Free Operating Agreement Template for North Carolina

Create Other Popular Operating Agreement Forms for Different States

Is an Operating Agreement Required for an Llc - Helps maintain organizational structure as the business grows.

Completing the California Vehicle Purchase Agreement form is vital for both buyers and sellers to establish a clear understanding of the vehicle transaction. By detailing factors such as the purchase price and vehicle specifics, this form helps to prevent misunderstandings and protects the interests of all parties involved. To get started on this important step in your vehicle purchase process, you can easily Fill PDF Forms for a seamless experience.

State Filing Fee for Llc in Texas - This document often includes provisions for adding or removing members.

Similar forms

The North Carolina Operating Agreement form is similar to the Limited Liability Company (LLC) Operating Agreement used in other states. Like its North Carolina counterpart, this document outlines the management structure, ownership percentages, and operational procedures of the LLC. It serves as a foundational document that helps prevent misunderstandings among members by clearly defining roles and responsibilities, making it essential for any LLC regardless of location.

Another document that shares similarities is the Partnership Agreement. This agreement governs the relationship between partners in a business venture. Much like the Operating Agreement, it specifies each partner's contributions, profit-sharing arrangements, and decision-making processes. Both documents aim to establish clear guidelines to minimize disputes and ensure smooth operations.

The Shareholders Agreement is another relevant document. This agreement is typically used by corporations to outline the rights and responsibilities of shareholders. Similar to an Operating Agreement, it addresses issues such as voting rights, transfer of shares, and management roles. Both documents are designed to protect the interests of the parties involved and provide a clear framework for decision-making.

A Joint Venture Agreement also bears resemblance to the North Carolina Operating Agreement. This document is used when two or more parties collaborate on a specific project while retaining their separate identities. Like an Operating Agreement, it defines the roles, contributions, and profit-sharing arrangements of each party, ensuring that all participants are aligned in their goals and expectations.

The Bylaws of a corporation are another document that shares commonalities with the Operating Agreement. Bylaws govern the internal management of a corporation, detailing procedures for meetings, voting, and the appointment of officers. Both documents are essential for establishing a clear governance structure and ensuring that all parties understand their rights and responsibilities.

A Non-Disclosure Agreement (NDA) is also somewhat similar, particularly in the context of protecting sensitive information. While it does not govern the operational aspects of a business, it establishes confidentiality obligations that can complement the provisions in an Operating Agreement. Both documents are designed to safeguard the interests of the parties involved and maintain trust within the business relationship.

In addition to the various agreements discussed, it is important to highlight the significance of a Non-disclosure Agreement (NDA), which can be crucial for businesses to protect their proprietary information and trade secrets. To create a detailed and effective NDA, you can refer to templates available online, such as the one found at https://arizonapdfs.com/non-disclosure-agreement-template, ensuring that all necessary clauses are adequately covered to uphold confidentiality and trust within business relationships.

The Employment Agreement is another document that shares some characteristics. This agreement outlines the terms of employment between an employer and an employee, including duties, compensation, and termination conditions. Similar to an Operating Agreement, it sets clear expectations and responsibilities, helping to prevent misunderstandings and disputes in the workplace.

A Franchise Agreement also shares similarities with the Operating Agreement. This document governs the relationship between a franchisor and a franchisee, outlining the rights and obligations of both parties. Like an Operating Agreement, it includes details about operational procedures, fees, and the overall management structure, ensuring that both parties are aligned in their business objectives.

Lastly, the Loan Agreement can be likened to the Operating Agreement in the sense that it outlines the terms and conditions of a loan between a lender and a borrower. While primarily focused on financial obligations, it often includes provisions related to the use of funds and the management of the business, similar to how an Operating Agreement details the operational framework of an LLC.

