Free Last Will and Testament Template for North Carolina

Create Other Popular Last Will and Testament Forms for Different States

Last Will and Testament Template Georgia - Can identify military service or other special considerations for the estate.

For those navigating legal matters, understanding the importance of a "Hold Harmless Agreement" is vital; it can be an essential tool in protecting your interests. Explore how this agreement can safeguard you by visiting our detailed overview of the relevant Hold Harmless Agreement implications.

Wills in Texas - An opportunity to communicate values and wishes to heirs.

Free Ohio Last Will and Testament Form Pdf - A method to avoid family disputes by clearly stating your wishes.

Similar forms

The North Carolina Last Will and Testament form shares similarities with a Living Will. A Living Will outlines an individual's preferences regarding medical treatment in situations where they cannot communicate their wishes. Both documents express the individual's intentions and provide guidance to others. While the Last Will and Testament deals with the distribution of assets after death, the Living Will focuses on healthcare decisions during life, highlighting the importance of personal choices in both scenarios.

Another document similar to the Last Will and Testament is the Durable Power of Attorney. This document allows a person to appoint someone else to make financial or legal decisions on their behalf if they become incapacitated. Like a Last Will, it ensures that the individual's wishes are honored. However, the Durable Power of Attorney is effective during the person’s lifetime, whereas the Last Will takes effect only after death, showcasing the need for planning in both life and afterlife matters.

The North Carolina Last Will and Testament also resembles a Trust. A Trust can manage assets during a person's lifetime and distribute them after their death. Both documents aim to protect the individual's wishes regarding their estate. However, a Trust may provide more privacy and avoid probate, while a Last Will typically goes through the probate process. This difference highlights the various options available for estate planning.

A Codicil is another document that relates closely to the Last Will and Testament. A Codicil is an amendment or addition to an existing will. It allows individuals to update their wishes without creating an entirely new document. Both serve the purpose of expressing the individual’s desires regarding their estate, but a Codicil specifically modifies an existing will, demonstrating the flexibility in estate planning.

The North Carolina Last Will and Testament is also similar to a Letter of Instruction. This informal document provides additional guidance to the executor or loved ones about the deceased's wishes. While a Last Will outlines legal directives for asset distribution, a Letter of Instruction can cover personal matters, such as funeral arrangements or the location of important documents. Together, they offer a comprehensive view of an individual’s intentions.

Another related document is the Revocable Living Trust. Like the Last Will, this trust manages the distribution of assets, but it does so while the person is still alive. A Revocable Living Trust can be changed or revoked at any time, offering flexibility. Both documents serve to ensure that a person’s wishes regarding their estate are fulfilled, but they operate under different circumstances and timelines.

In the realm of legal documents, understanding the significance of each form can greatly influence one's future, especially when considering an Emotional Support Animal Letter form. This form serves as a vital tool for individuals seeking to articulate their need for the companionship of an emotional support animal, which can significantly enhance mental health and well-being. Whether navigating housing or travel arrangements, having such documentation is essential. For those looking to initiate the process, it's advisable to visit Fill PDF Forms and begin the journey toward securing the support you need.

The North Carolina Last Will and Testament is also comparable to a Healthcare Power of Attorney. This document allows an individual to designate someone to make medical decisions on their behalf if they are unable to do so. Both documents reflect personal choices and preferences, ensuring that an individual’s values are respected, whether in financial or medical matters.

Finally, the North Carolina Last Will and Testament is similar to a Financial Power of Attorney. This document grants someone authority to handle financial matters for another person. Both documents emphasize the importance of having trusted individuals manage one’s affairs, whether in life or after death. They ensure that the individual’s wishes are carried out, providing peace of mind for everyone involved.

