Free Promissory Note Template for North Carolina

Create Other Popular Promissory Note Forms for Different States

Promissory Note Template Illinois - It can be used for personal loans, business loans, or real estate transactions.

The Employee Handbook form plays a crucial role in defining the relationship between the company and its employees, providing a comprehensive overview of workplace policies and expectations. To access a useful resource that can aid in completing this important document, visit https://pdftemplates.info which offers valuable templates and guidance.

Georgia Promissory Note - Under certain conditions, promissory notes can be modified with mutual consent.

Similar forms

A promissory note is a written promise to pay a specified amount of money at a designated time or on demand. It is a common financial instrument used in various transactions. One document similar to a promissory note is a loan agreement. Both documents outline the terms of a loan, including the principal amount, interest rate, and repayment schedule. However, a loan agreement often contains more detailed provisions regarding the obligations of the borrower and lender, including covenants and default clauses, making it more comprehensive than a simple promissory note.

An installment agreement is another document akin to a promissory note. Like a promissory note, it involves a borrower agreeing to repay a loan in a series of scheduled payments. The key difference lies in the structure; an installment agreement typically specifies the number of payments, their frequency, and the exact amounts due. This clarity can help both parties understand their obligations better, whereas a promissory note may simply state the total amount and the due date.

A mortgage is also similar to a promissory note, particularly in its function as a security instrument. When a borrower takes out a mortgage, they sign a promissory note as part of the transaction, which outlines the promise to repay the loan. The mortgage itself serves as collateral, giving the lender the right to take possession of the property if the borrower defaults. Thus, while the promissory note establishes the debt, the mortgage secures it with real property.

A lease agreement shares similarities with a promissory note in that both documents involve a promise to pay. In a lease, a tenant agrees to pay rent to a landlord over a specified term. Like a promissory note, the lease outlines the payment amount and due dates. However, a lease also includes terms regarding the use of the property, maintenance responsibilities, and conditions for termination, providing a broader framework for the relationship between the parties.

When it comes to eviction processes in New York, one important legal document is the Notice to Quit form. This form serves to formally notify tenants of their requirement to vacate the property due to lease violations or non-payment of rent. For those looking to initiate this process, you can find a helpful resource for the form that outlines the necessary steps and legal requirements.

An IOU, or "I owe you," is a more informal document that is similar to a promissory note. An IOU acknowledges a debt and states the amount owed, but it typically lacks the detailed terms found in a promissory note. While an IOU can serve as evidence of a debt, it may not provide the same legal protections or clarity regarding repayment terms, making it less formal and potentially riskier for the lender.

A bond is another document that resembles a promissory note, particularly in its function as a debt instrument. When an entity issues a bond, it promises to pay back the principal amount along with interest to the bondholder at a future date. Both bonds and promissory notes represent a promise to pay, but bonds are often used by governments and corporations to raise large sums of money, whereas promissory notes are typically used in personal or small business transactions.

Finally, a credit agreement is similar to a promissory note in that it outlines the terms under which a borrower can access credit. This document specifies the credit limit, interest rates, and repayment terms. While a promissory note is a promise to pay a specific amount, a credit agreement provides a framework for borrowing up to a certain limit, allowing for more flexibility in how and when the borrower can access funds.

