Free Durable Power of Attorney Template for North Carolina

Create Other Popular Durable Power of Attorney Forms for Different States

Does Durable Power of Attorney Cover Medical - It protects your interests should you become temporarily ill or injured.

A Non-disclosure Agreement (NDA) in Arizona is a legal document that protects confidential information shared between parties. This agreement ensures that sensitive information remains private and is not disclosed to unauthorized individuals. By signing an NDA, parties can foster trust and encourage open communication while safeguarding their interests. For more information, you can visit arizonapdfs.com/non-disclosure-agreement-template.

Power of Attorney Form Chicago - It may also outline how to handle your personal property during a crisis.

Similar forms

The North Carolina Durable Power of Attorney form shares similarities with the General Power of Attorney. Both documents grant an individual the authority to act on behalf of another person in various matters, such as financial decisions and legal transactions. However, the key distinction lies in the durability aspect. While a General Power of Attorney may become invalid if the principal becomes incapacitated, a Durable Power of Attorney remains effective even if the principal is unable to make decisions due to health issues. This ensures continuity in decision-making during critical times.

Another document that resembles the Durable Power of Attorney is the Healthcare Power of Attorney. This form specifically allows an individual to designate someone to make medical decisions on their behalf when they are unable to do so. While the Durable Power of Attorney focuses on financial and legal matters, the Healthcare Power of Attorney is tailored to health-related decisions. Both documents empower an agent to act in the principal's best interest, but they address different aspects of a person's life.

The Living Will is another document that aligns closely with the Durable Power of Attorney. A Living Will expresses an individual's wishes regarding medical treatment in situations where they cannot communicate their preferences, particularly at the end of life. While the Durable Power of Attorney allows an agent to make decisions, the Living Will provides specific instructions that guide those decisions. Together, these documents ensure that a person's values and desires are respected in both financial and medical contexts.

The Revocable Trust also shares some similarities with the Durable Power of Attorney. Both instruments allow for the management of assets and can help avoid probate. A Revocable Trust can be altered or revoked by the person who created it, while a Durable Power of Attorney remains effective until revoked or the principal passes away. In essence, both documents serve to facilitate the management and distribution of a person’s assets, but they do so in different ways and under different circumstances.

The Advance Directive is another document that is akin to the Durable Power of Attorney. This legal tool combines elements of both the Healthcare Power of Attorney and the Living Will. It allows individuals to outline their preferences for medical treatment and designate someone to make healthcare decisions on their behalf. Like the Durable Power of Attorney, the Advance Directive ensures that a person's wishes are honored when they cannot communicate them, providing a comprehensive approach to healthcare decision-making.

To facilitate essential transactions, ensuring all parties are well-informed and protected, it's important to have the right documentation in place. The Fill PDF Forms allows users to easily create necessary agreements, including vehicle purchase agreements that streamline the buying process and safeguard the interests of both buyers and sellers.

Lastly, the Financial Power of Attorney is closely related to the Durable Power of Attorney. Both documents grant authority to an agent to manage financial matters on behalf of the principal. However, the Financial Power of Attorney may not necessarily remain effective if the principal becomes incapacitated, unless it is specifically designed to be durable. This type of document can cover a wide range of financial activities, ensuring that someone can handle the principal's financial affairs seamlessly, much like the Durable Power of Attorney.