Instructions on Writing North Carolina Last Will and Testament

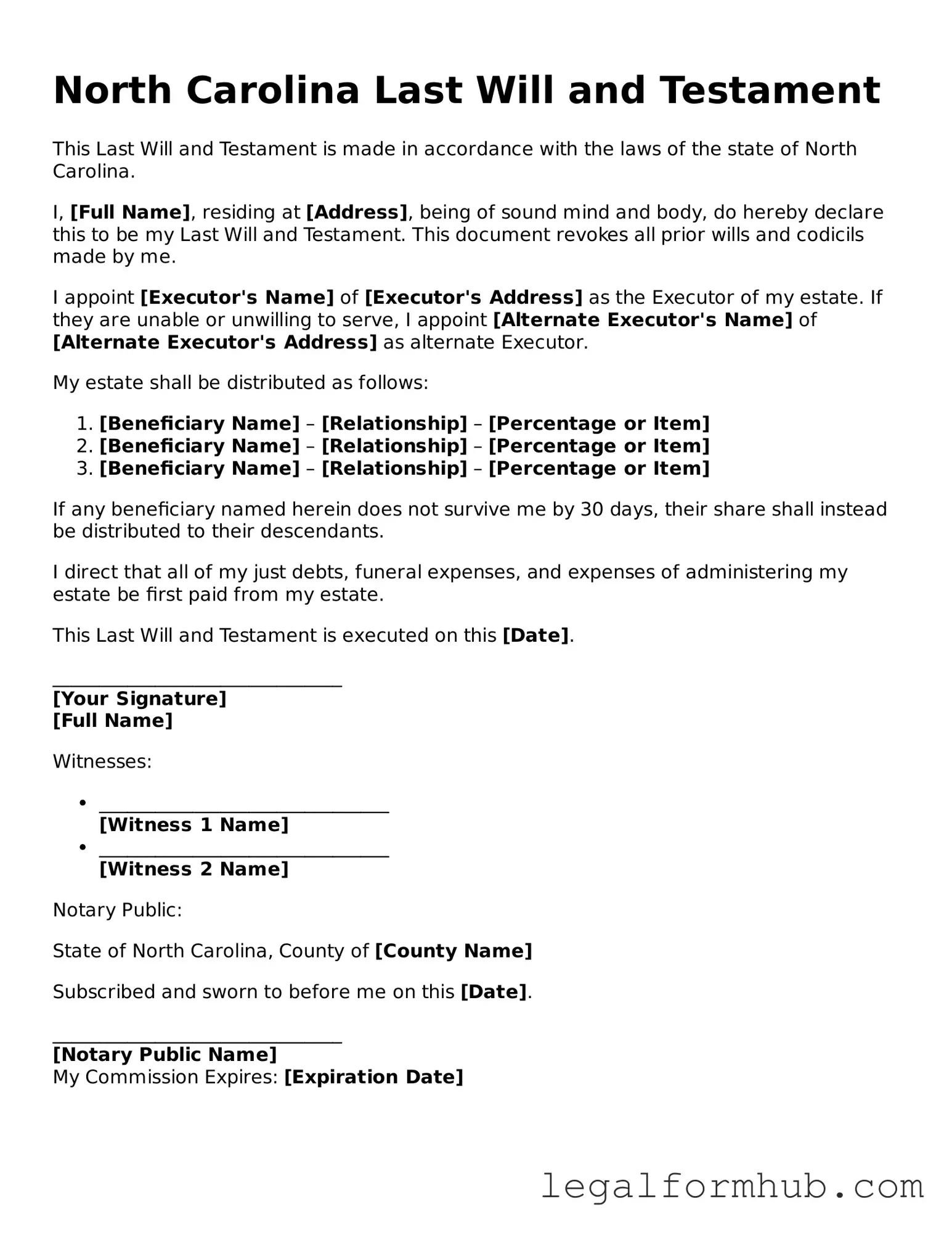

After gathering the necessary information, you are ready to fill out the North Carolina Last Will and Testament form. This document allows individuals to outline their wishes regarding the distribution of their assets after death. Ensure that you have all required details at hand for a smooth completion process.

- Begin by writing your full legal name at the top of the form.

- Provide your current address, including city, state, and zip code.

- State your date of birth clearly.

- Designate an executor by writing their full name and address. This person will be responsible for managing your estate.

