Free Lady Bird Deed Template for North Carolina

Create Other Popular Lady Bird Deed Forms for Different States

How to File a Lady Bird Deed in Michigan - This legal document avoids the complications of intestate succession if there is no will.

To create a successful rental arrangement in California, it is crucial to utilize the California Lease Agreement form, as it provides a structured approach to defining the attributes of the lease. Ensure that both parties understand their obligations clearly to avoid disputes in the future. For those ready to begin the process, you can easily access the necessary documentation through Fill PDF Forms.

Texas Transfer on Death Deed Form - Individuals can specifically outline conditions and restrictions tied to the property's use.

Similar forms

The North Carolina Lady Bird Deed is similar to a traditional life estate deed. Both documents allow a property owner to retain certain rights during their lifetime, such as the right to live in and use the property. However, a traditional life estate deed typically requires the property to pass to a designated beneficiary upon the owner's death, while the Lady Bird Deed allows the owner to retain the ability to sell or change the beneficiaries without needing consent from them. This flexibility is a significant advantage of the Lady Bird Deed over the traditional life estate deed.

Another document that shares similarities with the Lady Bird Deed is the revocable living trust. Both instruments are used to manage property and facilitate a smooth transfer upon death. A revocable living trust allows the property owner to maintain control over the assets during their lifetime and can be altered at any time. However, unlike the Lady Bird Deed, which automatically transfers property upon death, a revocable living trust requires the trust to be properly funded and may involve more complex administration processes.

The North Carolina Lady Bird Deed also bears resemblance to a transfer-on-death (TOD) deed. Both documents enable property owners to designate beneficiaries who will receive the property upon the owner's death without going through probate. The key difference lies in the rights retained by the property owner. With a TOD deed, the owner cannot sell or mortgage the property without the beneficiary's consent, while the Lady Bird Deed allows for complete control until death.

When navigating the complexities of educational documentation, families considering homeschooling may find it beneficial to familiarize themselves with the process of submitting essential forms like the Arizona Homeschool Letter of Intent, which can be found at arizonapdfs.com/homeschool-letter-of-intent-template/. This formal document is crucial for officially notifying the state of a parent's choice to homeschool, ensuring clarity and compliance with educational regulations.

Similar to the Lady Bird Deed is the warranty deed, which provides a guarantee that the property title is clear and free of liens. While both documents serve to transfer property, the warranty deed does not allow for the retention of rights by the seller after the transfer. Once a warranty deed is executed, the seller relinquishes all rights to the property, unlike the Lady Bird Deed, which allows the owner to maintain control until death.

The quitclaim deed is another document that has similarities to the Lady Bird Deed. Both can be used to transfer property, but a quitclaim deed does not guarantee that the title is clear. Instead, it merely transfers whatever interest the grantor has in the property. The Lady Bird Deed, in contrast, ensures that the property owner retains rights during their lifetime and provides a clear pathway for the property to pass to beneficiaries upon death.

The durable power of attorney (DPOA) also shares some characteristics with the Lady Bird Deed in terms of property management. A DPOA allows an individual to appoint someone else to make decisions regarding their property while they are alive. However, unlike the Lady Bird Deed, which specifically deals with the transfer of property upon death, a DPOA is focused on managing property and affairs during the principal's lifetime and does not directly address what happens after death.

Lastly, the general warranty deed can be compared to the Lady Bird Deed in terms of property transfer. Both documents facilitate the conveyance of real estate, but a general warranty deed offers a higher level of protection to the buyer, ensuring that the seller is responsible for any issues with the title. The Lady Bird Deed, while allowing for a smooth transfer upon death, does not provide such guarantees and primarily focuses on retaining the owner's rights during their lifetime.