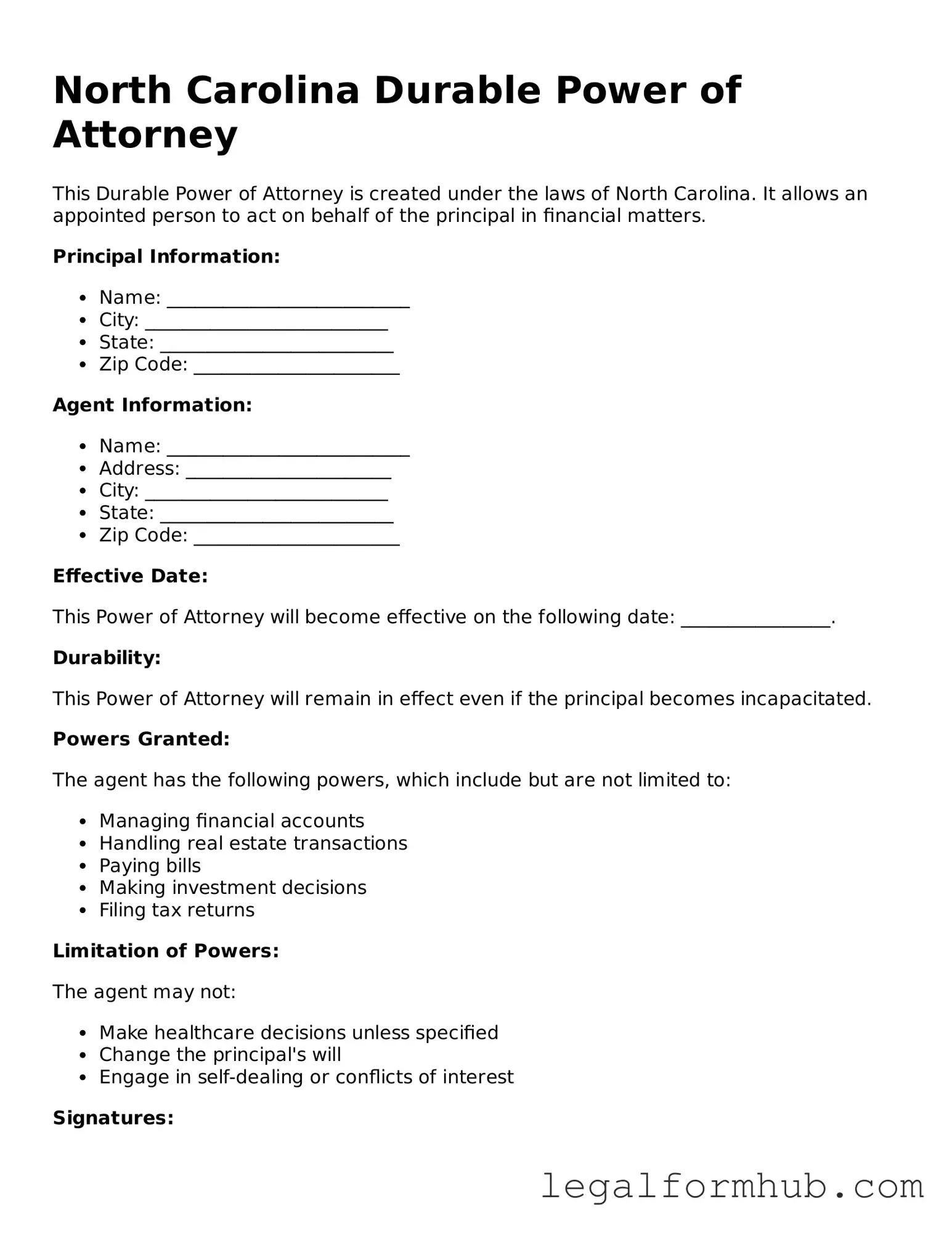

Instructions on Writing North Carolina Durable Power of Attorney

To fill out the North Carolina Durable Power of Attorney form, follow these steps carefully. Make sure to have all necessary information on hand before you begin. This process involves providing specific details about the principal, the agent, and the powers granted.

- Obtain the Durable Power of Attorney form. You can find it online or at a local legal office.

- Fill in the date at the top of the form. This is the date you are completing the document.

- Provide the full name and address of the principal. This is the person who is granting the powers.

- Enter the full name and address of the agent. This is the person who will act on behalf of the principal.

- Specify the powers being granted. Clearly list the specific actions the agent can take. This may include managing finances, making medical decisions, or handling property matters.