- List the beneficiaries by writing their names and the specific assets or amounts they will receive.

- Include any specific instructions regarding funeral arrangements or other personal wishes.

- Sign and date the document at the designated area. Ensure your signature is clear.

- Have at least two witnesses sign the document. They should also print their names and provide their addresses.

- Consider having the will notarized for added legal validity.

Once completed, store the document in a safe place. Inform your executor and trusted family members of its location. Regularly review and update the will as necessary to reflect any changes in your circumstances or wishes.

Misconceptions

Understanding the North Carolina Last Will and Testament form is crucial for anyone looking to plan their estate. However, several misconceptions can lead to confusion. Here are ten common misconceptions:

-

All wills must be notarized to be valid. Many people believe that notarization is necessary for a will to be legally binding in North Carolina. In reality, a will can be valid without a notary, as long as it is signed by the testator and witnessed by two individuals.

-

Verbal wills are acceptable. Some assume that a verbal will can hold up in court. In North Carolina, a will must be in writing to be valid. Verbal statements do not meet the legal requirements.

-

Only lawyers can draft a will. While legal assistance can be beneficial, individuals can create their own wills. North Carolina law allows for homemade wills, as long as they meet the state’s requirements.

-

A will automatically go into effect upon signing. Many believe that signing a will immediately puts it into action. However, a will only takes effect after the testator's death.

-

All assets must be listed in the will. Some think that every single asset must be included in the will. While it’s important to outline significant assets, not every item needs to be specified.

-

Wills are only for wealthy individuals. This misconception suggests that only those with substantial assets need a will. In reality, anyone can benefit from having a will, regardless of their financial situation.

-

Once a will is created, it cannot be changed. Many people fear that a will is set in stone after it is signed. However, wills can be amended or revoked at any time, as long as the testator is mentally competent.

-

Wills avoid probate. Some believe that having a will means their estate will bypass the probate process. In fact, all wills must go through probate to ensure that the wishes of the deceased are carried out.

-

Only the oldest will is valid. There is a belief that only the first will created is the one that counts. In North Carolina, the most recent will that meets legal requirements is the one that is honored.

-

Wills are only necessary for adults. Some think that only adults need wills. However, parents of minor children should consider a will to designate guardianship and manage their children's inheritance.

Clearing up these misconceptions can help individuals make informed decisions about their estate planning in North Carolina.

Key takeaways

When it comes to creating a Last Will and Testament in North Carolina, understanding the process is essential. Here are some key takeaways to keep in mind:

- Legal Age Requirement: You must be at least 18 years old to create a valid will in North Carolina.

- Sound Mind: It is crucial that you are of sound mind when drafting your will, meaning you understand the nature of the document and its implications.

- Written Document: The will must be in writing. Oral wills are not recognized in North Carolina.

- Signature Requirement: You must sign the will at the end. If you are unable to sign, you can have someone sign on your behalf in your presence.

- Witnesses: At least two witnesses must sign the will. They should not be beneficiaries to avoid potential conflicts of interest.

- Revocation: You can revoke or change your will at any time, as long as you follow the proper procedures, such as creating a new will or destroying the old one.

- Probate Process: After your passing, the will must go through probate, a legal process that validates the will and oversees the distribution of your assets.

- Consultation Recommended: While you can create a will on your own, consulting with an attorney can ensure that your wishes are clearly articulated and legally binding.

These points serve as a guide to navigating the important task of creating a Last Will and Testament in North Carolina. Being informed can help ensure that your wishes are honored and that your loved ones are taken care of after your passing.

File Overview

| Fact Name | Details |

|---|---|

| Governing Law | The North Carolina Last Will and Testament is governed by Chapter 31 of the North Carolina General Statutes. |

| Signature Requirement | A valid will in North Carolina must be signed by the testator or in the testator's presence and at their direction. |

| Witness Requirement | North Carolina law requires at least two witnesses to sign the will, who must be present at the same time. |

| Revocation | A will can be revoked in North Carolina by creating a new will or by physically destroying the existing will with the intent to revoke it. |