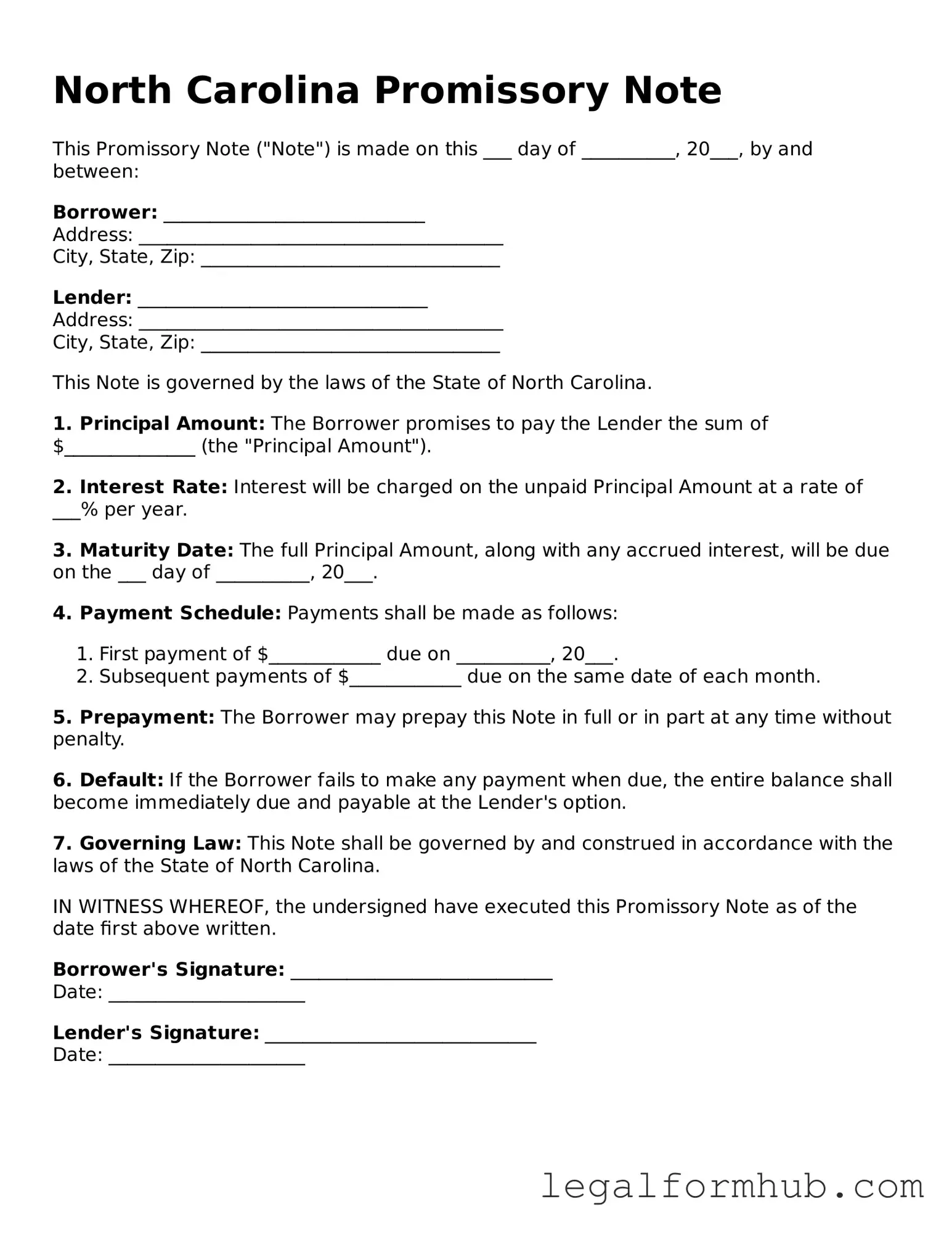

Instructions on Writing North Carolina Promissory Note

After obtaining the North Carolina Promissory Note form, you will need to fill it out accurately to ensure it serves its purpose. Follow these steps carefully to complete the form correctly.

- Enter the Date: Write the date when the note is being created at the top of the form.

- Borrower Information: Fill in the full name and address of the borrower. This is the person who will be repaying the loan.

- Lender Information: Provide the full name and address of the lender. This is the individual or entity providing the loan.

- Loan Amount: Clearly state the amount of money being borrowed. Make sure to write this in both numbers and words for clarity.

- Interest Rate: Specify the interest rate applicable to the loan, if any. Indicate whether it is fixed or variable.

- Payment Terms: Describe how and when payments will be made. Include details about the payment schedule, such as monthly or bi-weekly payments.

- Maturity Date: Indicate the date when the loan must be fully repaid.

- Signatures: Both the borrower and lender must sign and date the form. This confirms agreement to the terms outlined.

- Witness or Notary: Depending on your needs, you may want to have a witness or notary public sign the document for added validity.

Misconceptions

Understanding the North Carolina Promissory Note form is essential for individuals and businesses engaging in lending and borrowing. However, several misconceptions can lead to confusion. Here are seven common misconceptions about the North Carolina Promissory Note form:

- It must be notarized. Many believe that a promissory note must be notarized to be valid. In North Carolina, notarization is not a requirement for the note to be enforceable, though it can provide additional legal protection.

- Only banks can issue promissory notes. This is incorrect. Individuals and businesses can create and use promissory notes. They are not limited to financial institutions.

- All promissory notes are the same. Promissory notes can vary significantly in terms of terms, conditions, and legal language. Each note should be tailored to the specific agreement between the parties involved.

- Verbal agreements are sufficient. While verbal agreements can be legally binding, they are difficult to enforce. A written promissory note provides clear evidence of the terms agreed upon.

- Interest rates must be fixed. Some assume that interest rates in promissory notes must be fixed. In reality, interest can be either fixed or variable, depending on what the parties agree upon.

- Promissory notes are only for large amounts. This is a misconception. Promissory notes can be used for both small and large sums of money, making them versatile financial tools.

- They are not legally binding. Some people believe that promissory notes lack legal weight. In fact, when properly executed, they are enforceable contracts that can be upheld in court.

By addressing these misconceptions, individuals can better navigate the complexities of promissory notes in North Carolina and make informed decisions regarding their financial agreements.

Key takeaways

When filling out and using the North Carolina Promissory Note form, keep these key takeaways in mind:

- Ensure all parties involved are clearly identified. This includes the borrower and the lender.

- Specify the loan amount and the interest rate, if applicable. This information is crucial for clarity.

- Include the repayment terms. Outline how and when payments will be made to avoid confusion later.

- Consider adding a default clause. This can protect the lender in case the borrower fails to make payments.

- Both parties should sign and date the document. This confirms agreement and makes the note legally binding.

File Overview

| Fact Name | Details |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated person or bearer at a specified time. |

| Governing Law | The North Carolina Uniform Commercial Code (UCC) governs promissory notes in North Carolina. |

| Parties Involved | The two main parties involved are the maker (borrower) and the payee (lender). |

| Essential Elements | A valid promissory note must include the principal amount, interest rate, payment terms, and signatures of the parties. |

| Interest Rate | North Carolina allows parties to agree on an interest rate, but it must comply with state usury laws. |

| Default Consequences | If the borrower defaults, the lender may pursue legal remedies, including collection actions or foreclosure on collateral. |

| Transferability | Promissory notes in North Carolina are generally negotiable, allowing lenders to transfer their rights to third parties. |

| Record Keeping | It is advisable to keep a copy of the promissory note for personal records and to document all payments made. |