- Include any limitations or special instructions if applicable. If there are certain areas where the agent cannot act, note them here.

- Sign and date the form at the bottom. The principal must sign it in the presence of a notary public.

- Have the form notarized. This step is important for the document to be legally valid.

- Provide copies to the agent and any relevant institutions. Keep a copy for your records as well.

Once the form is completed and notarized, it is ready for use. Ensure that all parties involved understand the contents and implications of the document.

Misconceptions

Understanding the North Carolina Durable Power of Attorney form is crucial for effective estate planning. However, several misconceptions may lead to confusion. Here are six common misconceptions:

- Misconception 1: A Durable Power of Attorney is only necessary for the elderly.

- Misconception 2: A Durable Power of Attorney is the same as a regular Power of Attorney.

- Misconception 3: The agent can do anything they want with the Durable Power of Attorney.

- Misconception 4: A Durable Power of Attorney can only be revoked by the principal's death.

- Misconception 5: A Durable Power of Attorney is only useful for financial matters.

- Misconception 6: Once a Durable Power of Attorney is signed, it cannot be changed.

This is not true. Anyone over the age of 18 can benefit from a Durable Power of Attorney. It allows individuals to designate someone to make decisions on their behalf in case they become incapacitated, regardless of age.

While both documents grant authority to another person, a Durable Power of Attorney remains effective even if the principal becomes incapacitated. In contrast, a regular Power of Attorney typically becomes void under such circumstances.

This is misleading. The agent must act in the best interest of the principal and follow any specific instructions outlined in the document. They are legally bound to act responsibly and ethically.

This is incorrect. The principal can revoke the Durable Power of Attorney at any time, as long as they are mentally competent. Revocation must be done in writing and communicated to the agent.

While it is often used for financial decisions, a Durable Power of Attorney can also cover healthcare decisions if specified. This allows the agent to make medical choices on behalf of the principal when they cannot do so themselves.

This is false. The principal can modify or create a new Durable Power of Attorney at any time, provided they are mentally competent. Changes should be documented properly to avoid confusion.

Key takeaways

- Understand the Purpose: A Durable Power of Attorney (DPOA) allows you to designate someone to make decisions on your behalf if you become unable to do so.

- Choose Your Agent Wisely: Select a trusted individual who understands your values and wishes. This person will have significant authority over your financial and legal matters.

- Specify Powers Clearly: Clearly outline the powers you are granting. You can limit the scope to specific tasks or grant broad authority.

- Consider Alternatives: If you want to restrict certain decisions, consider creating multiple documents or a separate DPOA for specific areas.

- Sign and Date Properly: Ensure the document is signed and dated according to North Carolina law. This typically requires your signature and the signatures of two witnesses or a notary public.

- Keep Copies Accessible: After completing the form, keep copies in a safe but accessible place. Share copies with your agent and any relevant institutions.

- Review Regularly: Life circumstances change. Review your DPOA periodically to ensure it still reflects your wishes and that your chosen agent is still appropriate.

- Revocation is Possible: You can revoke your Durable Power of Attorney at any time, as long as you are competent. Notify your agent and any institutions that may have the document.

File Overview

| Fact Name | Description |

|---|---|

| Definition | A Durable Power of Attorney allows an individual to appoint someone to make decisions on their behalf, even if they become incapacitated. |

| Governing Law | This form is governed by North Carolina General Statutes, Chapter 32A. |

| Durability | The "durable" aspect means the authority remains effective during periods of incapacity, unlike a standard power of attorney. |

| Principal and Agent | The person granting the power is called the principal, while the person receiving the authority is known as the agent or attorney-in-fact. |

| Limitations | Specific powers can be granted or restricted in the document, allowing for tailored decision-making authority. |

| Execution Requirements | The form must be signed by the principal and witnessed by two individuals or notarized to be valid. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time, as long as they are competent to do so. |

| Common Uses | This form is often used for financial matters, healthcare decisions, or managing property when the principal is unable to do so themselves. |