sign the deed in the presence of a notary public to validate the transfer.

- Recording: After execution, the deed should be recorded at the county register of deeds office to provide public notice of the property transfer.

- Tax Implications: Be aware of any tax implications that may arise from the transfer of property, including potential gift taxes.

- Legal Advice: Consulting with a legal professional is advisable to ensure that the deed meets all legal requirements and protects the interests of both parties.

File Overview

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed is a legal document that transfers ownership of property from one person to another without any warranties. |

| Governing Law | In North Carolina, quitclaim deeds are governed by the North Carolina General Statutes, specifically Chapter 47. |

| Purpose | This type of deed is often used to transfer property between family members or to clear up title issues. |

| Consideration | While a quitclaim deed can be executed with or without consideration, it is common for it to be done for little or no money. |

| Signature Requirements | The grantor (the person transferring the property) must sign the deed in front of a notary public for it to be valid. |

| Recording | To protect the interests of the new owner, the quitclaim deed should be recorded with the local county register of deeds. |

| Limitations | A quitclaim deed does not guarantee that the property is free from liens or other claims; it simply transfers whatever interest the grantor has. |

| Tax Implications | Transferring property via a quitclaim deed may have tax implications, so consulting a tax professional is advisable. |