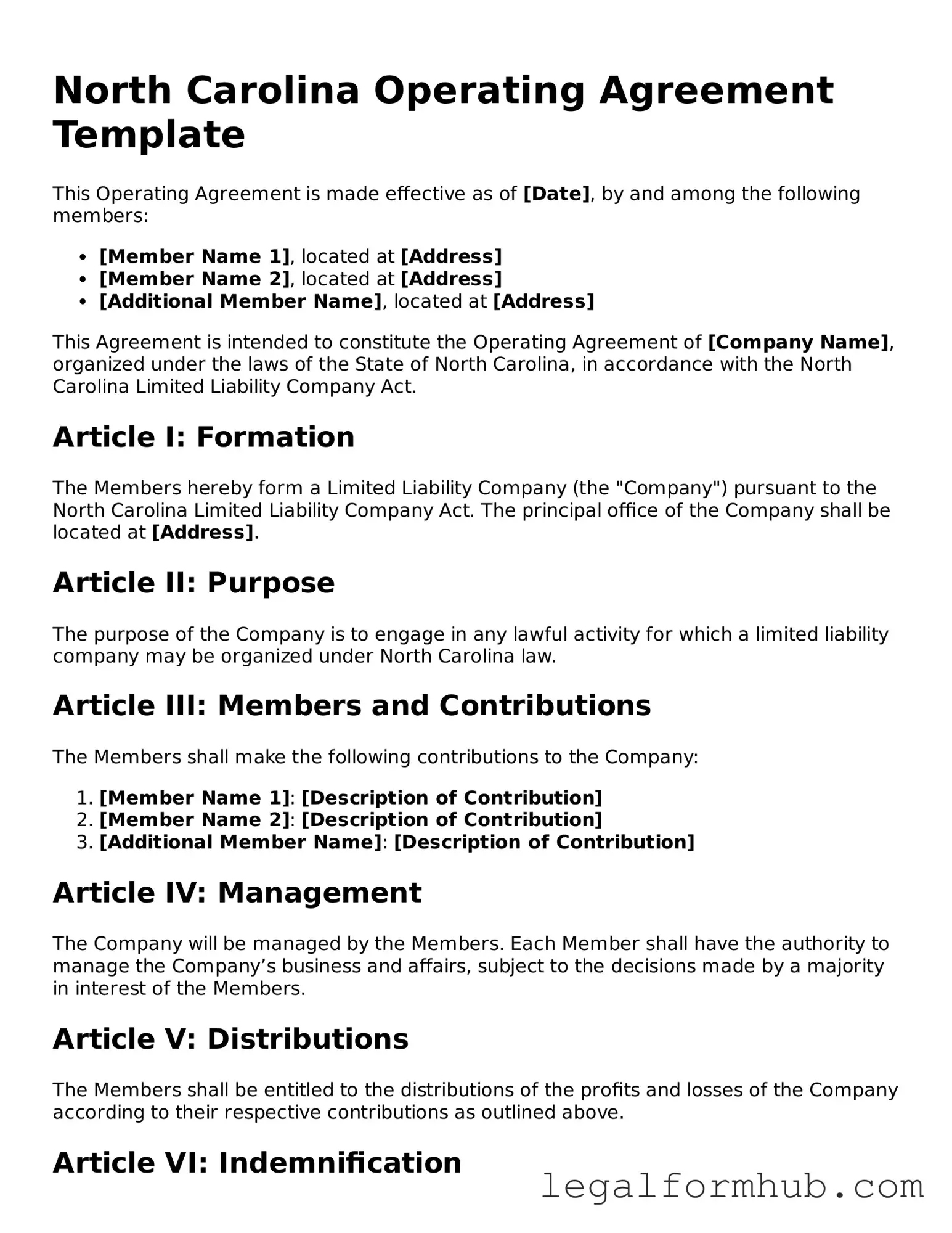

Instructions on Writing North Carolina Operating Agreement

Completing the North Carolina Operating Agreement form is an important step for establishing your business structure. After filling out this form, you will have a clear understanding of the rules and regulations governing your business operations. This will help ensure that all members are on the same page regarding their rights and responsibilities.

- Begin by gathering all necessary information about your business, including the name, address, and purpose of your LLC.

- Identify the members of the LLC. List each member's full name and address.

- Determine the percentage of ownership for each member. Clearly outline how profits and losses will be distributed.