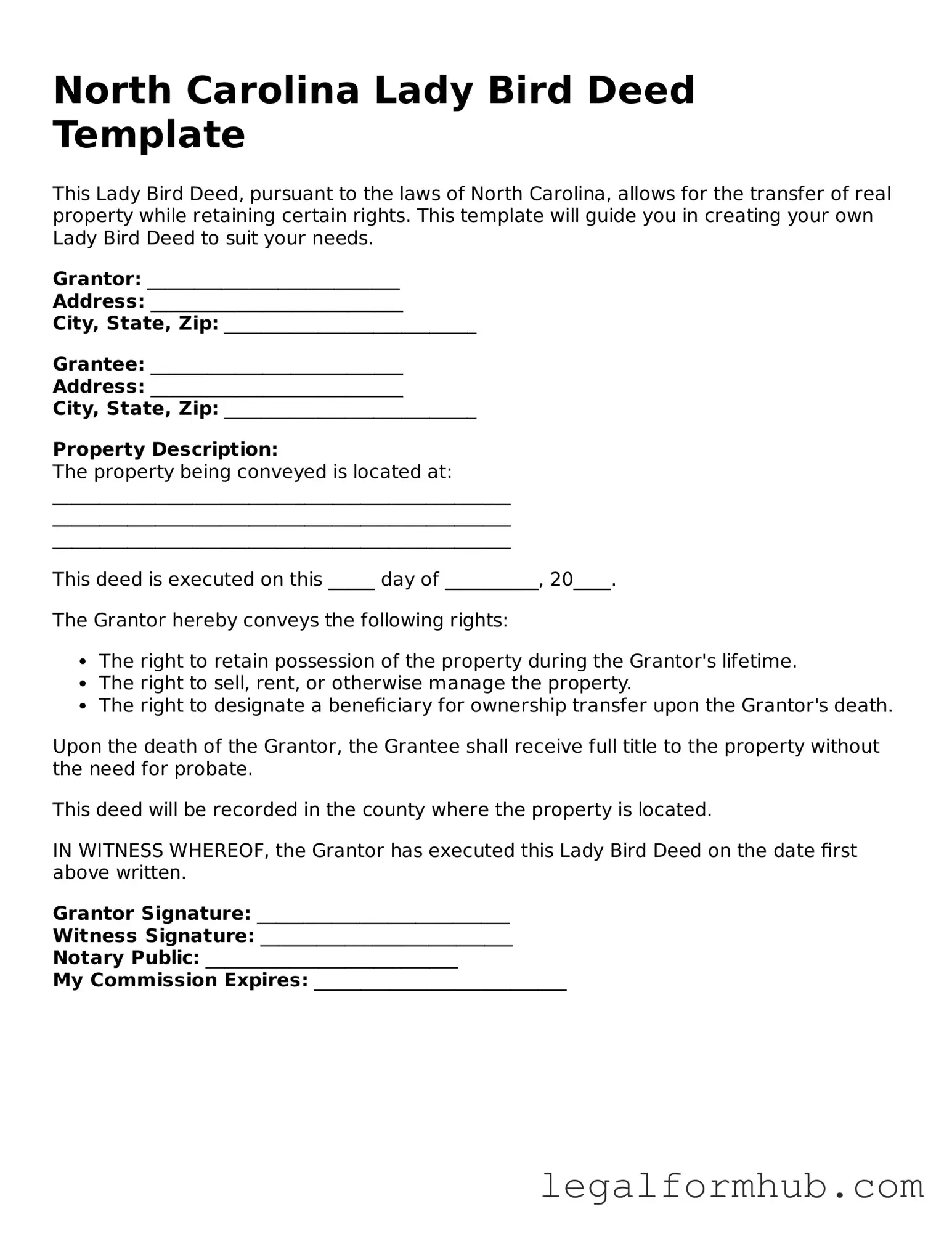

Instructions on Writing North Carolina Lady Bird Deed

Filling out the North Carolina Lady Bird Deed form is an important step in ensuring your property is transferred according to your wishes. After completing the form, you'll need to have it signed and notarized before filing it with the appropriate county office. This process helps to secure your intent regarding property ownership and can simplify matters for your heirs.

- Begin by downloading the North Carolina Lady Bird Deed form from a reliable source.

- Read through the entire form carefully to understand the required information.

- Fill in your name as the current owner of the property at the top of the form.

- Provide the legal description of the property. This can usually be found on your property deed or tax records.

- Enter the name of the beneficiary or beneficiaries who will receive the property upon your passing.

- Specify any conditions or limitations regarding the transfer of the property, if applicable.

- Sign the form in the designated area. Ensure your signature matches the name provided at the top.

- Have the form notarized. A notary public will verify your identity and witness your signature.

- Make copies of the completed and notarized form for your records.

- File the original form with the Register of Deeds in the county where the property is located.

Misconceptions

The North Carolina Lady Bird Deed form is a useful estate planning tool, but several misconceptions surround it. Understanding these misconceptions can help individuals make informed decisions about their property and estate planning. Here are five common misunderstandings:

-

It’s only for married couples.

This is not true. The Lady Bird Deed can be used by anyone who owns property, regardless of marital status. Single individuals, partners, and families can all benefit from this type of deed.

-

It avoids probate entirely.

While a Lady Bird Deed can simplify the transfer of property upon death and may avoid some probate processes, it does not eliminate probate for all assets. Other properties or assets may still require probate.

-

It’s the same as a regular transfer on death deed.

Although both deeds allow for property transfer upon death, a Lady Bird Deed provides the grantor with more control during their lifetime. The grantor can sell or mortgage the property without needing consent from the beneficiaries.

-

It’s only for real estate.

While the Lady Bird Deed specifically pertains to real estate, it can be part of a broader estate plan that includes various types of assets. It is important to consider how all assets will be managed and transferred.

-

It’s a complicated legal document.

Many people believe that the Lady Bird Deed is complex, but it can be straightforward when properly understood. With the right guidance, individuals can create a Lady Bird Deed that meets their needs without excessive difficulty.

By dispelling these misconceptions, individuals can better understand the benefits and limitations of the North Carolina Lady Bird Deed form. It’s always wise to consult with a knowledgeable professional when considering estate planning options.

Key takeaways

Filling out and using the North Carolina Lady Bird Deed form can be a straightforward process if you keep a few important points in mind. Here are some key takeaways to consider:

- The Lady Bird Deed allows property owners to transfer their real estate to beneficiaries while retaining control during their lifetime.

- It is particularly useful for avoiding probate, which can save time and money for your heirs.

- When filling out the form, ensure that all names and property descriptions are accurate to avoid future disputes.

- This deed can provide tax benefits, as it may help minimize estate taxes for your heirs.

- Unlike traditional life estate deeds, a Lady Bird Deed allows the property owner to sell or mortgage the property without needing consent from the beneficiaries.

- Consulting with a legal professional is advisable to ensure that the deed aligns with your overall estate planning goals.

- Make sure to record the deed with the local register of deeds office to make it legally binding.

- Review the deed periodically, especially after significant life changes, to ensure it still reflects your wishes.

File Overview

| Fact Name | Description |

|---|---|

| Purpose | The North Carolina Lady Bird Deed allows property owners to transfer real estate to beneficiaries while retaining control during their lifetime. |

| Governing Law | This deed is governed by North Carolina General Statutes § 31-41.1. |

| Retained Interest | Property owners maintain the right to live in and use the property for the duration of their lives. |

| Transfer on Death | The property automatically transfers to the designated beneficiaries upon the owner's death without going through probate. |

| Tax Implications | Using a Lady Bird Deed may help avoid capital gains taxes for beneficiaries, as the property receives a step-up in basis. |

| Revocability | The deed can be revoked or modified at any time during the owner’s lifetime, providing flexibility. |