- Decide on the management structure. Specify whether the LLC will be managed by members or appointed managers.

- Include provisions for meetings. Specify how often meetings will occur and the process for notifying members.

- Outline the process for adding new members or removing existing ones. Clearly define the steps that need to be followed.

- Discuss how disputes among members will be resolved. Consider including mediation or arbitration as options.

- Review the completed form carefully. Ensure all information is accurate and all members agree with the contents.

- Have all members sign the agreement. This signifies their acceptance of the terms outlined in the document.

Once the form is completed and signed, keep it in a safe place. This document will serve as a reference for your LLC's operations and member responsibilities.

Misconceptions

When it comes to the North Carolina Operating Agreement form, several misconceptions can lead to confusion among business owners. Understanding the truth behind these myths is crucial for proper compliance and effective business management.

- Misconception 1: The Operating Agreement is not necessary for LLCs.

- Misconception 2: The Operating Agreement must be filed with the state.

- Misconception 3: All Operating Agreements are the same.

- Misconception 4: Once created, the Operating Agreement cannot be changed.

Many people believe that an Operating Agreement is optional for Limited Liability Companies (LLCs) in North Carolina. However, while it is not legally required, having one is highly recommended. This document outlines the management structure and operational procedures, helping to prevent disputes among members.

Some individuals think that the Operating Agreement needs to be submitted to the North Carolina Secretary of State. In reality, this document is kept internally within the company. It does not need to be filed, but it is essential to maintain it for reference and legal protection.

There is a common belief that a standard template can be used for all LLCs. This is misleading. Each Operating Agreement should be tailored to fit the specific needs and structure of the business. Customizing the agreement ensures that it accurately reflects the members' intentions and operational strategies.

Many assume that an Operating Agreement is a permanent document that cannot be altered. In fact, it can be amended as needed. Members should review and update the agreement periodically to ensure it remains relevant to the business's evolving circumstances.

Key takeaways

When preparing to fill out and utilize the North Carolina Operating Agreement form, consider these essential takeaways:

- Understand the Purpose: The Operating Agreement outlines the management structure and operating procedures of your LLC. It serves as a roadmap for how your business will function.

- Include All Members: Ensure that all members of the LLC are included in the agreement. This fosters transparency and sets clear expectations for everyone involved.

- Define Roles and Responsibilities: Clearly outline the roles of each member. Specify who handles day-to-day operations and who makes major decisions.

- Address Financial Contributions: Document each member's initial financial contribution. This helps prevent disputes over ownership percentages and profit sharing.

- Establish Voting Procedures: Determine how decisions will be made. Specify whether voting will be based on ownership percentage or one member, one vote.

- Plan for Changes: Include provisions for adding new members or handling the departure of existing ones. This ensures your LLC can adapt over time.

- Legal Compliance: Ensure the agreement complies with North Carolina laws. This helps protect your business and its members from potential legal issues.

- Review Regularly: Periodically review and update the Operating Agreement as needed. Changes in the business or membership may require adjustments to the document.

File Overview

| Fact Name | Description |

|---|---|

| Governing Law | The North Carolina Operating Agreement is governed by the North Carolina General Statutes, specifically Chapter 57D. |

| Purpose | This document outlines the management structure and operating procedures for a limited liability company (LLC) in North Carolina. |

| Membership Details | The agreement specifies the rights and responsibilities of each member of the LLC. |

| Flexibility | Members can customize the agreement to suit their specific business needs and preferences. |

| Dispute Resolution | It may include provisions for resolving disputes among members, such as mediation or arbitration. |

| Financial Arrangements | The agreement typically addresses how profits and losses will be distributed among members. |

| Amendments | Members can outline the process for making amendments to the agreement as needed. |

| Duration | The operating agreement can specify the duration of the LLC, whether it is perpetual or for a set term. |

| Compliance | Having an operating agreement helps ensure compliance with state laws and regulations. |

| Not Mandatory | While not required by law, an operating agreement is highly recommended for LLCs in North Carolina. |